Impact Assessment of CSX Train Derailment and Investment Risk Analysis of the Railroad Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On December 30, 2025, a CSX freight train derailed in the Trenton area of southern Kentucky, causing a flammable chemical leak and fire[1]. Authorities immediately issued a shelter-in-place order to nearby residents, which has since been lifted[1]. On-site photos show multiple carriages derailed and severely damaged, including overturned oil tankers[1].

According to brokerage API data, CSX’s stock price fell by 0.69% on the day of the accident (December 30)[0]. By the close, CSX closed at $36.44, with a daily drop of 0.78%[0].

- Accident day drop: -0.69%

- 5-day cumulative drop: -0.92%

- December overall performance: +4.63%

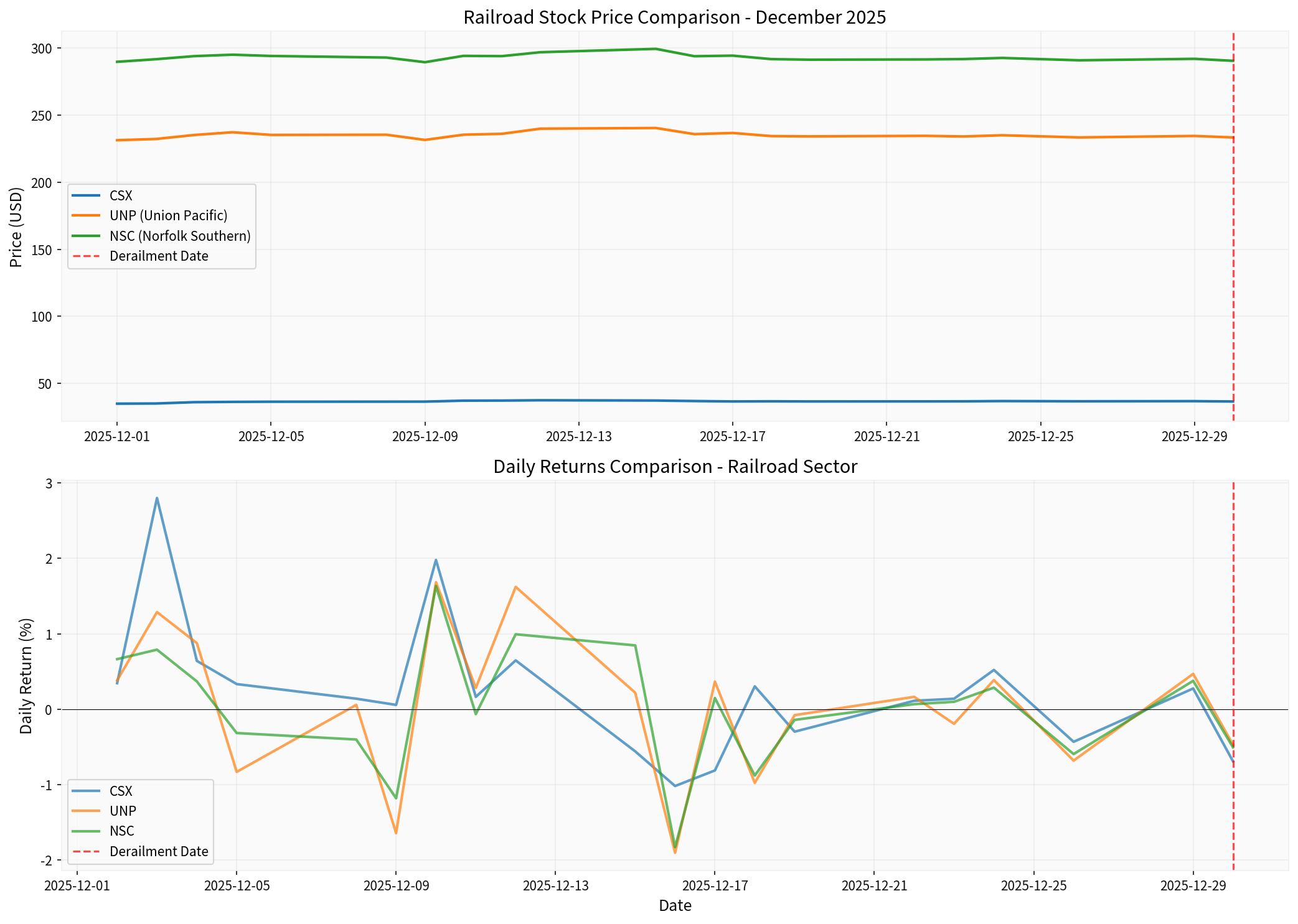

In industry comparison, despite the derailment, CSX’s December performance outperformed peers:

- CSX: +4.63%

- Union Pacific (UNP): +0.89%

- Norfolk Southern (NSC): +0.25%

Figure 1 shows the comparison of stock price trends between CSX and major peers in December 2025. The red dashed line marks the time of the derailment accident on December 30. As seen from the chart, despite the drop on the day of the accident, CSX’s cumulative performance in December was still stronger than UNP and NSC.

According to brokerage API data analysis, CSX demonstrates strong profitability:

- Market Cap:$67.86 billion

- P/E Ratio:23.60x

- ROE:23.14%

- Net Profit Margin:19.21%

- Operating Profit Margin:30.68%

These indicators show CSX has strong profitability. However, financial analysis also points out the company has

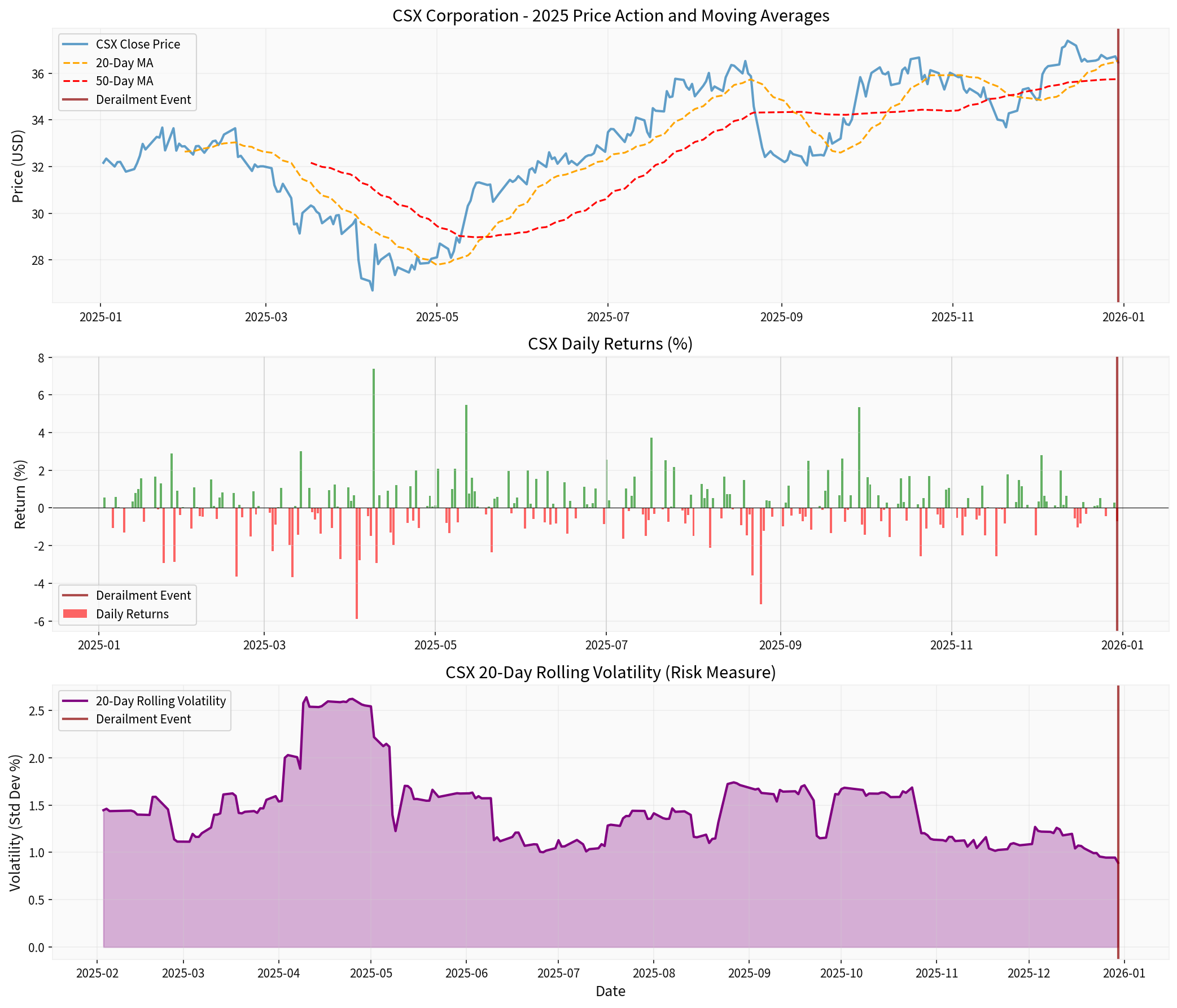

Figure 2 shows CSX’s 2025 full-year price trend, daily returns, and 20-day rolling volatility. The red vertical line marks the December 30 derailment time point. The chart reveals CSX experienced a maximum drawdown of approximately 20.73% in 2025, and the current stock price is only 2.47% lower than the 52-week high.

- Current Trend:Sideways/No clear direction[0]

- Support Level:$36.21

- Resistance Level:$36.72

- Beta Coefficient:1.3 (higher volatility than S&P 500)

- Annualized Volatility:23.59%

Brokerage API data shows analysts hold a

- Consensus Target Price:$40.00 (9.8% upside from current price)

- Rating Distribution:

- Buy Rating: 60.9% (28 analysts)

- Hold Rating: 37.0% (17 analysts)

- Sell Rating: 2.2% (1 analyst)

Recently, multiple institutions maintained positive ratings, including Barclays, JPMorgan Chase, and Baird[0].

In February 2023, the Norfolk Southern Railway train derailment in East Palestine, Ohio was one of the most serious safety accidents in the railroad industry in recent years. The accident caused toxic chemical leaks, triggering a large-scale environmental disaster and public concern.

According to web search data, Norfolk Southern has agreed to pay

- Direct Financial Costs:$600 million settlement, plus cleanup costs and regulatory fines

- Reputational Loss:Decline in public trust and damaged corporate image

- Regulatory Pressure:Triggered comprehensive review of railroad safety regulations

- Operational Disruption:Long-term closure of the accident section, affecting overall operational efficiency

Compared to the East Palestine accident, the impact of CSX’s Kentucky derailment may be limited:

- Chemical Type:Although flammable chemicals were involved, no highly toxic substances were reported

- Geographic Location:Occurred in rural areas with low population density and limited evacuation scope

- Preliminary Assessment:The severity of the accident may be lower than the East Palestine incident

Based on the analysis of CSX’s current accident and historical cases, railroad safety accidents bring the following core risks to investors:

Railroad companies face multiple potential legal liabilities:

- Class-Action Lawsuits:Damage compensation for affected residents and enterprises

- Environmental Cleanup Costs:Long-term environmental restoration for chemical leaks

- Government Fines:Administrative penalties for violating safety regulations

- Punitive Damages:Punitive compensation in cases involving negligence or violations

- Norfolk Southern East Palestine Accident: $600 million class-action settlement[2]

- Potential Additional Costs: Environmental cleanup, regulatory fines, business disruption losses

The railroad industry is strictly regulated. Major accidents usually trigger:

- New Safety Regulations:The Federal Railroad Administration (FRA) may introduce stricter safety requirements

- Rising Compliance Costs:Web search shows safety compliance documentation alone costs the railroad industry approximately$1.5 billionannually[3]

- Operational Restrictions:May face speed limits, increased maintenance frequency, etc.

Impacts caused by safety accidents include:

- Line Closure:Relevant lines stop operating during accident investigation

- Capacity Decline:Affects overall network efficiency

- Customer Churn:Shippers may switch to other transportation methods

- Rising Insurance Costs:Accident records will push up future insurance costs

Long-term impacts are often underestimated:

- Brand Damage:Decline in public awareness and damaged corporate reputation

- Investor Confidence:May trigger institutional investors to re-evaluate risk exposure

- ESG Rating Downgrade:Environmental, Social, and Governance ratings may be lowered

- Valuation Multiple Compression:The market may require a higher risk premium

Risks from railroad safety accidents are not limited to the involved company but also affect the entire industry:

- Correlated stock price drops for peer companies

- Pressure on overall industry valuation multiples

- Regulatory policy tightening affects the entire industry

- Industrial sector performance on the day: -0.018%[0]

- Capital may flow to other defensive sectors

In the face of railroad safety accidents, investors should consider the following factors:

- Accident severity and chemical type

- Whether there are casualties

- Scope of environmental impact and cleanup difficulty

- Company emergency response capability

- NTSB investigation results and liability determination

- Possible penalties from regulatory authorities

- Insurance coverage and deductibles

- Management response measures and transparency

- Company safety record and accident frequency

- Capital expenditure plan (safety equipment investment)

- Insurance cost change trend

- Changes in industry competition pattern

Based on existing information, a preliminary assessment of the impact of CSX’s current derailment event is conducted:

| Risk Category | Expected Impact Level | Explanation |

|---|---|---|

| Direct Financial Loss | Low-Medium |

May involve equipment loss and cleanup costs, but expected to be below the ten-million-dollar level |

| Legal Liability | Low-Medium |

Need to assess whether highly toxic substances and casualties are involved; rural areas reduce claim scale |

| Regulatory Penalty | Low-Medium |

Depends on accident cause determination; compliance issues may trigger fines |

| Operational Disruption | Low |

Rural accident, limited impact on the overall network |

Based on current information, the following assessment is given for CSX stock:

- Robust Fundamentals:19.21% net profit margin and 23.14% ROE show strong profitability[0]

- Reasonable Valuation:Analyst target price of $40.00, with 9.8% upside from current price[0]

- Industry Position:As a major railroad operator in eastern US, it has moat advantages

- Controllable Risk:The impact of this accident is limited, and it is not expected to cause major financial shocks

- Debt risk level is

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.