In-depth Impact Analysis of Zhejiang Construction Investment's 1.8 Billion Yuan Campus Construction Project

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest financial data and market information, I will comprehensively analyze this project from four dimensions:

According to the company’s 2024 financial data [0], Zhejiang Construction Investment’s annual revenue reached 21.79 billion USD (approximately 154 billion yuan). The 1.8 billion yuan project accounts for only

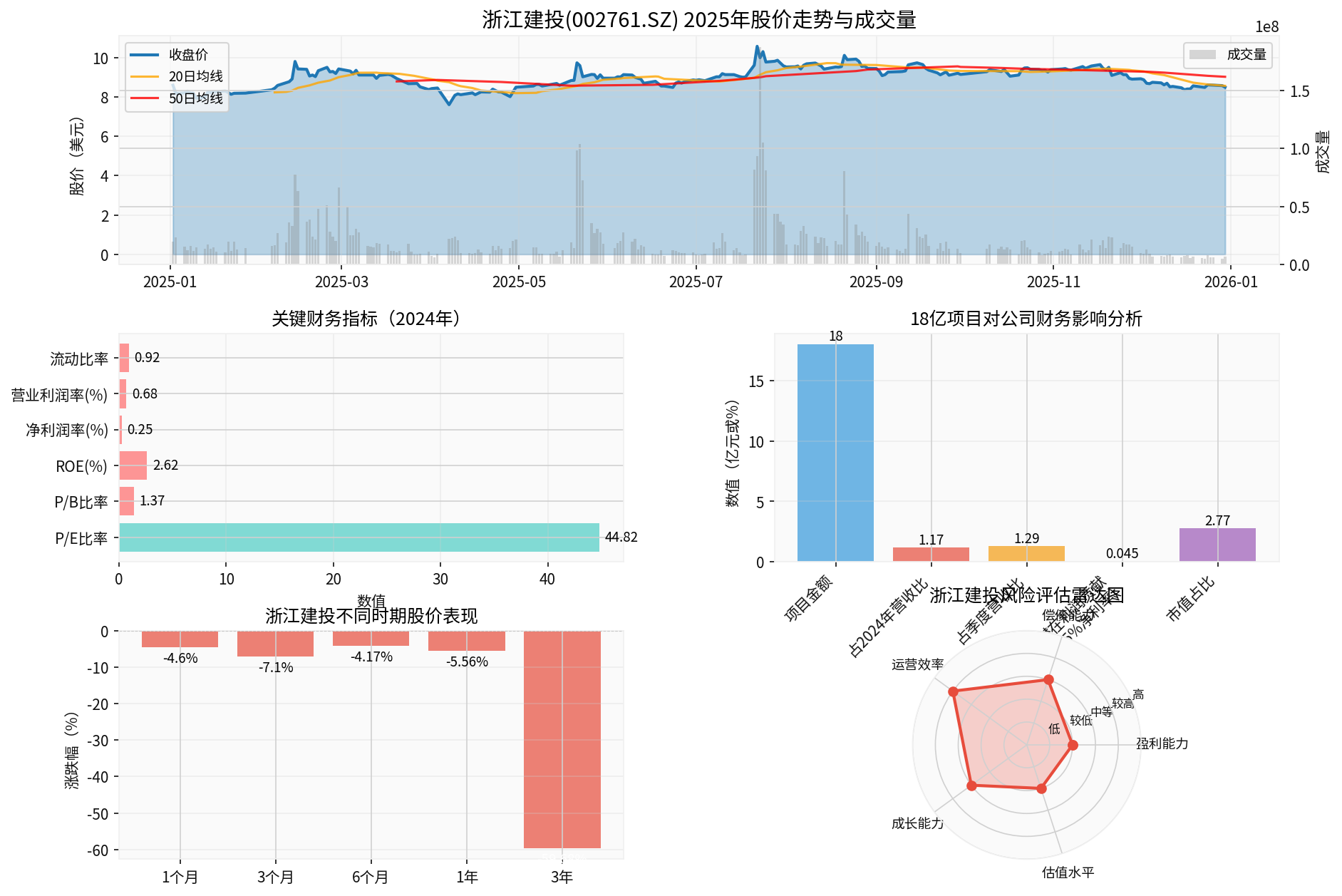

- Top Left Chart: 2025 stock price trend shows a volatile downward trend, currently at a relatively low level (USD 8.50)

- Top Right Chart: Key financial indicators show a net profit margin of only 0.25% and ROE of 2.62%, indicating weak profitability

- Bottom Left Chart: The 1.8 billion yuan project accounts for 1.17% of revenue, with potential profit contribution of only 4.5 million yuan (0.045 billion yuan)

- Bottom Right Chart: The risk assessment radar chart shows that the company has high risks in debt-paying ability and profitability

The company’s 2024 net profit margin was only

- Potential net profit contribution from the 1.8 billion yuan project: approximately 4.5 million yuan

- Potential operating profit contribution: approximately 12.24 million yuan(based on 0.68% operating profit margin)

- Current market capitalization: 9.2 billion USD(approximately 65 billion yuan)

- The 1.8 billion yuan project accounts for 2.77%of market capitalization

- Current P/E ratio: 44.82x-65.38x[0]

From a valuation perspective, this project has limited impact on the company’s overall value. However, successful completion of the project may help the company

Although specific backlog data of the company has not been obtained, it can be inferred from financial performance:

- 2025 Q2 Revenue: 19.96 billion USD (approximately 140 billion yuan) [0]

- 2024 Full-Year Revenue: 21.79 billion USD [0]

The data shows that the company has a large revenue scale, indicating

- Contract Performance Risk: The 1.8 billion yuan project is large-scale; if there are project delays or quality issues, the company may face liability for breach of contract.

- Payment Recovery Risk: The construction engineering industry generally faceslong payment cycles and high bad debt risks.

- Cost Control Risk: Fluctuations in raw material prices and rising labor costs may compress the project’s profit margin.

- Current ratio: 0.92(below the 1.0 safety line) [0]

- Quick ratio: 0.90[0]

- Debt risk level: High Risk[0]

These indicators show that the company faces certain short-term liquidity pressure, which may affect the smooth performance of the project.

- The country continues to promote infrastructure construction investment.

- The demand for higher education campus construction continues to exist.

- As an economically developed region, Zhejiang Province has strong financial strength, so the project payment recovery risk is relatively controllable.

- The construction industry is highly competitive, with generally low profit margins.

- The downturn in the real estate market affects related construction businesses.

- Higher environmental protection requirements increase compliance costs.

- Regional leading position: Significant brand and resource advantages in Zhejiang Province.

- Large project experience: Undertaking the Qiantang University campus construction project demonstrates the company’s ability to undertake large-scale projects.

- Scale effect: The huge revenue scale (154 billion yuan) shows the company’s high market share.

- Weak profitability: Net profit margin of only 0.25% and ROE of only 2.62% [0].

- High financial risk: Debt risk is assessed as “High Risk” [0].

- Weak stock price performance: A cumulative decline of 59.68% over 3 years [0].

- Cost overrun risk during project execution.

- Cash flow pressure caused by delayed accounts receivable recovery.

- Current ratio below 1 may lead to short-term debt repayment problems.

- Sustained decline in industry profit margins.

- Transformation and upgrading pressure: Need to transform to high-value-added businesses.

- Regional market saturation may limit growth space.

- The 1.8 billion yuan project provides the company with stable order increment, helping to maintain revenue scale.

- Campus construction projects have the characteristics of good social benefits and relatively reliable payment recovery.

- Successful project performance can enhance the company’s brand influence, helping to obtain subsequent orders.

- Extremely low profit margin: The 1.8 billion yuan project contributes only about 4.5 million yuan in net profit, with limited improvement to performance.

- High financial risk: Current ratio of 0.92 and debt risk rating of “High Risk” indicate the company’s fragile financial status [0].

- Execution risk: Large-scale projects face multiple uncertainties such as performance and payment recovery.

- Valuation risk: The P/E ratio of 44.82x-65.38x is at a relatively high level [0], while profitability is weak, so there may be valuation pressure.

- Closely monitor project execution progress and payment recovery status.

- Pay attention to changes in the company’s liquidity and debt risk.

- The 1.8 billion yuan project has limited impact on overall performance and should not be the main basis for investment decisions.

- View the financial contribution of this project cautiously.

- Focus on the company’s profitability improvementandfinancial risk resolutionprocesses.

- It is recommended to wait for clearer profitability improvement signalsbefore considering investment.

| Indicator | Current Value | Target Value | Monitoring Frequency |

|---|---|---|---|

| Net Profit Margin | 0.25% | >2% | Quarterly |

| Current Ratio | 0.92 | >1.2 | Quarterly |

| ROE | 2.62% | >8% | Annual |

| Debt Risk | High Risk | Medium-Low Risk | Quarterly |

The 1.8 billion yuan campus construction project has

From the perspective of

From the perspective of

[0] Gilin API Data - Zhejiang Construction Investment (002761.SZ) financial data, stock price data and analysis

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.