Analysis of the Impact of JD.com Undertaking National Subsidy Policies on 2025 Home Appliance and Digital Product Sales

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

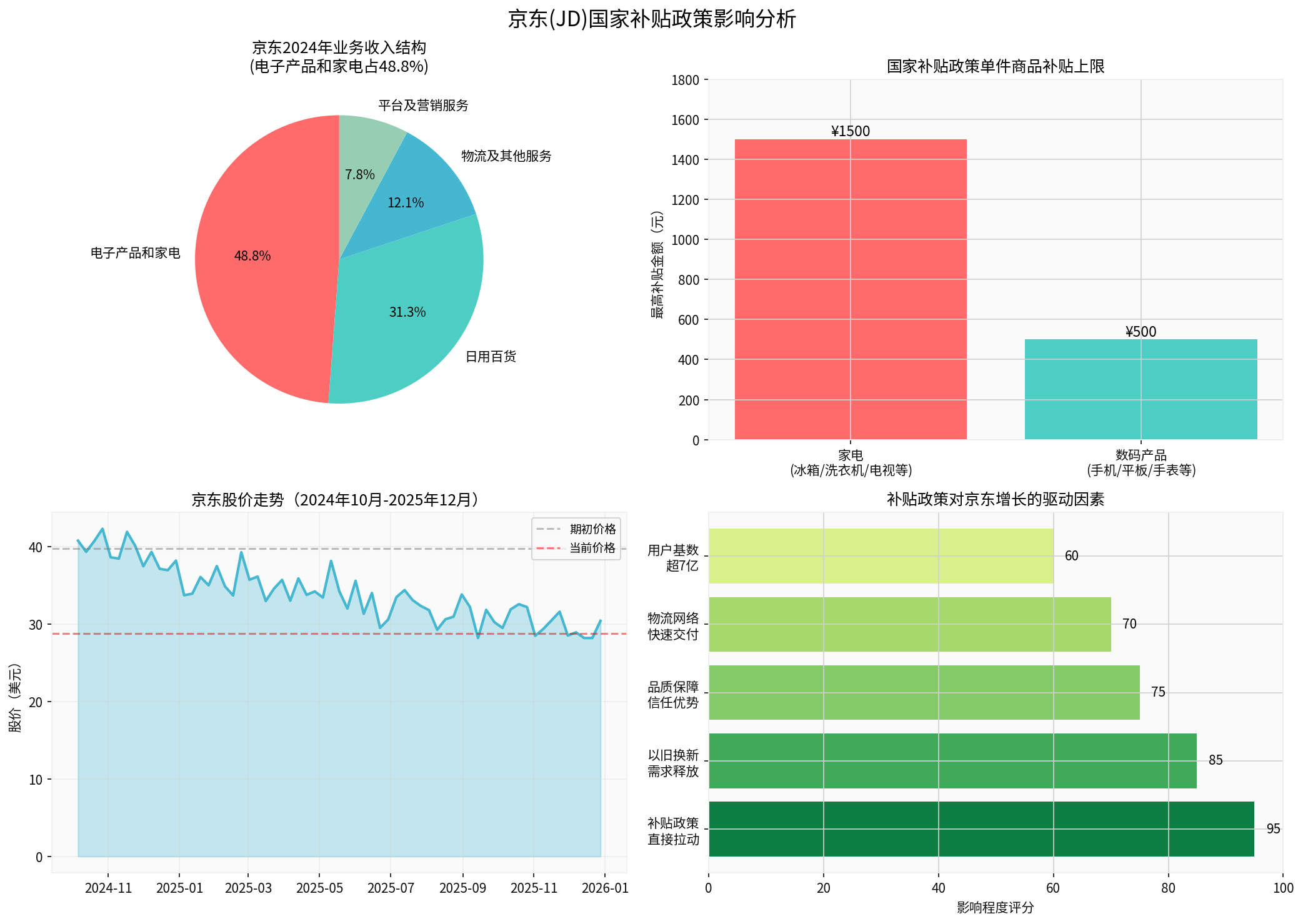

According to public information, China’s national consumer subsidy policy was officially implemented on January 1, 2025, aiming to stimulate consumption through trade-in and other methods [1]. Key policy points include:

- Home Appliances: Refrigerators, washing machines, TVs, air conditioners, computers, water heaters, etc., with a maximum subsidy of 1,500 yuan per unit

- Digital Products: Mobile phones, tablets, smart watches/bands, smart glasses, etc., with a maximum subsidy of 500 yuan per unit

- Implementation Method: Rolled out through e-commerce platforms, with JD.com as the main undertaking platform

- Policy Scale: China allocated approximately 300 billion yuan in subsidy funds for 2025, twice the amount in 2024 [1]

JD.com has significant first-mover advantages in electronic products and home appliances:

- Category Proportion Advantage: According to financial data, JD.com’s 2024 revenue from electronic products and home appliances accounted for 48.8% of total revenue [0], making it its largest revenue source, accounting for nearly half

- Quality Assurance: JD.com’s self-operated model + self-built logistics system have established a user perception of quality assurance in the large home appliance and digital product sectors

- Fulfillment Capability: JD.com’s logistics network covers the whole country, with mature large home appliance delivery and installation services, enabling rapid response to policy implementation needs

- User Base: As of October 2025, JD.com’s annual active users have exceeded 700 million [2], with quarterly active users growing by over 40% year-on-year

The

-

Conversion of Price-Sensitive Users: The maximum subsidy of 1,500 yuan for home appliances and 500 yuan for digital products has strong appeal to price-sensitive consumers. Especially for large home appliances, the 1,500 yuan subsidy is equivalent to 15%-25% of the price of mid-to-high-end products, which will effectively stimulate replacement demand.

-

Release of Trade-In Demand: The subsidy policy combined with trade-in solves consumers’ worries about handling old products. JD.com already has a mature system in home appliance recycling, which can quickly undertake this demand.

-

Category Linkage Effect: Purchases of home appliances and digital products are often连带. Users who buy refrigerators may also buy TVs, and users who buy mobile phones may buy smart watches and other accessories, creating cross-selling opportunities.

Based on JD.com’s current business structure, the potential impact of the subsidy policy on 2025 sales:

From the chart above:

- Home appliance and digital categories account for nearly 50% of JD.com’s revenue, so the subsidy policy directly affects nearly half of JD.com’s business

- The maximum 1,500 yuan subsidy for home applianceswill have a significant pull on high-unit-price categories

- The 500 yuan subsidy for digital productswill promote the release of replacement demand

Based on JD.com’s 2024 electronic product and home appliance business scale (about 565 billion yuan) [0], it is conservatively estimated that the subsidy policy can bring

The launch of the subsidy policy at the current time has special significance:

-

Boosting Consumer Confidence: China’s consumer price index unexpectedly rose in October 2025, and holiday demand drove growth in tourism, food and transportation demand [1]. The subsidy policy will further consolidate this recovery trend.

-

Industry Cyclical Demand: Home appliances usually have a 5-8 year update cycle. 2025 is in the update peak period of products from the previous home appliance countryside policy (2009-2013), and the policy overlay will produce a resonance effect.

-

Technology Upgrade Cycle: The popularization of 5G mobile phones, the increase in smart home penetration, and the rise of AI devices are all in the放量 stage, and subsidies will accelerate this process.

According to the latest financial reports and market data [2], China’s e-commerce market pattern:

- Alibaba: Leading in market share, but growth slowing down, with Q3 2025 revenue growing by only 4.77% year-on-year (15% excluding the impact of sold businesses)

- : Strong revenue growth, with Q3 growing by 14.9% year-on-year, maintaining double-digit growth for four consecutive quarters [2]

- Pinduoduo: Solid low-price perception, but mainly focusing on daily necessities and agricultural products, with relatively weak advantages in home appliance 3C categories

In home appliance and digital categories, JD.com has always maintained a

- JD.com has established a stable user perception in home appliance and 3C categories [2]

- Its self-operated model + fast delivery have natural advantages in large-item goods

- Quality assurance and after-sales service are key factors in home appliance purchase decisions

The subsidy policy will further strengthen JD.com’s competitive advantages in the following aspects:

-

Trust Advantage: The subsidy policy involves national funds, so consumers have higher requirements for platform compliance and reliability. JD.com’s self-operated model has natural advantages in this regard.

-

Fulfillment Advantage: Delivery and installation of large home appliances are core pain points. JD.com’s self-built logistics network can provide integrated services, which is a barrier that other platforms cannot replicate in the short term.

-

Data Advantage: JD.com’s long-term accumulated user purchase data and preference data will help it reach target user groups more accurately and improve conversion efficiency.

-

Service Advantage: JD.com’s accumulation in the full-link services of home appliance installation, maintenance, and trade-in will form differentiated competitiveness.

It is expected that driven by the subsidy policy, JD.com’s

From a financial perspective, the potential impact of the subsidy policy:

- Revenue Growth: Directly driving 10%-15% growth in home appliance and digital categories, contributing about 5%-7% to total revenue

- Scale Effect: Increased sales volume leads to the dilution of procurement and fulfillment costs, improving gross profit margin

- User Stickiness: Subsidies attract users to use JD.com, increasing long-term user retention and LTV

- Service Revenue: Driving growth in high-margin service businesses such as logistics, installation, and after-sales

- Marketing Investment: May need to increase marketing investment to acquire subsidy users

- Price Pressure: Subsidies may lower unit prices, affecting gross profit levels

- Competition Response: Competitor platforms may launch supporting promotions, intensifying competition

According to Q3 2025 financial report data [2], JD.com’s marketing expenses increased by 110.5% year-on-year to 21.05 billion yuan, mainly used for user expansion and new business development. The subsidy policy may lead to continued growth in marketing investment, but ROI is expected to improve due to policy热度.

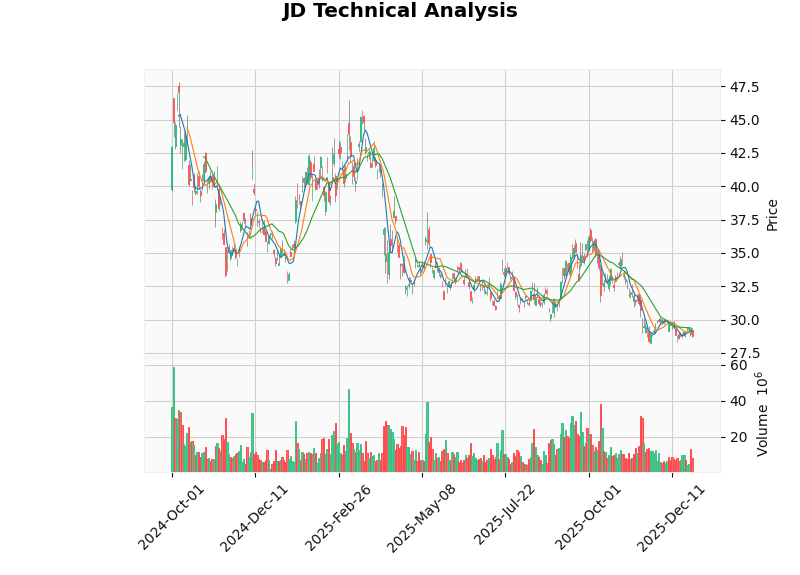

Despite positive fundamentals, JD.com’s stock price fell by 27.63% from October 2024 to December 2025 [0], with the current price at $28.80, at the lower end of the 52-week range ($28.21-$46.45) [0].

- Price-to-Earnings Ratio (P/E): 7.5x, far below the historical average

- Price-to-Book Ratio (P/B):1.28x, close to book value

- Median Analyst Target Price: $37.50, with a 30.2% upside potential from the current price [0]

- 31 out of 37 analysts gave a “Buy” rating, accounting for 70.5% [0]

Technical analysis shows that the current trend is sideways consolidation, with a trading range of $28.52-$29.32 [0], in the bottoming stage, and policy利好 may become a catalyst for a breakthrough.

###5. Competitive Landscape and Strategic Recommendations

####5.1 Possible Reactions of Competitors

After the launch of the subsidy policy, competitors are expected to adopt the following strategies:

- Alibaba: May launch supporting subsidy policies through the Tmall platform, leveraging its brand advantages in home appliance categories

- Pinduoduo: May increase investment in large home appliance categories, but is limited by the platform model and has shortcomings in large-item fulfillment

- Douyin E-commerce: May enter the mid-to-high-end home appliance market through live streaming

####5.2 Strategic Recommendations for JD.com

To maximize policy dividends, it is recommended that JD.com:

- Strengthen Fulfillment Advantages: Highlight integrated delivery and installation services to establish differentiated barriers

- Precise User Reach: Use big data to identify users with replacement needs and improve conversion rates

- Category Linkage Promotions: Design home appliance + digital combination discounts to increase average order value

- Service Package Sales: Launch extended warranty, installation, cleaning and other service packages to increase added value

- Sink Market Penetration: Combine subsidy policies to expand coverage in third- and fourth-tier cities and county markets

###6. Risk Warnings

Although the subsidy policy brings significant opportunities, the following risks need to be noted:

- Policy Execution Risk: There are uncertainties in the specific implementation rules, audit standards, and fund distribution rhythm of the subsidy policy

- Increased Competition Risk: Other platforms may launch countermeasures, leading to price wars and profit margin pressure

- Demand Overdraft Risk: Pre-released replacement demand may lead to weak demand in subsequent quarters

- Macroeconomic Risk: If overall consumption recovery in 2025 is less than expected, the effect of the subsidy policy may be discounted

- Supply Chain Risk: Surge in demand stimulated by subsidies may test the supply chain’s undertaking capacity

[0] Gilin API Data - JD.com Company Profile, Financial Data, Stock Price and Analyst Ratings

[1] The Business of Fashion - “China Unveils Initial $9 Billion in Consumer Subsidies for 2026” (https://www.businessoffashion.com/news/china/china-unveils-initial-nine-billion-consumer-subsidies-2026/)

[2] Sina Finance - “E-commerce ‘Three Giants’ Q3成绩单: Alibaba’s Revenue Grows Without Profit, JD.com’s Profit is Thin With More Sales, Pinduoduo’s Operating Profit Slightly Increases” (https://finance.sina.com.cn/jjxw/2025-12-02/doc-infzmiff0282471.shtml)

[3] Yahoo Finance - “MELI vs. JD: Which Global E-commerce Stock Has More…” (https://finance.yahoo.com/news/meli-vs-jd-global-e-154900624.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.