Impact of Form 6K Regulatory Disclosures of Biopharmaceutical Company ADRs on Investor Decisions and Analytical Framework

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Information Integration Hub: Acts as a bridge between the company’s local market announcements and U.S. investors, ensuring information synchronization

- Catalyst Carrier: Primary disclosure channel for major events such as clinical trial results, regulatory approval progress, and collaboration agreements

- Risk Early Warning Mechanism: Timely notification platform for negative information such as changes in financial status, regulatory issues, and legal proceedings

- Valuation Adjustment Basis: Key information source affecting company valuation, such as pipeline value changes and milestone achievement/failure

Biopharmaceutical ADR stock prices often react strongly to Form 6K disclosure content:

- Positive Catalysts: Positive clinical trial data (especially Phase III topline data), acceptance of new drug applications (NDA/BLA) by regulatory agencies like FDA/EMA, breakthrough therapy designation, patent authorization, collaboration with large pharmaceutical companies

- Negative Catalysts: Clinical trial failure/termination, rejection of regulatory applications, safety issues, patent challenges, financial distress warnings

By continuously monitoring Form 6K, investors can:

- Early Layout: Establish positions before key clinical trial data is released

- Timely Stop-Loss: Quickly assess loss extent and make decisions after negative announcements

- Capture Arbitrage Opportunities: Trade using the time difference of information between local and U.S. markets

Cumulative information from Form 6K helps investors:

- Evaluate Pipeline Progress: Track milestone achievement in each stage of drug development

- Judge Commercialization Capability: Assess commercialization potential through financial reports and market access progress

- Monitor Management Team Execution: Observe whether the company meets established goals on time

Upon receiving a Form 6K document, first classify it:

| Category | Priority | Typical Content | Investment Impact |

|---|---|---|---|

Regulatory Milestone |

Extremely High | FDA/EMA approval decisions, breakthrough therapy designation, orphan drug status | Significant stock price fluctuations, valuation restructuring |

Clinical Data |

Extremely High | Topline results of various phases of clinical trials, interim analysis data | Pipeline value revaluation, competitive position changes |

Financial Report |

High | Quarterly/annual financial reports, cash flow status, financing announcements | Valuation model adjustment, bankruptcy risk assessment |

Strategic Collaboration |

Medium-High | Licensing agreements, collaborative development, M&A transactions | Cash inflow/outflow, pipeline expansion/contraction |

Corporate Governance |

Medium | Management changes, board adjustments, equity incentive mechanisms | Execution evaluation, agency cost analysis |

Routine Disclosure |

Low | General meeting notices, routine announcements | Information update, usually no direct impact on stock price |

-

Study Design Quality

- Whether the sample size is sufficient (statistical power)

- Whether it is randomized, double-blind, placebo-controlled

- Whether endpoint selection is scientific (primary vs. secondary endpoints)

-

Data Interpretation

- Statistical Significance: p-value <0.05 is standard, but confidence intervals should be noted

- Clinical Significance: Effect size, whether it truly improves patient prognosis

- Safety Signals: Incidence of serious adverse events (SAE), treatment discontinuation rate

-

Competitive Landscape Positioning

- Head-to-head comparison data with similar drugs

- Mechanism advantages or differentiation characteristics

- Market exclusivity potential (patent protection, first-mover advantage)

- Regulatory Agency Feedback: Content of Complete Response Letter (CRL), supplementary data requirements

- Approval Timeline: PDUFA date, priority review vs. standard review

- Market Potential: Target patient population size, expected pricing capability

- Approval Probability: Based on advisory committee meetings, past similar cases

- Cash Runway: Survival time under current cash burn rate

- R&D Expense Ratio: R&D expenditure as a percentage of total revenue (measures innovation capability)

- Milestone Revenue: Phased payments from partners

- Valuation Multiple: Enterprise Value/Pipeline Value (EV/Pipeline Value)

Establish a systematic scoring framework (example):

Investment Value Score =

Pipeline Quality Weight (40%) × Pipeline Score +

Clinical Progress Weight (25%) × Progress Score +

Financial Health Weight (20%) × Financial Score +

Management Team Weight (15%) × Team Score

- Pipeline Quality: Mechanism novelty, market size, competitive landscape, patent protection

- Clinical Progress: Clinical trial success rate, phase advancement speed, data quality

- Financial Health: Cash runway, financing capability, capital structure

- Management Team: Past success rate, industry reputation, equity incentive mechanism

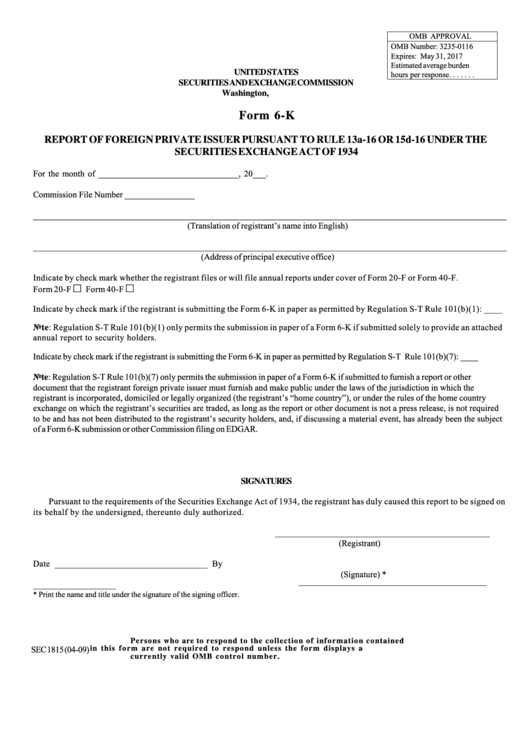

- SEC EDGAR Database: Access original Form 6K documents

- : Independently verify clinical trial registration information

- FDA Drugs@FDA Database: Confirm regulatory application status

- Professional Analysis Platforms: Pipeline databases like EvaluatePharma and Citeline

- Calendar Reminders: Key clinical trial data release dates, PDUFA dates

- Competitor Monitoring: Comparative progress of similar drugs

- Template-Based Announcement Analysis: Standardized report format to improve analysis efficiency

- Event-Driven: Build option strategies (e.g., straddle) around data release dates

- News-Reactive: Use market overreaction after announcements for reverse operations

- Arbitrage Trading: Utilize price differences between ADRs and local stocks

- Pipeline Diversification Verification: Avoid single-pipeline dependency risk

- Phase-Diversified Investment: Balanced allocation across early, mid, and late-stage pipelines

- Risk Assessment: Systematic analysis of technical, regulatory, and commercialization risks

“Red flags” to watch for in Form 6K documents:

- Cash runway less than 12 months with no clear financing plan

- Frequent turnover of senior management

- Clinical trial suspension or patient recruitment difficulties

- Multiple regulatory application rejections or requirements for large amounts of supplementary data

- Qualified audit opinions or financial restatements

[1] Investopedia - “Understanding SEC Form 6-K: Essential Guide for Foreign Issuers” (https://www.investopedia.com/terms/s/sec-form-6k.asp)

[2] Yahoo Finance - “What Awaits These 4 Biotech Stocks That More Than Doubled in 2025” (https://finance.yahoo.com/news/awaits-4-biotech-stocks-more-151100013.html)

[3] Yahoo Finance - “FDA Advisory Panel Votes Against Approval of GSK’s Blenrep Combo” (https://finance.yahoo.com/news/fda-advisory-panel-votes-against-143900892.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.