Analysis of the Impact of Narada Power's 8.9 Billion Yuan Energy Storage Orders and 6GWh Production Capacity on Gross Margin

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

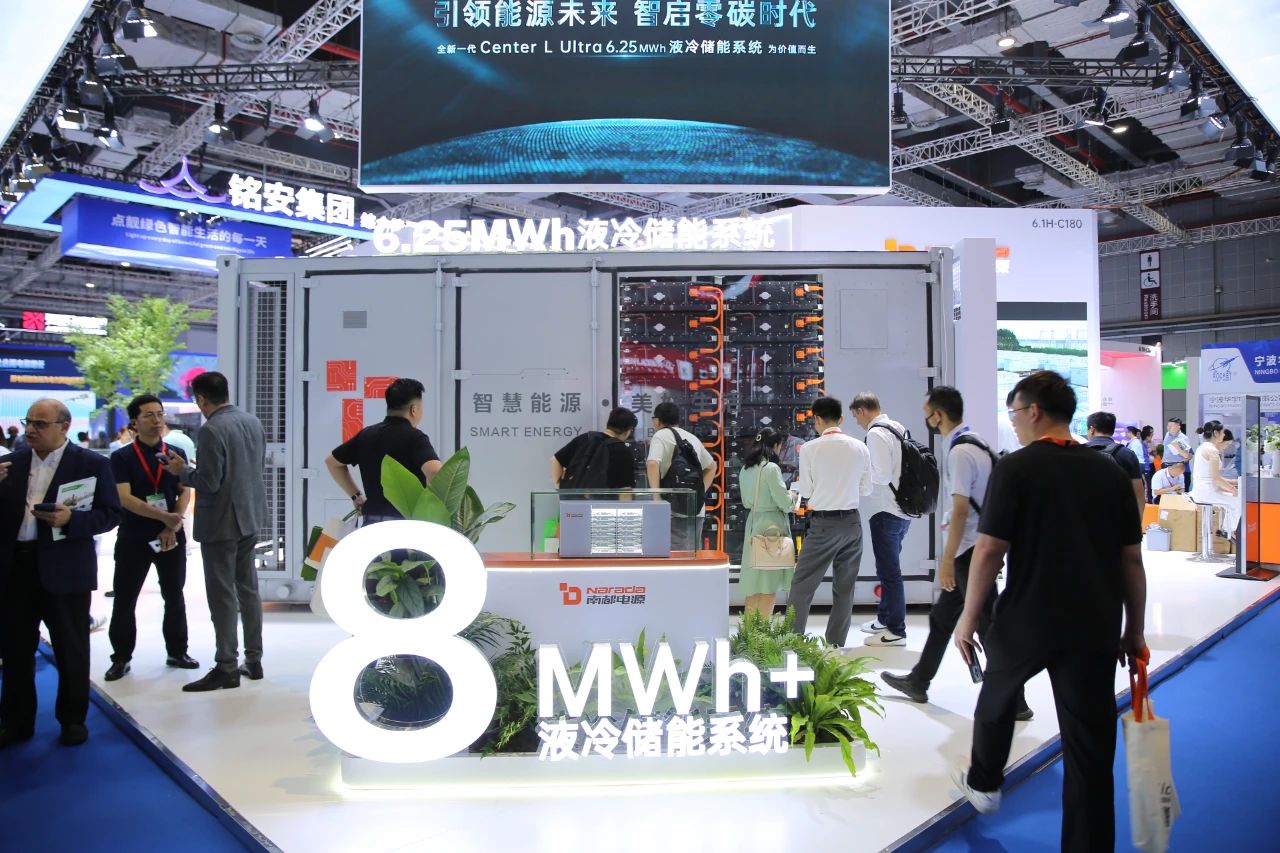

Based on collected data and market information, I conducted a systematic analysis of the impact of Narada Power’s (300068.SZ) 8.9 billion yuan energy storage orders and 6GWh under-construction capacity on its gross margin.

Narada Power is currently facing significant operational pressure, with key financial indicators showing negative values:

| Key Indicators | Value | Industry Comparison |

|---|---|---|

| Gross Margin | -8.12% |

Significantly lower than industry average (15-20%) |

| Operating Margin | -32.74% |

Severe loss |

| Net Profit Margin | -32.55% |

Sustained loss |

| ROE | -50.88% |

Negative shareholder return |

| Current Ratio | 0.92 |

Below 1, tight liquidity |

| P/E Ratio | -7.14x |

Negative due to losses |

The company’s market capitalization is 14.19 billion yuan, with a current stock price of 15.79 yuan and a 52-week trading range of 12.45-22.50 yuan [0]. From the stock price performance, it has fallen 6.57% cumulatively in 2025 and 23.39% in the past three months, indicating market concerns about the company’s performance.

According to industry reports and market information, Narada Power has approximately 8.9 billion yuan in hand orders, with the following structure:

- Large-scale Energy Storage Projects:5.5 billion yuan, accounting for61.8%

- Communication Energy Storage:1.8 billion yuan, accounting for 20.2%

- Industrial Energy Storage:1 billion yuan, accounting for 11.2%

- Others:0.6 billion yuan, accounting for 6.8%

- Significant Strategic Meaning:Large-scale storage projects worth 5.5 billion yuan account for over 60%, showing the company’s strong competitiveness in the grid-side energy storage sector

- Project Scale Effect:Large-scale storage projects usually have large individual scales, which are conducive to forming economies of scale

- Customer Quality:Customers of large-scale storage projects are mainly power grid companies and power operators, with relatively controllable credit risks

| Capacity Type | Scale (GWh) | Expected Commissioning Time | Investment Amount |

|---|---|---|---|

| Existing Capacity | 8 | Already commissioned | - |

Under-construction Capacity |

6 |

2025-2026 | Approximately 1.5-2 billion yuan |

| Planned Capacity | 15 | After 2027 | Subject to market conditions |

- First Stage (0-6 months):Capacity utilization rate of 30-50%, with large fixed cost amortization pressure

- Second Stage (6-12 months):Capacity utilization rate of 50-70%, with marginal contribution turning positive

- Third Stage (12-24 months):Capacity utilization rate of70-85%, with scale effects emerging

- Fourth Stage (After 24 months):Capacity utilization rate of over80%, with profit improvement

##4. Analysis of Gross Margin Improvement Path

- Lithium carbonate prices fluctuate violently; although they fell from highs in2024, they remain relatively high

- Battery-grade lithium carbonate accounts for about30-40% of the cost of energy storage cells

- The utilization rate of existing 8GWh capacity is about50-60%

- Fixed cost amortization pressure during capacity expansion

- Overcapacity in the energy storage battery industry, with fierce price wars

- Leading enterprises like CATL and BYD squeeze the market share of small and medium-sized manufacturers

- High proportion of low-margin products

- The gross margin of large-scale storage projects is usually lower than that of user-side storage

| Scenario | Assumptions | Expected Gross Margin |

|---|---|---|

Baseline Scenario |

Capacity utilization rate of 50%, raw material costs remain flat | -8.12% |

Optimistic Scenario |

Capacity utilization rate of80%, cost reduction of5% | 0-3% |

Neutral Scenario |

Capacity utilization rate of70%, cost reduction of3% | -3% to 0% |

Conservative Scenario |

Capacity utilization rate of60%, raw material costs remain flat | -6% to -4% |

- For every 10 percentage points increase in capacity utilization rate, the gross margin improves by about1.5-2 percentage points

- Scale effects lead to a 3-5% reduction in material procurement costs

- Increased automation reduces labor costs by about5-8%

##5. Investment Risks and Opportunities

- The overcapacity situation in the energy storage industry will continue for1-2 years

- Policy subsidy withdrawal affects terminal demand

- The business model of grid-side energy storage is still being explored

- High asset-liability ratio and great financial pressure

- Sustained negative cash flow; need to pay attention to the capital chain

- Whether technology and cost can keep up with leading enterprises

- The stock price has fallen by more than23% in the past three months, with bearish market sentiment

- Valuation is under pressure, with negative P/E ratio

- Under the “Dual Carbon” goals, the long-term growth of energy storage demand is certain

- Energy storage installed capacity is expected to grow by more than50% year-on-year in2025

- 8.9 billion yuan in orders provide revenue guarantee for the next2-3 years

- High proportion of large-scale storage projects, with relatively stable customer quality

- After the launch of 6GWh new capacity, costs are expected to decrease

- Scale effects gradually emerge

##6. Conclusions and Recommendations

- Whether the capacity utilization rate can quickly increase to over70%

- Whether raw material costs (especially lithium carbonate) can remain stable or decrease

- Execution efficiency and payment collection quality of large-scale storage projects

- Changes in the industry competition pattern

[0] Jinling API - Real-time Quotes and Company Profile Data of Narada Power (300068.SZ)

[1] Public Industry Information - Narada Power’s Energy Storage Business Orders and Capacity Layout

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.