In-depth Analysis Report on the Acquisition Rumor of Sichuan Swellfun Co., Ltd.

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On December 25, 2025, Sichuan Swellfun (stock code: 600779.SS) experienced a dramatic day. At around 1 PM that day, the company’s stock price suddenly soared, and finally closed at the daily limit, leading the entire liquor sector. Rumors that “Jiannanchun intends to acquire Swellfun” immediately spread in the market, with unknown sources. That night, Swellfun urgently issued a clarification announcement, clearly denying the relevant acquisition reports [1][2].

The company’s announcement stated: “After verification by the company, the above reports are untrue.” This quick response shows the company’s high attention to market rumors and its intention to avoid misleading investors [1].

From the secondary market performance, the rumor had a significant short-term stimulating effect on the stock price:

| Time Node | Stock Price Performance | Market Interpretation |

|---|---|---|

| Before December 25 | Volatile consolidation trend | Normal trading range |

| Afternoon of December 25 | Straight-up surge to daily limit | Driven by acquisition expectations |

| After clarification announcement | Expected to return to fundamentals | Valuation repair |

Swellfun is currently the only domestically listed liquor company controlled by foreign capital, with its controlling shareholder being the global spirits giant Diageo. Diageo holds approximately 63% of Swellfun’s shares through direct and indirect means [3].

- In mid-December 2025, Diageo announced an agreement with Japan’s Asahi Group to sell its 65% stake in East African Breweries Limited (EABL) for $2.3 billion

- This move is an important part of Diageo’s “turnaround” strategic plan

- The goal is to restore the net debt to EBITDA ratio to a reasonable range of 2.5–3.0 times

From the financial data, Diageo’s debt ratio is as high as 73%, which is the aftermath of its global expansion [4]. The market generally regards Kenya’s EABL, China’s liquor business Swellfun, and other underperforming international brands under its umbrella as potential sale targets.

The liquor industry was in a period of deep adjustment in 2025, and large-scale mergers and acquisitions within the industry were rare. Against the backdrop of a downward industry cycle, the willingness for resource integration among enterprises has increased [2].

- After resolving historical issues, Jiannanchun has an urgent need to go public

- Driven by Sichuan’s policy to build a 100-billion-level liquor industry

- Swellfun has a clear equity structure and clean assets, regarded as an ideal shell resource

- Foreign-controlled background makes it more likely to be an M&A target

From discussions on investment communities like Xueqiu, some investors believe that “denial doesn’t mean anything”, implying that there may already be intentions in negotiation [4].

Swellfun has recently faced significant performance pressure, which may be an important incentive for the market to associate it with “being acquired”:

| Financial Indicator | Performance Status |

|---|---|

| 2025 Q3 Net Profit | Fell by more than 70% year-on-year |

| ROE | Significant year-on-year decline |

| Investment Income | Contribution weakened significantly |

| Monetary Funds | Scale cannot cover short-term loans |

In terms of gross profit margin, as a high-end liquor brand, Swellfun’s sales gross profit margin has long maintained a high level of over 80%, showing typical brand premium and product structure characteristics [3]. However, the terminal consumer market is facing challenges, with prices of some products loosening and actual transaction prices showing a downward trend.

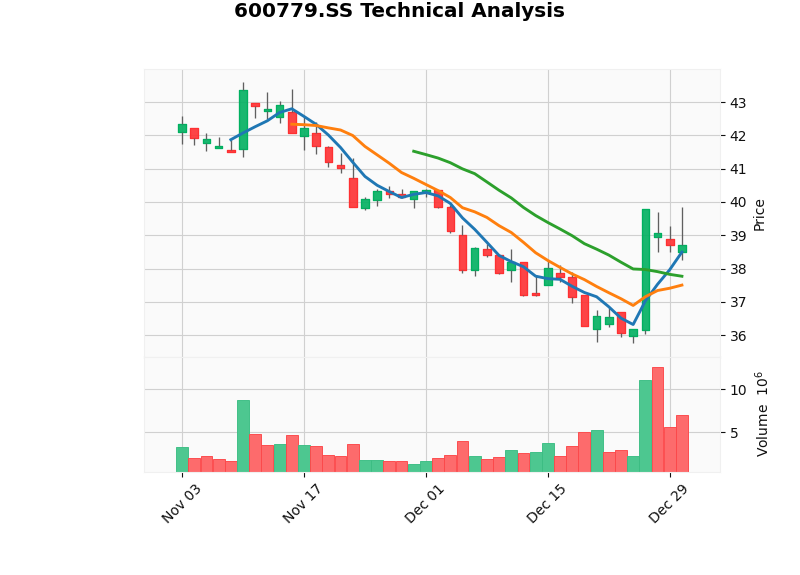

According to the latest technical analysis data [0]:

| Valuation Indicator | Value | Industry Comparison |

|---|---|---|

| P/E (TTM) | 34.60 | Medium to high |

| P/B (TTM) | 3.73 | Reasonable range |

| P/S (TTM) | 4.97 | - |

| Market Value | 18.75 billion USD | - |

- MACD indicator shows a bullish arrangement with no death cross signal

- KDJ indicator: K value 65.7, D value 52.0, J value 93.2, overall bullish

- RSI indicator operates in the normal range

- Short-term support level: $37.77

- Short-term resistance level: $39.21

Since Swellfun was taken over by Diageo in 2010, it has experienced frequent management changes:

- The first two general managers were foreigners but left quickly

- From 2019 to April 2024, the general manager was replaced 5 times

- Lack of strategic continuity has become a market concern

The current management is under pressure to reverse performance, but from their performance during their tenure at their previous employer Yuyuan Co., Ltd., the liquor segment also faced continuous performance decline [5].

- Positive Stimulus: The daily limit caused by the acquisition rumor reflects the market’s expectation of M&A premium; if it comes true, it will bring an opportunity for valuation revaluation

- Negative Risk: After clarification, the stock price faces pullback pressure, especially for investors who bought at high prices

- Diageo’s Strategic Intent: Although the acquisition by Jiannanchun has been refuted, Diageo’s direction of optimizing global asset allocation is clear; as its only layout in China’s liquor market, Swellfun’s future strategic direction still has uncertainty [3][5]

- Industry Integration Expectation: As the liquor industry enters the era of stock competition, the concentration of leading enterprises will inevitably increase. As a representative enterprise of Sichuan liquor, Swellfun’s historical origin of “The First Fang” still has brand value

- Fundamental Improvement Expectation: The company is starting a sprint to ultra-high-end against the trend, trying to break through through product structure upgrade

- Closely track Diageo’s subsequent capital operation trends

- Pay attention to the actual implementation of the company’s performance improvement

- Watch for potential impact of industry policy changes on valuation

- The overall industry downward cycle lasts longer than expected

- Uncertainty of foreign shareholder’s strategic adjustment

- Loss of market share due to intensified competition in the high-end market

The acquisition rumor of Swellfun has had a significant short-term stimulating effect on its stock price; the daily limit on December 25 fully reflects the market’s expectation of M&A premium. Although the company has issued a clarification announcement, from the background of Diageo’s global asset optimization and Swellfun’s own equity structure characteristics, there is no exclusion of the possibility of strategic adjustment in the future.

From an investment perspective, the current performance pressure faced by Swellfun and the industry cycle adjustment are the core factors affecting the stock price. Against the backdrop of overall pressure on the liquor industry, investors should pay more attention to the company’s fundamental changes and the long-term strategic intent of foreign shareholders, rather than the transactional opportunities brought by short-term rumors.

[1] 21st Century Business Herald - “Moutai to Fully Promote Marketing Marketization Transformation; Wahaha’s Moutai Town Liquor Enterprise Deregistered | Wine Watch Weekly” (https://www.21jingji.com/article/20251229/herald/34927ed69766c5fed7c8811c37c3f9ea.html)

[2] Phoenix Finance - “Swellfun Clarifies Late at Night: Reports That ‘A Liquor Enterprise Intends to Acquire Swellfun’ Are Untrue” (https://finance.ifeng.com/c/8pNhWEj8y3M)

[3] NetEase Finance - “Swellfun Continues to Promote Strategic Layout to Seek Breakthrough; Stock Price Outperforms Market This Year, Profit Drops by 70%” (https://www.163.com/dy/article/KI1D6SQS05568TV0.html)

[4] Xueqiu - “Discussion on Diageo (DEO) Stock Price” (https://xueqiu.com/S/DEO)

[5] Caifuhao/Eastmoney - “After Being Rumored to Be Sold, Swellfun Urgently Needs to Win the ‘Against-the-Wind Game’” (https://caifuhao.eastmoney.com/news/20251226212429365515240)

[6] Sina Finance - “Swellfun Denies Being Acquired by Jiannanchun; Why Are Large-Scale M&As Rare in the Liquor Industry?” (https://finance.sina.com.cn/roll/2025-12-26/doc-inhecmrf8005647.shtml)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.