Jereh (002353.SZ): Valuation Logic Analysis of Transition from Cyclical Stock to Growth Stock

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Jereh (Yantai Jereh Oilfield Services Group Co., Ltd.) was founded in 1999 and is a leading domestic energy equipment manufacturing and technical service enterprise. Its traditional core business is oil and gas equipment manufacturing and technical services, which belongs to a typical cyclical industry closely related to the global oil and gas capital expenditure cycle. However, in recent years, the company has actively promoted a business diversification strategy, gradually building three major business segments: ‘oil and gas equipment + natural gas engineering + power energy’, forming a business pattern transitioning from a traditional cyclical stock to a growth stock [1][2].

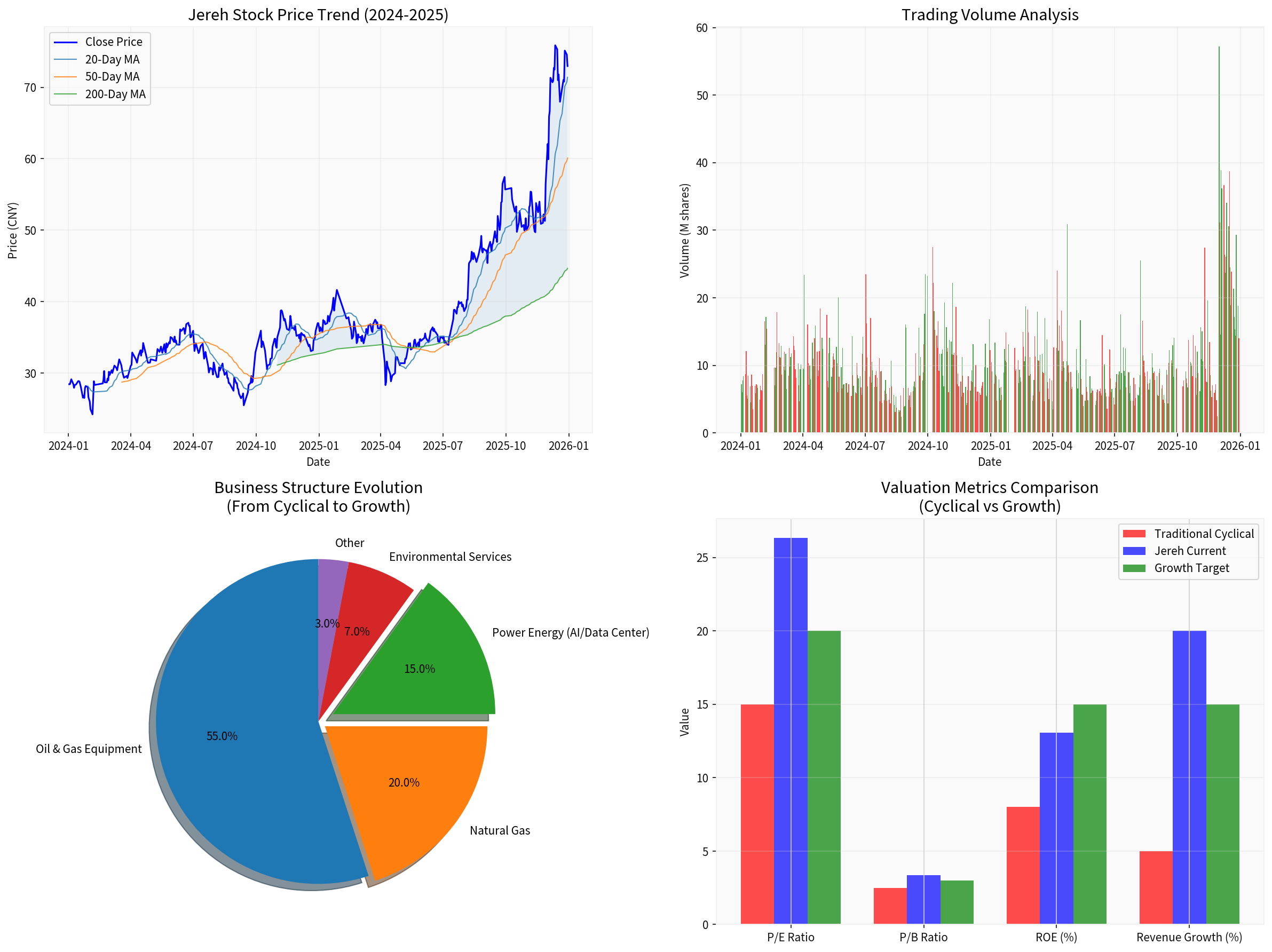

In terms of market performance, the company’s stock price rose from about 30 yuan at the beginning of 2024 to around 73 yuan in December 2025, an increase of more than 140%. The stock price even doubled in 2025, with a market capitalization reaching 738.8 billion yuan. This stock price performance reflects the market’s recognition of the company’s business transformation and growth logic [0].

Oil and gas equipment manufacturing remains the main source of the company’s revenue, accounting for about 55% of its operating income. This business mainly includes drilling and completion equipment, fracturing equipment, etc., which are greatly affected by crude oil prices and capital expenditures in the oil and gas industry. In 2024, the company’s drilling and completion equipment maintained a 100% winning record in PetroChina’s electric drive fracturing bidding projects, with both overseas market orders and revenue growing, and market share continuing to increase [1][2].

- Revenue is highly correlated with crude oil prices: The prosperity of the oil and gas industry directly affects the willingness of downstream capital expenditures

- High customer concentration: Main customers are large oil enterprises such as PetroChina and Sinopec

- Obvious order cycle: There is a 1-2 year lag from new order signing to revenue confirmation

The natural gas business has become an important growth engine for the company. In the first half of 2025, the revenue of this business surged by 112.69% year-on-year, and new orders increased by 43.28%. The company has built an integrated solution for the entire industry chain of ‘gas development - purification treatment - liquefaction storage and transportation - terminal utilization’, and its products are widely used in underground gas storage, LNG liquefaction plants and other scenarios [2][3].

- Demand growth brought by the reshaping of the global natural gas supply pattern

- Accelerated clean energy transformation promotes natural gas investment

- Continuous breakthroughs in emerging markets such as North Africa and the Middle East, such as the 316 million US dollar natural gas booster station project of Bahrain National Oil Company

This is the business segment with the most imagination space for the company. The company has successfully transformed from an oil and gas supporting service provider to a core power supply solution provider for AI data centers. Since November 2025, the company has successively won gas turbine generator set orders from leading US AI giants, with each contract amount exceeding 100 million US dollars, providing a total of more than 200MW high-power generator sets [2][3].

- Independently developed 6-35MW mobile gas turbine generator set series

- Established strategic cooperation with Siemens Energy, Baker Hughes, and Kawasaki Heavy Industries

- The power demand gap of North American data centers is huge, and the subsequent potential demand reaches 1-2GW

| Indicator | Jereh’s Current Value | Traditional Cyclical Stock Level | Growth Stock Level |

|---|---|---|---|

| P/E Ratio | 26.34x | 10-15x | 25-40x |

| P/B Ratio | 3.37x | 1.5-2.5x | 3-5x |

| ROE | 13.06% | 5-10% | 12-20% |

| Net Profit Margin | 18.04% | 5-10% | 15-25% |

| Current Ratio | 2.52 | 1.0-1.5 | 1.5-2.5 |

From the perspective of financial indicators, the company has already shown growth stock characteristics: its profitability is significantly higher than that of traditional cyclical stocks, with ROE reaching 13.06%, net profit margin maintaining above 18%, and healthy cash flow status [0].

According to the latest data, the company’s business structure is undergoing profound changes:

- The proportion of oil and gas equipment business has dropped from over 80% in the past to about 55%

- The proportion of natural gas business has increased to about 20%

- The power energy business has risen rapidly, accounting for about 15%

- The proportion of overseas revenue has increased to 47.75% (up 38.38% year-on-year in H1 2025) [2][3]

The core reason for the low valuation of traditional cyclical stocks is the large volatility of performance and unsustainable growth. By deploying natural gas and power businesses, Jereh has effectively reduced the impact of a single oil and gas cycle. The natural gas business benefits from the long-term trend of global energy transformation, and the power business benefits from the wave of AI data center construction; both have strong growth sustainability [1][2].

This is the key catalytic factor supporting the valuation transition. North American data centers face severe power shortages due to the explosion of AI computing power, making gas turbine power generation a rigid demand. The company has signed orders exceeding 100 million US dollars with North American AI giants, and the subsequent potential demand reaches 1-2GW, with a broad market space. Referring to the industry situation where GEV (General Electric Vernova) gas turbine orders increased by 112.63% year-on-year and production capacity was sold out until 2028, Jereh is expected to fully benefit from this structural opportunity [2][3].

The company’s overseas revenue increased from 1.377 billion yuan in 2017 to 6.037 billion yuan in 2024, with a CAGR of about 23.51%. It has continuously won large orders in markets such as the Middle East, North Africa, and Southeast Asia, such as the 6.6 billion yuan digital transformation project of ADNOC in the United Arab Emirates and the 6 billion yuan order in Algeria. The increase in the proportion of overseas business not only reduces the risk of a single market but also improves the stability and predictability of the company’s profits [2].

The company has independent R&D capabilities in electric drive fracturing, turbine fracturing, gas turbine power generation and other fields, forming certain technical barriers. Cooperation with international giants (Siemens, Baker Hughes, Kawasaki Heavy Industries) further strengthens technical endorsement and market recognition [3].

Although the company is actively transforming, the oil and gas equipment business still contributes more than 50% of its revenue. If crude oil prices fall sharply, it will still have a large impact on the company’s performance in the short term, affecting the market’s recognition of the company’s growth stock positioning [1].

Currently, AI data center orders are mainly concentrated in delivery from 2025 to 2026, and the sustainability of subsequent orders is uncertain. If the progress of AI construction in North America slows down or competition intensifies, it may affect the growth expectations of the company’s power business [2].

The company’s current P/E ratio is 26.34 times, close to the upper edge of the historical valuation range. According to the research report data of Guosen Securities, the company’s P/E valuation range in the past 5 years is 12-40 times; the current valuation has fully reflected the business transformation expectations, and there is a risk of valuation correction [1].

The gas turbine generator set market faces competition from international giants such as GEV, Siemens, and Mitsubishi. The company still needs continuous investment in brand awareness and channel coverage [2].

Based on the above analysis, we believe that the valuation logic of Jereh’s transition from a cyclical stock to a growth stock

- Partially reasonable: The rapid growth of natural gas and power businesses has indeed brought new growth momentum to the company, the volatility of performance has decreased, and the valuation logic of growth stocks has certain support.

- Not fully transitioned yet: The oil and gas business still contributes the main revenue, and the company still has strong cyclical attributes in the short term; valuing it completely as a growth stock may have overvaluation risks.

- Need continuous tracking: In the future, we need to focus on the sustainability of AI data center orders, the growth of overseas businesses, and changes in the profitability of the natural gas business.

According to calculations by different institutions:

- Guosen Securities: The reasonable PE for 2025 is 13-16 times, corresponding to a stock price of 38.22-47.04 yuan (relatively conservative)

- Donghai Securities: It is expected that the net profit attributable to shareholders from 2025 to 2027 will be 3.164/3.778/4.449 billion yuan, corresponding to PE of 22.91/19.19/16.29 times

- The current stock price corresponds to a PE of about 26 times in 2025, which has already discounted part of the future growth [1][3]

- Top left: Stock price trend and moving average from 2024 to 2025; the stock price rose from around 30 yuan to more than 70 yuan, which is in the historical high range

- Top right: Volume analysis, showing that the trading volume increased significantly during the stock price rise, and capital attention increased

- Bottom left: Business structure evolution chart, reflecting the company’s transformation from a single oil and gas business to diversification

- Bottom right: Valuation indicator comparison; Jereh’s current valuation level has approached the growth stock range

[0] Jinling AI Securities API Data - Jereh Company Overview, Financial Analysis, Technical Analysis

[1] Guosen Securities - 《Jereh (002353.SZ) In-depth Research Report》 (https://pdf.dfcfw.com/pdf/H3_AP202505151673290363_1.pdf)

[2] Donghai Securities - 《Company In-depth Report: Drilling and Completion Leader is Stable,

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.