Analysis of Welltrend Electric's (688698) Strong Performance and Sustainability Assessment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

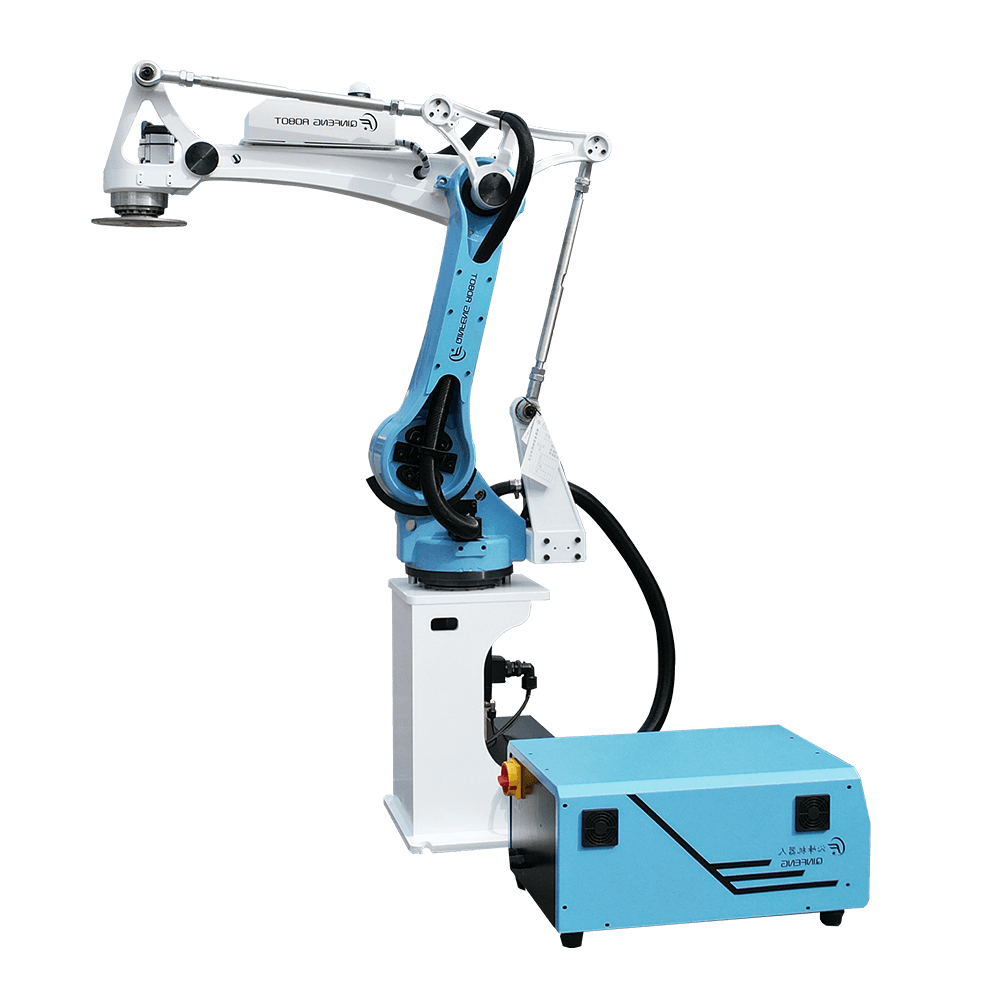

Welltrend Electric (688698), an industrial automation company, the core driver of its recent strong performance is the framework agreement for a Thai joint venture signed with Zhejiang Rongtai on December 26, 2025 [1][2]. The joint venture will focus on the intelligent robot mechatronics market, developing and producing mechatronics components, intelligent transmission systems, etc. It is expected to rely on the technical and resource advantages of both parties to strengthen the company’s layout in the intelligent robot field. Technically, the stock has risen 106.2% cumulatively in 2025 [3], with a one-year increase of 167.8% and a three-month increase of 58.3% [4], showing strong upward momentum. Fundamentally, Capital Research’s report predicts that the company’s net profit compound annual growth rate from 2025 to 2027 will be about 20%, with EPS increasing from 1.26 yuan to 1.81 yuan [4]. Its products include frequency converters (64.1%), servo systems (30.3%), etc., with a full industrial chain layout in the humanoid robot industry, and received a buy rating and a target price of 99 yuan [4].

The company’s layout in the intelligent robot field and joint venture expansion align with the current growth trend of the industrial automation and robot industry, attracting the attention of institutional investors such as Juming Investment [5]. The strategy of locating the joint venture in Thailand may help the company avoid trade risks and expand into the Southeast Asian market. However, it should be noted that the current joint venture is only a framework agreement, and there is uncertainty in subsequent implementation. At the same time, the company’s stock has risen 359.5% since its IPO [3], with a large short-term increase, so we need to be alert to the rise in market volatility.

Welltrend Electric’s (688698) recent strong performance is mainly driven by the announcement of the Thai joint venture, with both technical and fundamental aspects providing support. Sustainability requires attention to joint venture progress, industry competition, and macroeconomic environment. The current price is about 78.64 yuan, and the target price is 99 yuan [4]. Investors need to make careful judgments based on risk factors.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.