Analysis of the Reasons for Wolong Electric Drive (600580.SH) Being Popular and Its Investment Prospects

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The core logic behind Wolong Electric Drive (600580.SH)'s rising popularity on December 30 is

- Sector Market Driver: On that day, the A-share robot and AI agent sectors rose generally [2], and the company, as a humanoid robot concept target, followed the upward trend.

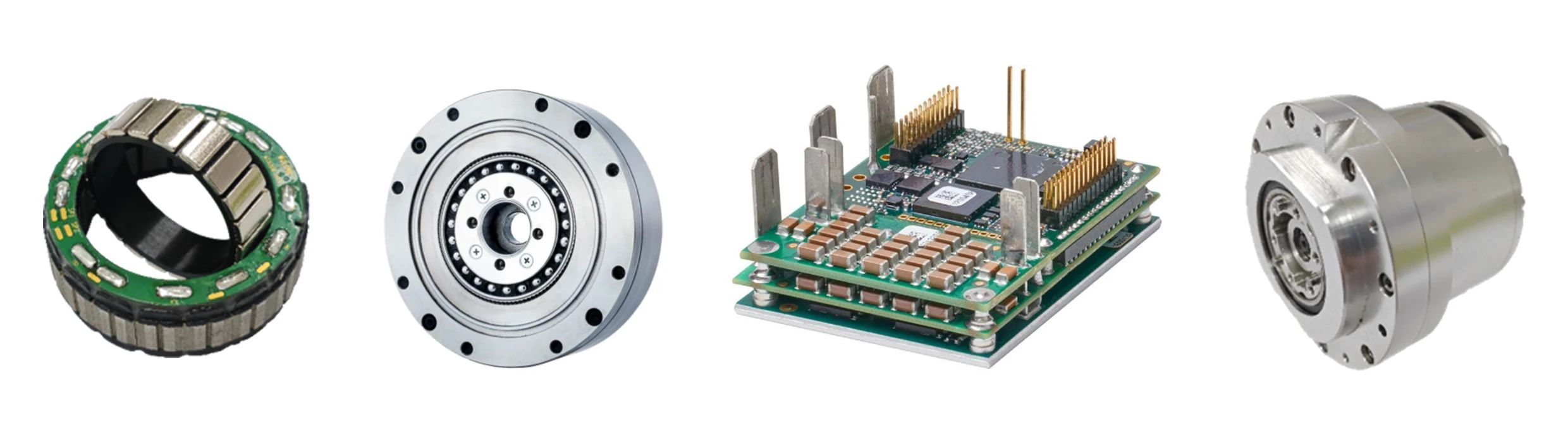

- Technology and Cooperation Layout: The company participated in key humanoid robot projects such as the “small-volume high-burst motor driver technology”, and its products have been applied and verified; it has established cooperation with leading enterprises like Zhiyuan Robot and SIASUN Robot & Automation [3].

- Market Attention Accumulation: On December 22, it gained a 10% limit-up due to the humanoid robot concept, accumulating market attention [3]; as a heavyweight stock in index funds like China Life 500 ETF, institutional holdings have enhanced the resilience of its stock price [1].

- Price Performance: It hit the 10% limit-up on December 22 and rose 7.08% on December 30, with a significant short-term cumulative increase [1][3].

- Mismatch Between Industrial Trend and Company Layout: The humanoid robot industry is in a window period of policy and technological breakthroughs, but the company’s robot business only accounted for 2.71% of its first-half 2025 revenue [3], contributing limited to short-term performance; long-term growth depends on business expansion.

- Sector Resonance and Sentiment Amplification: The company’s popularity is highly correlated with the overall strength of the robot sector, belonging to a theme rotation market, and capital inflows are short-term [2].

- Double Impact of Institutional Holdings: Institutional heavy holdings enhance the resilience of the stock price, but may also trigger a correction when the concept cools down [1].

- Risk Points:

- Low Business Proportion: Robot-related businesses have limited impact on the company’s overall performance [3].

- Concept Speculation Risk: Recent rises lack short-term performance support, with high volatility risks [1].

- Sector Rotation Risk: A correction may occur after the theme’s popularity fades [2].

- Opportunities:

- Industrial Growth Potential: The humanoid robot industry has long-term growth space and strong policy support [2].

- Technology and Cooperation Advantages: The company’s technical accumulation and leading cooperation may promote the increase of business proportion [3].

- Priority Assessment: Short-term risks are high, but long-term opportunities are worth paying attention to.

Wolong Electric Drive’s short-term popularity has risen due to the humanoid robot concept and sector market, with significant stock price performance. Investors need to rationally view the risks such as its low business proportion and concept speculation, and avoid blindly following short-term fluctuations. They can continue to pay attention to humanoid robot industry policies, the company’s business implementation progress, and sector dynamics to evaluate long-term investment value.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.