Analysis of Industrial Synergy and Strategic Integration After Ubtech Takes Control of Fenglong Shares

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to public information, Shenzhen Ubtech Technology Co., Ltd. (09880.HK) plans to acquire a total of 43% equity in Zhejiang Fenglong Electric Co., Ltd. (002931.SZ), a listed company on the Shenzhen Stock Exchange, for approximately RMB 1.665 billion. The transaction will be carried out in two phases: first, acquire 29.99% equity through share transfer, then launch a tender offer for 13.02% equity. After the acquisition is completed, Fenglong Shares will become Ubtech’s first A-share listed subsidiary, its financial results will be consolidated into Ubtech’s statements, and six out of seven board seats will be appointed by Ubtech, achieving holding and control change [1].

Fenglong Shares mainly engages in R&D, production, and sales of engines and electric complete machines for garden machinery (such as lawn mowers, chainsaws, hedge trimmers, blowers, etc.), hydraulic control systems, and auto parts; its hydraulic products are applied to hydraulic and pneumatic control systems of engineering, industrial, and semiconductor machinery, while auto parts cover lightweight and new energy vehicle parts [2].

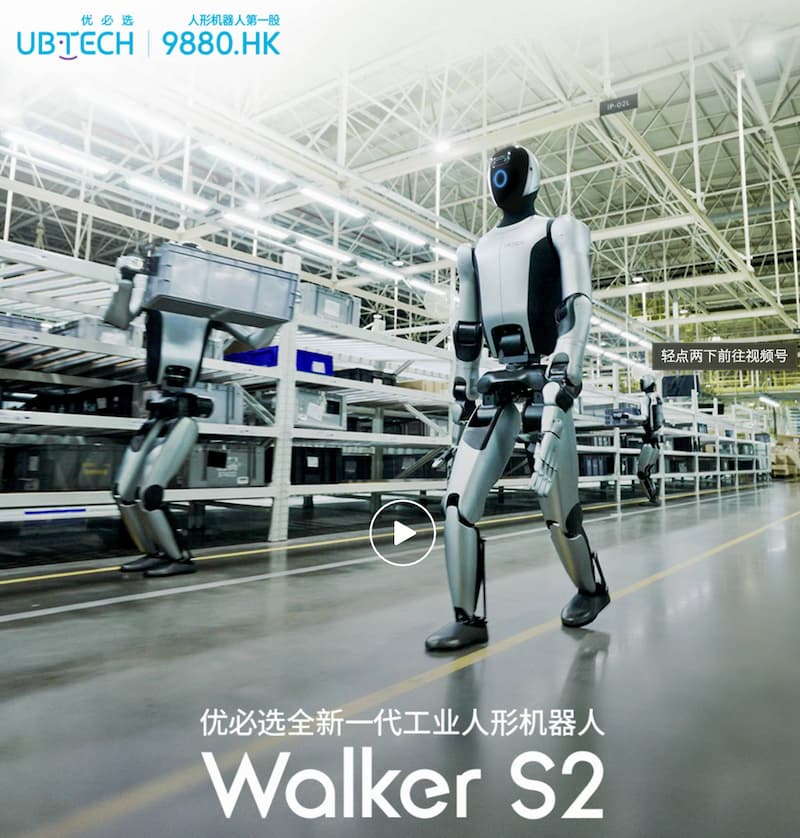

Ubtech has provided public guidance on mass production and capacity ramp-up of humanoid robots: its 2025 humanoid robot orders are nearly RMB 1.4 billion, with annual delivery of industrial humanoid robot Walker S2 exceeding 500 units and capacity exceeding 1,000 units; with the upcoming full production of Liuzhou Robot Super Smart Factory, it is expected that the humanoid robot capacity will reach 10,000 units next year [3].

- Collaboration on Precision Components and Hydraulic Actuators: Fenglong has application experience in hydraulic control and precision components for engineering and industrial machinery, which can be extended to precision components such as humanoid robot joint actuators and dexterous hand end actuators, helping to improve the consistency and reliability of the robot body.

- Introduction of Manufacturing and Quality Control Systems: Fenglong has mature mass production and quality management capabilities, which can form capacity linkage and process collaboration with Ubtech’s Liuzhou Factory, reducing manufacturing costs and shortening the ramp-up cycle.

- Upstream Bulk Procurement and Logistics Optimization: After the merger, the two parties can realize centralized procurement of bulk raw materials and standard parts, optimize warehousing and logistics layout, and reduce comprehensive supply chain costs.

- Electrification and Robotization Upgrade of Garden Machinery: Combine Fenglong’s garden machinery complete machine capabilities with Ubtech’s motion control, navigation, and AI capabilities to develop new product lines such as intelligent lawn mowing robots and outdoor inspection robots, entering the C-end and service robot markets.

- Industrial/Engineering Scenario Implementation: Fenglong’s accumulated experience in engineering machinery and hydraulic technology can accelerate the implementation of Ubtech’s industrial robots in scenarios such as handling, assembly, and inspection, forming a closed-loop solution.

- Integration of Auto Parts and Mobile Robots: Utilize Fenglong’s capabilities in new energy vehicle parts to explore the integration of wheels, steering, lightweight structural parts with mobile platforms/unmanned vehicles, expanding applications such as AGV/AMR.

- Reuse of Overseas and B-end Channels: If Fenglong has overseas channels for garden or industrial customers, it can provide Ubtech with ready-made networks and brand endorsement for product overseas expansion and industry implementation.

- Scenario Verification and Feedback: Pilot robot applications (such as factory inspection, warehouse handling, park cleaning) in existing customer scenarios first, quickly accumulate operation data and iterate products.

- Refinancing Capability of A-share Platform: As an A-share listed platform, Fenglong can provide financial support for humanoid robot capacity expansion and scenario expansion through private placements, convertible bonds, etc. in the future.

- Improvement of Credit and Financing Costs: After the merger, the credit qualification and scale effect will be improved, which is conducive to reducing the comprehensive financing cost.

- Board and Senior Management Adjustment: Based on the arrangement that “six out of seven seats are appointed by Ubtech”, the corporate governance will tilt towards Ubtech’s leadership, and strategic formulation, resource allocation, and performance assessment will tilt towards the robot business [1].

- Organization and Process Alignment: Promote process and IT system docking in key functions such as R&D, procurement, production, quality, and finance, and establish an integrated plan and budget management mechanism.

- Short-term (6-12 months): Launch supply chain collaboration and joint R&D pilots, focus on quickly accessible components and scenarios, and avoid large capital expenditures. Use the window period of “no plan to change the main business of the listed company or conduct major asset restructuring within the next 12 months” to lay the foundation and build capabilities.

- Medium-term (1-3 years): Form large-scale order and delivery capabilities in hydraulic/precision components, intelligent garden machinery, industrial scenario solutions, etc.; moderately expand production and upgrade production lines based on order and capital conditions.

- Long-term (more than 3 years): Focus on core components of humanoid robots and industry solutions, forming comprehensive capabilities of “hardware manufacturing + scenario implementation + platform operation”.

- Chain-focused Supplemental Investment: According to Ubtech’s robot capability map (perception, decision-making, execution, interaction), strengthen Fenglong’s links in materials, surface treatment, tooling fixtures, testing and measurement, etc.

- Ecological Collaboration and Scenario Investment: Conduct equity participation or strategic cooperation in scenarios such as logistics, warehousing, park operation and maintenance, and education and training to build solution models and ecological networks.

- Cultural and Mechanism Differences: There are differences between traditional manufacturing and technology companies in R&D rhythm, talent structure, and incentive mechanisms; organizational integration and incentive alignment need to be well handled.

- Technology Migration and Quality Ramp-up: Robot components have higher requirements for precision, lifespan, and consistency; they need to go through design and process adaptation, avoiding short-term gross profit margin fluctuations.

- Valuation and Performance Bet: If there are performance commitments and bet clauses in this transaction, attention should be paid to their implementation paths and risk exposures to avoid excessive expansion affecting cash flow.

- Policy and Compliance: It involves the supervision of listed companies in two places and cross-border regulatory cooperation; it is necessary to ensure compliance with information disclosure and related-party transactions.

- Collaboration Project List and Milestones: Whether the company discloses the first batch of collaboration projects (such as joint development, production line transformation, pilot scenarios) and their timetables.

- Organization and Personnel Adjustments: Retention, rotation, and incentive arrangements for Fenglong’s senior management and key position personnel.

- Capital Expenditure and Capacity Planning: Capacity allocation and equipment investment rhythm between Liuzhou Factory and Zhejiang Base.

- Order and Revenue Structure: The proportion and growth rate of robot-related businesses in the consolidated statements.

[1] Yahoo Finance Hong Kong—Brief News: Ubtech Acquires 43% Equity in A-share Listed Company Fenglong Electric (https://hk.finance.yahoo.com/news/簡訊-優必選收購a股上市公司鋒龍電氣43-股權-025904496.html)

[2] Yahoo Finance Hong Kong—Ubtech (09880) Acquires Equity in A-share Fenglong Shares for Over RMB 1.6 Billion (https://hk.finance.yahoo.com/news/優必選-09880-逾16億人幣收購a股鋒龍股份股權-兩股升-成-032347961.html)

[3] Yahoo Finance Hong Kong—Ubtech (09880.HK) Chairman Zhou Jian Voluntarily Bans Share Sales for 12 Months (https://hk.finance.yahoo.com/news/優必選-09880-hk-主席周劍自願12個月內禁售持股-011536082.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.