Haozhi Electromechanical (300503.SZ) In-Depth Investment Analysis: Can Commercial Aerospace and Robot Localization Layout Support Valuation?

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Haozhi Electromechanical’s layout in commercial aerospace and robot core component localization does have

- Cooperated with leading commercial aerospace enterprises like Landspace, some products have achieved small-batch application

- Products are mainly used for precision processing and assembly of core components like rocket engines

- Currently has small profits, but the proportion of total revenue is low

China’s commercial aerospace market is in an

- Market size soared from 380 billion yuan in 2015to2.3 trillion yuan in 2024

- Expected to exceed 2.8 trillion yuan in 2025[1]

- Policy-wise, the 15th Five-Year Plan included commercial aerospace in the national strategy for the first time, and the Science and Technology Innovation Board opened its doors to hard technology enterprises[1]

- Significant technical gap between China and US SpaceX: Falcon 9 rocket recovery success rate exceeds 91%, launch cost per kg is only 20,000 yuan, while China’s private rocket recovery technology is still in the breakthrough stage[1]

- The company is currently in the industrial chain supporting link, with relatively limited bargaining power and market space

The company has formed a diversified product matrix, with a number of core components fully realized domestic independent research and development:

| Core Components | Technical Breakthroughs | Market Position |

|----------------|-------------------------|----------------|----------------|

| Reducer | Harmonic reducer, RV reducer | Break Japanese monopoly, domestic substitution |

| Low-voltage Driver | High-performance servo drive | Localization rate improvement |

| Torque Sensor | High-precision force feedback | Core component of humanoid robot |

| Frameless Torque Motor | High torque density | Key component of joint module |

| Encoder | High-precision position detection | Core of automation control |

Morgan Stanley predicts that by

- Localization rate over 90%: Referring to the supply chain strategy of peers like Unitree Robotics (China’s version of Boston Dynamics), core component localization is the key to cost control[2]

- Independent and controllable technology: Avoid being “stuck by the neck”, in line with national industrial policy orientation

- Diversified application scenarios: Extend from industrial robots to humanoid robots and service robots

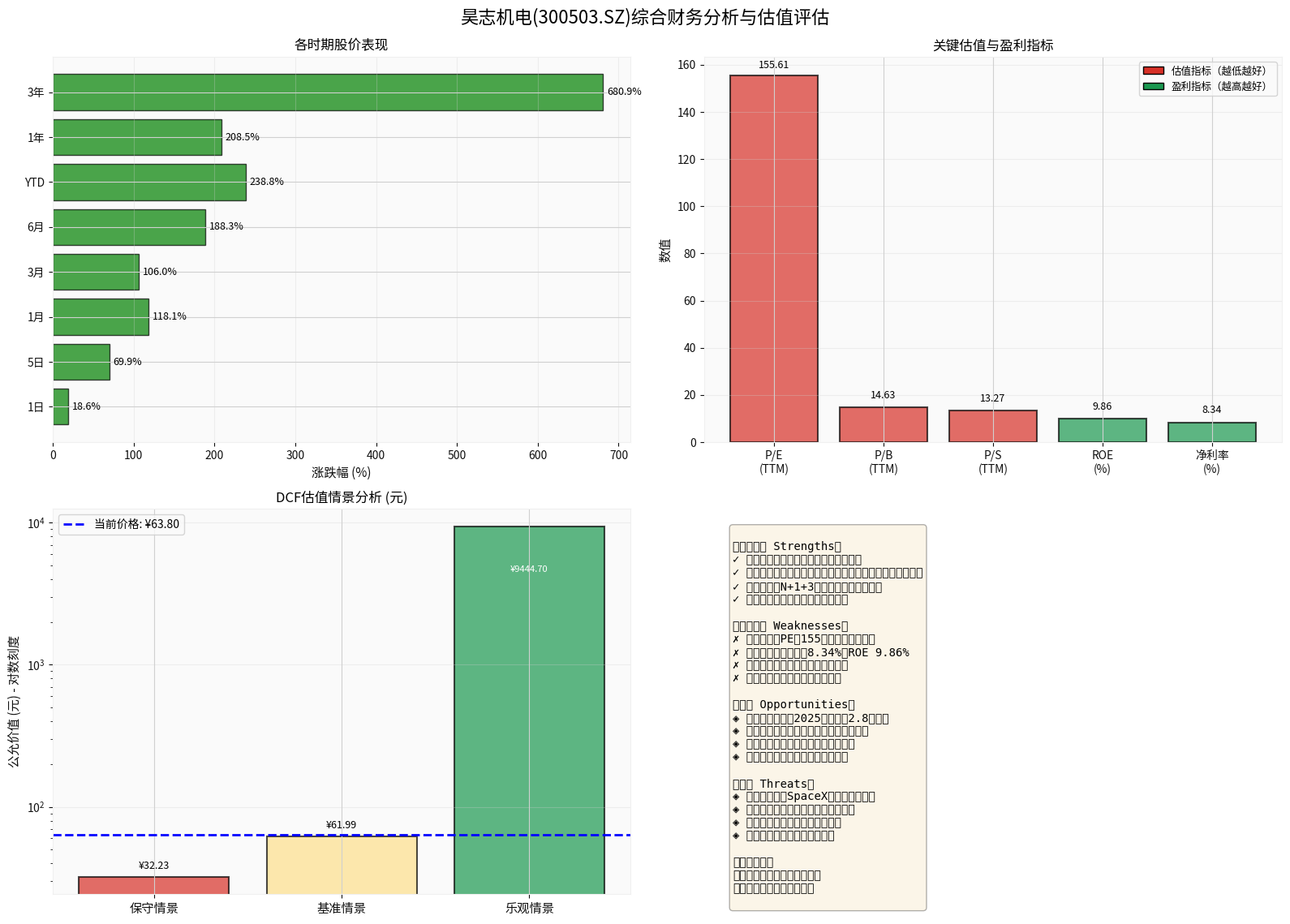

- 1 day: +18.59% (today’s limit-up)

- 5 days: +69.91%

- 1 month: +118.12%

- YTD: +238.82%

- 1 year: +208.51%[0]

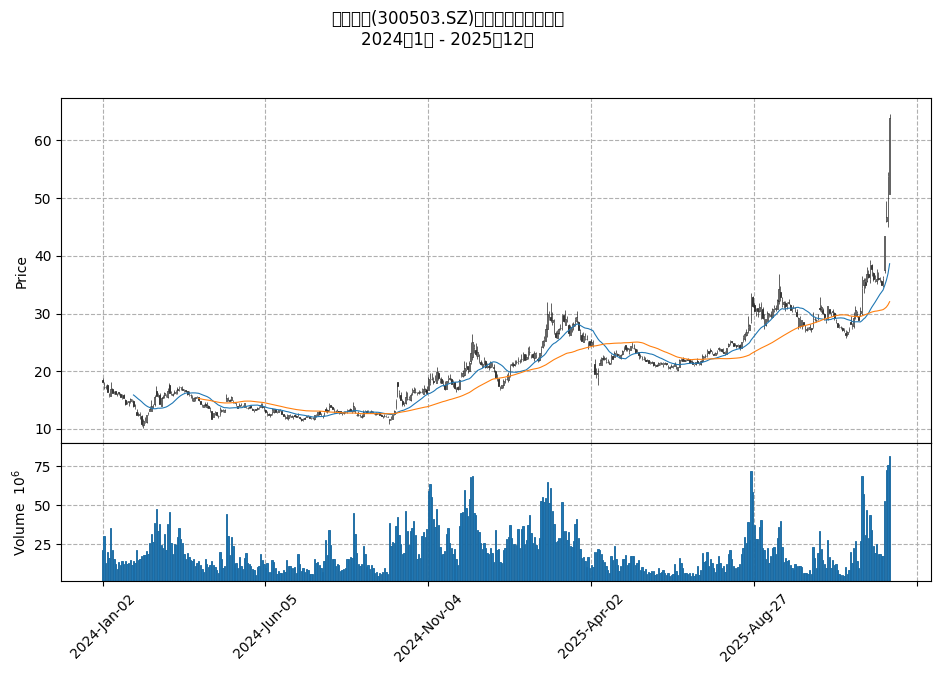

From the K-line chart, the stock price has entered an accelerated upward channel since the second half of 2024, recently breaking through the resistance level of 64.56 yuan, with significant volume expansion, indicating extremely excited market sentiment.

| Indicator | Value | Industry Comparison | Evaluation |

|---|---|---|---|

| P/E (TTM) | 155.61x |

Industry average ~30-50x | Seriously overvalued |

| P/B (TTM) | 14.63x |

Normal level:2-5x | Bubbly |

| P/S (TTM) | 13.27x |

Normal level:1-3x | Excessive premium |

| ROE | 9.86% | Excellent company >15% | Weak profitability |

| Net Profit Margin | 8.34% | Industry excellent level:10-15% | Large room for improvement |

###3.3 DCF Valuation Analysis: Base Scenario Close to Current Price

Three-scenario analysis based on Discounted Cash Flow (DCF) model[0]:

| Scenario | Fair Value | vs Current Price | Key Assumptions |

|---|---|---|---|

Conservative |

¥32.23 | -49.5% |

Revenue growth:0%, EBITDA margin:14.3% |

Base |

¥61.99 | -2.8% |

Revenue growth:10.6%, EBITDA margin:15.0% |

Optimistic |

¥9,444.70 | +14,703.6% |

Revenue growth:13.6%, EBITDA margin:15.8% |

- Base scenario(using historical 5-year average data) gives fair value of61.99 yuan, basically flat with current price of63.80 yuan

- Conservative scenarioshows nearly50% downside space

- Optimistic scenario’s extremely high valuation is obviously unrealistic (reflecting the limitation of the model under high growth assumptions)

##4. Technical Analysis: Short-term Overbought, Correction Risk Increases

- Trend: Inupward trend(breakthrough day, to be confirmed), buy signal appeared on December25[0]

- KDJ: K value:81.6, inoverbought area,发出 warning signal[0]

- Key Prices:

- Resistance level:¥64.56 (touched today; may correct if not effectively broken)

- Next target:¥68.34

- Support level:¥42.26[0]

##5. Investment Logic SWOT Analysis

###Strengths ✓

- Domestic substitution pioneer: Core components fully self-developed, in line with national industrial security strategy

- Dual-track layout: Commercial aerospace + robot, capturing opportunities in two trillion-level markets

- Leading customer cooperation: Established partnerships with Landspace etc., technology recognized by the market

- Policy dividend: Commercial aerospace included in national strategy; Science and Technology Innovation Board supports hard technology enterprises

###Weaknesses ✗

- Valuation seriously overvalued: PE of 155x far exceeds reasonable industry level

- Weak profitability: ROE only9.86%, net profit margin 8.34%—large gap from excellent enterprises

- Insufficient scale effect: Commercial aerospace business still in small-batch application stage, limited contribution to performance

- Large R&D investment: Continuous high-intensity R&D investment puts pressure on short-term profits

###Opportunities ◈

- Commercial aerospace market explosion: China’s market will exceed2.8 trillion yuanin 2025[1]

- Humanoid robot revolution: Morgan Stanley predicts China’s market will reach4.7 trillion US dollarsby2050[2]

- Localization acceleration: Core component localization rate increases; huge space for import substitution

- Capital catalysis: Science and Technology Innovation Board provides financing platform for hard technology enterprises

###Threats ◈

- Valuation bubble burst risk: Technical side overbought after stock price surge; correction pressure increases

- Technical gap: Large technical gap with global leaders like SpaceX[1]

- Intensified competition: Domestic and foreign manufacturers layout one after another; competition pattern becomes increasingly fierce

- Policy & geopolitical risks: International trade frictions may affect industrial chain cooperation

##6. Investment Suggestions and Risk Warnings

###6.1 Investment Suggestions

| Investor Type | Suggestion | Reason |

|---|---|---|

Short-term investors |

Avoid |

Technical side seriously overbought; high short-term correction risk |

Mid-term investors |

Wait for correction to 40-45 yuan range |

DCF conservative scenario (32.23 yuan) provides safety margin |

Long-term investors |

Layout in batches, hold for3-5 years |

Localization logic established; need to wait for reasonable price |

- Performance realization: Whether 2025 performance can maintain >30% growth

- Order landing: Large order signing in commercial aerospace and robot business

- Technical breakthrough: Whether key product indicators reach international advanced level

- Valuation digestion: Reduce PE to below 80x through performance growth

###6.2 Risk Warnings

- Valuation correction risk: Current PE of155x; if growth is lower than expected, stock price may drop sharply

- Market competition risk: Domestic and foreign manufacturers layout; may lead to price war and profit margin decline

- Technology iteration risk: Robot technology iterates rapidly; risk of technology route being subverted

- Customer concentration risk: Fluctuations in main customer orders will have a great impact on performance

- Policy change risk: Industrial policy adjustments may affect business development

##7. Conclusion

Haozhi Electromechanical’s layout in commercial aerospace and robot core component localization does have long-term strategic value. The company has realized full domestic independent R&D of core components like reducers, sensors, and motors—this aligns with national industrial security strategy and gives it a first-mover advantage in the trillion-level market.

##References

[0] Gilin API Data—Real-time quotes, financial analysis, DCF valuation, technical analysis data for Haozhi Electromechanical (300503.SZ)

[1] Yahoo Finance—“1.5 Trillion USD Market! China-US Commercial Aerospace Race” (https://hk.finance.yahoo.com/news/1-5兆美元市場-中美商業航太競速-spacex引爆史上最大ipo-陸航太民企集體衝刺科創板-075003307.html)

[2] Yahoo Finance—“Morgan Stanley: China’s Humanoid Robot Market Will Grow 100x to 4.7 Trillion” (https://hk.finance.yahoo.com/news/大摩-中國人形機器人市場將增100倍至4-7兆-人形機器人可望承擔哪些工作-065005697.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.