Analysis of the Impact of Hyundai Motor's Exit from the Russian Market on Global Business Layout and Stock Valuation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Hyundai Motor faced severe geopolitical challenges following the Russia-Ukraine conflict. Its manufacturing plant in St. Petersburg has been idle since March 2022, and was sold to Russia’s AGR Automotive Group at a

According to brokerage data, this asset disposal resulted in an

| Impact Item | Amount | Explanation |

|---|---|---|

| Asset Sale Loss | 287 billion KRW (≈ 219 million USD) | Impairment loss from selling Russian factory in 2024 [1] |

| Annual Plant Capacity | Over 200,000 units | St. Petersburg plant capacity [3] |

| Historical Market Share (2019) | 23% (Hyundai + Kia) | Once Russia’s largest foreign automaker [3] |

According to Hyundai Motor’s 2024 financial data [0]:

- Total Revenue: 175.2 trillion KRW (≈ 125 billion USD)

- Net Profit: 13.23 trillion KRW (≈ 9.45 billion USD)

- Total Assets: 339.8 trillion KRW

- Asset impairment loss as % of total revenue: ~0.16%

- Asset impairment loss as % of net profit: ~2.3%

- Conclusion: Limited impact on overall financial health

- 2024 Russian Market: Total sales of 1.6 million units [3]

- Hyundai Motor Global Sales (2024): 4.142 million units [0]

- Russian Market Share of Global Sales: ~1.89% (assuming historical data)

- Actual Financial Impact: Since Russian operations were suspended in 2022, theactual impact in 2024-2025 is a one-time accounting loss

According to Hyundai Motor’s Sustainability Report [2]:

| Market | Sales Share | Strategic Position |

|---|---|---|

North America |

28.76% | Core growth market, main force in electrification transformation |

South Korea |

17.02% | Domestic market, stable profit contributor |

Europe |

14.71% | Second largest market, leading in electrification |

India |

14.62% | Growth engine in emerging markets |

| Central and South America | 7.62% | Developing market |

| Middle East/Africa | 7.55% | Emerging market |

| Asia-Pacific | 5.24% | Regional market |

| China | 3.02% | Highly competitive market |

Q3 2025 data shows [2]:

- Global Electrified Vehicle Sales Growth: 37%

- North America Electrified Vehicle Sales: 94,786 units, up 52.6% YoY

- North America Electrification Penetration: 30.1%

- Conclusion: Electrification transformation successfully offsets the impact of exiting the Russian market

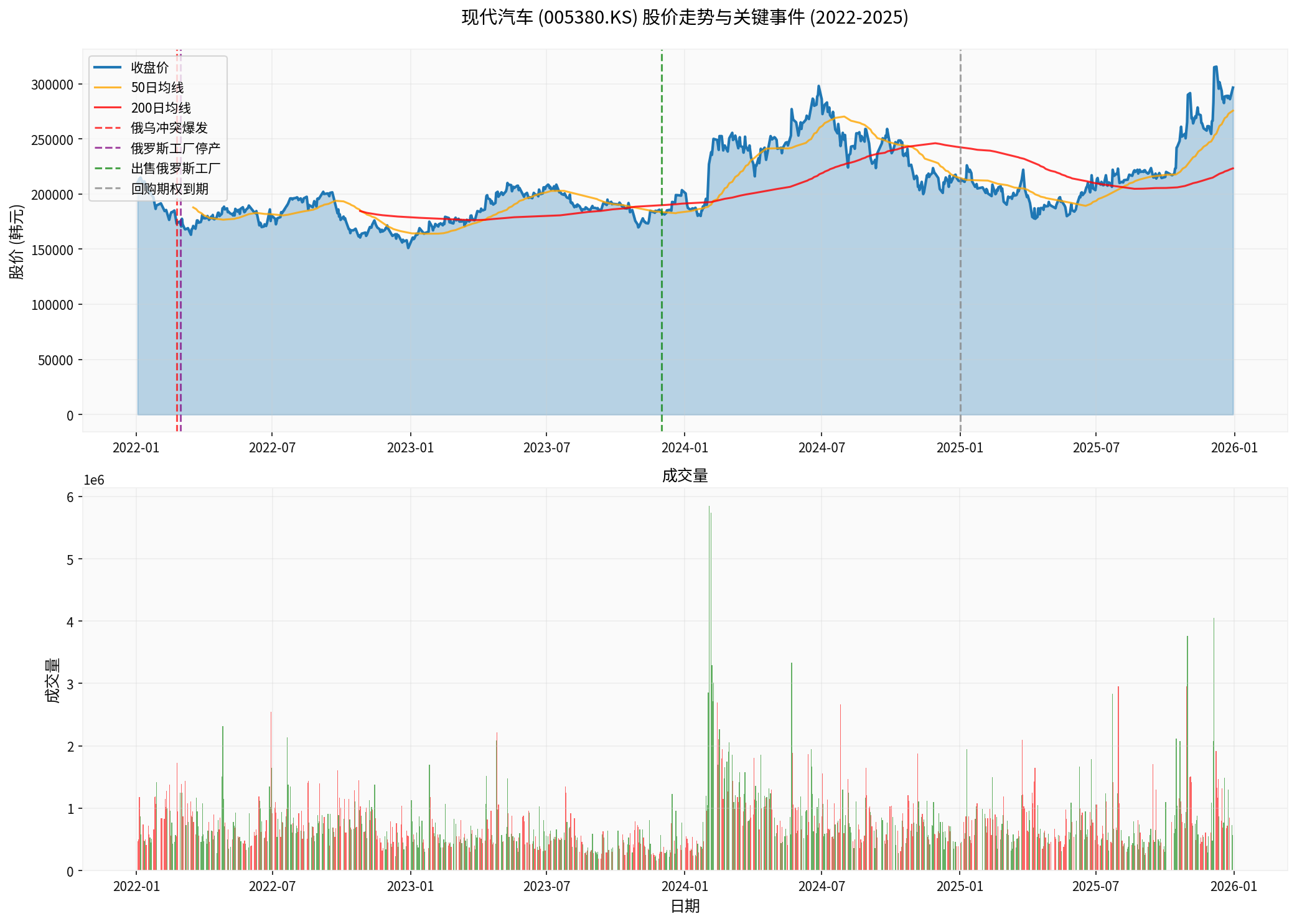

| Time Point | Event | Stock Price Reaction |

|---|---|---|

| 2022-02-24 | Outbreak of Russia-Ukraine conflict | Short-term volatility |

| 2022-03 | Russian factory suspended operations | Market gradually digested |

| 2023-12 | Sold Russian factory | Limited impact |

| 2024-2025 | Accelerated electrification transformation | Stock price continued to rise |

| Current Stock Price (2025-12-30) | 296,500 KRW | Annual increase of +40.19% |

According to brokerage data [0]:

| Indicator | Value | Valuation Level |

|---|---|---|

P/E Ratio |

7.33x | Significantly undervalued |

P/B Ratio |

0.64x | Below book value |

ROE |

9.66% | Healthy level |

Net Profit Margin |

5.90% | Reasonable level |

Market Capitalization |

66.73 trillion KRW | Top 5 global automakers |

According to DCF model valuation [0]:

| Scenario | Intrinsic Value (KRW) | Premium Over Current Price | Probability |

|---|---|---|---|

| Conservative | 4,350,367 | +1,367% | 20% |

| Base | 10,098,907 | +3,306% | 60% |

| Optimistic | 11,946,918 | +3,929% | 20% |

Probability Weighted |

8,798,731 |

+2,868% |

- |

- The current market uses relative valuation methods, considering geopolitical risks to be long-term

- P/B <1.0 indicates market discount for emerging market risks

- P/E=7.33x is significantly lower than the global peer average of over 15x

| Risk Type | Impact | Response Measures |

|---|---|---|

Supply Chain Disruption |

Medium | Diversified supply chain layout |

Brand Reputation Risk |

Medium-High | Withdrawal in line with ESG standards |

Asset Impairment Risk |

High (already occurred) | Quick disposal to stop losses |

Future Market Access |

Low-Medium | Indirect entry via Chinese brands |

- Successful Risk Isolation: Avoid deeper sanctions and supply chain disruptions

- Resource Reallocation: Resources directed to high-growth markets (North America +37% electrification growth)

- Enhanced ESG Reputation: Aligns with international expectations for withdrawal from Russia

- Controllable Financial Impact: One-time loss of $219 million, accounting for <3% of profit

- Permanent Market Loss: Russian market dominated by Chinese brands (62.5% share in 2024 [3])

- Repurchase Right Invalidated: Unable to recover assets via repurchase option, loss solidified

- Geopolitical Premium: Market discount for South Korean companies’ geopolitical risks may persist long-term

| Factor | Assessment |

|---|---|

Financial Impact |

Minor (one-time loss already accounted for) |

Stock Price Impact |

Neutral (already digested by the market) |

Business Impact |

Positive (resource reallocation) |

- North America Market Expansion: Q3 2025 North America sales growth of 13.2%, electrification penetration of 30.1% [2]

- Europe’s Electrification Leadership: Aligns with EU’s 2035 ban on fuel vehicles strategy

- India Market Rise: Sales share of 14.62%, becoming the third largest market

- Technological Leadership: Leading industry in electrification and hydrogen technology investment

- China-US Trade Frictions: May affect global supply chains

- Korean Peninsula Geopolitical Risks: Unique risk discount for South Korean companies

- Global Demand Slowdown: 1.8% decline in global sales in 2024 [2]

- P/E=7.33x: Significantly lower than global automaker average

- P/B=0.64x: Sufficient safety margin

- Dividend Yield: ~2.7% (based on 2024 net profit)

- Impact of Russian exit is fully priced in

- Significant results from electrification transformation, strong growth in North America

- Valuation is attractive, but geopolitical risks need attention

Hyundai Motor’s exit from the Russian market is a

- Controllable Financial Impact: Loss accounts for <3% of net profit, no impact on overall financial health

- Successful Business Restructuring: Resources successfully shifted to high-growth markets (North America, Europe, India)

- Strong Stock Price Performance: Annual increase of +40.19%, indicating market recognition of strategic adjustments

- Attractive Valuation: P/E=7.33x, P/B=0.64x, room for revaluation

[0] Jinling API Data - Hyundai Motor (005380.KS) stock price, financial data, DCF valuation

[1] Reuters via Investing.com - “Hyundai not in a position to buy back Russian auto factory, source says” (https://www.investing.com/news/stock-market-news/exclusivehyundai-not-in-a-position-to-buy-back-russian-auto-factory-source-says-4423543)

[2] Hyundai Motor Company - 2025 Sustainability Report / Q3 2025 Earnings Release (https://www.hyundai.com/worldwide/en/newsroom/detail/hyundai-motor-company-reports-strong-q3-2025-performance-4.8%2525-global-growth-driven-by-37%2525-electrified-vehicle-surge-0000001043)

[3] Business Times - “Hyundai not in position to buy back Russian auto factory: source” (https://www.businesstimes.com.sg/companies-markets/transport-logistics/hyundai-not-position-buy-back-russian-auto-factory-source)

[4] Leave-Russia.org - “The List Of International Companies That Are Leaving Russia” (https://leave-russia.org/leaving-companies)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.