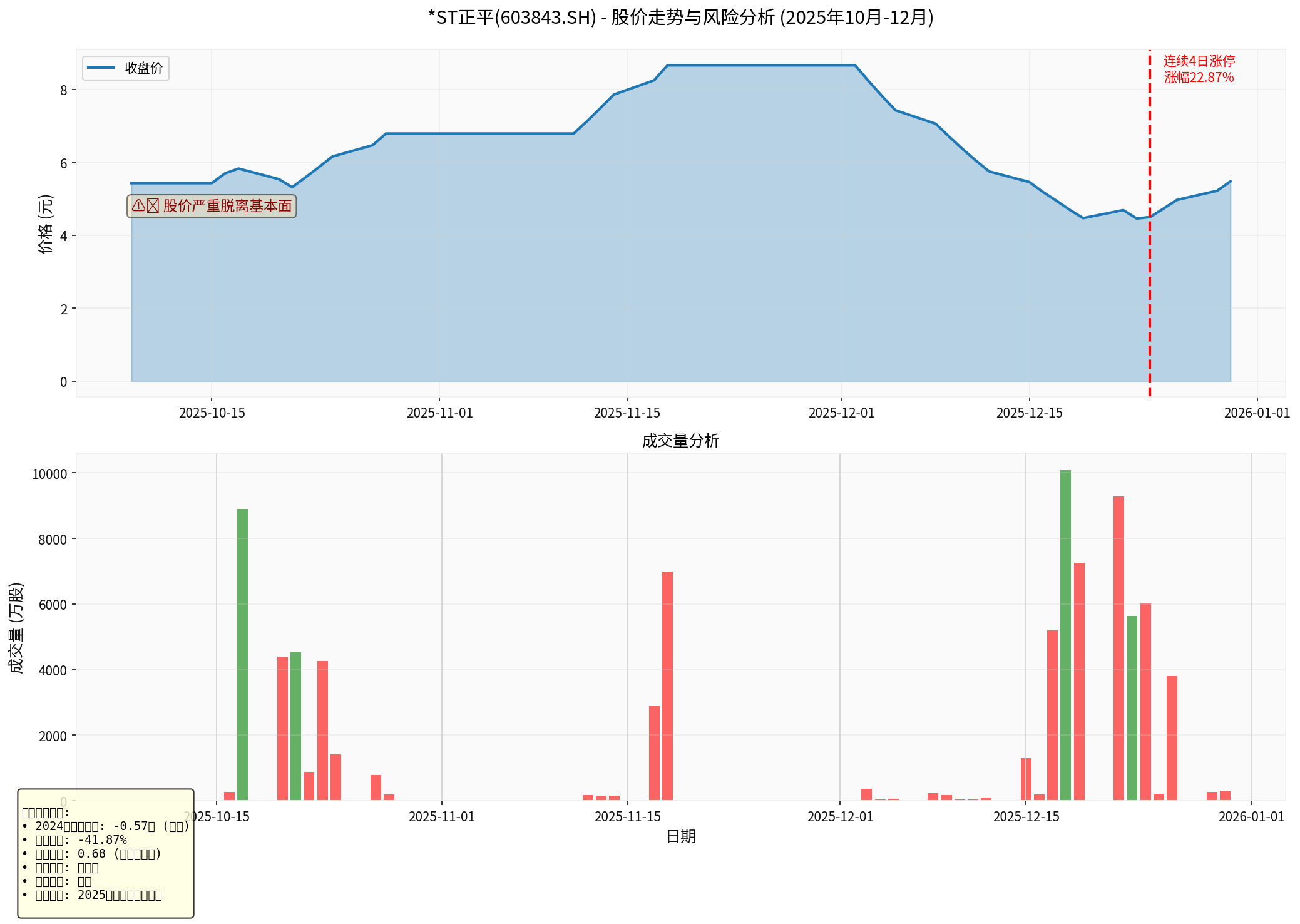

*ST Zhengping: Strategies for Resolving Delisting Risks and Protecting Investors Amid Pre-reorganization Creditor Declaration Dilemmas

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

According to brokerage API data [0], *ST Zhengping’s current financial condition is extremely severe:

| Key Financial Indicators | Value | Risk Rating |

|---|---|---|

| 2024 EPS | -0.57 CNY | Severe Loss |

| ROE (Return on Equity) | -150.27% | Extremely Deteriorated |

| Net Profit Margin | -41.87% | Profitability Collapsed |

| Operating Margin | -48.02% | Core Business Severe Loss |

| Current Ratio | 0.68 | Insufficient Liquidity |

| Free Cash Flow | -477 million CNY | Cash Flow Exhausted |

| Debt Risk | High Risk | Insufficient Solvency |

According to company announcements and online search information [1][2]:

- Limited declaration scope: Only applies to the parent company level; major holding subsidiaries are not included

- Cannot eliminate unqualified audit opinions: Difficult to resolve audit issues such as inaccuracy and incompleteness of project cost expenses and external loan measurement through this creditor declaration

- Outstanding subsidiary issues: Subsidiaries like Guizhou Water Conservancy Industry have abnormal operations and unverifiable financial data

According to the Shanghai Stock Exchange Listing Rules, the company faces the following delisting risks [1]:

-

Financial delisting indicators:

- 2025 audited归母 net assets may be negative

- The financial report for the most recent fiscal year is issued with an unqualified or adverse audit opinion

-

Normative delisting indicators:

- Existence of illegal behaviors such as fund occupation and illegal guarantees

- Information disclosure violations and internal control failures

-

Major illegal risks:

- If involved in false statements, it may trigger investor claims

According to bankruptcy law theoretical research [5],

- Debts not recorded in the books and not declared (especially guaranteed debts)

- May lead to pre-reorganization failure or re-crisis after reorganization

- Core concern of reorganization investors

According to the Enterprise Bankruptcy Law and relevant judicial interpretations, the following measures can be taken:

- Apply to the court to include major holding subsidiaries in the pre-reorganization scope

- Reason: Subsidiary financial issues are the main cause of unqualified audits; including them in pre-reorganization is conducive to solving problems in a package

- Basis: Substantive consolidation bankruptcy principle, high confusion of associated enterprise personalities

Professional analysis suggestions from online searches [3]:

- Use the coercive power of the pre-reorganization procedure to force creditors to cooperate with creditor declaration and verification by the administrator

- Clarify key evidence that the audit institution could not obtain previously, such as loan principal and interest and project costs

- Work closely with the new audit institution Zhongruicheng Accounting Firm to ensure all disposal procedures have sufficient audit evidence support

According to professional analysis [3], selling subsidiaries not included in pre-reorganization during the pre-reorganization period is a feasible path:

| Disposal Object | Disposal Method | Expected Effect |

|---|---|---|

| Abnormal subsidiaries like Guizhou Water Conservancy Industry | Quick divestment at symbolic prices | Cut loss sources and eliminate unqualified audits |

| Subsidiaries with certain value | Introduce strategic investors for joint disposal | Revitalize assets and obtain cash flow |

| Still operational assets | Retain and reorganize | Maintain sustainable operation capabilities |

- Immediately start subsidiary evaluation work

- Complete major rectification work by the end of 2025

- Create conditions for issuing standard audit opinions in April 2026 [3]

- Debt reduction: Negotiate with major creditors to reduce debt burden through debt-to-equity swaps, extensions, and reductions

- Introduce reorganization investors: Restore sustainable operation capabilities by injecting funds and high-quality assets

- According to the Supreme People’s Court Guidance Opinions [6], the debt repayment plan should be clear and feasible, and shall not repay debts in a way that is obviously unenforceable or difficult to realize

- Shrink loss-making businesses: Stop continuously loss-making businesses like mineral resources

- Recover funds: Accelerate accounts receivable recovery and dispose of non-core assets

- Cost control: Strictly control various expenses to ensure cash safety

- Focus on core business: Return to the core advantage business of road and bridge construction

- Business transformation: Seek project opportunities with stable profit models

- Internal control reconstruction: Improve corporate governance and eliminate issues like fund occupation and illegal guarantees

According to the Supreme People’s Court Guidance Opinions on Listed Company Bankruptcy Reorganization Cases [6]:

- The company should timely, accurately, and completelydisclose pre-reorganization progress

- Disclose key progress like creditor declaration, asset disposal, and debt restructuring weekly

- Conduct risk prompts for major uncertain matters

- Strictly prohibitmarket speculation using pre-reorganization information

According to bankruptcy law regulations, the creditors’ meeting is the highest decision-making body in the bankruptcy procedure. Recommendations:

- Small and medium investors can participate in the creditors’ committee through institutions like the China Securities Investor Services Center

- Exercise voting rights on reorganization plan drafts and asset disposal plans

- Ensure small and medium investors’ voting rights on reorganization plans through the exchange’s online voting system

- The reorganization plan draft needs to be approved by the investors’ group meeting (more than two-thirds of the voting rights held by investors attending the meeting) [6]

According to relevant laws and regulations [6]:

- If the company is involved in false statements, damaged investors can file civil compensation lawsuits according to law

- The administrator should reserve debt repayment resources for possible investor damage compensation in the reorganization plan

- The court can consult the opinions of investor protection institutions

- Pursue compensation responsibilities of controlling shareholders and actual controllers for behaviors like fund occupation and illegal guarantees

- Recover losses through methods like shareholder derivative litigation

- If intermediary institutions like audit firms and sponsors fail to perform their due diligence obligations, investors can pursue their joint and several compensation responsibilities

| Time Node | Key Tasks | Objectives |

|---|---|---|

| December 2025 - January 2026 | Complete evaluation and disposal of major subsidiaries | Eliminate main obstacles to unqualified audits |

| January - February 2026 | Complete creditor declaration and verification | Clarify debt scale |

| March 2026 | Introduce strategic investors | Inject funds and resources |

| April 2026 | Issue standard audit opinions | Avoid negative net assets in 2025 |

| Before June 2026 | Complete reorganization plan | Restore sustainable operation capabilities |

According to professional analysis from online searches [3] and bankruptcy law theoretical research [5][6]:

- Judicial and administrative collaboration: Close cooperation between courts, local governments, and securities regulatory authorities

- Professional competence of administrators: Efficient performance of duties by the temporary administrator Qinghai Shuren Law Firm

- Creditor support: Major creditors need to support the reorganization plan

- Transparent information disclosure: Avoid speculation using pre-reorganization information and prevent regulatory risks

- Grasp of time windows: Efficiently execute the above plans within the limited time window (before April 2026)

Based on current analysis, *ST Zhengping faces the following major risks:

- Delisting risk: 2025 net assets may be negative, with the risk of termination of listing [1]

- Reorganization failure risk: Pre-reorganization may not be converted to formal reorganization, or the reorganization plan cannot be implemented [5]

- Sharp stock price decline risk: Short-term gains deviate from fundamentals, with regression pressure [1]

- Equity dilution risk: If the reorganization involves capital reserve conversion to share capital, the rights and interests of original shareholders may be diluted

- Rational decision-making: Be alert to short-term speculation and focus on the progress of fundamental improvement

- Information tracking: Closely follow announcements on pre-reorganization progress, audit opinions, and major asset disposals

- Risk assessment: Evaluate personal risk tolerance and make decisions carefully

- Right maintenance: If rights are damaged, maintain legal rights through legal channels

The delisting risk faced by *ST Zhengping is severe but not completely unsolvable. There is still hope to reverse the situation through the following comprehensive measures:

- Expand pre-reorganization scopeto include major holding subsidiaries

- Accelerate disposal of problematic subsidiariesto cut loss sources and eliminate unqualified audits

- Introduce strategic investorsto inject funds and high-quality assets

- Reconstruct internal controlto eliminate illegal behaviors like fund occupation and illegal guarantees

- Improve sustainable operation capabilitiesto ensure positive net assets in 2025

- Strengthen information disclosure transparency to protect the right to know

- Improve participation mechanisms to protect voting rights

- Improve loss compensation mechanisms to protect claim rights

- Do a good job in delisting risk education to protect the right to choose

The key to success lies in

[0] Jinling API Data

[1] Daily Economic News - “*ST Zhengping: Stock Price Has Risen Sharply in Short Term with Risk of Sharp Decline; Pre-reorganization Creditor Declaration Scope Limited” (https://finance.sina.com.cn/roll/2025-12-30/doc-inhequpk4140422.shtml)

[2] Caixin Society - “ST Zhengping: Stock Price Has Risen Sharply in Short Term with Risk of Sharp Decline; Pre-reorganization Creditor Declaration Scope Limited” (https://finance.ifeng.com/c/8pVrjW192cy)

[3] East Money Wealth Account - “Now It Can Be Said: Zhengping Will Be the Next Salt Lake Co.” (https://caifuhao.eastmoney.com/news/20251225230858901870260)

[4] East Money - “*ST Zhengping: Stock Price Has Risen Sharply in Short Term with Risk of Sharp Decline; Pre-reorganization Creditor Declaration Scope Limited” (https://wap.eastmoney.com/a/202512303605904569.html)

[5] Bankruptcy Law Theoretical Research

[6] Supreme People’s Court Guidance Opinions

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.