Analysis of Strategic Landscape and Media Industry Valuation Impact After Warner Bros. Rejects Paramount Acquisition

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

In December 2025, the board of Warner Bros. Discovery (WBD) officially rejected the

- Insufficient Financing Guarantee: Paramount cannot provide sufficient financing certainty

- Transaction Structure Issues: All-cash acquisition ($30/share) has execution risks

- Regulatory Risk Considerations: WBD believes the deal with Netflix faces fewer regulatory barriers

Meanwhile,

| Indicator | WBD (Warner Bros.) | PARA (Paramount) | Gap Comparison |

|---|---|---|---|

Current Stock Price |

$28.93 | $11.04 | WBD is 162% higher |

Market Cap |

$71.7B | $7.0B | WBD is 9.2x larger |

2025 YTD Growth |

+171.44% | +4.35% | WBD outperforms by 167 percentage points |

P/E Ratio |

147.72x | -54.76x (Loss) | WBD is profitable, PARA is in loss |

P/B Ratio |

1.99x | 1.24x | WBD has a 60% premium |

Net Profit Margin |

1.28% | -0.95% | WBD is profitable, PARA is in loss |

Free Cash Flow |

$4.43B | $0.49B | WBD is 8x higher |

Debt Risk |

High Risk | Medium Risk | PARA is relatively better |

Data Source: Broker API Real-Time Data [0]

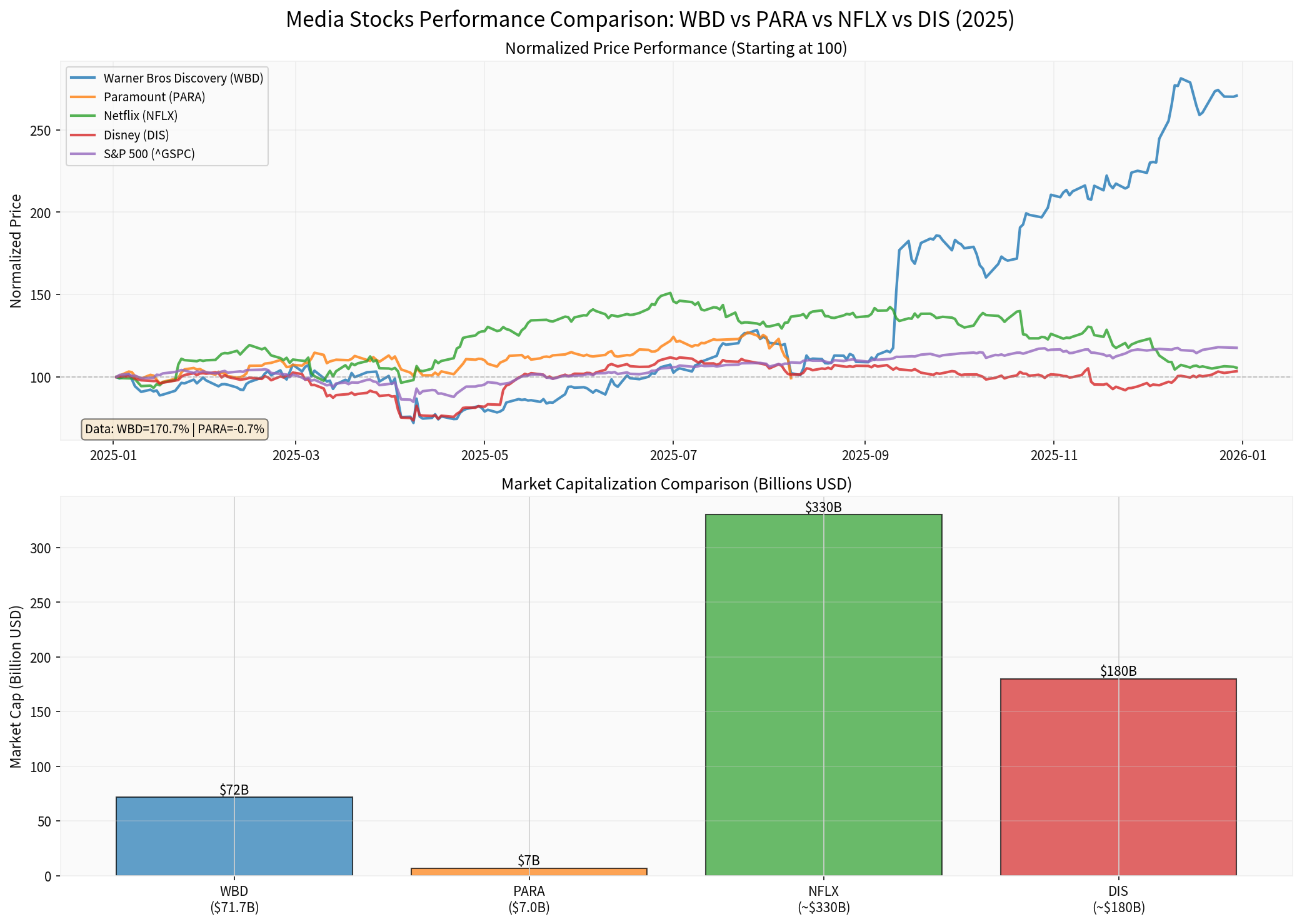

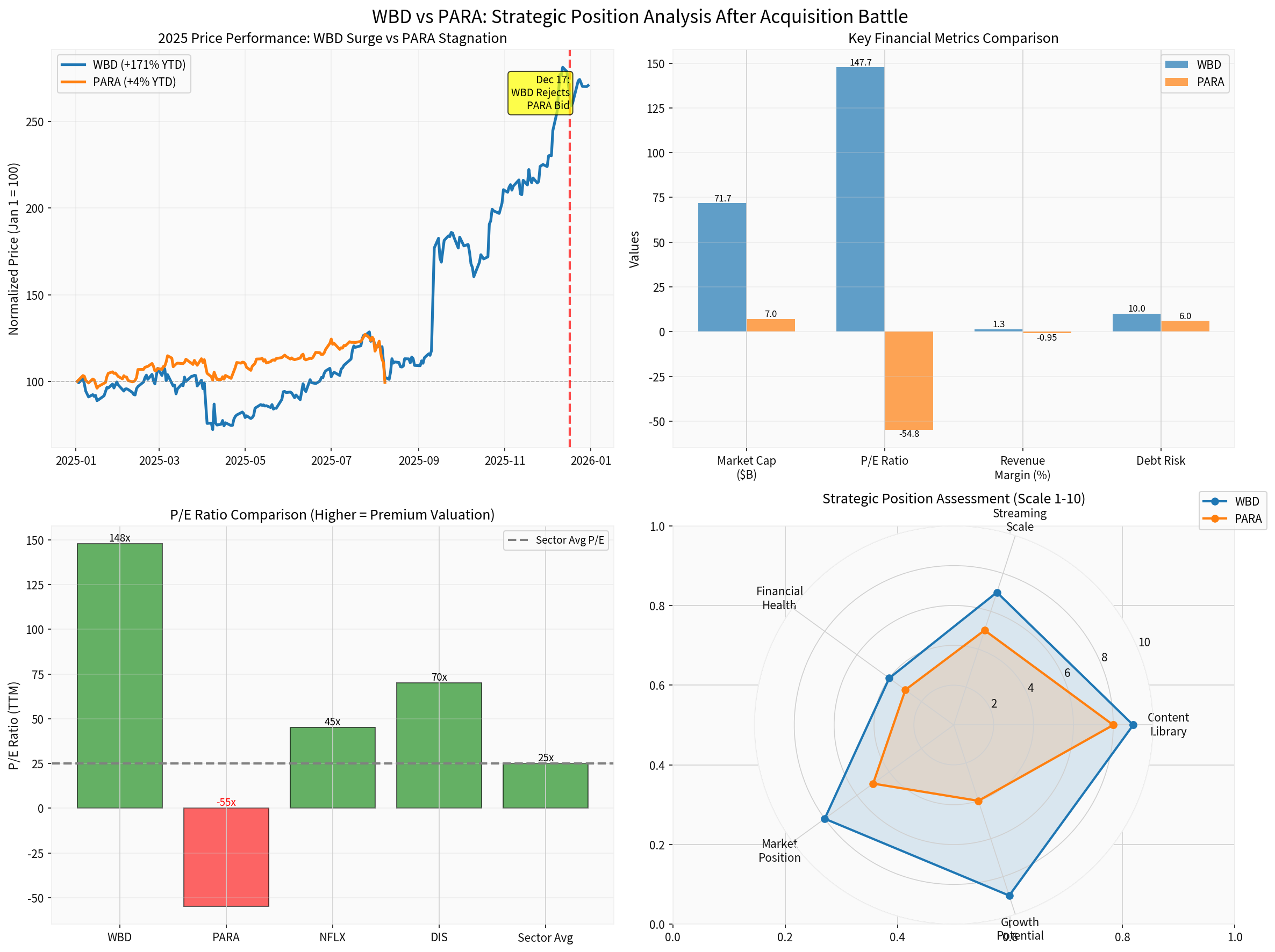

Chart shows: In 2025, WBD’s stock price soared by 171% (blue line), while PARA remained almost flat (orange line). Netflix (green) and Disney (red) showed stable performance. In terms of market cap, WBD ($71.7B) far exceeds PARA ($7.0B), but is still much smaller than Netflix (~$330B) and Disney (~$180B).

- WBD rejected Paramount’s all-cash offer of $30/share, with its stock price around $28-29 at the time, representing a premium of only 7-14%.

- However, considering WBD’s stock price has surged from $10.66 at the start of 2025 to $28.93 (+170%), management believes there is greater upside potential in the future.

- Compared to Netflix (NFLX) with a P/E ratio of about 45x and Disney (DIS) with about 70x, WBD’s current P/E ratio of 147.72x, though high, reflects market recognition of its growth potential [0].

- WBD owns HBO Max, a high-quality streaming platform with valuable user base and content library.

- Its content library includes top IPs such as Harry Potter, Friends, and Batman.

- Maintaining independence can maximize content monetization value and avoid integration dilution after acquisition.

- Although the net profit margin is only 1.28%, the free cash flow reaches $4.43 billion, indicating improved cash generation capacity [0].

- Q2 2025 single-quarter EPS reached $0.63, turning profitable year-over-year, showing the effectiveness of business optimization.

- Streaming business losses narrowed, and user ARPU increased.

- Advance the deal with Netflix: Obtain better financing terms and regulatory certainty.

- Optimize streaming business: Reduce content spending and increase user subscription prices.

- Divest non-core assets: Sell traditional business assets such as cable TV channels.

- Content Library Monetization: License to third-party streaming platforms (e.g., Amazon, Apple TV+).

- International Market Expansion: Focus on high-growth markets like Latin America and Asia-Pacific.

- Ad Tech Upgrade: Develop programmatic advertising to increase the share of ad revenue.

- AI Content Production: Invest in AI-generated content to reduce production costs.

- Game and Interactive Content: Expand IP to the game sector to open new revenue sources.

- Direct-to-Consumer (D2C): Strengthen the HBO Max brand and reduce reliance on third parties.

- Market cap is only $7 billion, far lower than WBD’s $71.7 billion [0].

- Free cash flow is only $0.49 billion, making it difficult to support debt burdens after large-scale acquisitions.

- Q2 2025 EPS was a loss of $0.03, with weak profitability for consecutive quarters.

- Paramount+ streaming user scale is only 67 million, far lower than Netflix (270 million+) and Disney+ (150 million+).

- Its content library lacks top IPs; compared to WBD’s Harry Potter series, its influence is limited.

- Traditional cable TV business continues to shrink, and it has not yet completed a smooth transition to streaming.

- Stock price has fallen by 61% in 5 years, severely underperforming the market [0].

- 46% of analyst ratings are “Sell”, with a consensus target price of $14, representing only a 26% upside from the current level.

- It needs to boost market confidence through mergers and acquisitions or transformation.

- Pause aggressive expansion: Reassess capital allocation and prioritize improving core business profitability.

- Debt Management: Refinance existing debt in the current low-interest environment to extend debt maturity.

- Strategic Cooperation: Reach content distribution partnerships with Apple and Amazon to increase cash flow.

- Business Restructuring: Divest underperforming international assets and linear TV businesses.

- Strengthen CBS Brand: Take CBS news and sports content as core differentiation advantages.

- Realize UFC Agreement Value: Use the $7.7 billion UFC broadcasting rights to enhance the value of sports content.

- Seek “White Knight”: Consider being acquired by large tech companies such as Apple or Google.

- Merger and Restructuring: Merge with mid-sized studios like Sony Pictures and Lionsgate.

- Strategic Alliance: Establish in-depth content cooperation alliances with Disney or NBCUniversal.

Radar chart shows: WBD (blue) is significantly ahead in content library, market position, and growth potential; both face challenges in financial health (PARA is slightly better); PARA lags明显 in streaming scale.

- After rejecting the acquisition on December 17, WBD’s stock price remained strong, closing at $28.93, indicating market support for its independent strategy.

- Technical analysis shows sideways consolidation, with support at $28 and resistance at $29.24 [0].

- Beta value of 1.61 reflects high volatility, pricing in market uncertainty about mergers and acquisitions.

- On December 30, it fell by 6.04% in a single day, with trading volume surging to 46.7 million shares (average daily volume 9.98 million) [0].

- Technical analysis shows a downward trend, with support at $10.38; if broken, the next target is $9.79.

- KDJ indicator shows oversold (19.4/27.1/4.0), with possible short-term technical rebound.

| Company | Market Cap | P/E | EV/EBITDA | Streaming Users | 2025 YTD Change |

|---|---|---|---|---|---|

| Netflix | ~$330B | ~45x | ~18x | 270M+ | +4.6% |

| Disney | ~$180B | ~70x | ~13x | 150M+ | +2.7% |

| WBD | $71.7B | 147.72x | 13.49x | 96M (Max) | +171.4% |

| PARA | $7.0B | Negative | 43.35x | 67M (+) | +4.4% |

Data Source: Broker API and Market Data [0]

Traditional media company valuation is undergoing a paradigm shift:

- “Burn money for scale” model centered on user growth.

- High P/S multiples (8-15x) tolerate negative profits.

- Market gives high-growth companies a 3-5x P/B premium.

- Profitability First: Free cash flow and EBITDA become core valuation indicators.

- Content Library Value Reassessment: IP Life Cycle Total Value (LTV) is more valued.

- Strategic Synergy Premium: Mergers and acquisitions need to show real cost savings and revenue synergy.

The WBD rejection case reflects this shift:

- Paramount’s $30/share offer did not fully consider the long-term value of HBO Max.

- WBD’s EV/OCF (Enterprise Value/Operating Cash Flow) is 13.49x, which is higher than PARA’s 43.35x, but considering the quality of content library and growth potential, the valuation is reasonable [0].

- Netflix’s $82.7 billion offer implies an EV/EBITDA of about 15x, which is in line with current M&A market valuation standards.

In the past few years, M&A arbitrage strategies in the media industry usually achieved an annual return of 15-25%. However, the WBD case shows:

- Increased Regulatory Threshold: FTC and DOJ have stricter reviews on large media mergers and acquisitions, and antitrust risk premiums have risen.

- Rising Financing Costs: Interest rate environment pushes up debt financing costs, reducing M&A arbitrage space.

- Increased Integration Difficulty: Streaming user churn rate rises, and user retention uncertainty after mergers and acquisitions increases.

After WBD rejected the acquisition, the market re-calibrated the valuation method for independent streaming platforms:

- Premium for High-quality Content Libraries: Valuations of platforms like HBO and Max have increased.

- Vertical Integration Value: Companies with content production + distribution capabilities get higher multiples.

- International Market Value: Global platforms (e.g., Disney+) in emerging markets are repriced.

- Slow User Growth: The North American market is saturated, and user acquisition costs rise.

- Price War Risk: Platform competition leads to pressure on subscription prices, limiting ARPU growth.

- Content Inflation Risk: Production costs of top IP content continue to climb.

The value of traditional media assets such as cable TV and radio continues to shrink:

- Structural Decline in Ad Revenue: Linear TV ad spending decreased by 8-12% in 2025.

- Loss of Young Audience: Cable TV subscription rate for 18-34-year-olds dropped below 35%.-Rising Discount Rate: Risk premium increases, and the discount rate in DCF valuation of traditional assets rises by 150-250 basis points.

But some assets still have value:

- Sports Live Broadcasting Rights: Sports content such as CBS and ESPN still maintains strong bargaining power.

- Local News Assets: Regional news businesses show resilience in political cycles.

- AMC/FM Radio: In-car listening remains stable.

- Tech Giants Acquire Content Providers: Apple, Google, Amazon may acquire mid-sized studios; valuation premium of 30-50% reflects strategic synergy value; regulatory risk is the main uncertainty.

- Traditional Media Mergers: “Strong-strong combination” or “weak-weak grouping”; scale effect brings cost savings, but integration risk is high; historical success rate is less than 40%.

- Private Equity Restructuring: Apollo, Blackstone and other firms acquire distressed assets; adopt spin-off, restructuring, and re-listing strategies; usually require a 3-5 year holding period.

| Asset Category | 2023 Avg EV/EBITDA | 2025 Expected EV/EBITDA | Change |

|---|---|---|---|

| Streaming Platforms | 18-25x | 12-18x | -25% |

| Cable TV | 8-12x | 6-9x | -30% |

| Content Studios | 10-15x | 14-20x | +25% |

| Local Radio | 5-8x | 4-7x | -15% |

Data Source: Industry Transaction Data and Web Search [4]

- 2025 YTD Growth of 171.4%: Shows strong momentum, but need to be alert to correction risks [0].

- High-quality HBO Max Users: ARPU is higher than industry average.

- Undervalued Content Library: IP licensing revenue has upside potential.

- Free Cash Flow of $4.43 Billion: Provides flexibility for strategic investments.

- Valuation at High Level: Current P/E ratio of 147.72x is far above historical average.

- Heavy Debt Burden: Net debt/EBITDA exceeds 4x.

- Intensified Streaming Competition: Netflix and Disney+ continue to invest.

- Regulatory Uncertainty: The deal with Netflix may face antitrust review.

- Short-term support at $28.00, resistance at $29.24; if broken, target $31.50.

- MACD shows sideways movement, waiting for direction break [0].

- Recommendation: Holders can take profits on highs; new investors wait for pullback to $25-26 range to enter.

- Stock Price Has Corrected Significantly: KDJ oversold indicates possible rebound.

- Stable CBS Brand Value: News and sports content have moats.

- $7.7 Billion UFC Agreement: Unique sports IP content.

- Potential Acquisition Target: Strategic buyers may offer a premium of 30-50%.

- Consecutive Quarterly Losses: Negative EPS, weak profitability [0].

- Stagnant User Growth: Paramount+ faces user churn pressure.

- Debt Pressure: Free cash flow of only $0.49 billion makes it difficult to support large-scale investments.

- Confidence Damage from Acquisition Failure: Management’s strategic execution ability is questioned.

- Downward trend, support at $10.38; if broken, next target $9.79.

- RSI oversold, short-term rebound resistance at $13.03 [0].

- Recommendation: High-risk speculators can take light positions to bet on rebound, set stop loss at $9.80; conservative investors avoid.

- Content Studios with Top IP: WBD, Disney, Netflix.

- Sports Media Rights: FOX, ESPN (Disney), CBS (PARA).

- International Streaming Growth: Opportunities in Latin America and Southeast Asia markets.

- AI Content Production Tools: Tech companies that reduce content production costs.

- Pure Linear TV Business: Facing structural decline.

- Small Independent Streaming: Difficult to achieve economies of scale.

- High-leverage Media Companies: Risk of debt refinancing rises.

Warner Bros.’ rejection of Paramount’s acquisition marks the

- WBD chooses independent path: Relying on HBO Max and content library value to seek organic growth.

- PARA faces strategic setback: Needs to reposition, may become an acquisition target or seek strategic partners.

- Netflix consolidates its position: Acquiring WBD assets will make it the undisputed streaming leader.

- Disney waits and sees: May launch acquisitions of PARA or other mid-sized studios.

Media industry valuation is shifting from “user growth-driven” to “profitability-driven”:

- Quality Over Scale: Platforms with high ARPU and low churn rate get premiums.

- Cash Flow is King: Free cash flow replaces user growth as the core valuation indicator.

- Synergy Pricing:

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.