In-depth Analysis of the Investment Impact of Co-Diagnostics (CODX) 1-for-30 Reverse Stock Split

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

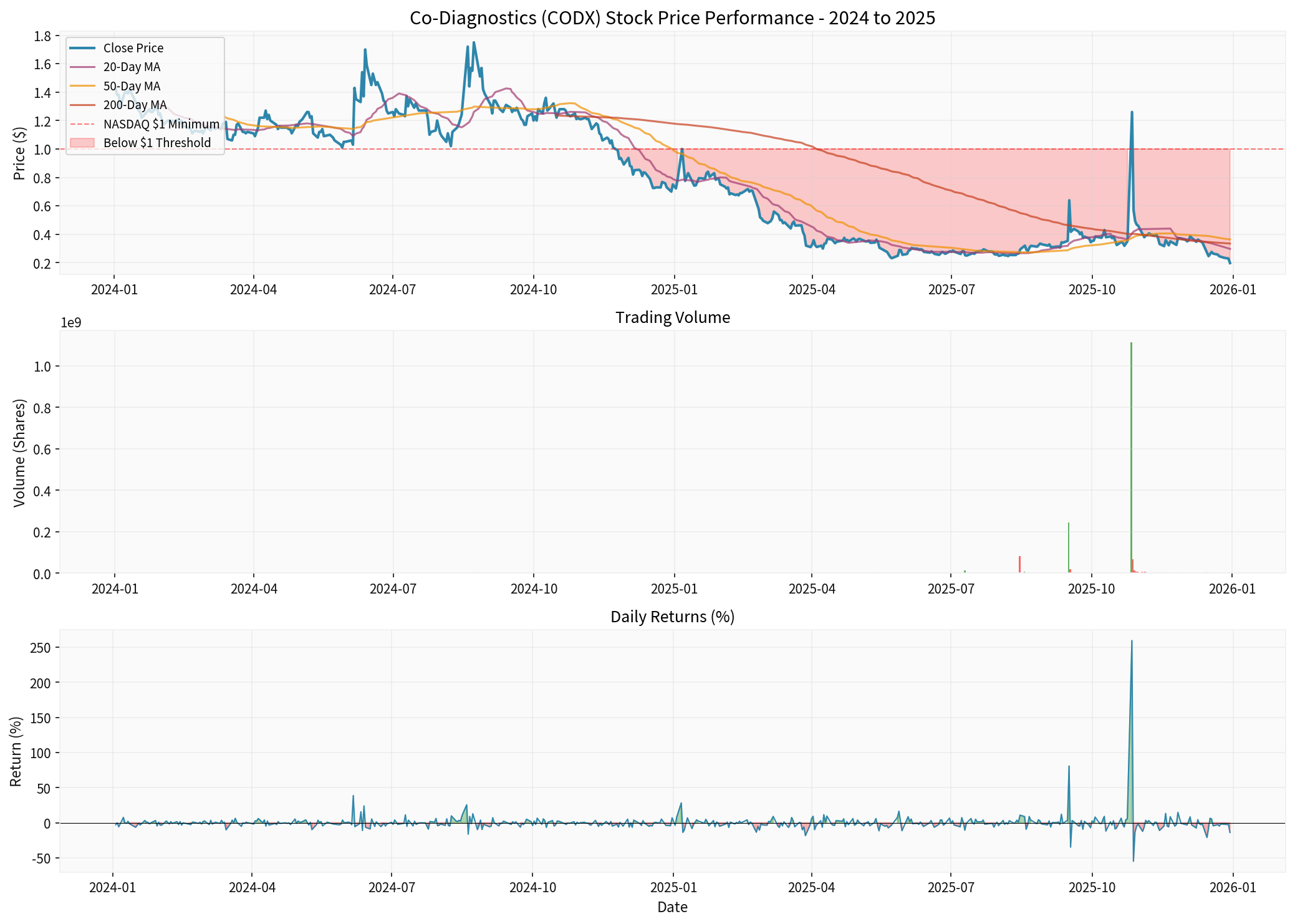

Co-Diagnostics (CODX)'s announced 1-for-30 reverse stock split is a clear signal that the company is in severe financial distress. With a current share price of $0.20, far below Nasdaq’s minimum bid requirement of $1, this reverse split is a last-ditch effort to maintain listing status [0]. Data shows that over the past 501 trading days, the stock price was below the $1 threshold for 54.3% of the time [0], reflecting the company’s long-term failure to meet exchange requirements. This corporate action has a

- Current Share Price:$0.20 (as of December 30, 2025) [0]

- Nasdaq Minimum Requirement:$1.00 (Listing Rule 5550(a)(2))

- Gap:Share price needs to rise by400%to meet the minimum compliance requirement

- Non-Compliant Days:54.3% of trading days in the past 2 years with share price below $1 [0]

Indicator |

Before Split |

After Split (Theoretical) |

|---|---|---|

| Share Price | $0.20 | $6.00 |

| Number of Shares Held (Assuming 1000 Shares) | 1,000 Shares | 33 Shares |

| Total Market Value | $200 | $200 (Unchanged) |

| Company Market Cap | $6.61M | $6.61M (Unchanged) |

- Single-Day Plunge:-14.79% [0]

- 5-Day Drop:-18.62% [0]

- 1-Month Drop:-47.30% [0]

- YTD Drop:-72.97% [0]

This sharp decline reflects the market’s

Based on research and historical data analysis:

- Barnes & Noble Education Case:After completing a 1-for-100 reverse split in 2024, the share price jumped from $2 to $20 instantly but thenplummeted sharply[1]

- Academic Research:Companies after reverse stock splits typically experiencenegative abnormal stock returns[1]

- Survival Rate:Many companies that conduct reverse splits eventuallyfail to survive, as reverse splits are often a sign of the “end of the lifecycle” [1]

- Reduced Liquidity:Number of shares decreases by 29.67x (30:1), potentially leading to significant decline in trading liquidity

- Concentrated Voting Rights:Number of shareholders will actually decrease, and small shareholders may be forced to exit

- Psychological Impact:The “false prosperity” of share price jumping from $0.20 to $6.00 masks the reality of deteriorating fundamentals

Financial Indicator |

CODX Value |

Health Standard |

Gap |

|---|---|---|---|

| Net Profit Margin | -6,336.27% | >10% | -6,346 Percentage Points |

| Operating Margin | -6,995.70% | >5% | -7,001 Percentage Points |

| ROE | -70.27% | >15% | -85 Percentage Points |

| EPS (TTM) | -$0.98 | Positive | Severe Negative |

- Q1 2025: $50,277

- Q2 2025: $162,910

- Q3 2025: $145,380

- FY2024 Full Year: $770,048 [0]

- CODX Market Cap: $6.61M

- Biotech Industry Average: Usually >$1B

- Gap: CODX’s market cap cannot even support R&D spending of a small biotech company

- Current Ratio:3.81 (Health Standard: >2.0)

- Quick Ratio:3.51 (Health Standard: >1.5)

- Free Cash Flow:-$29.9M (Latest Annual) [0]

- Cash Burn Rate:At the current loss rate, liquidity may be exhausted within 12-18 months

Dimension |

Rating |

Key Issues |

|---|---|---|

| Profitability | F | Huge losses, no signs of improvement |

| Growth | F | Tiny revenue scale, declining trend |

| Liquidity | B | 尚可 in short term, but堪忧 long term |

| Debt Risk | B | Low leverage, but no profit to support debt capacity |

Overall Rating |

D+ |

Severe financial distress, high survival risk |

- November:Selected Maxim Group as financial advisor (exploring strategic alternatives) [1]

- November:Launched clinical evaluation of upper respiratory multiplex point-of-care test (attempting to enter FDA market) [1]

- November:Delivered a speech at international tuberculosis conference (attempting to build international presence) [1]

- December:Joint venture CoSara invited to participate in Indian tuberculosis diagnosis course (limited progress) [1]

- Buy:2 (40%)

- Hold:3 (60%)

- November 24, 2025: HC Wainwright maintained “Neutral” rating

- October 28, 2025: D. Boral Capital maintained “Buy” rating

- December 2, 2025: Zacks upgraded to Buy #2 [1]

- Support Level:$0.18 (Historical Low) [0]

- Resistance Level:$0.30 (Recent High) [0]

- 52-Week Range:$0.18 - $1.55 [0]

- Trend:Sideways/No Clear Trend [0]

- KDJ:Oversold Opportunity Zone

- RSI:Oversold Opportunity Zone

- MACD:No Crossover (Bearish) [0]

Scenario |

Probability |

Post-Split Price |

Logic |

|---|---|---|---|

Extremely Bearish |

40% | <$3.00 | Deteriorating fundamentals, market loss of confidence |

Bearish |

35% | $3.00-$5.00 | Rebound after compliance, but no fundamental support |

Neutral |

20% | $5.00-$7.00 | Short-term compliance success, but long-term uncertainty |

Bullish |

5% | >$7.00 | Requires major business breakthrough (FDA approval, etc.) |

- ✗ 14.79% plunge in share price (announcement day) [0]

- ✗ 96.67% reduction in number of shares held (30:1 ratio)

- ✗ Reduced liquidity

- ✗ Diminished market confidence

- ✗ Probability of continued share price decline 1 year after reverse split >50%

- ✗ Company may face delisting risk (if unable to maintain above $1)

- ✗ May need more reverse splits or financing in the future

- If you are a long-term holder, the reverse split is a strong exit signal

- Consider reducing or liquidating positions after split takes effect (share price temporarily rebounds to ~$6)

- Only consider holding if you can承受 100% principal loss

- This is essentially high-risk speculationrather than investment

- Consider shifting funds to peer companies with healthy finances and strong growth

- If optimistic about the molecular diagnostics track, choose industry leaderssuch as:

- Abbott Laboratories (ABT)

- Thermo Fisher Scientific (TMO)

- Hologic (HOLX)

If you choose to continue holding, closely monitor:

Indicator |

Alert Value |

Current Status |

|---|---|---|

| Share Price | <$1.00 (post-split) | ❌ To be observed |

| Quarterly Revenue | <Expected | ❌ $145K (extremely low) |

| Cash Reserves | <6 months of operations | ❌ FCF -$29.9M |

| FDA Progress | No progress | ⚠️ Clinical evaluation stage |

| Delisting Notice | Received notice | ⚠️ High risk |

##7. Conclusion: The True Meaning of Reverse Split

###7.1 Interpretation of Management Signals

- Admission of Failure:Management admits inability to boost share price through business growth

- Last Resort:This is a last-ditch effort to avoid delisting, not an active strategic choice

- Time Pressure:Company faces urgent pressure from Nasdaq compliance deadlines

- Lack of Confidence:If management had confidence in business prospects, it would focus on operations rather than technical share price manipulation

###7.2 Investment Implications

- ✗ Catastrophicfinancial fundamentals: -6,336% net profit margin, $770K revenue scale

- ✗ Poorshare price performance: 97.99% drop over 5 years, 72.10% drop over 1 year

- ✗ Adversehistorical evidence: Companies after reverse splits usually perform poorly

- ✗ Slowbusiness progress: No commercial products, minimal revenue

- ✓ Only bright spot:尚可 liquidity ratios (but unsustainable)

###7.3 Final Recommendations

Investor Type |

Recommendation |

|---|---|

Long-Term Value Investors |

Strong Sell - Does not meet any value investment criteria |

Growth Investors |

Avoid - No growth, declining revenue |

Speculative/Short-Term Investors |

Extreme Caution - Only consider if you can承受 100% loss |

Institutional Investors |

Avoid - Extremely unreasonable risk/reward ratio |

[0] Jinling API Data - Including real-time quotes, financial analysis, technical analysis, company overview, and historical price data

[1] Investopedia - “Reverse Stock Split Explained: Definition, Process, and Examples” (https://www.investopedia.com/terms/r/reversesplit.asp) - Definition, process, and historical cases of reverse stock splits

[2] Seeking Alpha - “Co-Diagnostics announces 1-for-30 reverse stock split” (https://seekingalpha.com/news/4535856-co-diagnostics-announces-1-for-30-reverse-stock-split) - Reverse stock split announcement

[3] Yahoo Finance - “Co-Diagnostics Initiates Clinical Evaluations for Upper Respiratory Multiplex Point-of-Care Test” (https://finance.yahoo.com/news/co-diagnostics-initiates-clinical-evaluations-140000217.html) - FDA clinical evaluation progress

[4] ResearchGate - “Survivability following Reverse Stock Splits” (https://www.researchgate.net/publication/285782918_Survivability_following_Reverse_Stock_Splits_What_Determines_the_Fate_of_Non-Surviving_Firms) - Academic research on survival rate of companies after reverse splits

[5] CNN Business - CODX Stock Quote and News (https://www.cnn.com/markets/stocks/CODX) - Recent news and analyst rating changes

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.