Analysis of Driving Factors and Prospects for Wanxiang Qianchao (000559.SZ) Becoming a Hot Stock

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Wanxiang Qianchao (000559.SZ) hit the limit-up (+10.03% to 15.69 yuan) on December 30, 2025 and entered the hot stock list, with market attention rising significantly [0]. From trading data, the daily volume reached 23.468 billion yuan, an increase of 50% compared to the average volume (15.737 billion yuan), reflecting abnormally high investor participation [0].

Although no direct news or announcements were found as catalysts, combined with industry background, the driving factors may include: 1) The overall uptrend of the auto parts sector—recently, many stocks in the sector have performed strongly, driving linked gains for leading stocks like Wanxiang Qianchao; 2) Market sentiment and momentum trading—the stock has accumulated a 162.81% increase this year and a 105.10% increase in 6 months, and the short-term surge has attracted a large number of trend investors to follow, further pushing up the stock price [0].

-

Divergence Between Technical and Fundamental Aspects: Technically, the stock is in an uptrend with the next target price at 16.49 yuan [0], but KDJ and RSI indicators have entered the overbought zone, indicating an increased risk of short-term correction; fundamentally, the current P/E ratio is 51.57x and P/B ratio is 5.53x, far exceeding the industry average, and aggressive accounting policies and moderate debt risks are also worthy of attention [0].

-

Sentiment-driven Rise Without Direct Catalysts: Achieving limit-up without specific positive news reflects the current market’s high optimism towards the auto parts sector, and may also have factors of short-term capital speculation. The sustainability of such sentiment-driven rises is questionable, and investors need to be alert to speculative risks [0].

-

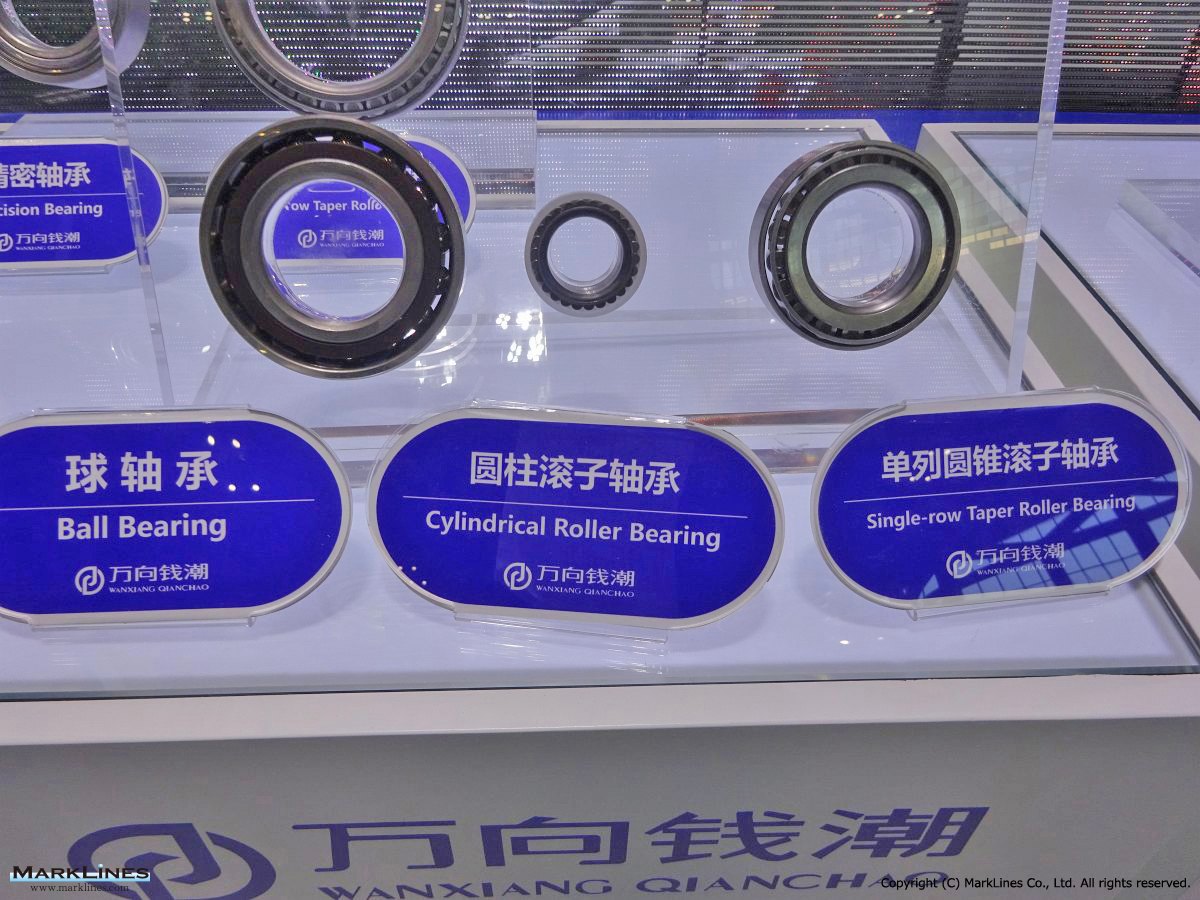

Game Between Long-term Trends and Short-term Fluctuations: The auto parts industry will benefit from the popularization of new energy vehicles and the trend of independent and controllable supply chains in the long run. As an industry leader, Wanxiang Qianchao has certain competitive advantages [0]. However, short-term overbought conditions and high valuations may lead to price regression, so it is necessary to balance long-term prospects and short-term fluctuations.

- Risks: Overbought technical indicators bring short-term correction risks; high valuation with the possibility of bubble bursting; aggressive accounting policies may affect the authenticity of future earnings; moderate debt risks may amplify pressure if the industry environment deteriorates [0].

- Opportunities: The auto parts sector has clear long-term growth prospects; if the company can continuously improve profitability and market share, it may support the valuation; the current uptrend attracts more capital attention—if there are substantive positive factors (such as order growth, technological breakthroughs), the stock price may rise further [0].

Wanxiang Qianchao became a hot stock today mainly driven by sector trends, market sentiment, and momentum trading, lacking direct news catalysts. Technically, it is in the overbought zone with high fundamental valuation—need to be alert to correction risks in the short term. In the long run, as a leading auto parts company, it benefits from industry growth, but needs to pay attention to the improvement of fundamentals. Investors should combine their own risk preferences and investment cycles to objectively evaluate the investment value of this stock.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.