Analysis of Benzinga’s Top Oversold Consumer Discretionary Stocks (2025-12-30)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

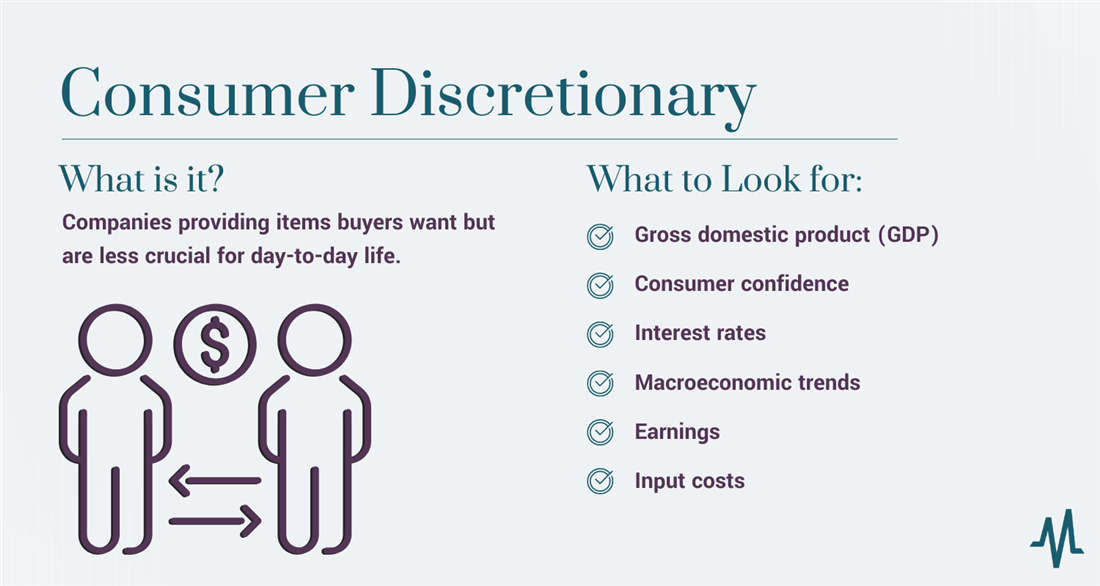

This analysis draws from Benzinga’s article [1] on top oversold consumer stocks and complementary market data [0]. On December 30, 2025, the consumer discretionary sector underperformed, declining 0.36145% [0]. Key sector stocks showed mixed performance: Nike (NKE) fell 4.01% in December, Home Depot (HD) dropped 1.86%, and Macy’s (M) declined 0.54%—all trading below their 20-day moving averages [0]. Macy’s further exhibited an “oversold_opportunity” signal via the KDJ indicator [0], while Amazon (AMZN) (down 0.49% in December) was slightly above its 20-day moving average with an “overbought_warning” KDJ signal [0]. A concurrent 3.8-point drop in the Conference Board’s consumer confidence index to 89.1 (below the 91.0 forecast) [2] likely contributed to the sector’s weakness.

- Macy’s (M) stands out as a potential candidate for one of Benzinga’s top 3 stocks due to its explicit oversold KDJ signal [0].

- The consumer confidence decline may continue to weigh on the sector short-term, but oversold conditions in stocks like NKE, HD, and M present contrarian opportunities [0][2].

- The article’s mention of stock buybacks (though full content is unavailable) suggests additional potential support if the highlighted companies have authorized such programs [0].

- Opportunities: Oversold conditions in consumer discretionary stocks (especially Macy’s with the KDJ signal) may offer entry points for those seeking undervalued assets [0].

- Risks: Persistently low consumer confidence could exert further downward pressure on the sector [2]. Amazon’s overbought signal indicates potential near-term volatility for that stock [0].

The consumer discretionary sector underperformed on December 30, 2025, with several major stocks showing weakness. Macy’s (M) has an oversold KDJ indicator signal, while Nike (NKE) and Home Depot (HD) trade below 20-day moving averages. A decline in consumer confidence to 89.1 (below forecast) is a headwind. The Benzinga article identifies these oversold stocks as potential opportunities for portfolio recovery.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.