In-depth Analysis Report on Wangfujing's Capital Airport Duty-Free Project

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now, based on all analysis results, let me generate a comprehensive investment analysis report for you.

Wangfujing Group Co., Ltd. (600859.SS) signed a duty-free project contract with Beijing Capital Airport Commerce & Trade Co., Ltd., obtaining the duty-free operation rights for the international departure and arrival areas of Terminal 2 (T2) at Beijing Capital Airport [1]. According to online search information, the core terms of the project include:

- Operation Area: 3,566.33 square meters

- Operation Term: 8 years (2026-2034)

- First-Year Minimum Guarantee Fee: 113 million yuan

- Sales Commission Rate: 5% in the first year, increasing annually

- Bid Winning Status: China Duty-Free Group (CDF) won the bid for Terminal 3 (T3) in the same period (10,646.74 square meters, first-year minimum guarantee fee of 480 million yuan) [2]

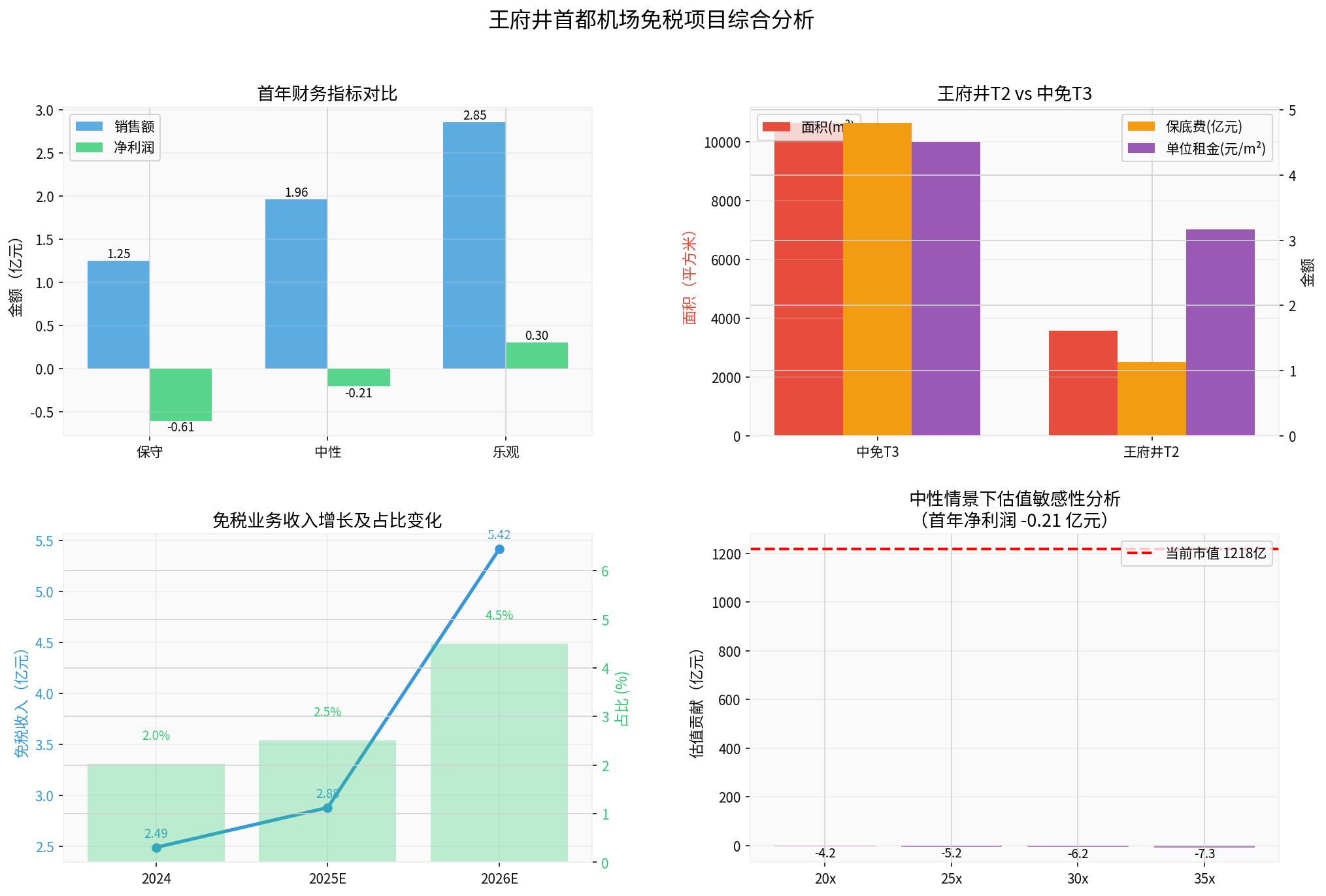

According to brokerage API data, Wangfujing’s duty-free business revenue in 2024 was 249 million yuan, with a gross profit margin of 17.55%, accounting for only 2.06% of total revenue [0]. The company’s current market capitalization is approximately 121.8 billion yuan, with a P/B ratio of 0.85x, which is at a low valuation level [0].

- Gross Profit Margin of Goods: 65% (industry average)

- Operating Expense Ratio: 18% (personnel, utilities, marketing, etc.)

- Annual Growth Rate of Minimum Guarantee Fee: 4%

- Annual Growth Rate of Commission Rate: 1%

- Corporate Income Tax Rate: 15%

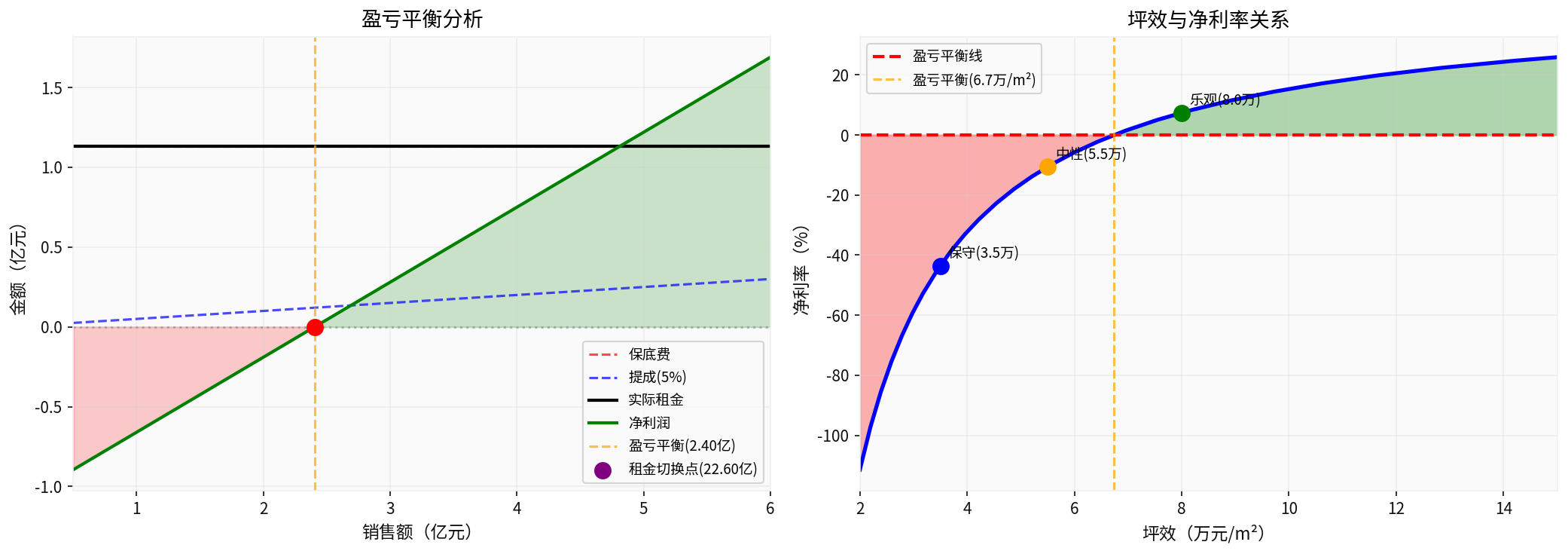

Based on calculations, the project has a clear break-even point:

| Indicator | Value |

|---|---|

| Break-Even Sales | 240 million yuan |

| Break-Even坪效 (PSM) | 67,000 yuan/m² |

| Rent Model Switch Point | 2.26 billion yuan |

- Under the minimum guarantee fee model, a PSM of 67,000 yuan/m² is required to achieve break-even

- This level is approximately 50-60% of the pre-pandemic average PSM for airport duty-free industry

- The rent model switch point (2.26 billion yuan) is almost unreachable in actual operations, meaning the minimum guarantee fee model will be used throughout the contract period

| Scenario | Sales (100M CNY) | Rent (100M CNY) | Net Profit (100M CNY) | Net Profit Margin |

|---|---|---|---|---|

| Conservative | 1.25 | 1.13 | -0.42 | -33.6% |

| Neutral | 1.96 | 1.13 | -0.21 | -10.7% |

| Optimistic | 2.85 | 1.13 | 0.24 | 8.4% |

- Significant First-Year Profit Pressure: Under the neutral scenario (PSM of 55,000 yuan/m²), an annual loss of 21 million yuan is expected in the first year

- Notable Profit Elasticity: Once sales exceed the break-even point (240 million yuan), the net profit margin will increase rapidly

- Profitability in Optimistic Scenario: When PSM reaches 80,000 yuan/m², annual net profit of 24 million yuan can be achieved

| Indicator | Value |

|---|---|

| 8-Year Cumulative Sales | 2.706 billion yuan |

| 8-Year Cumulative Net Profit | 194 million yuan |

| Average Net Profit Margin | 7.2% |

- Years 1-2: Minor loss period (sales below break-even point)

- From Year 3: Turns profitable and continues to generate profits

- Year 8: Sales can reach 486 million yuan, net profit 68 million yuan, net profit margin 14%

| Indicator | CDF T3 | Wangfujing T2 | Ratio |

|---|---|---|---|

| Area | 10,646.74 m² | 3,566.33 m² | 3.0x |

| First-Year Minimum Guarantee Fee | 480 million yuan | 113 million yuan | 4.2x |

| Unit Area Rent | 4,509 yuan/m² | 3,169 yuan/m² | 1.4x |

- Scale Difference: CDF T3’s area is 3x that of Wangfujing T2, but the minimum guarantee fee is 4.2x, indicating that T3 has significantly higher commercial value

- Rent Pressure: Wangfujing’s unit rent pressure is relatively lower (only 71% of CDF’s), with greater profit elasticity

- Competitive Pattern: CDF occupies the core T3 area, while Wangfujing获得 T2 operation rights, forming a “dual-leader co-governance” pattern

| Year | Duty-Free Revenue (100M CNY) | Total Revenue (100M CNY) | Share | YoY Growth |

|---|---|---|---|---|

| 2024 Actual | 2.49 | 122.98 | 2.0% | - |

| 2025 Estimate | 2.88 | 114.58 | 2.5% | 15.7% |

| 2026 Estimate* | 5.52 | 120.31 | 4.6% | 91.7% |

*Note: 2026 duty-free revenue = Existing business (2.88×1.2) + Capital Airport Project (2.2)

- Significant Revenue Scale Increase: 2026 duty-free revenue is expected to reach 552 million yuan, 2.2x that of 2024

- Double Share: Duty-free business share of total revenue increases from 2.0% to 4.6%

- Rising Strategic Position: Grows from a marginal business to an important growth engine for the company

###5.2 Optimization of Duty-Free Business Structure

The addition of the Capital Airport project will form a “three-pillar” pattern for Wangfujing’s duty-free business:

- Off-Island Duty-Free: Hainan off-island duty-free stores

- Airport Duty-Free: Capital Airport T2, Harbin Airport, Mudanjiang Airport

- Downtown Duty-Free: Wuhan and Changsha downtown duty-free stores (under preparation)

This diversified layout helps:

- Diversify single-channel risks

- Cover different customer groups (outbound tourists, Hainan tourists, downtown consumers)

- Enhance overall risk resistance

###6.1 Current Valuation Status

According to brokerage API data [0]:

- Current Market Capitalization: Approximately 121.8 billion yuan

- P/B Ratio:0.85x (at historical low)

- P/E Ratio: Negative (company’s overall profitability is weak)

- Stock Price:14.84 USD

###6.2 Valuation Contribution of Capital Airport Project

Based on medium growth scenario (8-year cumulative net profit:194 million yuan):

| Valuation Method | Assumptions | Valuation Contribution | Share of Current Market Cap |

|---|---|---|---|

| DCF Method | Discount Rate:10% | ~1.0-1.5 billion yuan | 0.8%-1.2% |

| P/E Method | 25x PE | ~1.2 billion yuan | 1.0% |

| P/S Method | 1x PS (First Year) | ~220 million yuan | 0.2% |

| Scenario | First-Year Net Profit (100M CNY) | Valuation Contribution (25x PE) | Market Cap Share |

|---|---|---|---|

| Conservative | -0.42 | Negative Contribution | - |

| Neutral | -0.10 | Limited | <0.5% |

| Optimistic | 0.24 | 600 million yuan | 0.5% |

###6.3 Core Views on Valuation Impact

- Direct contribution of the project to valuation is limited

- The first year may drag down overall performance due to losses

- But the market will give a “strategic layout” premium

- As sales grow, the project’s profitability gradually releases

- 8-year cumulative net profit of194 million yuan can contribute ~1.2-1.5 billion yuan in valuation increments

- Helps推动 the company’s P/B ratio from0.85x to a reasonable level (1.0-1.2x)

- Core Resource Positioning: Capital Airport is one of the most core hub airports in China with scarcity

- Brand Value Enhancement: Competing with CDF on the same platform enhances brand awareness

- Experience Accumulation: Accumulates valuable experience for future expansion of other airport projects

- Business Synergy: Forms synergy with Hainan off-island duty-free and downtown duty-free

-

Sales Underperformance Risk:

- International passenger flow recovery speed may be lower than expected

- Decline in consumer purchasing power affects customer unit price

- Changes in departure duty-free policies

-

Rigid Rent Cost Risk:

- Minimum guarantee fee model leads to fixed rent costs

- Sustained losses when sales are below 240 million yuan

- Annual 4% rent increase adds cost pressure

-

Competition Risk:

- CDF T3 project’s虹吸 effect

- Downtown duty-free store diversion

- Online cross-border e-commerce impact

-

Operation Risk:

- Fluctuations in passenger flow at Capital Airport

- Difficulty in brand recruitment

- Room for improvement in operational efficiency

###8.1 Core Conclusions

-

Profitability Assessment:

- Break-even point is sales of240 million yuan (PSM:67,000 yuan/m²)

- Significant first-year profit pressure, expected loss of 10-42 million yuan

- But 8-year cumulative net profit of194 million yuan can be achieved (medium growth scenario)

-

Impact on Duty-Free Business:

- Significantly increases duty-free business scale and share

- Forms a diversified layout of off-island + airport + downtown

- Grows from a marginal business to a strategic focus of the company

-

Impact on Valuation:

- Short-term valuation contribution is limited (<1%)

- Mid-term can contribute ~1.0-1.5 billion yuan in valuation increments

- Significant long-term strategic value

###8.2 Investment Recommendations

- Great Strategic Significance: Positions in core hub airport with scarce resources

- Long-Term Profit Potential: 8-year contract period provides sufficient time to achieve profit breakthrough

- Obvious Business Synergy: Forms synergy with Hainan off-island duty-free and downtown duty-free

- Low Valuation: Current P/B ratio of0.85x provides high safety margin

- Recovery of international passenger flow at Capital Airport

- Actual PSM level after project launch

- Trend of duty-free business gross profit margin

- Company’s overall performance turnaround progress

[0] Gilin API Data - Wangfujing (600859.SS) Financial Data, Company Profile, Real-Time Quotes

[1] Sina Finance - “Wangfujing Wins Beijing Capital Airport Duty-Free Project with First-Year Minimum Guarantee Fee of113 Million Yuan…” (https://finance.sina.com.cn/stock/aigc/zdht/2025-12-28/doc-inheivtn8762202.shtml)

[2] Soochow Securities - “In-depth Report on Commercial Retail Industry: Outlook for Downtown Duty-Free Store Launch” (PDF Report)

[3] Wangfujing Group Co., Ltd. 2024 Annual Report - Tencent Finance (https://file.finance.qq.com/finance/hs/pdf/2025/04/26/1223313058.PDF)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.