Coforge Acquires Encora: In-Depth Analysis Maintaining an Outperform Rating

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Coforge acquired U.S. AI engineering firm Encora for an enterprise value of $2.35 billion, marking the largest acquisition in the company’s history. CLSA (Credit Lyonnais Securities Asia) gave an “Outperform” rating, reflecting positive expectations for its long-term growth through strategic acquisitions [1]. The current share price is ₹1,668.40, down 13.36% year-to-date, in a technical consolidation range with multiple indicators showing an oversold opportunity [0][4]. This acquisition will significantly enhance the company’s capabilities in AI engineering, cloud, and data domains, but also bring short-term earnings pressure and valuation challenges.

- Total transaction value: $2.35 billion enterprise value

- Equity exchange: $1.89 billion (approximately ₹170.32 billion) issued at ₹1,815 per share (with a premium over pre-announcement price) [1]

- Equity structure: Encora shareholders will hold approximately 20% of the merged entity

- Debt arrangement: Plans to raise up to $550 million to repay Encora’s existing debt [1]

- Acquisition target: Encora is a U.S. AI engineering firm, the target company of this merger (not a “subsidiary”) [2]

| Metric | FY24 | FY25 | FY26 (Forecast) |

|---|---|---|---|

| Revenue (in millions of USD) | 481 | 516 | 600 |

| YoY Growth | 47% | 7.3% | 16.3% |

Note: Encora ranked first globally in YoY growth in FY23 according to Everest Group statistics [2].

After the announcement on December 26, 2025, Coforge’s stock price saw significant volume (about 8.2 million shares traded that day, far higher than the average daily volume of about 1.69 million shares) and volatility. Year-to-date, it has fallen approximately13.91%, with a year-high of around ₹1,978 and a year-low of around ₹1,263 [0].

- Scale leap: The merged platform’s revenue will approach the $2.5 billion level, with North American revenue expected to jump 50% to approximately $1.4 billion [1].

- Revenue target: The company guides for a merged revenue target of approximately $2 billion in FY27 (independent forecast of approximately $720 million without the acquisition), corresponding to an approximately178% revenue increase [0].

- Capability enhancement: Strengthens AI-driven engineering services, cloud and data capabilities, has significant advantages in HiTech and Healthcare verticals, and expands nearshore delivery布局 in the U.S. West/Midwest and LATAM [1].

- Revenue synergies: Stronger end-to-end digital and AI solution capabilities are expected to improve customer stickiness and cross-selling opportunities.

- Cost synergies: There is room for partial cost optimization during integration (e.g., back-office functions, procurement, and shared services).

- EPS path: Multiple institutions emphasize that rapid and efficient execution of synergies is a key prerequisite for achieving annual EPS accretion in FY27; if execution falls short of expectations, short-term earnings dilution may occur [1].

From a horizontal valuation perspective, Coforge’s P/E and P/B are both higher than industry averages:

- P/E (TTM): 47.72x (industry average approximately28x) [0]

- P/B (TTM):8.10x (industry average approximately6x) [0]

- ROE:15.82% (lower than some industry leaders) [0]

Based on the DCF model (data as of March31,2025):

- Conservative scenario fair value: ₹5,130.48 (up 207.5% from current price)

- Base scenario fair value: ₹8,206.88 (up 391.9% from current price)

- Optimistic scenario fair value: ₹20,475.47 (up 1127.3% from current price)

- Probability-weighted value: ₹11,270.94 (potential upside of +575.6%) [0]

Key Assumptions (Base Scenario): Revenue growth rate of approximately26.8%, EBITDA margin of approximately14.7%, WACC of approximately6.3% [0].

- EPS may be diluted in the short term due to merger consideration, synergy realization pace, and debt costs (some institutions publicly commented on “near-term earnings likely to be diluted” and “execution risks”) [1].

- Whether EPS accretion can be achieved in FY27 depends highly on the rapid implementation of integration and synergies [1].

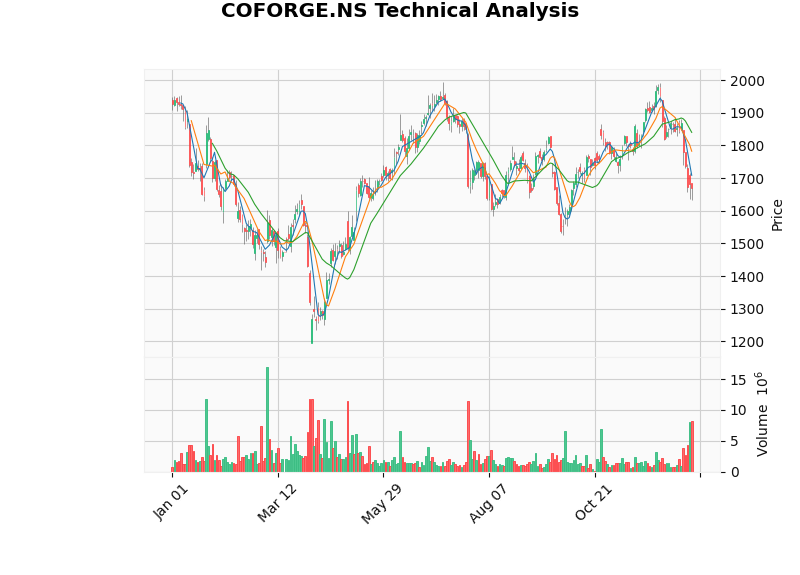

- Trend type: Consolidation/no obvious trend (SIDEWAYS)

- Key levels: Support at approximately ₹1,641.06, resistance at approximately ₹1,840.06

- Beta (vs NIFTYIT.NS):0.25 (relatively low systematic risk)

- Indicator signals: KDJ and RSI show oversold opportunities, MACD is bearish/no crossover

Chart Explanation:

- Time range: Jan1,2025 to Dec30,2025

- Y-axis: Price (Indian Rupees)

- Chart content includes: Closing price, volume, and key technical indicators (MACD, KDJ, RSI)

- Key Interpretation: Currently in a consolidation range, KDJ and RSI both indicate oversold opportunities, MACD shows no obvious crossover and a bearish bias [4]

- Integration complexity: Encora is one of Coforge’s largest and most complex mergers to date; synergy implementation pace and customer retention are key.

- Uncertainty exists regarding whether EPS accretion can be achieved in FY27; multiple institutions emphasize the need for “sharp and immediate execution” [1].

- Acquisition valuation: Based on FY26E revenue, the transaction consideration corresponds to a revenue multiple of approximately3.9x (a relatively high valuation level compared to historical industry mergers) [1].

- Financing and debt: The company plans to raise funds through equity and possible financing methods (QIP/bridge loans, etc.) to repay debt, which may have a phased impact on financial leverage and net profit margins [1].

- The current global IT services demand environment is uncertain; macro fluctuations may affect customer budget rhythms and project extensions [1].

- Post-acquisition organizational and cultural integration takes time, and key talent retention is also a risk point.

- CLSA: Current rating is “Outperform”, believing long-term capabilities will be significantly enhanced, but earnings and stock prices may come under pressure in the short term; rapid synergy realization is a decisive factor for achieving FY27 EPS accretion [1].

- Morgan Stanley: Rating “Overweight”, target price approximately ₹2,030; views this acquisition as a strategically challenging but necessary step for Coforge to build a more sustainable growth driver [1].

- Kotak Securities: Rating “Buy”, target price approximately ₹2,250; believes asset quality is strong but valuation is expensive, strong revenue synergies and partial cost synergies help absorb the premium [1].

- Dolat Capital: Rating “Accumulate”, target price approximately ₹1,990; believes the merged entity can move toward a $2.5 billion-scale IT services platform, enhancing AI/cloud/data capabilities and regional coverage [1].

- Strategic positioning: The acquisition significantly strengthens the company’s long-term competitiveness and market scale in the AI engineering and digital services track, opening up space for future growth.

- Valuation perspective: DCF scenarios show large potential upside, but this depends on revenue growth and profit margins maintaining or exceeding historical levels and synergies being realized [0].

- Phased layout: If the stock price continues to come under pressure, consider phased entry, focusing on integration and earnings realization pace.

- Technical characteristics: Currently in a consolidation range, key support at approximately ₹1,641.06, resistance at approximately ₹1,840.06; short-term consolidation may continue [4].

- Risk events: Integration announcements, performance guidance, and financing progress may trigger volatility; pay attention to marginal changes in volume and technical indicators.

Coforge’s acquisition of Encora for $2.35 billion is a key step toward becoming an AI-driven engineering service provider. Brokerages like CLSA have given an “Outperform” rating, reflecting recognition of its long-term strategic direction and market space expansion [1]. In the short term, high valuation, integration complexity, and earnings dilution are major pressures; in the long term, it depends on the pace of synergy realization and the path to earnings recovery. Current technical indicators show an oversold opportunity; investors can evaluate allocation timing based on risk preferences and integration progress.

- Technical K-Line Chart: Shows prices and volumes from Jan1,2025 to Dec30,2025, including key technical indicators (MACD, KDJ, RSI). Currently in a consolidation range, KDJ and RSI indicate oversold opportunities, MACD shows no obvious crossover and a bearish bias [4].

[0] Gilin API Data (Company Overview, Market Quotes, Finance, Technology, DCF Valuation and Python Analysis)

[1] NDTV Profit - “How Brokerages View Coforge After Landmark Encora Deal”, https://www.ndtvprofit.com/markets/how-brokerages-are-viewing-coforge-after-landmark-encora-deal-check-target-price-buy-sell-share-price

[2] Economic Times - “Coforge–Encora deal likely to be long-term positive: Analysts”, https://m.economictimes.com/markets/stocks/news/coforgeencora-deal-likely-to-be-long-term-positive-analysts/articleshow/126241895.cms

[3] Coforge Official Press Release - “Coforge to acquire Encora”, https://www.coforge.com/who-we-are/newsroom/press-release/coforge-to-acquire-encora.-reaffirms-intent-to-be-the-leading-ai-driven-engineering-firm-for-the-new-era

[4] Gilin API Technical Analysis Chart: Coforge K-Line Chart (Jan1,2025 to Dec30,2025), https://gilin-data.oss-cn-beijing.aliyuncs.com/financial_charts/39ba8674_COFORGE_NS_kline.png

Note: Encora is the target company of this transaction, not an existing “subsidiary” of Coforge. Relevant data and views are based on public information and professional analysis and do not constitute investment advice. Gilin AI

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.