Analysis of Cinda Securities' Reduction in Holdings of Unisplendour Corporation: Considerations and Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

-

Product Investment Plan Needs and Position Adjustment:Cinda Securities officially stated that this reduction is for “product investment plan needs” and will continue to reduce holdings as appropriate over the next 12 months until it is no longer a shareholder with more than 5% ownership. Such operations are usually driven by asset management businesses rebalancing position concentration, liquidity, or risk exposure, rather than fundamental negative changes in the target company. Therefore, observing whether it continues to exit through phased reductions is particularly important for judging the rhythm of the capital supply side.

-

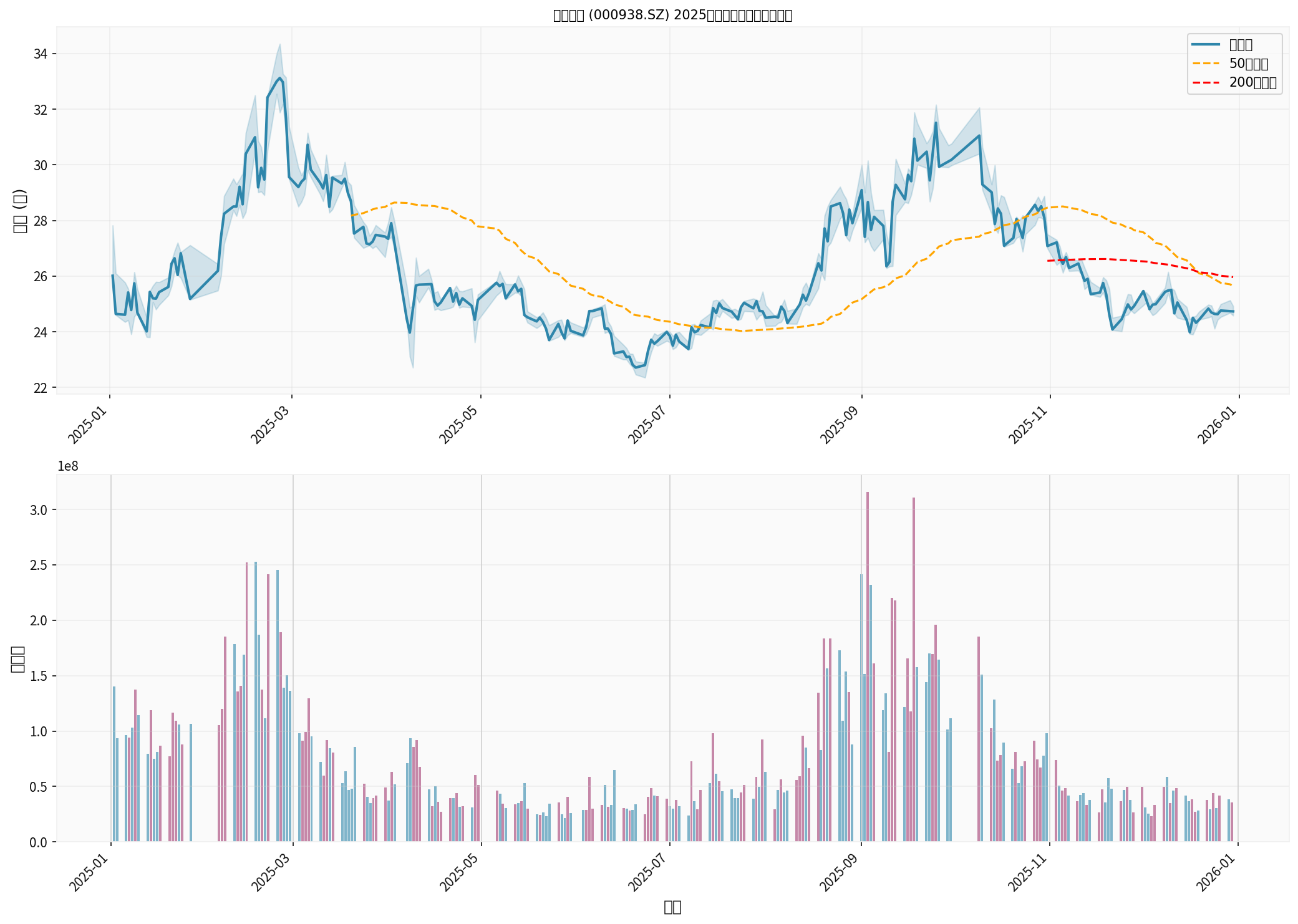

Market Volatility and Liquidity Management:In 2025, Unisplendour Corporation’s stock price has retreated nearly 11% from its early-year high, currently consolidating around $24.7, and is in a horizontal range slightly above the 50/200-day moving average under the pressure of bullish moving averages [0]. If Cinda Securities takes advantage of the relatively stable stock price phase to gradually reduce holdings, it can reduce the impact on market prices while coordinating product-side risk diversification.

-

Strategic Non-Controlling Exit:From the perspective of the shareholding ratio dropping to 4.999998% after the reduction, Cinda Securities has not fully exited, but has given up significant influence over the company, meaning that the product side will tend to non-controlling allocation in the future, reducing constraints on stock price fluctuations and corporate governance rules.

-

Short-Term Supply Pressure and Investor Sentiment:Announcements by major shareholders and clear indications of possible future reductions (even if low-frequency and phased) usually trigger market concerns, which may intensify selling pressure in the short term, especially when the stock price is in the middle of the range and there are already signs of volatility on the technical side. If subsequent reductions occur in the form of concentrated selling, it may put pressure on the stock price and stimulate an increase in trading volume.

-

Valuation Logic Needs to Align with Fundamentals:The current price-to-earnings ratio is still above 50x, the price-to-book ratio is about 4.89x [0], while ROE is only about 10% with low profit margins, and cash flow is not yet sufficient to support high valuations. If the reduction leads to a repricing in the capital market, it may push valuations toward earnings quality; however, if the reduction is viewed by the market as a structural exit (e.g., lack of confidence in future performance), it may lower the valuation premium.

-

Rotation Opportunities for Leveraged Capital:For existing capital, the shares released by Cinda Securities’ reduction may be absorbed by other medium-to-long-term value-oriented or policy-supported funds. If the company maintains order fulfillment and stable cash flow in areas such as AI servers and data centers, the narrative of valuation regression can still be sustained; however, without external capital succession, the stock price may maintain a range-bound consolidation in the short term.

-

Subsequent Reduction Rhythm and Price Range:Observe whether Cinda Securities continues to announce “product investment plan” reduction arrangements and the price range for reductions (if reductions occur in a concentrated price segment, it may intensify pressure).

-

Improvement in Fundamental Indicators:Pay attention to improvements in gross profit margin, ROE, and free cash flow in the 2026 financial report or quarterly financial data to help judge the sustainability of high valuations.

-

Liquidity and Capital Succession:If strategic investors or policy funds enter to take over, it can ease valuation risks; conversely, if market turnover drops after the reduction, it may intensify volatility.

The 2025 stock price and trading volume chart of Unisplendour Corporation shows the full-year fluctuation range (22.35~34.35 yuan), with the current closing price of 24.73 yuan slightly below the 50/200-day moving average, annual volatility exceeding 39%, and average annual trading volume reaching 79 million shares, indicating that there is still a certain degree of liquidity after the reduction announcement. This chart can help judge the short-term supply and demand changes brought by Cinda’s reduction at the current price. [0]

Cinda Securities’ this reduction is mainly due to the liquidity and risk control requirements of asset management products, and does not directly reflect the deterioration of Unisplendour Corporation’s fundamentals. However, the potential continued reduction over the next 12 months still brings downside risks to the supply-demand balance, and its rhythm and market succession situation need to be closely observed. For long-term investors, it is necessary to evaluate whether the growth of the company’s core businesses such as AI/data centers can support its high valuation and whether there are new strategic investors to take over. If the market forms a consensus on valuation rebalancing and fundamental improvement is sustainable, the current price may provide a medium-to-long-term layout opportunity; however, before the capital side is clear, the short-term stock price may still maintain range-bound consolidation or even a correction.

[0] Gilin API Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.