Impact of Zhima Enterprise Credit on the Fintech Industry and Investment Value Analysis of Ant Group Concept Stocks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Zhima Enterprise Credit, as an enterprise credit reporting service platform under Ant Group, has built significant competitive advantages in the credit reporting field for small and medium-sized merchants:

- Has established credit files for over 27 million small and medium-sized enterprises (SMEs), of which 10 million have managed and applied the “Strength Label” [1]

- Covers 50 million small and medium-sized merchants nationwide, integrating data from multiple industries such as e-commerce, local life, and chain supermarkets

- Data dimensions include industrial and commercial, judicial, online sales, etc., supporting hourly updates

- Through data-driven credit evaluation, it reduces the credit approval time for small and micro enterprises from the traditional 1-2 weeks to minutes [1]

- The “Small and Medium Merchant Operation Portrait Restoration Solution” has served more than 20 large institutional clients

- Forms an application closed loop in scenarios such as risk control access for financial institutions, marketing and customer acquisition for e-commerce and local life platforms

- Top Leaders:Zhima Enterprise Credit, Tianyancha, Qcc.com and other leading platforms

- Mid-tier Service Providers:Professional credit reporting institutions focusing on segmented vertical fields

- Base Service Providers:Massive small local credit reporting institutions

According to industry analysis, in the field of enterprise credit reporting big data applications, market participants mainly include:

- Ranked second in market share in 2023, second in mobile active users, with cumulative registered users exceeding 150 million [4]

- **Tianyancha:**并列 with Qcc.com as the leading brand in general commercial big data services

- Zhima Enterprise Credit:Relying on the Ant Group ecosystem, it has unique advantages in small and medium-sized merchant operation data

- Qcc.com’s gross margin is about 90%, comparable to companies like Kingsoft Office, Compass, and Hexun Information [4]

- The industry as a whole shows high gross margin characteristics, reflecting the value of data assets

- Fintech uses big data, AI, blockchain and other technologies to solve the dilemma of “difficult and expensive financing” for small and micro enterprises [1]

- Practice by the People’s Bank of China shows that in some regions, there are 52 online inclusive finance products, with loan amounts exceeding 3.5 billion yuan and interest rates as low as 2.95% [1]

- Banks have shifted from “looking at cash flow and statements” to “technology flow”, incorporating “sci-tech innovation attributes” such as intellectual property rights and R&D investment intensity into key dimensions [2]

- Data-driven credit evaluation has become an industry standard, and intelligent risk control decision-making systems are widely used

- The credit reporting industry market size is growing rapidly, from “niche demand” to “professional track” [4]

- Policies such as the “Implementation Plan for Further Improving the Credit Repair System” have been introduced to promote the standardized development of the industry

According to public information, Ant Group holds shares in multiple listed companies through direct and indirect methods:

| Company Name | Stock Code | Relationship with Ant Group |

|---|---|---|

| Hundsun Electronics | 600570.SS | Ali system is an important shareholder, core target in financial IT |

| Junzheng Health | 601567.SH | Ant Group holds shares through subsidiaries |

| China Life | 601628.SH | Ant Group shareholder (1.66% stake) is also a listed company |

| Huatai Securities | 601688.SH | Ant Group strategic investment |

- Industry: Fintech/Application Software

- Market Capitalization: 57.34 billion yuan

- Current Stock Price: 30.27 yuan (closing on December 30, 2025)

| Indicator | Value | Evaluation |

|---|---|---|

| P/E Ratio | 54.47x | High, reflecting high market expectations for fintech |

| P/B Ratio | 6.34x | High asset premium |

| ROE | 11.98% | Good profitability |

| Net Profit Margin | 17.90% | High profit margin |

| Current Ratio | 1.20 | Stable liquidity |

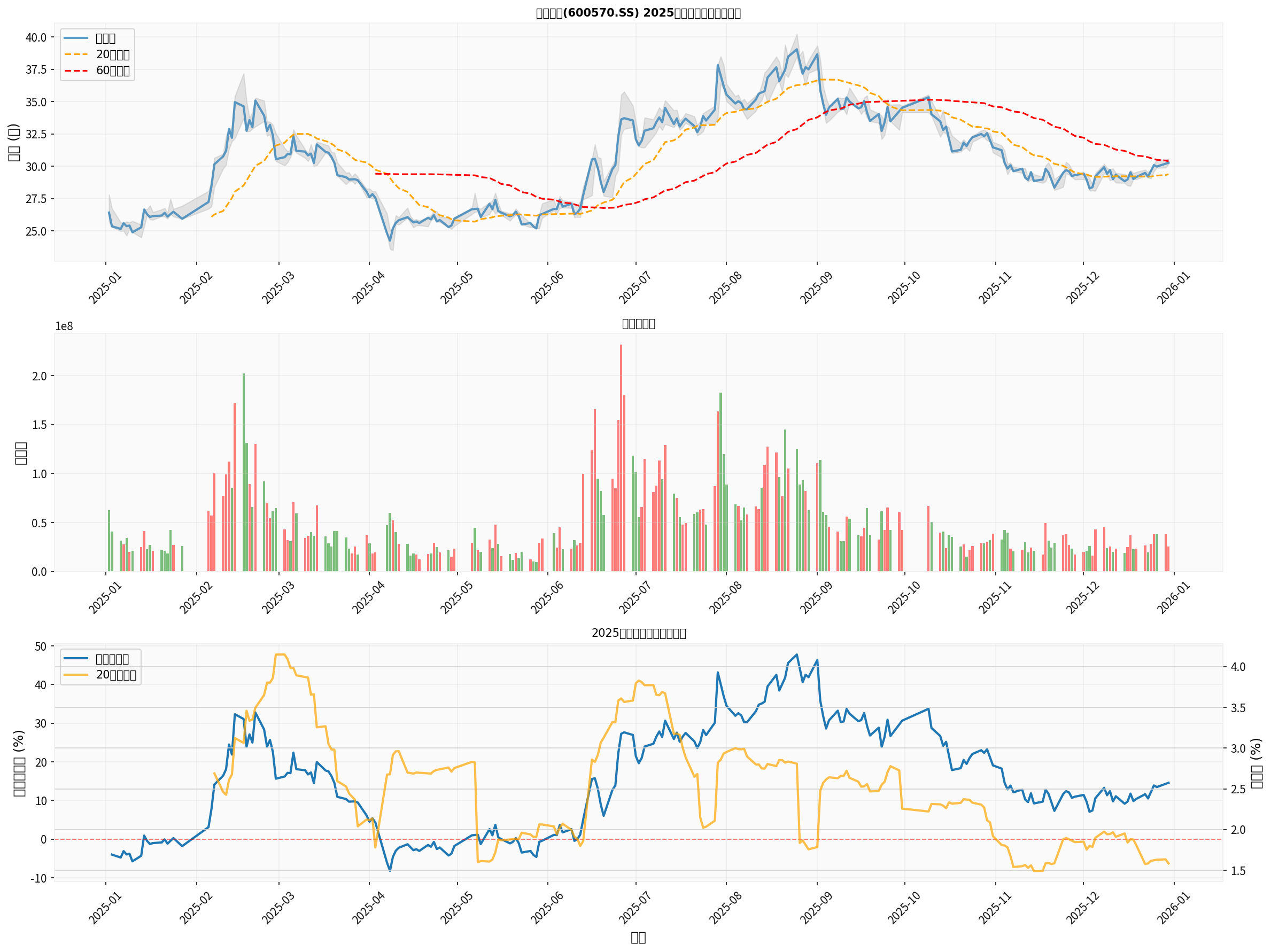

According to charts and technical analysis [0]:

- Annual Opening Price: 26.42 yuan

- Latest Price:30.27 yuan

- Annual Increase: +14.57%

- Annual High:39.04 yuan (August 25)

- Annual Low:24.25 yuan (April 8)

- Annual Volatility:2.57%(relatively stable)

- Current 20-day moving average:29.38 yuan

- Current 60-day moving average:30.38 yuan

- Short-term stock price is above the 20-day moving average but below the 60-day moving average, showing a consolidation trend

- Current 20-day volatility:1.58%, at a relatively low level

- Average daily trading volume:52 million shares

- Shows sufficient market liquidity

Chart shows Hundsun Electronics’ 2025 price trend, trading volume, and volatility. Data source: Brokerage API [0]

| Scenario | Intrinsic Value | Relative to Current Stock Price |

|---|---|---|

Conservative Scenario |

21.24 yuan | -29.8% |

Base Scenario |

26.47 yuan | -12.6% |

Optimistic Scenario |

41.60 yuan | +37.4% |

Probability-Weighted Value |

29.77 yuan | -1.7% |

- WACC:9.3%

- Beta:0.69 (below market average, reflecting the relative defensiveness of the financial IT industry)

- Base scenario revenue growth rate:12.1%

- Base scenario EBITDA margin:18.7%

- Current stock price of 30.27 yuan is slightly higher than the probability-weighted intrinsic value of 29.77 yuan, with reasonable valuation

- There is 37.4% upside potential in the optimistic scenario

- There is 29.8% downside risk in the conservative scenario

- Overall valuation is in a reasonable range, but downside risks cannot be ignored

- Hundsun Electronics is a leading financial IT solution provider in China

- Main businesses cover core transaction systems for financial institutions such as securities, funds, banks, and insurance

- Has deep synergy with the Ant Group/Alibaba ecosystem

- Application of large models in the banking industry is accelerating; in the first half of 2025, banking accounted for more than half of the financial industry’s large model-related winning projects (44) [2]

- Demand for digital transformation continues to grow; Hundsun Electronics benefits as a core IT supplier

- Intelligent risk control and AI-enabled finance have become industry trends

- The fintech industry maintains high prosperity; the Technology sector performed +0.31% today [0]

- Digital transformation of the banking industry is accelerating, and technology investment by financial institutions continues to grow

- The development of Zhima Enterprise Credit and other businesses may drive the joint growth of enterprises in the Ant ecosystem

- Demand for fintech services and credit reporting industry development form a positive cycle

- ROE reaches 11.98%, with good profitability

- Net profit margin of 17.90%, high profit level

- Healthy cash flow and low financial risk

- The “Fintech Development Plan (2022-2025)” continues to advance

- Strong policy support for inclusive finance for small and medium-sized enterprises

- Current P/E ratio of 54.47x, relatively high valuation level

- DCF base scenario valuation is 12.6% lower than current price

- The difference between the annual high and low prices is 61%, with large fluctuation range

- Has fallen back after reaching the annual high in August

- More competitors in the financial IT industry

- Cloud computing vendors are penetrating into the fintech field

- If the macroeconomy declines, IT investment by financial institutions may be affected

- Capital market fluctuations affect performance

- Reasonably High Valuation:Current stock price is close to the probability-weighted intrinsic value, but considering industry prosperity and growth, the valuation is at the upper limit of the reasonable range

- Short-term Correction Risk:Technical indicators show that the stock price is below the 60-day moving average, and may continue to consolidate in the short term

- Medium-to-Long-Term Allocation Value:As a leading financial IT company, it benefits from the industry’s digital transformation trend

- Recommended Strategy:

- Short-term investors: Be cautious and wait for technical stabilization

- Long-term investors: Consider building positions in batches, focusing on the support range of 26-28 yuan

- Strict stop-loss: It is recommended to set it at 24-25 yuan (previous low)

The rapid development of Zhima Enterprise Credit may have the following positive impacts on enterprises in the Ant ecosystem:

- Growth in Data Service Demand:With the expansion of credit reporting business, demand for IT systems and data processing capabilities increases

- Customer Resource Sharing:The customer base of credit reporting services may highly overlap with that of financial IT services

- Technical Capability Complementarity:Ant’s AI and big data technologies form synergy with Hundsun Electronics’ financial IT capabilities

Potential catalysts worth paying attention to:

- Zhima Enterprise Credit launches new services or products

- New布局 of Ant Group in the fintech field

- Regulatory policies supporting the fintech industry

- Bidding for digital transformation projects by financial institutions such as banks

As an important participant in the small and medium-sized merchant credit reporting field, Zhima Enterprise Credit has accelerated the digital and intelligent transformation of the fintech industry and improved the availability and efficiency of inclusive finance services through:

- Data Resource Integration:Breaking information silos and providing comprehensive portraits of small and medium-sized merchants for financial institutions

- Technology Innovation Driven:Applying AI, big data and other technologies to improve risk control efficiency

- Application Scenario Expansion:Expanding from risk control to multiple scenarios such as marketing and supply chain finance

- Industry Standard Leadership:Promoting the credit reporting industry to develop in a standardized and normalized direction

| Dimension | Evaluation | Explanation |

|---|---|---|

| Valuation | ⭐⭐⭐☆☆ | Current valuation is reasonably high, with limited safety margin |

| Growth | ⭐⭐⭐⭐☆ | Benefits from the growth of the fintech industry |

| Profitability | ⭐⭐⭐⭐☆ | ROE 11.98%, high profit margin |

| Financial Health | ⭐⭐⭐⭐⭐ | Low financial risk and healthy cash flow |

| Technical Aspect | ⭐⭐⭐☆☆ | Short-term consolidation |

- Short-term (0-3 months):Be cautious and wait for a better entry opportunity

- Medium-term (3-12 months):Focus on the support range of 26-28 yuan and consider building positions in batches

- Long-term (over 1 year):As a leading financial IT company, it is suitable for long-term allocation

- Valuation correction risk

- Intensified industry competition

- Macroeconomic downturn risk

- Policy risks related to Ant Group

[0] Gilin API Data - Stock data, financial analysis, technical analysis, valuation data provided by brokerage API

[1] People’s Daily Online - China Small and Medium Enterprise Association jointly launches “Market Position Certification Service” with Zhima Enterprise Credit (http://finance.people.com.cn/n1/2025/1222/c1004-40629699.html)

[2] Economic Observer Online - 2025 Banking Industry “Wall-breaking” Evolution: Elephants Dancing Towards New Life (http://www.eeo.com.cn/2025/1226/775379.shtml)

[3] China Small and Medium Enterprise Association - Zhima Enterprise Credit serves 27 million small and medium-sized enterprises (http://finance.people.com.cn/n1/2025/1222/c1004-40629699.html)

[4] Tencent News - Qcc.com in Suzhou, Jiangsu冲击 IPO with gross margin of about 90% (https://news.qq.com/rain/a/20251226A054NV00)

[5] Creative Economy Journal - Application Effect and Evaluation of Fintech in Precision Credit for Small and Micro Enterprises (https://www.wsp-publishing.com/rc-pub/front/front-article/download/137526514/lowqualitypdf)

[6] Securities Times - Analysis of Equity Relationships of Ant Group Concept Stocks (https://stcn-main.oss-cn-shenzhen.aliyuncs.com)

[7] China Securities Journal - “Ant Afu” Makes a Strong Breakthrough in AI Medical Industry Commercialization Accelerates (https://www.cs.com.cn/gppd/ggzx/202512/t20251224_6529852.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.