In-depth Analysis of Xiaomi Auto's Teardown Live Stream on Brand Image, Consumer Confidence, and Hong Kong Stock Valuation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the latest data, Xiaomi Group (1810.HK) currently has a stock price of

- YTD: Up 14.29%,indicating long-term investor confidence

- Past 3 months: Down 27.43%,reflecting obvious short-term pressure

- P/E Ratio: 20.01x,in a reasonable range

- P/B Ratio: 3.12x,showing reasonable asset premium

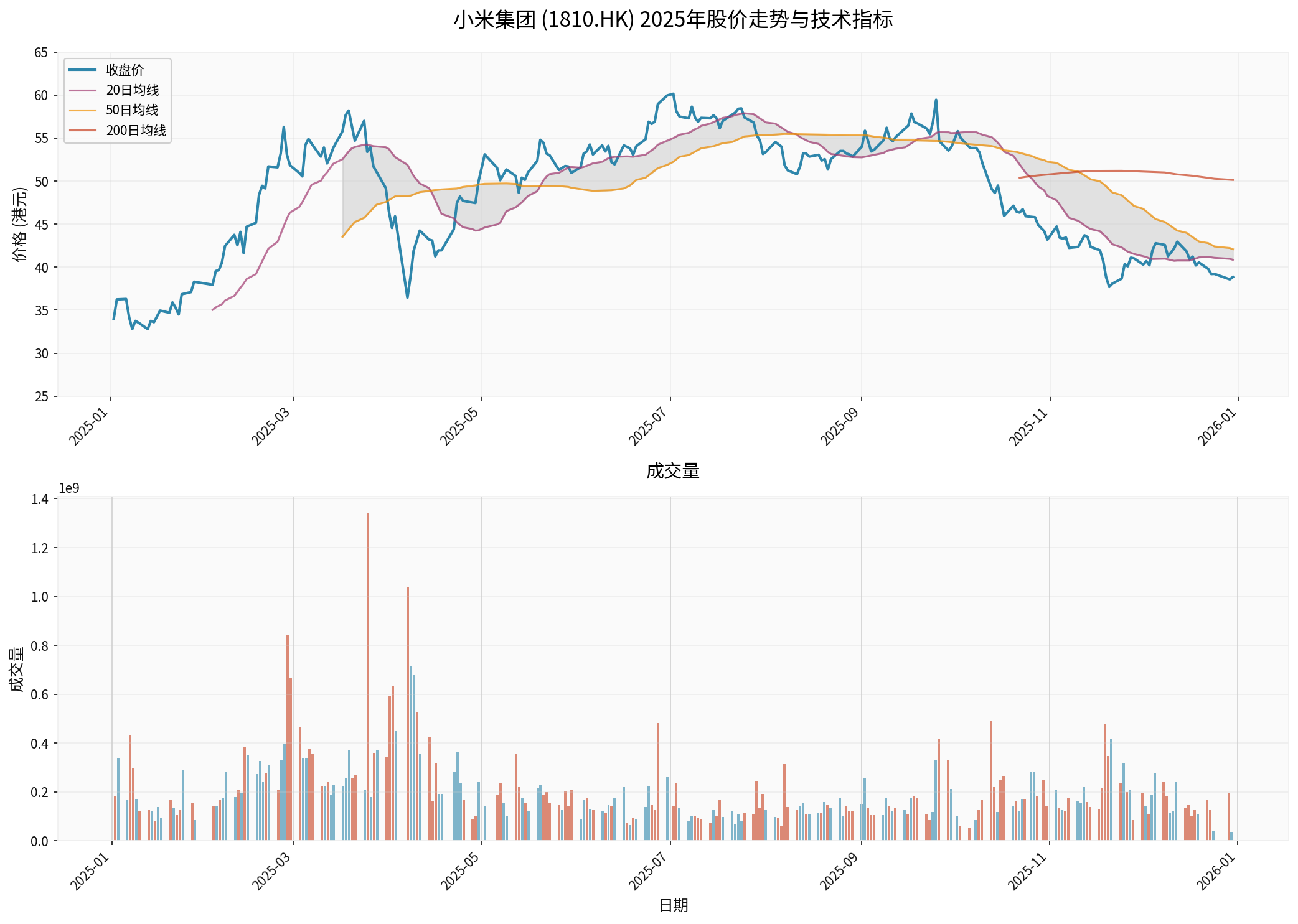

Technical analysis shows that Xiaomi’s stock is currently in a

Chart 1: Xiaomi Group’s 2025 Stock Price Trend and Moving Averages. The stock price is trading below the 200-day moving average (around HK$50),indicating a weak medium-to-long-term trend; the 20-day and 50-day moving averages have formed a death cross,putting short-term technical pressure.

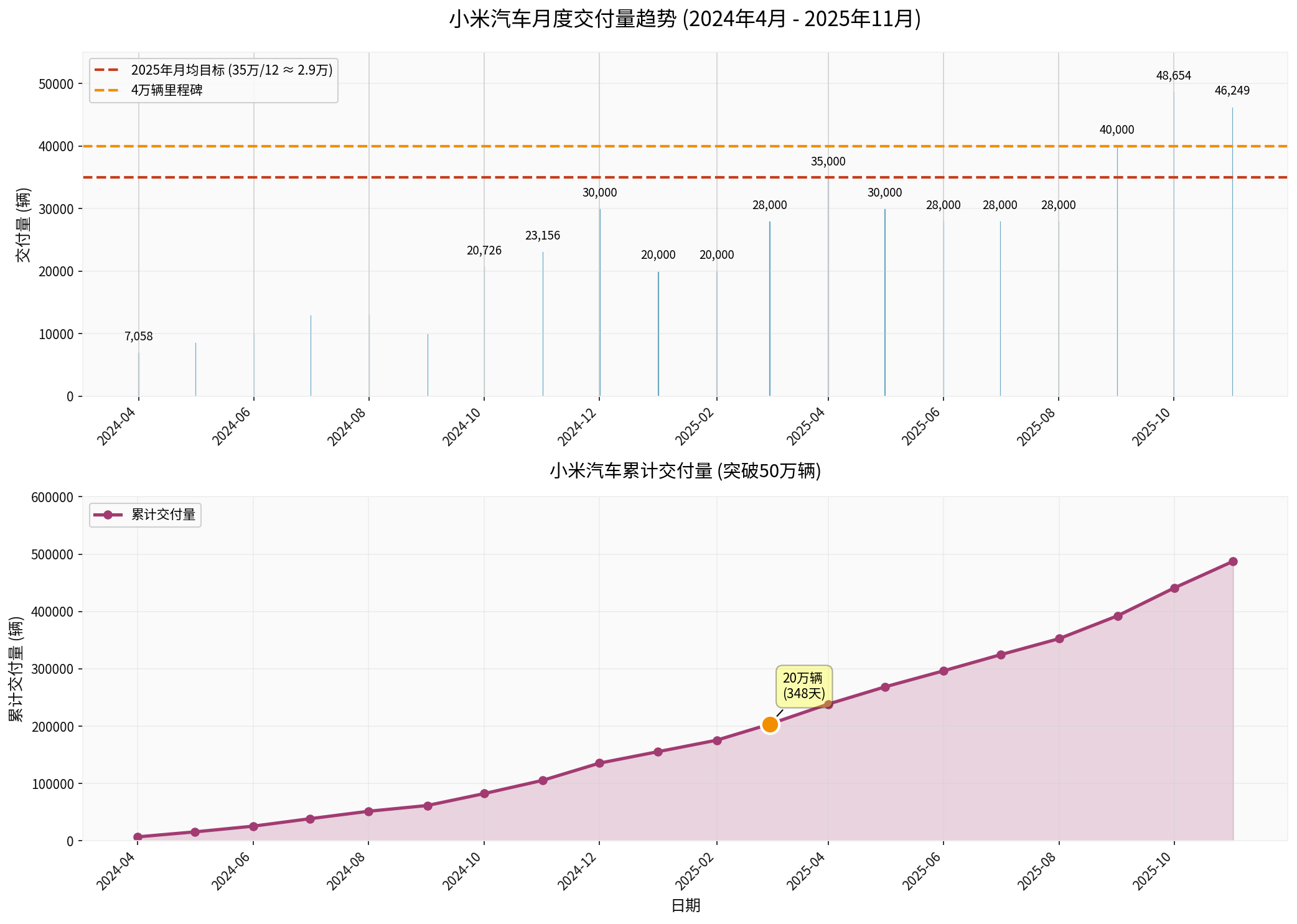

Xiaomi’s auto business has become the main growth engine of the group:

- Q3 2025 Auto Business Revenue: RMB 29 billion,up 199.2% YoY,a record high [5]

- Q3 2025 Auto Deliveries: Approximately 108,800 units,a quarterly record [5]

- Cumulative Deliveries: Exceeded 500,000 units,with over 350,000 units delivered in 2025,far exceeding the initial annual target of 350,000 units [3][4]

- **Strong YU7 Performance: **Wholesale sales reached 33,729 units in November 2025,ranking first in mainland China’s SUV sales ranking in October [3][5]

Chart 2: Xiaomi Auto Monthly Delivery Trend (April 2024 - November 2025). From an initial 7,058 units at launch to an average of over 40,000 units per month recently,cumulative deliveries exceeded 500,000 units,setting a new speed record in the new energy vehicle industry.

Lei Jun announced that he will host a New Year’s Eve live stream at

Xiaomi Auto has recently faced multiple safety doubts:

- **Fatal Accident at Delivery Center: **In December 2025,a fatal accident occurred at the Hangzhou Xiasha Delivery Center where a Xiaomi SU7 reversed and killed a salesperson [7]

- **Multiple Safety Accidents: **Including a fatal accident on the Deshang Expressway involving 3 deaths in NOA assisted driving mode and vehicle fire accidents [8][9]

- **Safety Design Doubts: **A blogger found through teardown that the SU7 door handle cannot work after power failure,lacking mechanical unlocking redundancy design [2]

These incidents have severely impacted Xiaomi’s brand image as a “safe electric vehicle”. The teardown live stream aims to rebuild consumers’ trust in product safety through

Through the teardown live stream,Xiaomi can:

- **Showcase core component quality: **Including key components such as battery packs,electronic control systems,and body structures

- **Prove supply chain integration capabilities: **Demonstrate cooperation results with top international suppliers (e.g. Infineon,NVIDIA,etc.) [4]

- **Reflect manufacturing process level: **Through on-site explanations by engineers,showcase the quality control and process details of Xiaomi Auto

Xiaomi has always been good at winning consumer trust through hardcore technical demonstrations:

- **Teardown live streams in the mobile phone era: **Xiaomi has repeatedly shown the internal structure and materials of mobile phones through teardowns

- **Brand gene of “Born for Enthusiasts”: **Xiaomi’s core user group is highly sensitive to technical details

- **Lei Jun’s personal IP effect: **Lei Jun’s image from “Enthusiast Leader” to “Game Changer” is deeply rooted in people’s hearts [8]

Through on-site teardowns,Xiaomi can:

- **Directly demonstrate technical strength: **Let consumers see the core technical configurations of SU7 and YU7

- **Eliminate information asymmetry: **Teardowns can provide more real product information than PPTs and promotional videos

- **Establish professional image: **On-site explanations by engineers can enhance the brand’s professionalism and technical depth

In response to recent safety accidents,the teardown live stream can:

- **Showcase safety design: **Focus on displaying safety configurations such as body structure,airbags,and battery protection

- **Respond to doubts: **Provide targeted demonstrations and explanations for specific doubts such as door handles and AEB functions

- **Prove quality control standards: **Demonstrate Xiaomi Auto’s quality standards by showing internal materials

Compared with traditional car companies,Xiaomi’s teardown live stream can:

- **Reflect internet genes: **Transparent and open communication methods are more in line with the preferences of young consumers

- **Highlight “cost-effective” positioning: **Prove the value proposition of “lower price for the same configuration” by showing materials

- **Enhance user participation: **Live stream interactions can strengthen the emotional connection between users and the brand

If the technical advantages shown in the live stream cannot be兑现 in actual use,it may:

- **Trigger new doubts: **Consumers may look for gaps against promotional standards

- **Amplify negative information: **Any quality problem may be amplified as “inconsistent with宣传”

After teardown,consumers and media may:

- **Directly compare with competitors: **Compare Xiaomi Auto’s materials with Tesla,BYD,etc.

- **Expose cost structure: **Teardowns may expose Xiaomi’s cost control strategies,leading to doubts about “cutting corners”

Even if comments are turned off (like Xiaomi 17 Ultra launch [9]),online public opinion may still:

- **Selectively spread: **Only spread problematic parts and ignore overall advantages

- **Overinterpret: **Overinterpret and negatively associate certain details

According to Xiaomi Auto’s market performance,its brand strategy has achieved significant results:

- **Blind order ratio as high as 60%: **The blind order ratio in early SU7 orders reached 60%,showing strong consumer trust in the Xiaomi brand [2]

- **Repurchase and word-of-mouth: **The impression of Xiaomi products as “cost-effective and reliable” has been deeply rooted in consumers’ hearts [2]

The teardown live stream will further strengthen this trust mechanism based on technical transparency.

Xiaomi has always emphasized the positioning of “lower price for the same configuration”. The teardown live stream can:

- **Showcase solid material quality: **Prove that the price advantage is not achieved by cutting corners

- **Prove supply chain integration capabilities: **Showcase Xiaomi’s strength in supply chain management

For technical consumers,the teardown live stream provides:

- **First-hand technical information: **More reliable product information than marketing materials

- **Verifiable commitments: **Can be verified through subsequent teardown videos

The teardown live stream mainly shows

- **Dynamic safety performance: **Safety performance in actual driving

- **Long-term reliability: **Durability after 3-5 years

- **After-sales service: **Maintenance convenience and cost

These cannot be directly shown by teardowns.

For recent safety accidents,consumers are more concerned about:

- Authoritative investigation results of accident causes

- Xiaomi’s improvement measures and compensation plans

- Improvement of long-term safety records

The teardown live stream cannot replace authoritative accident investigations and official reports.

For Xiaomi’s main target group (young,first-time car buyers),they are more concerned about:

- Reliability of driving assistance functions

- Newbie-friendliness

- Convenience of after-sales service

Building trust in these aspects requires longer time and more actual experience.

- **Increased attention: **As a marketing event,the teardown live stream may increase market attention in the short term

- **Improved sentiment: **If the live stream效果 is good,it may improve investor sentiment and drive a short-term rebound in stock price

- **Technical position: **The current stock price is near the technical support level (HK$38.23),with a rebound basis [0]

- **Stock price has reflected auto business success: **Xiaomi’s stock price has risen 14.29% YTD,which has already reflected the success of the auto business to a certain extent [0]

- **Technical pressure: **The stock price is below the 200-day moving average,and the 20-day/50-day moving averages have formed a death cross,with weak short-term technicals [0]

- **Volume constraint: **Recent trading volume is lower than the average level (35.96M vs average 180.62M) [0],lacking momentum for a volume-driven upward attack

The short-term stock price trend will depend on:

- Propagation effect and public opinion feedback of the live stream

- Analysts’ interpretations and rating adjustments

- Delivery data for December 2025 and January 2026

- Progress of safety accident investigations and Xiaomi’s response measures

- **Valuation re-rating potential: **Currently,the P/E ratio is 20.01x [0],in a reasonable range. If the auto business revenue share increases,there is potential for valuation re-rating

- **Earnings expectation upgrade: **The increase in auto business revenue will improve the group’s profit structure

- **Target price upgrade: **Analysts may upgrade the target price to reflect the contribution of the auto business

- **Valuation pressure: **High investment in the auto business may drag down the group’s overall profitability

- **Growth expectation downgrade: **If safety accidents occur frequently,it may affect consumers’ purchase意愿,thus affecting sales growth

- **Increased risk premium: **Investors may require a higher risk premium

Based on current data,we expect:

- **2026 Auto Business Deliveries: **500,000-600,000 units (assuming an average of 40,000-50,000 units per month)

- **Auto Business Revenue: **RMB 80-100 billion (assuming an average unit price of RMB 150,000-180,000)

- **Profit Contribution: **Currently still in the investment period,contribution to the group’s profit is limited

- **Technical brand image: **If it continues to show through hardcore technical demonstrations,Xiaomi may establish a brand image of “excellent technology”

- **User ecosystem value: **The closed loop of the “full ecosystem of car,person,and home” strategy will enhance user stickiness and ecosystem value [4]

- **Repurchase and word-of-mouth: **The usage experience of the first batch of users will determine long-term word-of-mouth and repurchase rate

- **From hardware valuation to ecosystem valuation: **As the auto business matures,the market may shift from hardware company valuation to ecosystem company valuation

- **Increased service revenue share: **Increased share of recurring revenue such as software services and subscription services will improve valuation

- **Improved profitability: **Scale effect and supply chain optimization will improve the profitability of the auto business

- **Increased competition: **Continuous pressure from competitors such as Tesla,BYD,and Huawei

- **Technology iteration risk: **Risk of technical backwardness brought by rapid iteration of autonomous driving,battery technology,etc.

- **Policy risk: **Changes in new energy vehicle subsidy policies,double credit policies,etc.

- **Mainly Wait and See: **Wait for the teardown live stream effect to become clear before making a decision

- **Pay attention to technicals: **Wait for the stock price to break through the resistance level of HK$40.86 with volume before entering

- **Set stop loss: **If entering,it is recommended to set a stop loss below the support level of HK$38.23

- **Focus on fundamentals: **Key tracking of delivery data and profitability in Q1 and Q2 2026

- **Evaluate progress of safety trust reconstruction: **Pay attention to safety accident investigation results and Xiaomi’s improvement measures

- **Valuation rationality: **Currently,the P/E ratio of 20.01x [0] is in a reasonable range,with potential for valuation repair

- **Strategic positioning: **Xiaomi’s “full ecosystem of car,person,and home” strategy has long-term value

- **Competitive advantages: **Supply chain integration capabilities,brand influence,and user ecosystem are long-term moats

- **Risk tolerance: **Need to bear the profit pressure and competition risk during the auto business investment period

- Recent safety accidents may continue to ferment

- Reconstruction of safety trust takes time

- Risk of regulatory policy changes

- Fierce competition in the new energy vehicle industry

- Price wars may continue

- Rapid technology iteration

- High investment in the auto business may drag down short-term earnings

- Matching of delivery capacity and order demand

- After-sales network construction lags behind sales growth

- Current stock price has reflected certain optimistic expectations

- Profitability of the auto business has yet to be verified

- Market sentiment fluctuations may lead to valuation fluctuations

Comprehensive analysis shows that Xiaomi Auto’s teardown live stream:

- Technical transparencywill enhance consumers’ trust in Xiaomi Auto’s technical strength

- Hardcore demonstrationsare in line with Xiaomi’s brand gene of “Born for Enthusiasts”,which can strengthen the identity of core user groups

- Responding to safety doubtsprovides a direct channel to respond,helping to rebuild safety trust

- Cannot solve all problems,especially dynamic safety performance and long-term reliability

- Public opinion is difficult to fully control,and may face selective spread and overinterpretation

- Effect needs time to verify,short-term marketing events cannot replace long-term product performance and service quality

- Marketing events may bring trading opportunities,but technicals are under pressure (below 200-day moving average,20-day/50-day moving average death cross) [0]

- Stock price has reflected the success of the auto business (up 14.29% YTD) [0]

- Low trading volume (35.96M vs average 180.62M) [0],lacking momentum for volume-driven upward attack

- If safety trust is successfully rebuilt + deliveries continue to grow,there is potential for valuation re-rating

- Currently,the P/E ratio of 20.01x [0] is in a reasonable range,and the increase in auto business revenue share will improve the profit structure

- The success of the “full ecosystem of car,person,and home” strategy will bring long-term value

- Technical brand image and user ecosystem are long-term value drivers

- However,it needs to bear long-term risks such as intensified competition and rapid technology iteration

Investors should focus on:

- Delivery data for January-February 2026: Verify the conversion effect of the teardown live stream

- Safety accident investigation results: Authoritative reports on the responsibility of Xiaomi

- Profitability of the auto business: Gross margin and operating profit margin in Q4 2025 and Q1 2026 financial reports

- Competitor dynamics: Price adjustments and new product launches by Tesla,BYD,and Huawei

- Regulatory policy changes: New energy vehicle subsidy policies and autonomous driving regulations

[0] Gilin API Data - Xiaomi Group (1810.HK) Real-time Quotes,Company Overview,Technical Analysis,Financial Analysis,Historical Price Data

[1] Sohu - “Xiaomi Lei Jun Will Host a New Year’s Eve Live Stream Tomorrow Night,Inviting Engineers to Tear Down Cars On-site” (https://m.sohu.com/a/970820804_114760)

[2] HK01 - “From Marketing High Ground to Safety Low Ground: Why Can’t Xiaomi’s ‘Safest Electric Vehicle’ Prevent Fatal Accidents?” (https://www.hk01.com/中國觀察/60306073/)

[3] IT Home - “Xiaomi Auto Retail Sales Reached 46,249 Units in November,YU7 Wholesale Sales Exceeded 30,000 Units for the Month” (https://www.ithome.com)

[4] Xiaomi Official Website - “Xiaomi Auto’s ‘Full Ecosystem of Car,Person,and Home’ Strategy White Paper”

[5] Canalys - “2025 Q3 Global New Energy Vehicle Market Report”

[6] Bloomberg - “Xiaomi Auto Supply Chain Analysis”

[7] Xinhua News Agency - “Hangzhou Police Announce Investigation Results of Xiaomi Auto Fatal Accident”

[8] 36Kr - “Lei Jun’s Transformation: From ‘Enthusiast Leader’ to ‘Auto Industry Game Changer’”

[9] TechWeb - “Xiaomi 17 Ultra Launch Turns Off Comments,Sparkling Public Discussion on Marketing Methods”

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.