Analysis of the Significance of Innoscience's Leading Rally and the Subsequent Trend of Hong Kong Stock Semiconductor Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on market data and industry information, I systematically analyze the significance of Innoscience’s leading rally and evaluate its subsequent trends for you.

Innoscience is a semiconductor company focusing on

- High-efficiency power management systems

- Fast charging technology

- 5G communication devices

- Power systems for new energy vehicles

Innoscience’s performance of rising over 9% may reflect the following fundamental factors:

- GaN technology is gradually replacing traditional silicon-based devices in high-power and high-frequency application fields

- Third-generation semiconductors align with the global trends of energy efficiency improvement and carbon neutrality

- China’s independent R&D capabilities in the GaN field are increasing

- Against the backdrop of international supply chain restructuring, domestic semiconductor enterprises are accelerating the realization of self-reliance and controllability

- Enterprises focusing on niche areas such as Innoscience have formed competitive advantages at specific technical nodes

From macro data, the semiconductor industry has indeed shown some positive signals:

- According to SEMI’s forecast, the global semiconductor manufacturing equipment sales are expected to reach $133 billion in 2025, an increase of 13.7% year-on-year, and are expected to continue to climb to $145 billion and higher levels in 2026 and 2027 [2]

- Sustained growth in demand for AI chips drives investment in advanced processes and packaging technologies

- Strong demand from downstream applications such as data centers, new energy vehicles, and industrial automation

Take the industry leader

- Year-to-date increase of 147.59%

- 1-year increase of 120.25%

- 3-year increase of 334.62%

- 6-month increase of 60.09%

- Drop of 6.14% in the past 3 months

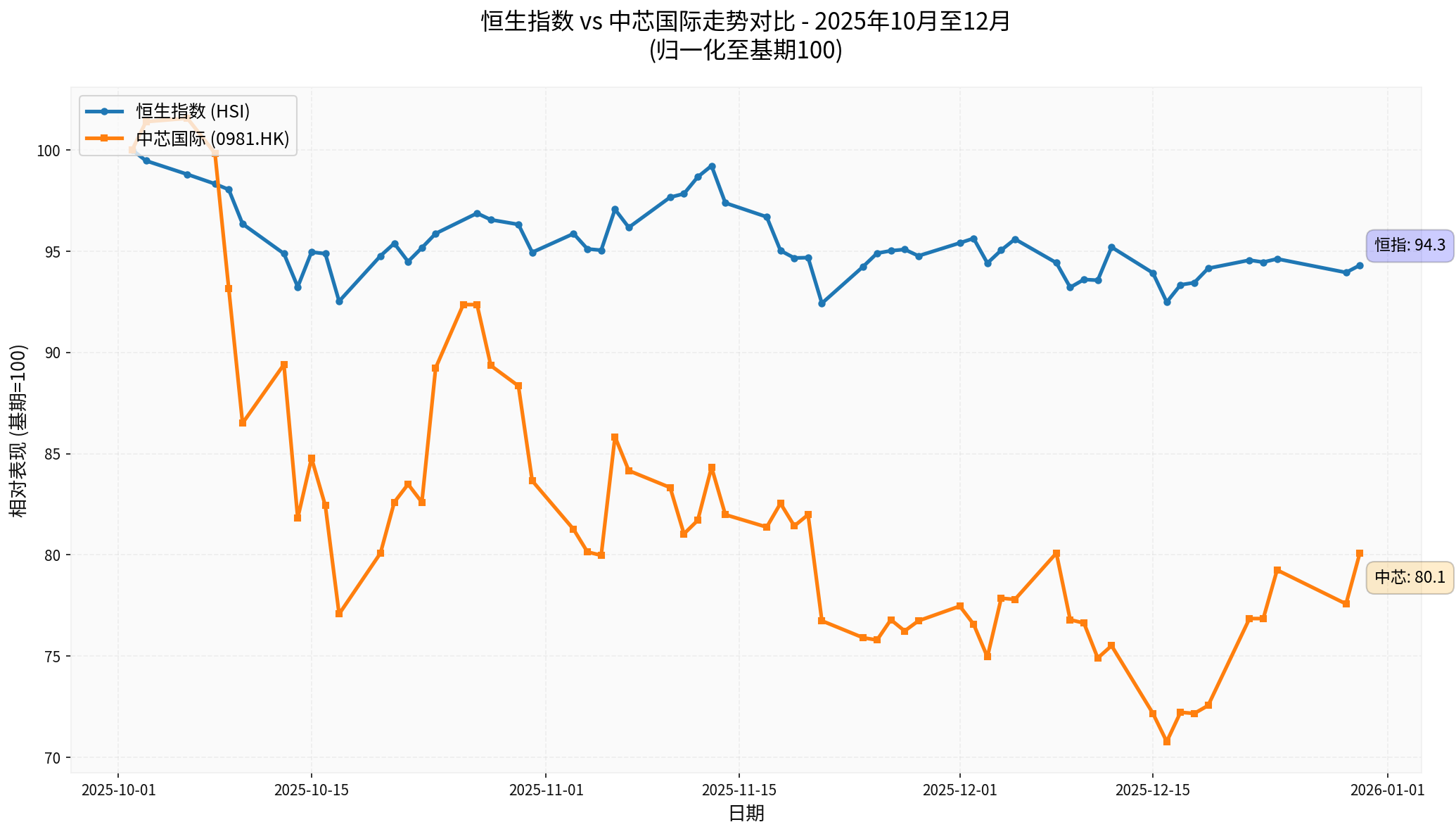

- Drop of 19.91% recently (Oct-Dec)

- Underperformed the Hang Seng Index by 14.21 percentage points

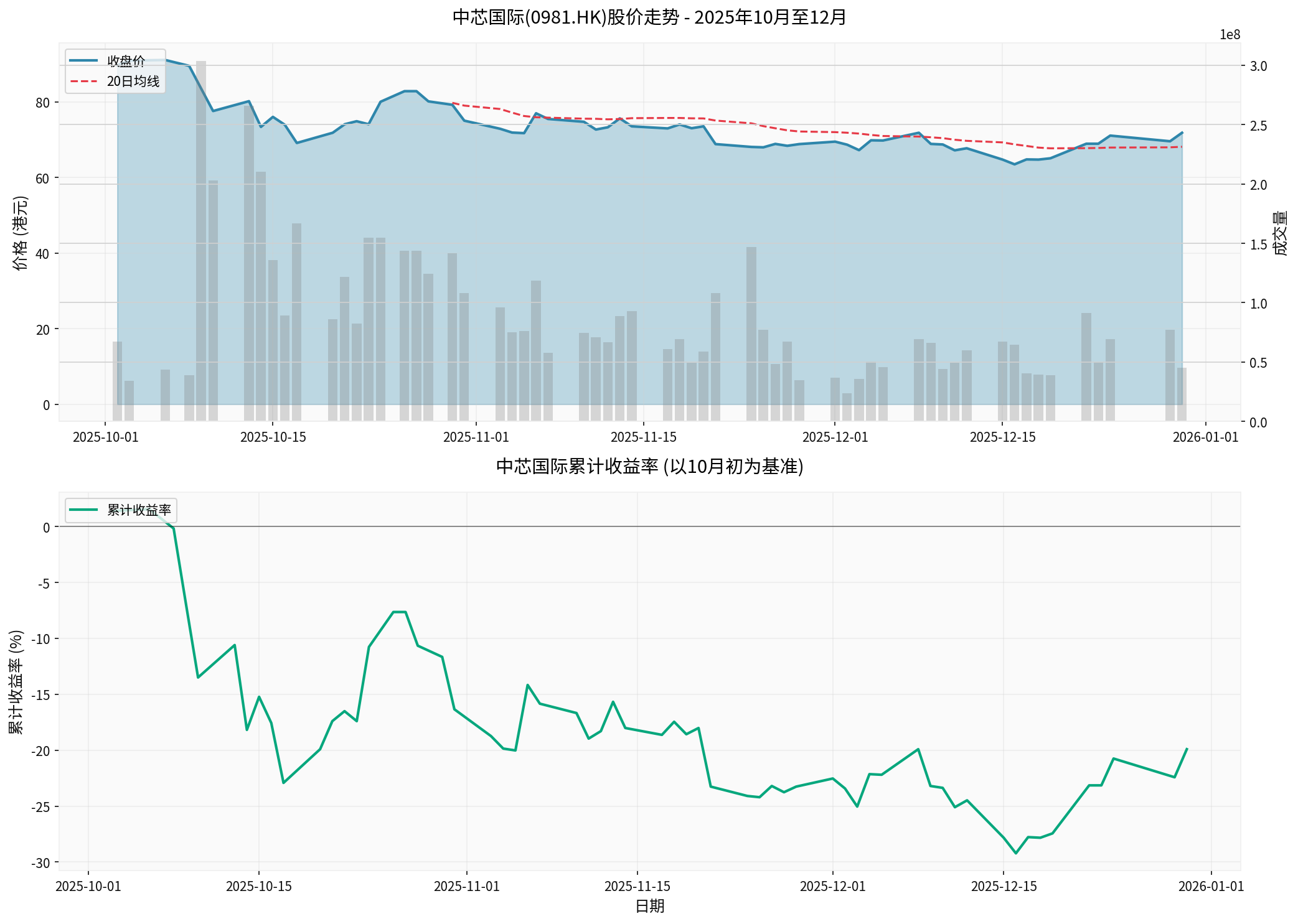

- The above chart shows that SMIC experienced significant adjustment from October to December

- The stock price fell from about HK$90 in early October to HK$71.80 at the end of December

- The 20-day moving average turned downward in early November, indicating a weakening medium-term trend

- The cumulative return curve continued to decline, reflecting the adjustment pressure over these three months

- The comparison chart shows that SMIC’s performance was significantly weaker than the Hang Seng Index from October to December

- The Hang Seng Index fell by 5.70% during this period, while SMIC fell by 19.91%

- The semiconductor sector’s excess return relative to the broader market was -14.21%, indicating that semiconductor stocks were under pressure during this period

✅ Global semiconductor equipment sales forecast shows industry prosperity is recovering

✅ Emerging applications such as AI drive long-term demand growth

✅ Clear domestic substitution trend and continuous policy support

✅ Technological breakthroughs in some niche areas (such as third-generation semiconductors like GaN and SiC)

❌ Hong Kong stock semiconductor leaders have experienced significant adjustments recently

❌ Southbound Capital has phased net outflows from the semiconductor sector

❌ Global macroeconomic uncertainty still exists

❌ U.S. semiconductor tariff policies on China may continue to exert pressure [3]

❌ After valuation repair, some companies’ stock prices have reflected more expectations

From the data, Southbound Capital in 2025 showed the characteristics of

- Annual dimension: Southbound Capital’s net purchases within the year were close to HK$1.41 trillion, setting a new historical record [4]

- Short-term dimension: Recent single-day net outflow of HK$512 million, indicating that funds are leaning towards defense or profit-taking in the short term

- Sector differences: Funds showed net inflows to semiconductor leaders like SMIC (e.g., single-day net inflow of HK$491 million)[5], but there was profit-taking in some tech growth stocks

This divergence between “expectation of fundamental improvement” and “short-term capital outflow” may stem from:

- After the sharp rise in 2025, the valuation of some semiconductor stocks is already at a high level

- SMIC’s P/E ratio reached 130.55 times, showing valuation pressure [0]

- Market style may switch between high-growth and defensive sectors

- At the end of the year, funds tend to lock in gains and avoid risks

- External factors such as the Fed’s policy path and Sino-US relations affect foreign capital flows

- The Hong Kong stock market is more sensitive to foreign capital flows

- Valuation digestion pressure: Stocks with large gains in the early stage need time to digest their valuations

- Performance verification period: The 2025 annual report and 2026 Q1 report will be key verification windows

- Increased capital game: Divergences among Southbound Capital, foreign capital, and local capital are increasing

- Focus on targets with high performance fulfillment

- Attach importance to the matching degree between valuation and growth

- Be alert to the risks of stocks炒作 based on pure themes

- Upward industry cycle: Global semiconductors enter a new boom cycle

- Deepening domestic substitution: Technology blockades accelerate the process of self-reliance and controllability

- AI-driven demand: Applications such as large models and autonomous driving drive demand for high-end chips

- AI chip industry chain: Computing power chips, high-speed interconnection, advanced packaging

- Automotive electronics: Intelligence and electrification drive demand for automotive-grade chips

- Third-generation semiconductors: Penetration of GaN and SiC in new energy, fast charging and other fields

- Equipment and materials: Localization of wafer manufacturing equipment and semiconductor materials

- Geopolitical risk: U.S. semiconductor管制 on China may further escalate

- Macroeconomic risk: Global economic recession expectations affect end demand

- Technology iteration risk: Changes in technical routes may lead to adjustments in investment directions

- Valuation fluctuation risk: The Hong Kong stock market has weak liquidity, leading to large valuation fluctuations

Innoscience’s leading rally

- An independent trend of leaders in niche areas

- A microcosm of accelerated domestic substitution of third-generation semiconductors

- A reflection of the trend of “de-retailization and institutionalization” of Hong Kong stock tech stocks

“Dumbbell-shaped” allocation idea:

- IDM or foundry enterprises with global competitiveness

- Companies that have formed technical barriers in niche areas

- Companies with abundant cash flow and continuous R&D investment

- AI chip design companies

- Third-generation semiconductor enterprises

- Semiconductor equipment and material companies

- Standard allocation: Maintain a neutral allocation to the semiconductor sector (accounting for about 15-25% of the stock portfolio)

- Phased layout: Gradually build positions using market adjustment opportunities

- Dynamic adjustment: Flexibly adjust positions according to performance verification and valuation changes

Against the background of short-term net outflows of Southbound Capital, investors should:

- Downplay short-term fluctuationsand focus on the long-term growth logic of the industry

- Select high-quality targets carefullyand attach importance to performance fulfillment and valuation matching

- Do a good job in risk managementby controlling positions and diversifying allocations

- Be patient; the full recovery of the semiconductor industry takes time to verify

[0] 金灵API数据 - 中芯国际(0981.HK)行情数据、公司概况、历史价格数据

[1] Yahoo财经香港 - “美中供應鏈合作安森美宣布採購英諾賽科GaN晶圓” (https://hk.finance.yahoo.com/news/美中供應鏈合作-安森美宣布採購英諾賽科gan晶圓-044640249.html)

[2] Yahoo财经香港 - “《市評》恒指平安夜半日市揚滙控六連升中芯造好” (https://hk.finance.yahoo.com/news/市評-恒指平安夜半日市揚-滙控六連升-中芯造好-050249090.html)

[3] Yahoo财经香港 - “中國|外交部:堅決反對美方濫施關稅 無理打壓中國產業” (https://hk.finance.yahoo.com/news/中國-外交部-堅決反對美方濫施關稅-無理打壓中國產業)

[4] Yahoo财经香港 - “港股2025年回顧:南向資金助力 IPO規模冠全球” (https://hk.finance.yahoo.com/news/港股2025年回顧-南向資金助力-ipo規模冠全球-021005439.html)

[5] Yahoo财经香港 - “港股通中移動淨流出7.11億港元” (https://hk.finance.yahoo.com/news/港股通中移動淨流出7-11億港元-102502501.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.