Seres 'From Adversity to Prosperity' Investment Analysis Report: The Dual Game of Dilemma and Reversal

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to user feedback, Seres (601127) stock price has continued to fall by approximately 30% since the National Day holiday. This trend reflects the market’s multiple concerns about the company:

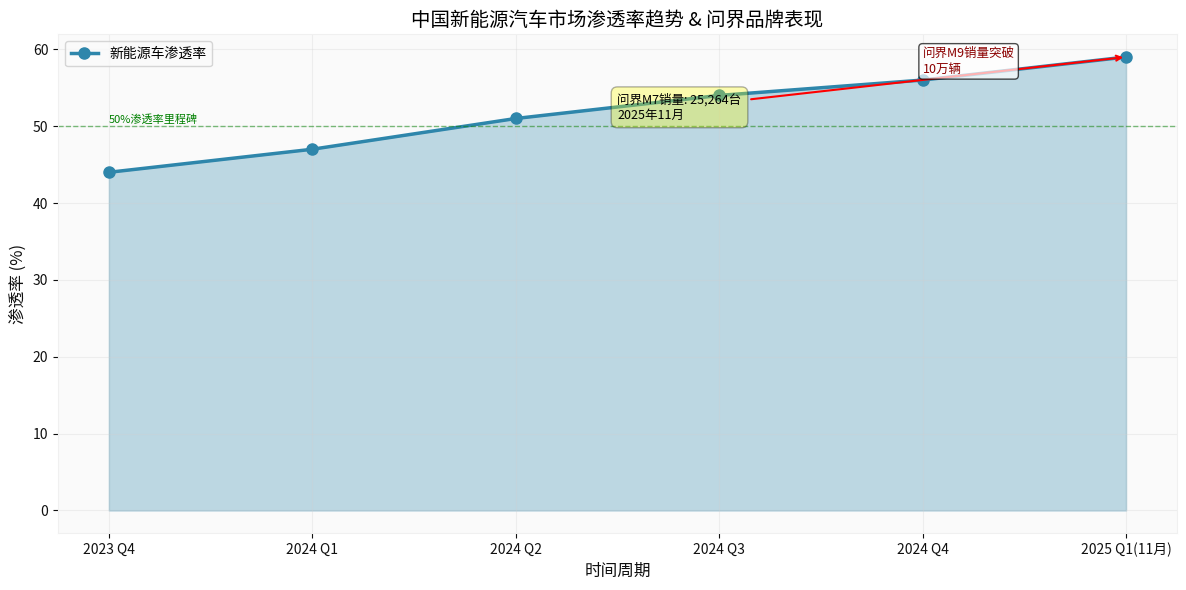

- Pressure from intensified competition: The competition in China’s new energy vehicle market has entered a white-hot stage. The penetration rate of new energy vehicles reached59%in November 2025, an increase of7 percentage pointscompared to November 2024 [1], but competition has become even fiercer.

- Impact of price wars: Major manufacturers have cut prices to maintain sales volume. BYD announced significant price cuts in 2025, further compressing profit margins in the industry [2].

- Valuation correction pressure: In the absence of substantial performance support, the previously high valuation faces correction pressure.

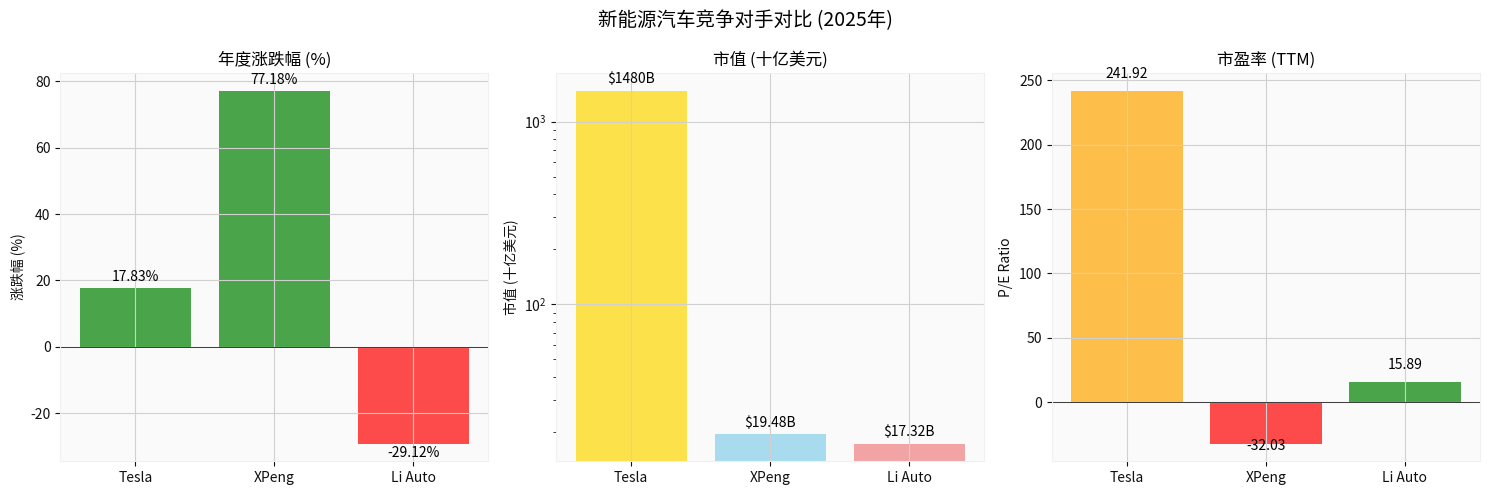

From the performance of competitors, the market differentiation is obvious:

- XPeng Motors (XPEV): Recorded a cumulative increase of+77.18%in 2025 with a price-to-earnings ratio of -32.03 [0], gaining market recognition through its technical positioning.

- Li Auto (LI): Fell by-29.12%cumulatively in 2025 with a price-to-earnings ratio of 15.89 [0], also facing growth dilemmas.

- Tesla (TSLA): Rose by+17.83%cumulatively in 2025 with a price-to-earnings ratio of 241.92 [0], remaining strong amid expectations of autonomous driving and robotaxi.

Despite the pressure on stock price, the

- AITO M7 sales surge: In November 2025, the new generation AITO M7 achieved sales of25,264 units, ranking among the top in the sales list [1].

- AITO M9’s luxury breakthrough: As a flagship model, the AITO M9 has performed prominently in the luxury SUV market with cumulative sales exceeding100,000 units[3].

- Recognition of product strength: The AITO M7 adopts a more rounded design language with a length of 5.1 meters, while the M8 and M9 reach the 5.2-meter class [1].

Seres’ fundamental value lies in its deep binding with Huawei:

- Leading autonomous driving technology: Huawei’s ADS (Advanced Driving System) autonomous driving technology is expanding to more than 20 models [4], with an obvious technical moat.

- HarmonyOS smart cockpit: Provides an excellent intelligent experience, an advantage that traditional car companies cannot replicate in the short term.

- Brand synergy effect: Huawei’s brand influence and channel advantages provide strong market endorsement for AITO.

According to online search results, Seres faces high expense ratio pressure:

- Huge R&D investment: As a deep partner in Huawei’s smart selection model, continuous R&D investment is required to maintain technological leadership.

- Rising sales expenses: Fierce market competition leads to high marketing costs.

- Economies of scale not fully realized: Although sales have broken through, there is still a distance from achieving ideal economies of scale.

From the perspective of expense ratio comparison, Seres needs to learn from Li Auto:

- Li Autohas performed relatively well in expense control, and its P/E ratio of 15.89 [0] reflects the market’s profit expectations.

- XPeng Motorshas a negative P/E ratio (-32.03) [0], but its technical investment has换来 a sharp rise in stock price (+77.18%).

- Market diversification: Relying on a single market carries high risks; overseas expansion can diversify risks.

- High-end brand positioning: The AITO M9 may have the opportunity to challenge traditional luxury brands in overseas markets.

- Tariff barriers: The EU imposes an import tariff of up to45.3%on electric vehicles made in China [5], seriously affecting price competitiveness.

- Low brand awareness: Similar to brands like Hongqi, Chinese brands lack “home field advantage” overseas and need to build brand awareness from scratch.

- Localization challenges: European consumers have high loyalty to local brands (Volkswagen, Mercedes-Benz, BMW, etc.) [5].

- Improvement in sales fundamentals: Sales of AITO M7 and M9 prove that product strength has been recognized by the market.

- Huawei’s technical empowerment: Maintains leading advantages in autonomous driving and smart cockpit fields.

- Industry penetration rate increase: China’s new energy vehicle penetration rate has reached 59% [1], and the market space is still broad.

- Valuation has corrected: The 30% drop in stock price may have already digested some pessimistic expectations.

- Competition continues to intensify: Competitors such as Tesla, XPeng, Li Auto, and BYD will not ease up.

- Price wars drag down profits: Price cuts and promotions may further compress gross margins.

- Difficulties in overseas expansion: High tariffs and insufficient brand awareness are major obstacles.

- Pressure to deliver performance: The performance in the fourth quarter and 2025 is crucial.

- Fourth-quarter sales data: Whether the AITO M7 can maintain monthly sales of over 25,000 units.

- Improvement in expense ratio: Whether R&D expense ratio and sales expense ratio show a downward trend.

- Overseas market progress: Whether there are clear overseas market strategies and substantial progress.

- Change in gross profit margin: Whether economies of scale begin to be reflected in gross profit margin improvement.

- Short-term (3-6 months): The stock price may have overreacted to pessimistic expectations, presenting a technical rebound opportunity.

- Medium-term (6-12 months): Depends on whether the fourth quarter and first quarter of 2025 performance can exceed expectations.

- Long-term (1-3 years): Depends on whether overseas expansion can break through and whether Huawei’s smart selection model can continue to output hit products.

- The new energy vehicle price war may intensify further.

- Huawei’s cooperation with other car companies may dilute Seres’ uniqueness.

- Macroeconomic downturn may suppress demand for high-end car consumption.

- Geopolitical risks may affect overseas expansion plans.

- Competitors’ stock price, market capitalization, P/E ratio and other data.

**[1] CleanTechnica - “Record Month for EV Sales in China!”

- China’s NEV penetration rate reached 59% in November, up 7 percentage points year-on-year.

- AITO M7 sales in November were 25,264 units, ranking among the top.

- AITO M7 product features: 5.1 meters in length, adopting a more rounded design.

**[2] Automotive World - “Hongqi rejuvenates image, attempts aggressive EU push”

- Competition in China’s new energy vehicle market intensifies, BYD cuts prices significantly.

- Overseas expansion faces tariff and brand awareness challenges.

- AITO M9 sales exceeded 100,000 units, performing prominently in the luxury SUV market.

**[4] Nikkei Asia - “Huawei’s self-driving tech expands to mass-market vehicles”

- Huawei’s ADS autonomous driving technology will expand to more than 20 models.

- Value embodiment of Huawei’s smart selection car model.

**[5] Automotive World - “EU creates compact EV class to compete with China rivals”

- The EU imposes an import tariff of up to 45.3% on electric vehicles made in China.

- Chinese car companies face severe challenges in the European market.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.