Comprehensive Analysis of Tencent Holdings (0700.HK) Long-Term Investment Value

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest data analysis, I will comprehensively evaluate the long-term investment value of Tencent Holdings at its current valuation level from multiple dimensions.

As of December 30, 2025, Tencent Holdings closed at

| Valuation Indicator | Value | Analysis |

|---|---|---|

| P/E Ratio | 24.37x | Reasonable range relative to history |

| P/B Ratio | 3.82x | Reflects market recognition of asset premium |

| Market Capitalization | 5.44 trillion Hong Kong dollars | Remains the leading tech stock in Hong Kong |

| 52-Week Range | 364.80-683.00 Hong Kong dollars | Currently in the upper-middle part of the range |

According to DCF model analysis[0]:

- Conservative Scenario: 500.45 Hong Kong dollars (-16.5%)

- Base Scenario: 635.79 Hong Kong dollars (+6.1%)

- Optimistic Scenario: 994.64 Hong Kong dollars (+66.1%)

- Probability-Weighted Value: 710.29 Hong Kong dollars (+18.6% upside potential)

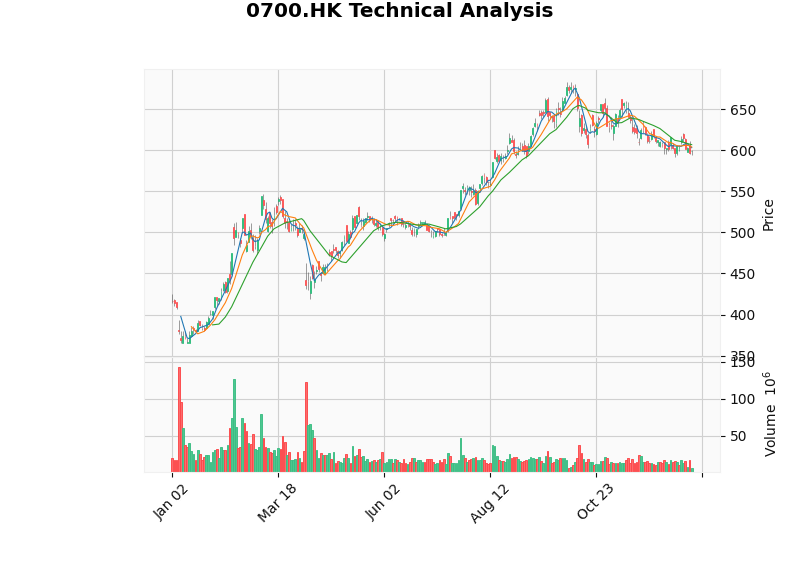

Technical analysis shows[0] that Tencent is currently in a

According to the latest financial report information[1], Tencent’s domestic game revenue reached

Network search information shows[1] that Tencent is actively promoting its game overseas strategy. With the great success of domestic games like Black Myth: Wukong overseas, it proves that Chinese games have global competitiveness. As an industry leader, Tencent’s layout in overseas markets will bring a second growth curve.

The game industry is undergoing an AI technology revolution[1]. Advances in AI technology are helping game companies:

- Reduce R&D costs: AI-assisted development accelerates the game production process

- Improve operational efficiency: Intelligent operations increase user retention and ARPU value

- Innovate gameplay: Integration of AI and games creates new gaming experiences

From a macro perspective[1], the game industry is in an upward cycle of sentiment in 2025:

- Improved policy environment, with regulatory pressure gradually easing

- Concentrated launch of new products, improving supply side

- Accelerated overseas expansion, opening up market space

- Low allocation ratio in the industrial chain, with room for capital inflow

WeChat Channels is Tencent’s core layout in the short video field, relying on the huge ecosystem of WeChat’s 1.3 billion monthly active users, with natural traffic advantages. In 2025, WeChat Channels is accelerating its commercialization process.

The monetization channels of WeChat Channels mainly include:

| Monetization Mode | Progress | Potential Evaluation |

|---|---|---|

Ad Monetization |

Native ads and brand partnerships continue to grow | ★★★★☆ |

E-commerce Live Streaming |

WeChat Channels Store and Mini Program e-commerce are connected | ★★★★★ |

Live Streaming Rewards |

Virtual gifts and creator sharing | ★★★☆☆ |

Paid Content |

Knowledge payment and member content | ★★★☆☆ |

Compared with Douyin and Kuaishou, WeChat Channels’ advantages lie in:

- Social relationship chain: Trust-based recommendations from WeChat friends

- Private domain traffic: Closed loop from public domain traffic to private domain沉淀

- Commercial closed loop: Seamless connection of Mini Programs, payment, and WeChat Work

According to Deloitte’s 2025 Digital Media Trends Report[2], video entertainment is being profoundly reshaped by social platforms and user-generated content, which provides macro support for the long-term development of WeChat Channels.

Although specific financial data is limited, from Tencent’s overall revenue structure, online advertising business is growing rapidly. With the deepening of WeChat Channels’ commercialization, it is expected to become an important revenue growth point in the next 2-3 years, with a conservative estimate of bringing

Tencent announced the comprehensive restructuring of the Hunyuan Large Model system, establishing the “Large Language Model Department” and “Multimodal Model Department”, implementing the “Dual-Engine AI Strategy” to actively respond to challenges from open-source models like DeepSeek[3]. This strategic layout reflects Tencent’s determination in the AI field.

Tencent’s AI capabilities are deeply empowering various business lines:

| Business Segment | AI Application Scenario | Value Creation |

|---|---|---|

Game |

AI-assisted development, intelligent operation | Reduce costs, improve experience |

Social |

Intelligent recommendation, content review | Increase user stickiness, reduce compliance risks |

Financial Technology |

Risk control, anti-fraud | Reduce risk losses |

Cloud Service |

AI computing power, enterprise-level AI services | New growth point |

Tencent President Liu Chiping said at the analyst meeting that AI chip supply is one of the factors limiting the growth of cloud business[3]. This indicates that Tencent is investing heavily in AI infrastructure construction, but also faces supply chain bottlenecks. However, with the expansion of global AI chip production capacity, this problem is expected to gradually ease.

The long-term value of AI to Tencent is reflected in:

- Cost reduction and efficiency improvement: AI improves operational efficiency and profit margins

- Product innovation: AI spawns new product forms and business models

- Ecological moat: AI technology deepens the synergy between various business lines

According to financial analysis[0], Tencent shows excellent financial quality:

| Financial Indicator | Value | Evaluation |

|---|---|---|

| ROE | 20.29% | Excellent shareholder return capability |

| Net Profit Margin | 29.93% | Industry-leading level |

| Operating Profit Margin | 31.84% | Strong profitability |

| Current Ratio | 1.36 | Healthy liquidity |

| Financial Attitude | Conservative | Prudent accounting policy |

Free cash flow in 2024 reached

- Sustained R&D investment

- Creating conditions for shareholder returns (repurchase + dividend)

- Providing ammunition for strategic investment and mergers and acquisitions

Main risks include:

- Regulatory risk: Policy uncertainty such as antitrust and data privacy

- Competition risk: Facing strong opponents like NetEase and Mihoyo in the game field

- Macro risk: Slowdown in China’s economic growth affects advertising and payment businesses

- Geopolitical risk: Sino-US relations affect overseas business expansion

Based on multi-dimensional analysis:

| Evaluation Dimension | Score | Weight | Weighted Score |

|---|---|---|---|

| Valuation Level | ★★★★☆ | 25% | 1.00 |

| Longevity Capability of Game Business | ★★★★★ | 30% | 1.50 |

| Monetization Potential of WeChat Channels | ★★★★☆ | 20% | 0.80 |

| Long-Term Value of AI Layout | ★★★★☆ | 15% | 0.60 |

| Financial Health | ★★★★★ | 10% | 0.50 |

Comprehensive Score |

- | 100% | 4.40/5.00 |

- Long-Term Holders: Around 600 Hong Kong dollars has strong safety margin, consider batch position building

- Value Investors: Current valuation is in a reasonable range, DCF base scenario provides 6% upside potential[0]

- Growth Investors: Pay attention to WeChat Channels’ monetization and AI commercialization progress, optimistic scenario provides 66% upside potential[0]

- Risk Management: It is recommended to adopt the “Barbell Strategy Allocation”[4], and configure defensive assets to hedge risks at the same time

Future focus should be on:

- Growth trends of domestic and overseas revenue in the game business

- MAU, duration, and monetization efficiency of WeChat Channels

- Actual application effects of AI technology in business

- Changes in regulatory policies

- Impact of macroeconomic environment on advertising and payment businesses

Tencent Holdings

For investors who are truly willing to hold long-term, the current valuation level provides a good risk-reward ratio. However, investors need to be prepared: Tencent has entered a steady growth period from the high-growth period, and will more reflect the characteristics of “value growth stock” rather than “growth stock” in the future.

[0] Jinling API Data - Tencent Holdings (0700.HK) Market Data, Financial Analysis, DCF Valuation, Technical Analysis

[1] Yahoo Hong Kong Finance - “Game Industry Sentiment Gradually Improves, Can It Boost Related Companies?” (https://hk.finance.yahoo.com/news/遊戲產業景氣逐步提升-可吼心動公司-022230191.html)

[2] Yahoo Hong Kong Finance - “Tencent’s Quarterly Results Beat Expectations, Domestic Game Revenue Grows Strongly” (https://hk.finance.yahoo.com/news/科技業-騰訊季績勝預期-內地遊戲收入增長勪調ai產生實質貢獻-093000981.html)

[3] Yahoo Hong Kong Finance - “Tencent Invests Heavily in AI! Comprehensive Restructuring of Hunyuan Large Model” (https://hk.finance.yahoo.com/news/騰訊大舉投入ai-混元大模型全面重構-雙引擎戰略迎戰開源挑戰-040002131.html)

[4] Yahoo Hong Kong Finance - “Hong Kong Stocks Boom This Year” (https://hk.finance.yahoo.com/news/港股大年-10倍股札堆-380隻翻倍股-最高漢幅近33倍-122004354.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.