Long-Term Growth Logic of Copper Mining Enterprises and Competitive Advantage Analysis of China's Copper Giants

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Copper mining enterprises are generally considered to have the best growth potential in the market, mainly based on the following core logic:

- Electric Vehicles: Each pure electric vehicle uses 80-83 kg of copper, 4 times that of traditional fuel vehicles

- Wind Power: Onshore wind turbines require 4 tons of copper per unit; offshore wind turbines need 12-16 tons due to extended cables

- Grid Construction: China’s ‘14th Five-Year Plan’ grid investment exceeds 3 trillion yuan, with 8 tons of copper consumed per kilometer of UHV lines

- AI Data Centers: Rapid expansion further increases copper consumption per unit investment [3]

Large copper reserves are conducive to long-term growth and M&A expansion of mining enterprises. From the perspective of resource endowment, copper mining enterprises can achieve cycle-spanning growth through continuous M&A and capacity expansion, an advantage that small metals like lithium and cobalt cannot match [1].

As the ‘King of Non-Ferrous Metals’, copper has both commodity and financial attributes. The Fed’s interest rate cut cycle has begun, and abundant liquidity will further support copper price performance [4].

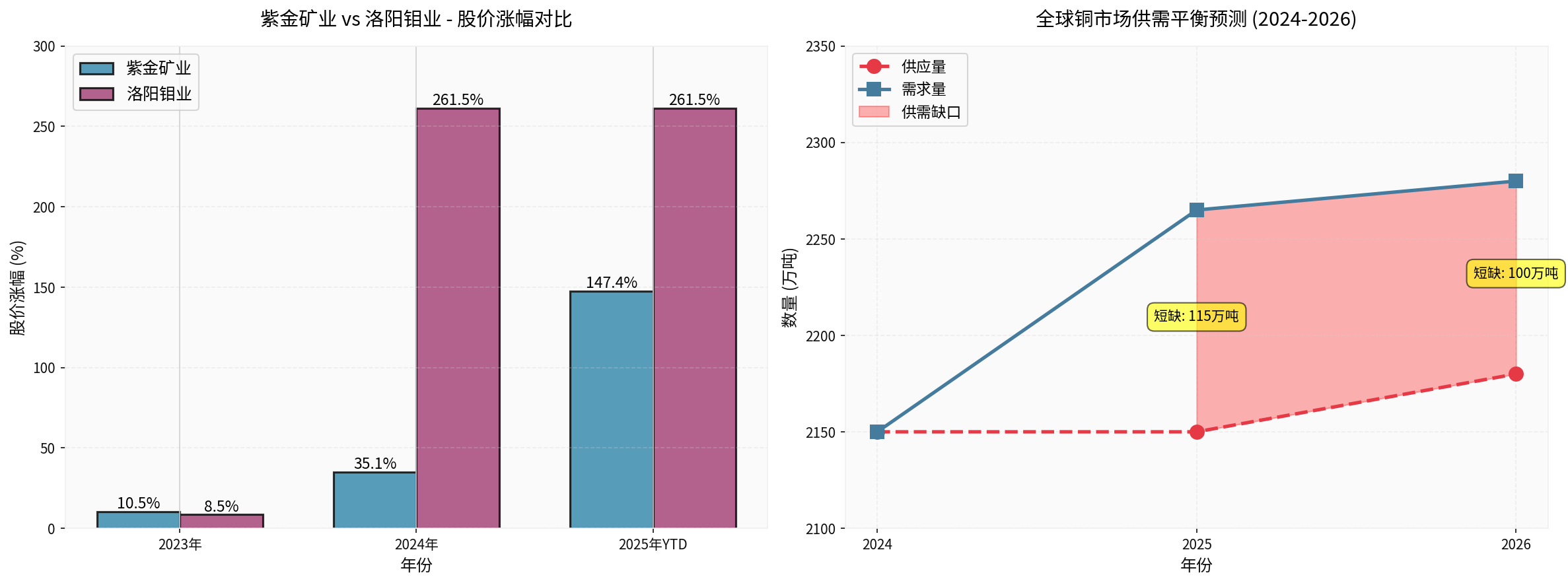

According to the latest market forecast, the global copper market deficit will reach 300,000 tons in 2025 and soar to 866,000 tons in 2026 [5]. Even in a moderate scenario where global GDP grows by only 2%, the copper market will still face a significant supply gap in the next year. The latest IEA report also emphasizes that even under high production conditions, the global copper supply gap will still reach 20% by 2035 [3].

From the price performance perspective, copper prices rose by more than 35% in 2025, and LME copper prices once突破12,000 USD/ton (historical high) [6]. Goldman Sachs predicts that by 2030, grid and power infrastructure will drive more than 60% of copper demand growth, equivalent to adding another US demand volume to global copper demand [3].

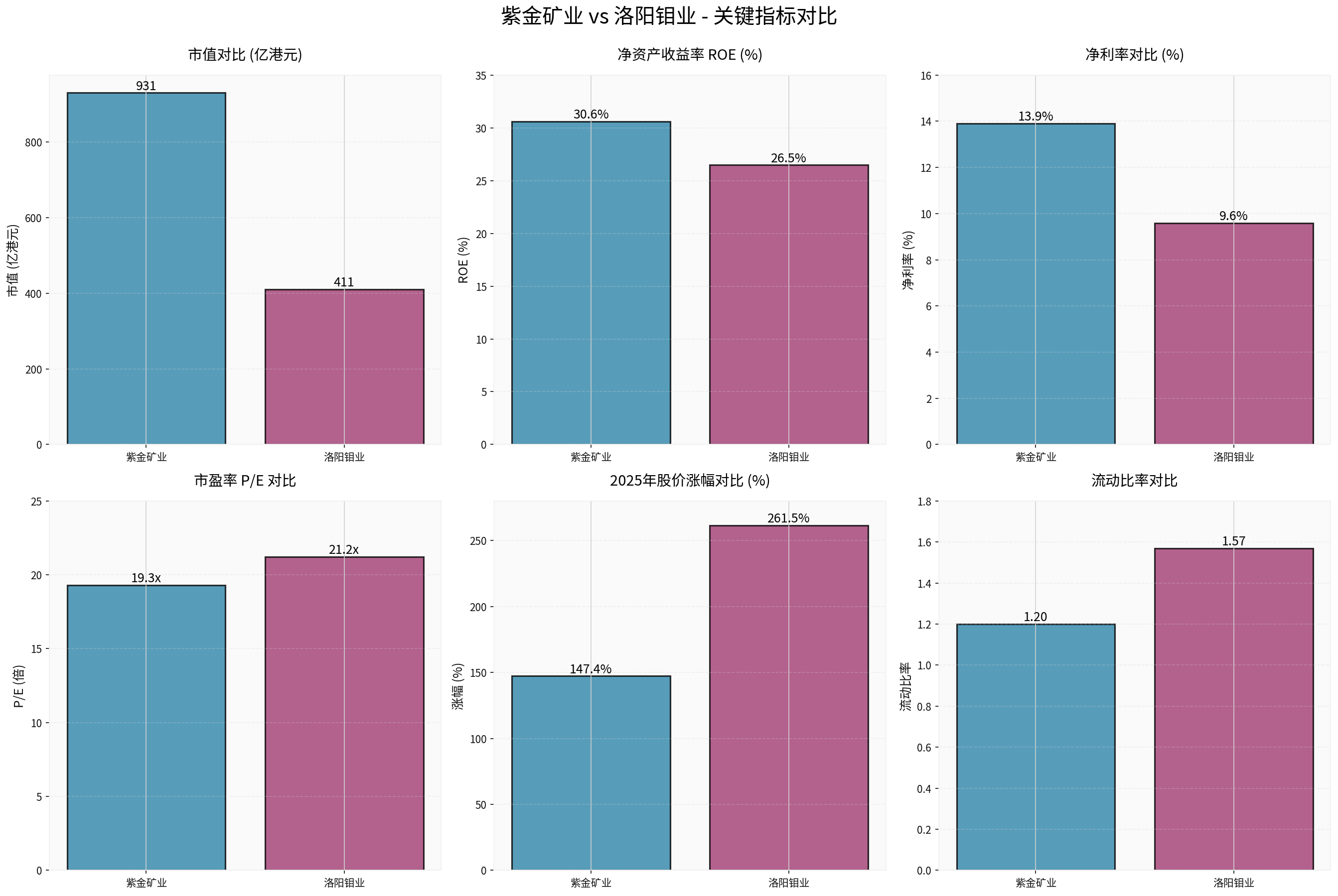

- Market Capitalization: 93.078 billion HKD

- ROE: 30.60%, Net Profit Margin:13.91%

- P/E:19.30x, Valuation in Reasonable Range

- Current Ratio:1.20, Sound Financial Condition [0]

- 2025 Hong Kong Stock Rose 147.39%, A-Share Rose118.51%

- Cumulative Gain Over Past 5 Years Exceeded317% [0]

- Perfect Global Layout, Continuous Expansion of Copper Mine Capacity

- Significant Cost Advantage, Excellent Resource Endowment

- Outstanding Counter-Cyclical M&A Capability, Able to Acquire High-Quality Assets During Industry Downturns

- Market Capitalization:41.062 billion HKD

- ROE:26.48%, Strong Profitability

- Current Ratio:1.57, Strong Short-Term Solvency

- Neutral Financial Attitude, Low Debt Risk [0]

- 2025 Hong Kong Stock Rose261.48%, Even Outperforming Zijin Mining

- Cumulative Gain Over Past3 Years Reached432% [0]

- Multi-Product, Multi-Country and Multi-Stage Resource Layout

- Top 10 Global Copper Producers, No.1 Cobalt Producer

- 2025 Copper Output About650,000 Tons, Medium-Term Target:800,000 Tons in2028,1 Million Tons in2030 [7]

-

Strong Resource Control: From2016 to2024, Chinese Miners’ Overseas Equity Output Grew About370%, Global Share Increased from10% to19% [2].

-

Cost Competitive Advantage: Chinese Enterprises Have Significant Cost Advantages in African and South American Copper Projects Through Technological Innovation and Large-Scale Operation.

-

Industrial Synergy Effect: China is the World’s Largest Copper Consumer, with Natural Advantage in Upstream-Downstream Integration of the Industrial Chain.

-

Strong Capital Strength: Large Market Capitalization of Chinese Copper Enterprises Can Support Large-Scale M&A Expansion and Capital Expenditure.

-

Policy Support: China Actively Supports Overseas Resource Development Through Diversified Supply and Resource Strategy; 2025 Copper Concentrate Imports from Congo (DRC) Exceeded800,000 Tons, YoY Growth35% [2].

##5. Risk Factors and Future Outlook

-

Macroeconomic Volatility: Global Economic Slowdown May Lead to Lower-Than-Expected Industrial Demand.

-

Unexpected Resumption of Major Mines: If Global Major Copper Mine Supply Recovers Beyond Expectations, It May Ease Supply Tension.

-

Exchange Rate Volatility: Affects Profitability of Export-Oriented Copper Enterprises.

-

Geopolitical Risks: Some Overseas Projects Face Political Instability and Policy Change Risks.

##6. Conclusion

[0] Jinling API Data - Stock Prices, Financial Indicators, Company Profiles

[1] Snowball - “Why Are Copper Mining Enterprises the Most Growth-Oriented?” (https://xueqiu.com/9829780332/367993730)

[2] Sina Finance - “Analysis of Bullish International Copper Prices: Supply Chain Restructuring, Technological Revolution and New Price Cycle” (https://finance.sina.com.cn/roll/2025-11-30/doc-infzffqx4269374.shtml)

[3] Phoenix New Media - “2025 Copper Market Year-End Review: Supply Imbalance and Structural Demand Reshape Pricing Logic” (https://i.ifeng.com/c/8pA8YiAhX3g)

[4] The Paper - “Collective Surge: Where Is the Cycle of Non-Ferrous Metals?” (https://m.thepaper.cn/newsDetail_forward_32257194)

[5] Jefferies Research Report - “Suggest Allocating a Basket of Copper Mining Enterprise Stocks; CMOC and Zijin Mining Are Core Targets in the Chinese Market” (https://www.hstong.com/news/detail/25122609592738753)

[6] Reuters - “Copper Miners Follow Red Metal Price Rises” (https://m.fastbull.com/cn/news/detail/news_7300_1_2025_4_28204_3/NYSE-FCX)

[7] Snowball - Minmetals Resources Stock Discussion (https://xueqiu.com/S/01208)

[8] Snowball User Comment - Discussion on JCHX Mining’s Lonshi Copper Mine

[9] Sina Finance - “Sina Finance Hot Hourly Report | 19:00, December 26, 2025” (https://cj.sina.cn/articles/view/7857201856/1d45362c001901gkgm)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.