Drivers of the Film and Television Sector Rebound and Fundamental Analysis of Huayi Brothers

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Positive changes have occurred in China’s radio, film and television regulatory policies. The State Administration of Radio, Film and Television announced the relaxation of drama rules, including:

- Relax restrictions on the number of episodes of TV dramas and quarterly intervals

- Strengthen the production of documentaries and animated films

- Welcome high-quality imported content and short videos to TV broadcasting

- Production companies including China Literature and Maoyan Entertainment are expected to benefit directly [1]

These policy relaxations provide greater creative space and content supply flexibility for the film and television industry, significantly improving market expectations for the industry’s prospects.

Although China’s box office fell 22.6% to 42.5 billion yuan in 2024 [2], signs of recovery began to appear in 2025:

- Avatar 3’s box office in China exceeded 300 million yuan in three days, breaking the record for sci-fi films during the Lunar New Year holiday period [2]

- Offline entertainment consumption shows a comprehensive recovery trend

- Movie-watching demand still shows some resilience amid economic slowdown

Important schedules such as summer档 and Lunar New Year档 continue to inject vitality into the industry:

- Multiple blockbusters were released during the 2024-2025 Lunar New Year holiday period

- Summer档 films include “Chang’an’s Lychees” and “The Legend of Luo Xiaohei II” [3]

- The schedule effect drives up short-term movie-watching enthusiasm

The film and television sector has a demand for technical rebound after a long-term decline:

- Huayi Brothers has fallen more than 70% from its peak

- Market sentiment is in a recovery stage after extreme pessimism

- Short-term capital inflows drive sector rotation

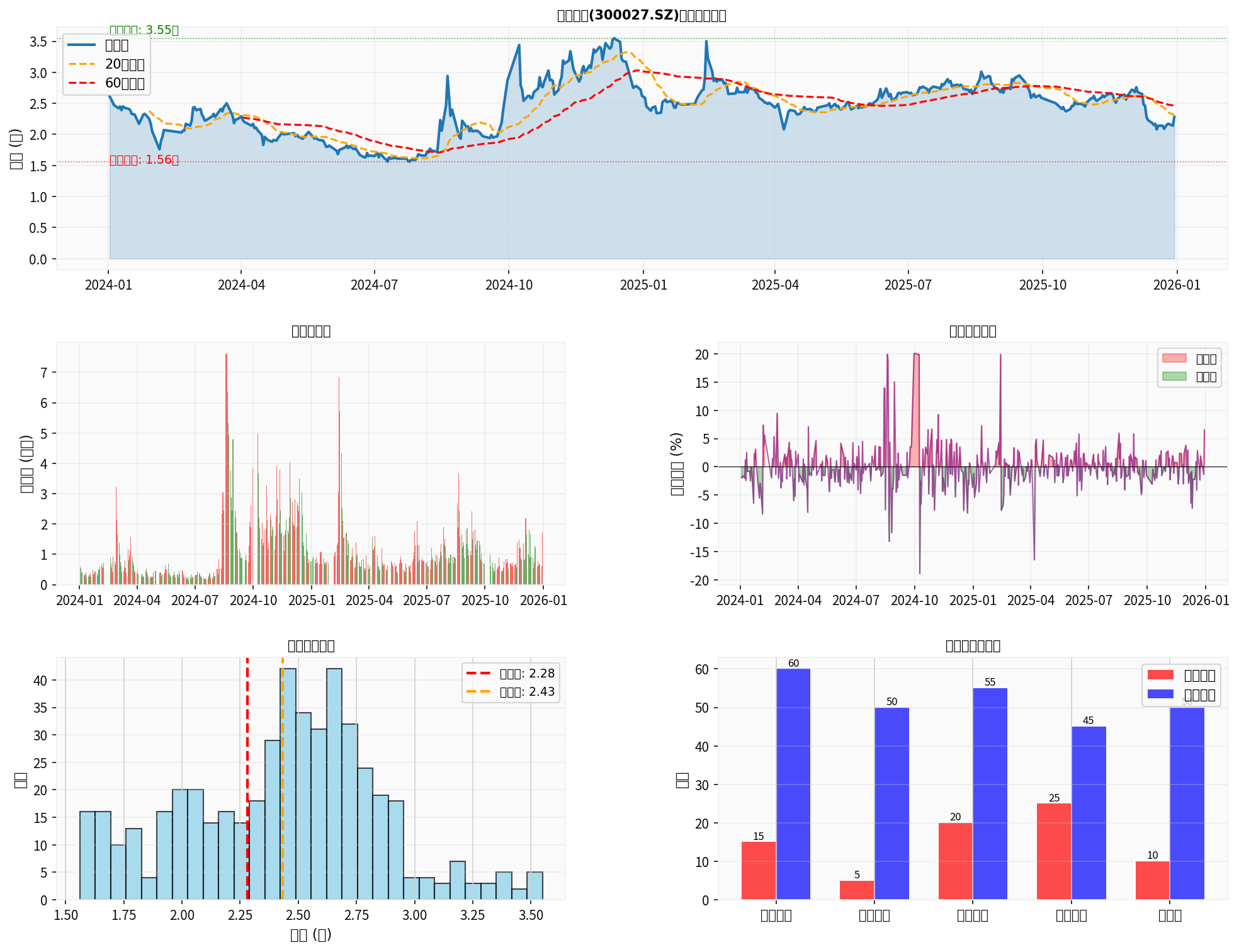

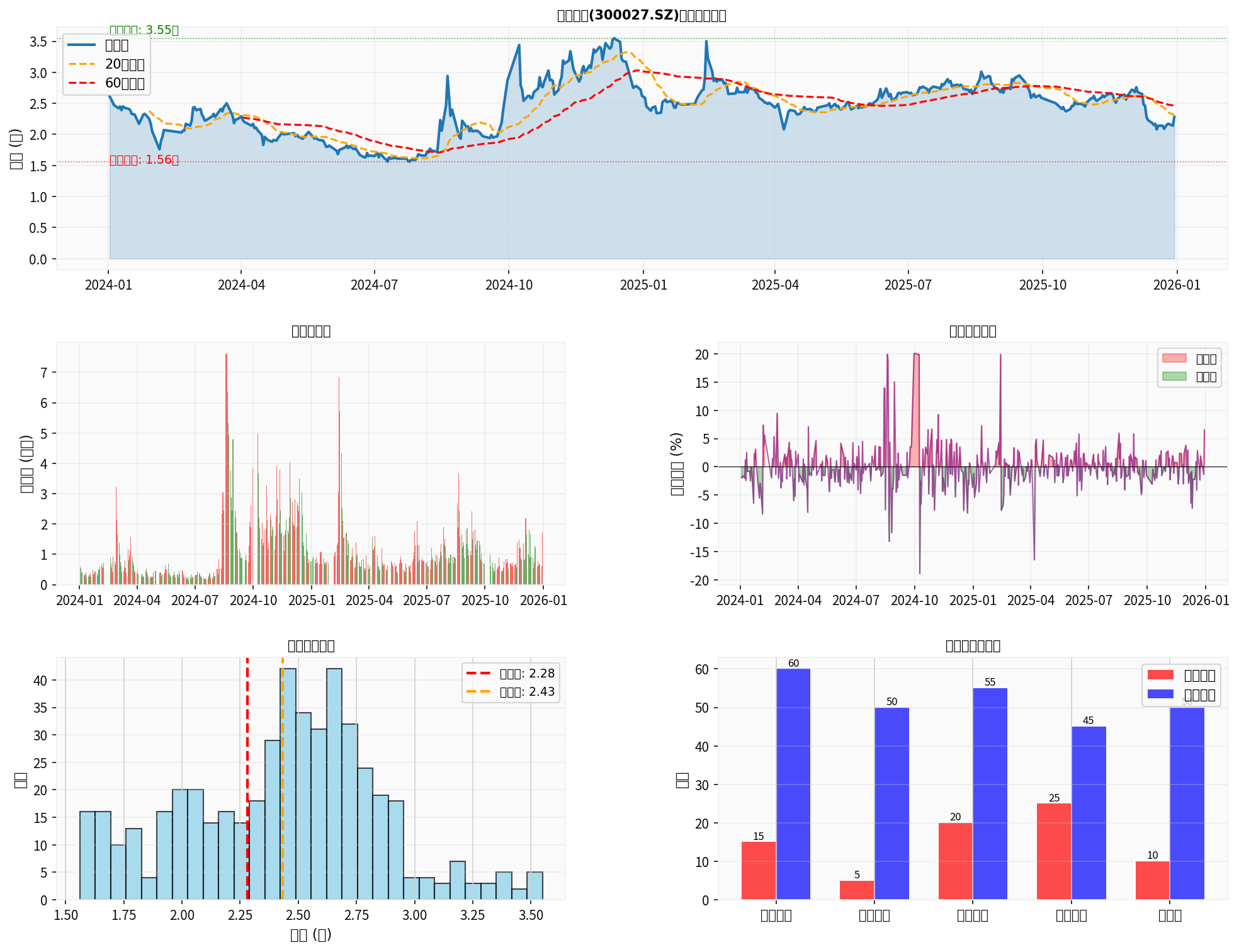

- Earnings Per Share (EPS, TTM): -0.12 yuan

- Net Profit Margin: -126.68%

- Operating Profit Margin: -121.58%

- Return on Equity (ROE): -108.67%

- Current Ratio: 0.31 (far below the safe value of 1.0)

- Quick Ratio: 0.19

- Serious Insufficiency in Short-term Solvency

- Price-to-Earnings Ratio (P/E): -18.83 (in loss state)

- Price-to-Book Ratio (P/B): 23.83 (obviously overvalued)

- Market Capitalization: 6.27 billion yuan

- High Risk: Financial analysis shows the company is in a high-risk level

- Free Cash Flow is negative: approximately -51.6 million yuan

- Conservative accounting policies, but investment returns have not been realized yet

- Current Price: 2.26 yuan (+5.61% today)

- 52-week Range: 2.00-3.50 yuan

- Year-to-Date Decline: -12.64%

- 5-day Increase: +9.09% (technical rebound)

- Trend State: Sideways Consolidation, no clear direction

- MACD: Golden Cross, bullish signal

- KDJ: K:61.6, D:48.2, J:88.5, bullish

- Support Level: 2.23 yuan

- Resistance Level: 2.33 yuan

- Average Daily Volume: 111 million shares

- Recent Average Daily Volume: 86 million shares

- Volume has increased, indicating improved capital activity

From five dimensions comparing Huayi Brothers with the industry average:

| Evaluation Dimension | Huayi Brothers Score | Industry Average | Evaluation |

|---|---|---|---|

| Solvency | 15 | 60 | Serious Insufficiency |

| Profitability | 5 | 50 | Extremely Weak |

| Operational Efficiency | 20 | 55 | Low |

| Growth Capacity | 25 | 45 | Needs Improvement |

| Cash Flow | 10 | 50 | Tight |

-

Policy Benefits: Although industry policies have marginally improved, the direct impact on Huayi Brothers is limited; the company needs to solve its own financial problems more [1]

-

Industry Recovery: The overall recovery of the film market is beneficial to the industry, but Huayi Brothers lacks high-quality content reserves and distribution capabilities [2]

-

Technical Rebound: The current rise is more driven by capital rotation and market sentiment, lacking fundamental support

-

Continuous Losses: The company has been losing money for multiple consecutive quarters, and profitability has not improved [0]

-

Liquidity Crisis: Current ratio is only 0.31, with extremely high short-term debt repayment risk [0]

-

Lack of Core Competitiveness: Lacks obvious advantages in core businesses such as content creation, artist management, and film distribution

-

Valuation Bubble: Price-to-book ratio of 23.83 times is far higher than the industry level, with valuation regression pressure

- Participate in the rebound cautiously, set strict stop-loss (suggested around 2.10 yuan)

- Pay attention to volume changes; only consider following up if it breaks through the 2.33 yuan resistance level with heavy volume

- Enter and exit quickly; not suitable for long-term holding

- Not Recommended to Allocate, no signs of fundamental improvement

- Wait for confirmation of performance inflection point (consecutive quarterly profits) before considering entry

- Pay attention to the possibility of company restructuring or strategic transformation

- Financial Risk: Insufficient liquidity may lead to debt default

- Operational Risk: Lack of high-quality project reserves, market share continues to shrink

- Valuation Risk: Current valuation lacks performance support, with great correction pressure

- Industry Risk: The recovery of the film market may be less than expected

- Improved industry policy environment, providing potential policy dividends

- Short-term technical improvement, MACD golden cross shows bullish signal [0]

- Market capitalization has shrunk significantly, with relatively limited downside space

The company’s financial difficulties, continuous losses, and liquidity crisis make it difficult to truly benefit from industry recovery. The current stock price rise is more driven by technical rebound and market sentiment,

[0] Gilin API Data - Huayi Brothers (300027.SZ) Real-time Quotes, Financial Data, Technical Analysis

[1] The Wall Street Journal - “China Eases Drama Rules to Strengthen Content Supply” (Aug.19,2025)

https://www.wsj.com/business/media/china-eases-drama-rules-to-strengthen-content-supply-5c3532a6

[2] Yahoo Finance (Hong Kong) - “Offline Entertainment Fully Recovers, Damai Profit Soars”

https://hk.finance.yahoo.com/news/線下娛樂全面復蘇-大麥盈利狂飆-003000249.html

[3] Yahoo Finance (Hong Kong) - “Ne Zha 2 Failed to Turn the Tide, Maoyan Profit Fell by Up to 40%”

https://hk.finance.yahoo.com/news/哪吒2-未能力輓狂瀾-貓眼盈利最多跌4成-001431082.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.