2026 Investment Strategy In-Depth Analysis: 'Reach for the Stars' vs 'Mine the Ground'

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on a comprehensive analysis of the current market environment, historical data, and 2026 outlook, I will provide you with systematic investment strategy recommendations.

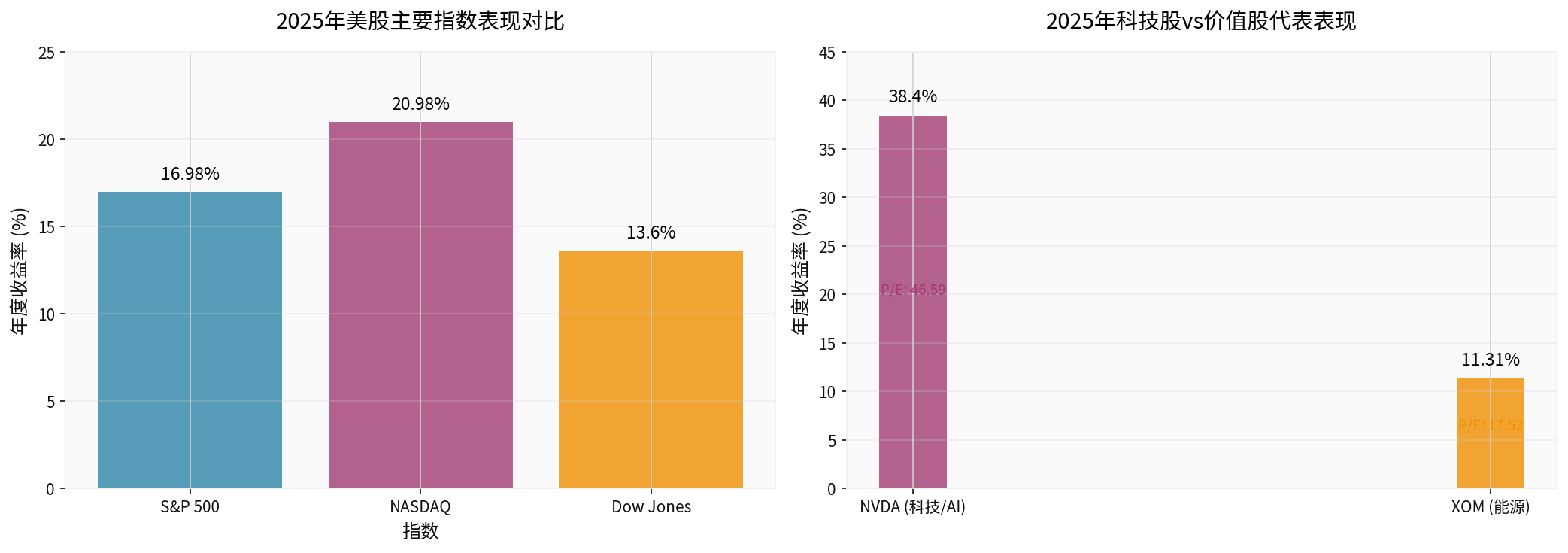

Chart Description: The left side shows the 2025 annual return comparison of the three major US stock indices, and the right side shows the annual performance and P/E ratio comparison of representative tech stocks (NVDA) and value stocks (XOM).

The 2025 market showed a

- Nasdaq Index (Tech/Growth): Up 20.98%, leading the three major indices

- S&P 500 Index (Mixed): Up 16.98%

- Dow Jones Index (Value/Traditional): Up 13.60%

| Indicator | NVDA (Nvidia/AI Chips) | XOM (ExxonMobil/Energy) |

|---|---|---|

| Annual Return | +38.40% |

+11.31% |

| P/E Ratio | 46.59x | 17.52x |

| Market Cap | $4.58 trillion | $508.3 billion |

| Volatility | 3.13% (High) | 1.49% (Low) |

According to the latest data, the Federal Reserve cut the key interest rate to the

- Only one interest rate cut expected(25 basis points)

- Core PCE inflation expectation: Drop to 2.5% by the end of 2026

- GDP growth expectation: Raised to 2.3% (up from 1.8% in September)

According to RBC Capital Markets analysis [1][2], the 2026 ‘tug-of-war’ between growth and value stocks will be influenced by the following factors:

- AI Profit Realization: The market will shift from ‘AI concept’ to ‘AI profit’, requiring actual performance growth

- Macro Volatility: In a stable economic context, the market may rotate to undervalued value stocks

- Political and Policy Risks: Including geopolitical risks, regulatory policies, etc.

The Semiconductor Industry Association (WSTS) predicts that

- AI Accelerators: Sustained strong demand for data center GPUs and ASIC chips

- High Bandwidth Memory (HBM): A necessity for AI training with tight supply

- Advanced Logic Chips: Supporting more complex AI models

Taking Nvidia as an example [0]:

- Analyst Consensus Target Price: $257.50 (36.8% upside potential from current price)

- Profit Margin: Net profit margin 53.01%, operating profit margin 58.84%

- Financial Health: Current ratio 4.47, strong cash flow

- Rating Distribution: 73.4% of analysts give a ‘Buy’ rating

According to Capital Group’s view [1], the market is shifting from a binary environment dominated by US tech stock returns to a more balanced opportunity environment, but

- Valuation Pressure: P/E ratio exceeds 46x; any earnings miss may trigger a correction

- Increased Competition: More companies entering the AI field may compress profit margins

- Regulatory Risks: Large tech companies face antitrust scrutiny

ExxonMobil (XOM) data [0]:

- P/E Ratio: Only 17.43x (far lower than tech stocks)

- P/B Ratio: 2.00x

- Dividend Yield: Generally high in the energy sector

- ROE: 11.42% (stable but not high)

According to Piper Sandler analysis [4], the energy industry has the following opportunities in 2026:

- Liquefied Natural Gas (LNG): A key transition fuel for global energy transformation

- Natural Gas Infrastructure: Growing demand, especially in Asian markets

- Efficiency Improvement Technologies: Cost advantages through technological innovation

Value stocks usually provide:

- Stable dividend income

- Stock Repurchases: Such as ExxonMobil’s continuous stock repurchases

- Lower Volatility: Suitable for risk-averse investors

- Commodity Price Volatility: Oil, copper prices, etc., are affected by global supply and demand

- Long-Term Transition Risks: Global shift to renewable energy may impact traditional energy demand

- Limited Growth Space: Mature industry with high growth difficulty

| Dimension | Reach for the Stars (Growth Stocks) | Mine the Ground (Value Stocks) |

|---|---|---|

2025 Performance |

Nasdaq +20.98% | Dow Jones +13.60% |

Valuation Level |

P/E 35-50x (High) | P/E 15-20x (Low) |

Growth Potential |

AI revolution, semiconductor expansion | Structural energy demand |

Volatility |

High (3.13%) | Low (1.49%) |

Interest Rate Sensitivity |

High (large discount rate impact) | Low (stable cash flow) |

2026 Catalysts |

AI profit realization, new products | Commodity rebound, dividends |

Risks |

Valuation bubble, increased competition | Price volatility, transition pressure |

Based on the following factors, we believe

- AI Profit Cycle Has Just Begun: According to Zacks data, semiconductor industry revenue is expected to grow by 26.3% in 2026, with companies like Amphenol seeing 12.4% revenue growth [3]

- Stable Interest Rate Environment: Fed’s slow rate cut pace means discount rate pressure on high-valued stocks is already priced in

- Continuous Innovation: New themes like AI agents and AGI (Artificial General Intelligence) keep emerging

- Valuation Protection: Value stocks provide defensive value when tech stocks correct

- Dividend Income: High-dividend stocks are attractive in a low-interest rate environment

- Sector Rotation: RBC Capital expects multiple growth/value rotations in 2026 [2]

Growth Stock Allocation:

- AI/Semiconductors: 40% (NVDA, AMD, TSMC)

- Cloud Computing/SaaS: 20% (MSFT, CRM)

- Biotech/Innovative Drugs:10%

Value Stock Allocation:

- Energy:20% (XOM, CVX)

- Finance:10% (JPM, BAC)

Growth Stock Allocation:

- AI/Semiconductors:25%

- Large Tech Stocks:25% (AAPL, GOOGL, META)

Value Stock Allocation:

- Energy:20%

- Finance:15%

- Industrial/Materials:15%

Growth Stock Allocation:

- Large Tech Stocks:20% (Cash flow-stable AAPL, MSFT)

- Semiconductor Equipment:10%

Value Stock Allocation:

- Energy:30%

- Utilities:20%

- Finance:20%

- Unexpected Fed Policy: If inflation rebounds, monetary policy may be tightened again

- Global Economic Recession: Although current forecasts are not significant, exogenous shocks (geopolitical, etc.) may trigger it

- Stronger US Dollar: May suppress emerging market and multinational company profits

- Tech Stock Valuation Bubble: Nasdaq P/E ratio is in the historical high range

- Earnings Expectation Downgrade: AI investment returns below expectations may trigger valuation compression

- Accelerated Sector Rotation: Any negative news may trigger rapid rotation in an ‘expensive market’ [6]

Based on comprehensive analysis, our judgment for 2026 is:

- If you believe in the AI revolution: Overweight growth stocks, especially semiconductors and AI infrastructure

- If you are worried about valuation risks: Increase value stock allocation to get stable dividends and lower volatility

- Optimal Strategy:60/40 or 50/50 dynamic balance, with flexible adjustments between the two based on market signals

- Whether AI companies can realize high profit expectations

- Fed’s inflation and interest rate policies

- Commodity prices (copper, crude oil, natural gas)

- Valuation multiple expansion/compression of tech giants

Capital Group’s summary is insightful[1]: “No longer choosing between US/non-US, growth/value—what matters is embracing both, but balancing them.” This is the core of the 2026 investment strategy.

[0] Gilin AI Data - Market Indices, Stock Prices, Company Financial Data (2025 Full Year and Latest Data)

[1] Capital Group - “Stock market outlook: Three investment strategies for 2026” (https://www.capitalgroup.com/intermediaries/lu/en/insights/articles/2026-stock-market-outlook.html)

[2] RBC Capital Markets via Yahoo Finance - “More tug-of-war between growth and value stocks expected next year” (https://finance.yahoo.com/news/more-tug-of-war-between-growth-and-value-stocks-expected-next-year-110012045.html)

[3] Zacks Investment Research - “3 Semiconductor Stocks Well-Poised for a Comeback in 2026” (https://www.zacks.com/stock/news/2809597/3-semiconductor-stocks-well-poised-for-a-comeback-in-2026)

[4] Piper Sandler via Yahoo Finance - “Piper Sandler Says These 3 Energy Stocks Are Top Picks for 2026” (https://finance.yahoo.com/news/piper-sandler-says-3-energy-095848844.html)

[5] J.P. Morgan - “Our 2026 investment outlook: key highlights” (https://www.personalinvesting.jpmorgan.com/insights/our-2026-investment-outlook-key-highlights)

[6] MarketWatch - “Here’s what might turn the tide for value stocks and the broader market over growth stocks in 2026” (https://www.morningstar.com/news/marketwatch/2025120173/heres-what-might-turn-the-tide-for-value-stocks-and-the-broader-market-over-growth-stocks-in-2026)

[7] Federal Reserve Related Report - “Federal Reserve Cuts Main Rate to 3.5%-3.75% Range, Signals Cautious 2026 Outlook” (https://www.jmco.com/articles/manufacturing/federal-reserve-cuts-main-rate-to-3-5-3-75-range-signals-cautious-2026-outlook/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.