Lionsgate Studios (LION) Insider Share Sale Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to SEC Form 4 filings, two senior executives of Lionsgate Studios (LION) sold shares in late December 2025 [1]:

- Transaction Date: December 23, 2025

- Number of Shares Sold: 21,748 common shares

- Selling Price: Weighted average of $9.01 per share

- Transaction Value: Approximately $196,000

- Shares Held After Transaction: 3,061,213 shares

- Official Reason: Year-end tax planning

- Transaction Date: December 22, 2025

- Number of Shares Sold: 195,000 common shares

- Selling Price: Weighted average of $8.28 per share

- Transaction Value: Approximately $1.615 million

- Official Reason: Year-end tax planning

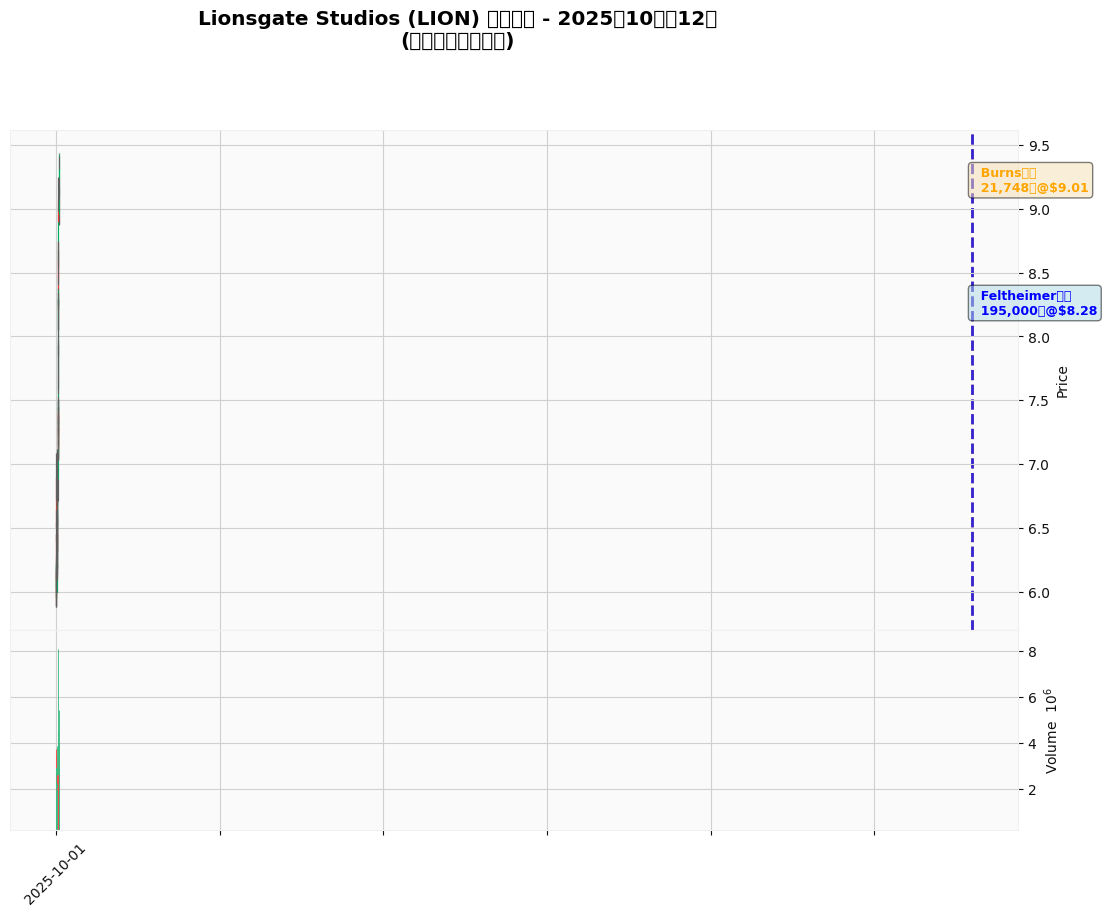

- X-axis: Trading days from October to December 2025

- Y-axis: Stock price (USD)

- Blue Dashed Line: December 22, 2025 (CEO Feltheimer’s sale date)

- Orange Dashed Line: December 23, 2025 (Vice Chairman Burns’s sale date)

According to brokerage API data [0]:

| Time Period | Change |

|---|---|

| 1 month | +26.41% |

| 3 months | +35.49% |

| 6 months | +60.65% |

| Year-to-date | +20.13% |

- Current Price: $9.43 (closing price on December 29, 2025)

- 20-Day Moving Average: $8.12 (stock price is ~16.20% above MA20)

- 50-Day Moving Average: $7.24 (stock price is ~30.28% above MA50)

- 52-Week Range: $5.54 - $9.44

- Current price is close to the 52-week high

According to SEC filings, both executives cited

- Tax Planning: Executives often sell shares at the end of the year to realize capital gains or losses for tax optimization

- Not a Confidence Signal: Such sales are usually not seen as a signal of lack of confidence in the company’s prospects

- Small Proportion: Burns still holds over 3 million shares, indicating his continued large position

This insider trading occurred against the following backdrop [1][2]:

- Strong Uptrend in Stock Price: Over 35% increase in the past 3 months and over 60% in 6 months

- Active Industry Mergers and Acquisitions: Media industry M&A activity is accelerating; Starz (former Lionsgate subsidiary) is in merger discussions with A+E and others

- Positive Company Developments: Lionsgate recently partnered with FreeWheel to strengthen FAST channel advertising business

- Analysts Are Optimistic: All covering analysts have given a “Buy” rating, with a consensus target price of $9.00

- ✓ Senior executives still hold large stakes: Burns still holds over 3 million shares after the transaction

- ✓ Small proportion of shares sold: Only 0.066% of the total market capitalization

- ✓ Clear tax planning reason: Not due to pessimism about the company

- ✓ Sale occurred at a high stock price: Rational profit-taking behavior

- ⚠ Two executives sold consecutively: CEO and Vice Chairman sold within two days

- ⚠ Stock price is near 52-week high: May reflect some executives believe current valuation is reasonable

- ⚠ Company is not yet profitable: TTM EPS is -$0.12, P/E ratio is negative

According to the analysis, this insider trading should be interpreted as a

- Clear tax planning motivation

- Executives still maintain large positions

- Small proportion of shares sold

- Sale occurred during a strong uptrend in stock price

- Two top executives sold simultaneously

- Stock price is near annual high

- Company has not yet achieved sustained profitability

Based on current information, investors should adopt the following strategies:

- No need for panic selling: Insider sale scale is small and motivation is clear

- Focus on company fundamentals: Key focus on Q1 2026 earnings report (expected to be released on February 5)

- Set stop-loss levels: Consider setting stop-loss at $8.50-$9.00 to protect gains

- Diversify risks: If position is too heavy,适当 take profits on part of the holdings

- Wait for a better entry point: Current stock price is near the 52-week high; wait for a pullback to the $8.00-$8.50 range

- Monitor M&A progress: Starz’s merger discussions with A+E and others may impact Lionsgate’s valuation

- Evaluate industry trends: Development of FAST channels and streaming business is a key growth driver

- Q1 2026 Earnings Report(February 5): Focus on revenue growth, profitability improvement, and cash flow

- Insider Trading Activity: Increase vigilance if more executives sell

- Institutional Position Changes: Monitor adjustments in positions by large institutional investors

- Industry M&A Progress: Media industry consolidation may bring valuation revaluation opportunities

Although the insider trading signal is relatively mild, investors should still be aware of the following risks:

- Valuation Risk: Stock price has risen over 60% in 6 months, which may be overbought in the short term

- Profitability Risk: Company has not yet achieved sustained profitability; TTM net profit margin is negative

- Industry Competition: Streaming and content production industries are highly competitive

- Macroeconomic Environment: Slowdown in advertising spending may affect media companies’ revenue

The share sales by Lionsgate Studios Vice Chairman Michael Burns and CEO Jon Feltheimer are, overall, more like

Investors should view this as a

[1] Stock Titan - “Lionsgate Studios (LION) Vice Chair reports year-end tax sale of shares” (SEC Form 4 filing)

[2] Trefis - “Lionsgate Stock (+7.4%): FAST Ad Growth + Analyst Upgrades Drive Rally” (December 24, 2025)

[3] Stock Titan - “Lionsgate Studios (LION) CEO Jon Feltheimer reports insider share sale” (SEC Form 4 filing)

[0] Gilin API Data (stock prices, financial data, technical indicators, Python calculations)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.