Impact on Shareholder Value and Strategic Assessment of Citigroup's Exit from Russian Operations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Citigroup has obtained board approval to sell its Russian legal entity AO Citibank to Renaissance Capital, with the transaction expected to be signed and completed in the first half of 2026. This disposal will be marked as “assets held for sale” and result in a one-time pre-tax write-down of approximately $1.2 billion to reflect accumulated geopolitical and regulatory risks in the region since 2014. [1]

-

One-Time Loss and Short-Term Profit Impact

The $1.2 billion pre-tax write-down will directly compress 2025 Q4 profits, but since this business was previously regarded as non-core and struggled to return to profitability under ongoing sanctions and compliance burdens, the loss is more of a historical book adjustment rather than a continuous deferral of future cash flows. Current share price is around $119, market capitalization is approximately $220 billion, the single write-down has limited impact per share, and “cleaning up” bad debts in advance helps improve future performance comparability and transparency. [0] -

Risk Release and Capital Recovery

Divesting high-risk markets like Russia allows Citigroup to further shrink its international retail footprint, thereby freeing up risk-weighted assets and capital (especially under the Basel III framework) and enhancing the downward resilience of the CET1 capital adequacy ratio. The +67% stock performance over the past year (YTD) and doubled market capitalization indicate the market recognizes its simplification strategy and improved capital efficiency. After strategic contraction, resources can be focused on high-ROE businesses such as core U.S. banking, trading, and corporate services, increasing the overall capital return rate and room for ROE improvement (current 6.9%). [0] -

Valuation and Market Signals

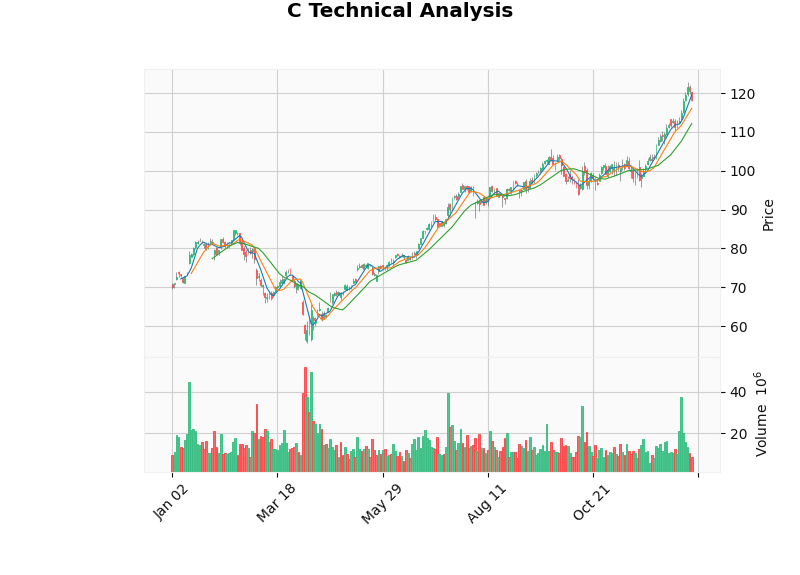

Current share price is at the upper edge of the upward channel; technical indicators show a consolidation phase, with MACD not forming a downward crossover and support at $112, indicating the market is still digesting the disturbance from this write-down. It is expected that once the write-down is recorded in future quarters, the “cleanup” will be completed, clearing emotional obstacles for the next phase of profit recovery. [0]

-

Geopolitical and Compliance Cost Pressure

Under ongoing sanctions, foreign exchange controls, and financial isolation, any foreign bank in Russia faces sudden capital control, capital withdrawal risks, and regulatory scrutiny. Continuing to maintain a “passive wind-down” would instead drag on management resources and compliance costs. Therefore, under the premise of ensuring a compliant exit channel and that the counterparty (Renaissance Capital) has local operational capabilities, a complete exit aligns with long-term sound governance logic. [1] -

Strategic Focus and Governance Simplification

Since Fraser took office, Citigroup has promoted the strategy of “focusing on high-share, low-complexity” and has sold retail businesses in multiple countries. This exit is one of the final steps of this strategy, which can reduce operational complexity and internal control costs, help improve management concentration and decision-making efficiency, thereby increasing overall ROE return expectations. Capital and management resources can be refocused on corporate/investment banking and wealth management businesses in North America and Latin America (still with growth potential), further supporting shareholder value. [0] -

Potential Opportunity Cost and Reputational Impact

While the sale means giving up possible future rebound opportunities (if the situation in Russia suddenly changes), the current probability is judged to be low. Conversely, retaining it may lead to potential capital retention and sanction risks. In addition, this move sends a signal to investors of “rebuilding into a more resilient global bank”, helping to enhance long-term valuation premiums.

Citigroup’s exit from Russian operations this time causes a short-term $1.2 billion book loss, but has positive significance for reducing geopolitical leverage, optimizing capital use efficiency, and improving governance concentration. The negative impact on shareholder value is relatively limited, and in the medium to long term, ROE and valuation can be improved through capital recovery and risk adjustment. Investors need to pay attention to the actual release of capital adequacy ratio from the asset disposal progress and whether the growth of core businesses in the future revenue structure can continuously compensate for the dilution caused by the write-down.

- Chart description: The 2025 full-year closing price K-line chart shows Citigroup’s share price has gradually climbed since the beginning of the year; current price is in the consolidation range of $112–$119, with volume matching the growth trend, indicating the market maintains positive expectations for structural transformation. [Chart link]

[0] Jinling API Data

[1] Wall Street Journal - “Citigroup to Sell Remaining Business Operating in Russia” (https://www.wsj.com/finance/banking/citigroup-to-sell-remaining-business-operating-in-russia-9e81c1f0?gaa_at=eafs&gaa_n=AWEtsqe47BwIxQRdFDXFzDOvcU-c8FNVt2faD6QEzIgBgnZJtO9Z2inUbpXB&gaa_ts=69530686&gaa_sig=bJk3dzh71-U1AqJ-mjU5X2O1ZcP5L3OTaQSvrp8SU33eUkZnYG5QOwJnJDZ9Wqhbk1vPOm4ghXl5IUDl3hiBrw%3D%3D)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.