Meta Acquires Manus AI: Analysis of AI Competitiveness and Valuation Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Acquisition Target: AI agent company “Butterfly Effect” (product: Manus) [1]

- Core Information (Media Reports):

- Founder: Xiao Hong will serve as Meta Vice President [1, 2]

- Business Model: Manus adopts a subscription system [1]

- Valuation & Funding Context: Pre-acquisition, the company was seeking funding at a $2 billion valuation (from user background) [1]

- Deal Size: Media reports indicate a multi-billion dollar scale [1, 2]

- Time Note: Public reports emerged at the end of 2025; no clear closing date specified. This analysis assumes the acquisition has been announced/ is in progress.

- Deal Terms: Not disclosed via public channels [1, 2]

- Manus is positioned as a “general AI agent” capable of tasks like resume screening, itinerary planning, and stock analysis [2], targeting enterprise/individual scenarios; the subscription model facilitates rapid validation and iteration [1].

- Complementarity & Potential Synergies:

- There is room for application imagination like “agent + communication/social” with Meta’s social and communication ecosystem (e.g., WhatsApp, Messenger) (unquantified assumption).

- If Manus capabilities are embedded into the WhatsApp ecosystem (e.g., business conversations, automated customer service, transaction processes) in the future, it may improve platform retention and monetization efficiency; however, this needs to be validated by product integration and regulatory progress.

- Alignment with Meta’s Existing AI Strategy:

- Meta adheres to an open-source route (e.g., Llama series) to nurture its ecosystem [5, 6]; Manus can be seen as a supplement at the “application/commercialization layer”, with synergy potential in the dual-track route of “open-source model base + closed-source/commercial product services” [5].

- The acquisition of Manus shows Meta’s strengthened layout in the “AI Agent” track, forming direct competition with OpenAI and Google in this area [5, 6].

- Manus’ subscription practice can help Meta accumulate operational experience in AI agents (pricing, retention, customer acquisition) [1].

- Potential Synergy Points (to be verified later):

- Combination of WhatsApp business messages, e-commerce diversion, financial/ticketing booking scenarios with Manus capabilities.

- Integration with advertising business (e.g., agent-assisted delivery, automated creative/copywriting).

- Short-term: Contribution to financial reports depends on product integration rhythm and scaling speed; no specific guidance is available from public data. Whether it can significantly提升 ARPU and monetization efficiency in the medium term remains to be seen.

- Stock Price & Market Cap: Approximately $658.69, market cap ~$1.66 trillion [0]

- Valuation Multiple: P/E ~29.12x [0]

- Analyst Targets: Consensus target price ~$825 (upside of ~+25.2% from current price), with most ratings being “Buy” [0]

- DCF Range (Tool Results):

- Conservative Scenario: ~$548.41 (down ~16.7% from current price) [0]

- Base Scenario: ~$629.29 (down ~4.5% from current price) [0]

- Optimistic Scenario: ~$856.20 (up ~+30.0% from current price) [0]

- This Acquisition (media-reported “multi-billion dollars”):

- Public reports state this is Meta’s “third-largest acquisition since its establishment”, second only to WhatsApp [2].

- Important Correction Regarding Scale AI:

- Web search results show rumors of Nvidia acquiring Scale AI-related assets, not Meta completing the acquisition of Scale AI [8].

- Therefore, Meta’s “second-largest acquisition” should be WhatsApp, and this Manus deal is referred to as the “third-largest acquisition” in public reports [2].

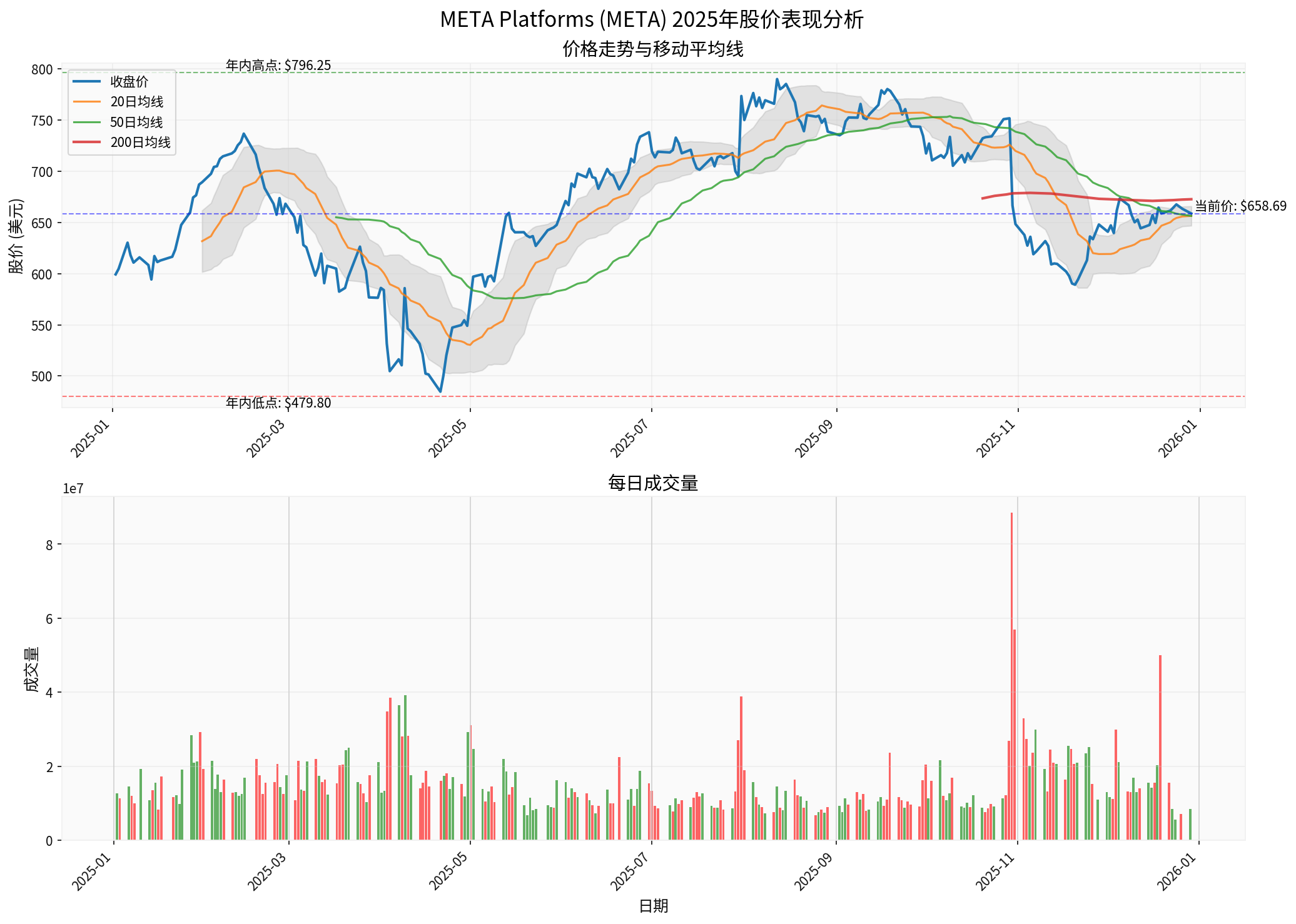

- META’s 2025 Performance:

- Year-to-date gain: ~+11.7% ($589.72 → $658.69) [0]

- Yearly high: ~$796.25, yearly low: ~$479.80 [0]

- Moving Average Structure: 20/50/200-day moving averages show a震荡修复 pattern (see chart description below) [0]

- Macro & Sector:

- In the past 30 days, the three major indices (S&P 500, NASDAQ, Dow Jones) rose by ~+2.86% to +3.01% [9].

- The tech sector rose slightly by ~+0.32% on the day [10].

- Market Interpretation (Public Information Level):

- This acquisition has a large deal size and is in an important track, which may strengthen the market’s confidence in Meta’s commitment to the AI Agent direction.

- Regulatory Risk: Recent attention from Italy’s antitrust authority on the integration of WhatsApp and AI services suggests future integration may face scrutiny (e.g., openness requirements) [7].

- Chart Interpretation:

- Closing price in 2025 rose by ~+11.7% from the start of the year [0].

- Yearly high: ~$796.25, yearly low: ~$479.80 [0].

- 20/50-day moving averages are intertwined, showing short-term震荡修复; the 200-day moving average serves as a medium-term trend reference [0].

- Trading volume increased fluctuatingly throughout the year, reflecting market divergence and changes in trading activity.

- On AI Competitiveness:

- Clear Strategic Intent: Enhance in-depth layout in the AI Agent track by complementing the application layer of AI agents [1,2].

- Combining open-source ecosystem (Llama) with “subscription practice” is expected to accelerate Meta’s AI productization and commercialization exploration [5,6].

- There is “potential synergy” in empowering WhatsApp/social/advertising, but it depends on subsequent product launch and compliance progress.

- On Valuation Impact:

- At the current valuation level (P/E ~29x, cautious DCF midpoint), the market has partially priced in the “increment brought by AI” [0].

- This acquisition is a positive factor in strategic direction, but short-term direct pull on EPS and cash flow depends on product integration and launch rhythm.

- If product synergy is well realized, there is room to move closer to the DCF “optimistic scenario” (tool shows optimistic scenario at ~$856.20, +30%) [0]; if execution/compliance encounters obstacles, it may maintain a cautious pricing.

[0] Gilin API Data (real-time quotes, company overview, financial analysis, DCF, historical prices)

[1] Sina Finance “Meta Acquires Manus Company Butterfly Effect for Multi-Billion Dollars: A China-Born AI…” (https://finance.sina.com.cn/tech/roll/2025-12-30/doc-inhepntw9749737.shtml)

[2] IT Home “Zuckerberg Makes a Bold Move: Meta Acquires Butterfly Effect, Developer of AI Agent Manus” (https://www.ithome.com/0/909/014.htm)

[3] Tencent News “Explosive Growth of AI Agent Industry: What Market Opportunities Remain?” (cites McKinsey’s “The State of AI in 2025” and industry research) (https://news.qq.com/rain/a/20251227A06MQU00)

[4] East Money “AI Agent Market Sees Explosive Growth” (https://finance.eastmoney.com/a/202512103586856535.html)

[5] 21st Century Business Herald “The Business Narrative of AI Agents is Far More Exciting Than Technology” (https://www.21jingji.com/article/20250709/herald/2ccaec47165db360f16f3078aa391845.html)

[6] Wikipedia LLaMA (https://zh.wikipedia.org/wiki/LLaMA)

[7] FastBull “Italian Regulator Requires Meta to Suspend WhatsApp’s Exclusive AI Policy” (related news background) (https://www.fastbull.com/news-detail/the-year-of-the-tariff-gives-way-to-4361892_2)

[8] TradesMax News Summary (mentions “Nvidia and Scale AI” related reports) (https://www.tradesmax.com/~tradesm7/index.php?option=com_k2&view=itemlist&task=user&id=352)

[9] Gilin API Market Index Data (S&P 500, NASDAQ, Dow Jones from 2025-11-17 to 2025-12-29)

[10] Gilin API Sector Performance (2025-12-30)

(Note: The above analysis is based solely on publicly available and verifiable information and tool outputs, and does not constitute investment advice.)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.