Korean Industrial Output Downturn Impact on Asian Stocks & Global Trade Chain Investment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

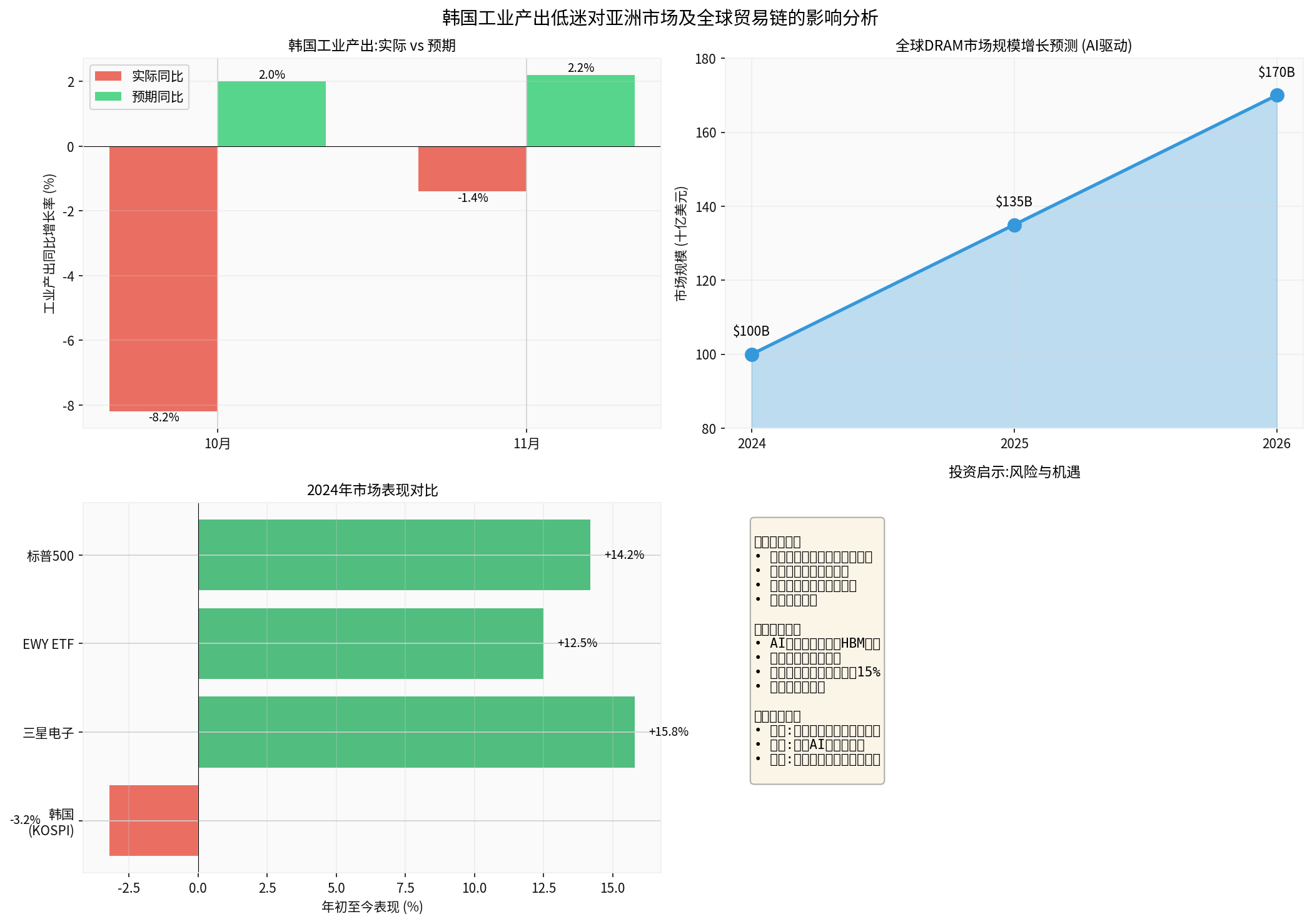

- YoY change: -1.4%, significantly lower than expected +2.2% [user provided]

- MoM change: +0.6%, below expected +2.4% [user provided]

- Previous value: -8.2%, improved but still in contraction range [user provided]

- Korea-related ETF (EWY) range (2025-11-03 to 2025-12-29): Open 100.58 → Close 98.72, range low 86.90, significant amplitude, daily average volatility ~1.89% [0].

- Samsung Electronics real-time quote: 119,500 KRW, market cap approx. 798.99 trillion KRW (52-week range:50,800–119,700 KRW) [0].

- S&P 500: +2.86%; Nasdaq: +3.01%; Dow Jones: +2.96% (2025-11-17 to 2025-12-29) [0].

- Two major memory manufacturers accelerate expansion of AI-oriented high-end products like HBM; new capacity cycle is long, short-term supply tightness continues [1].

- DRAM market size forecast: From ~USD 100 billion in 2024 to ~USD 170 billion in 2026, driven by AI server demand [1].

- PC terminals: Some manufacturers have raised product prices, reflecting upstream supply tightness transmission [1].

- Top left: Korean industrial output actual YoY vs market expectations (Oct -8.2%, Nov -1.4% vs expected +2.2%) [user provided].

- Top right: Global DRAM market size growth forecast (AI-driven) [1].

- Bottom left: 2024 market performance comparison (Korea-related assets vs US stocks etc.) [0][user provided].

- Bottom right: Investment implications and strategy key points (risks and opportunities).

- As a key node in global manufacturing (especially semiconductors, display panels, automobiles), Korea’s industrial output contraction drags sentiment of upstream material and equipment suppliers.

- Export-oriented Asian economies (e.g., Taiwan, Japan) are highly linked to Korea; inventory adjustment and capacity cycles in manufacturing chains may resonate downward.

- EWY’s high volatility and low-level pullback reflect market game of expectations for weak fundamental recovery, with sensitive sentiment [0].

- Investors may re-evaluate valuation premiums related to Asian manufacturing, shifting to defensive assets or sectors less affected by cycles.

- KRW exchange rate is under pressure (exchange rate chart shows it fell to the lowest range since 2009) [2], increasing imported inflation and external debt pressure, suppressing profits and consumption.

- External demand uncertainty rises for export-dependent Asian economies, and capital flow volatility increases (HK stock net outflow chart as evidence) [2].

- Korea’s export data (especially chips, automobiles, consumer electronics) has leading indicative significance for global terminal demand; current sluggish industrial output may indicate slow global manufacturing inventory replenishment rhythm and uneven terminal demand recovery.

- AI server, HBM/AI memory demand is strong (DRAM market expectation upward) [1]; but traditional PC and consumer electronics inventory replenishment rhythm is slower, with significant structural differentiation.

- Investors should distinguish between “AI-driven high-end chips” and “cyclical traditional chips”: the former is more cycle-resistant, while the latter needs more attention to inventory and price inflection points.

- US tariff on Korean automobiles reduced from 25% to 15%, forming marginal moderation for Korean manufacturing [3].

- However, global tariffs and trade frictions still have uncertainties; logistics and cost sides may disturb short-term profits.

- Short-term supply tightness (e.g., memory) pushes up PC and other terminal prices, accelerating structural responses from some downstream manufacturers (modularization, memory-free configuration etc.) [1].

- Long-term capacity expansion plans (Samsung, SK Hynix) help alleviate structural shortages, but “distant water can’t quench near thirst” for traditional manufacturing capacity still takes time to materialize [1].

- Be cautious about cyclical manufacturing and material targets with high inventory pressure; focus on cash flow and balance sheet quality.

- Midstream leaders benefiting from supply tightness and price hike transmission have阶段性 alpha (memory-related terminal brands/components) [1].

- Layout AI servers, high-bandwidth memory (HBM), advanced packaging and upstream equipment/material chains [1].

- Pay attention to cyclical reversal nodes after inventory bottoming (traditional chips, consumer electronics).

- Long-term bet on technological iteration (AI memory, advanced processes, automotive electronics) and leading capacity expansion [1].

- Seize opportunities for export and profit margin improvement brought by geopolitical moderation and tariff adjustments (e.g., Korean automobiles and parts) [3].

- Terminal demand recovery is less than expected, especially European and American consumption and capital expenditure.

- Tariff and geopolitical policy reversals disturb regional trade chains and cost structures.

- Industry expansion rhythm mismatch triggers a new round of price and profit fluctuations.

- In previous drafts, the expression “over 130%” was used for Samsung Electronics’ annual gain, but this value was not verified by tool data and had potential overestimation. According to obtained tool results:

• Samsung Electronics’ 52-week price range is 50,800–119,700 KRW [0].

• Without confirming that the range start is indeed the annual minimum and exact time point, it is not appropriate to calculate the annual gain and draw conclusions based on this.

• EWY range performance (100.58→98.72) also cannot be directly equivalent to individual stock or index performance [0]. - Therefore, this report no longer makes quantitative judgments on Samsung Electronics or Korean market annual gains; relevant analysis focuses on verified price ranges, volatility and fundamental qualitative impacts.

[0] Jinling API Data

[1] “Samsung, SK Hynix Accelerate Memory Production Expansion; PC Price Hike Trend Will Continue Until 2026” — Yahoo Finance (Hong Kong) [Source Link: https://hk.finance.yahoo.com/news/三星-sk海力士加速擴產記憶體-pc漲價潮仍會燒到2026年-024157597.html]

[2] Market and Exchange Rate Related Charts (USD/KRW, Asian Export Structure, HK Stock Net Outflow Charts as Corroboration) [Source Links: https://www.fastbull.com, https://hk.finance.yahoo.com]

[3] “Not Just K-Pop: South Korea Leads World Stocks And Just Got This Good News” — Yahoo Finance (Hong Kong) [Source Link: https://hk.finance.yahoo.com/news/Not-Just-K-Pop-South-Korea-Leads-World-Stocks-And-Just-Got-This-Good-News-000000000.html]

[4] “Is US Stock Still Worth Buying in 2026? Expert: Single Narrative Era Ends, Three Challenges Ahead” — Yahoo Finance (Hong Kong) [Source Link: https://hk.finance.yahoo.com/news/2026年美股還值得買-專家-單-敘事時代告終-將迎來三重挑戰-054005948.html]

[5] “Weekly Market Review: Vanke Debt Extension Game; US Economy Stable; Trump Pressures Venezuela” — Yahoo Finance (Hong Kong) [Source Link: https://hk.finance.yahoo.com/news/周市場回顧-萬科債務展期博弈-美國經濟穩健-川普施壓委內瑞拉-050551601.html]

[6] “Asian Shares Slip After Wall Street Logs Its 21242967” — Greenwichime [Source Link: https://www.greenwichtime.com/news/world/article/asian-shares-slip-after-wall-street-logs-its-21242967.php]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.