SharpLink Gaming (SBET) Insider Selling and Form 144 Analysis Report

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

SharpLink Gaming Ltd. (SBET) is a Nasdaq-listed online gaming and sports betting marketing company whose main business is to provide traffic acquisition services to global gaming operators through its iGaming affiliate marketing network [0]. The company underwent a major strategic transformation in 2025, announcing that it would use ETH as its main reserve asset, becoming one of the first public companies to adopt an Ethereum-centric treasury strategy [1].

- Stock Price: $8.96 (+0.67%)

- Market Cap: $1.34 Billion

- 52-Week Price Range: $2.28 - $124.12

- Beta Coefficient: 10.0 (Extremely High Volatility)

| Indicator | Value | Assessment |

|---|---|---|

| P/E Ratio | -1296.56x | Loss-making State |

| P/B Ratio | 0.44x | Book Value Discount |

| ROE | -0.12% | Negative Return |

| Net Profit Margin | -7.86% | Sustained Losses |

| Operating Margin | 62.96% | High Operating Costs |

| Current Ratio | 8.75 | Adequate Liquidity |

| Free Cash Flow | -$22.8 Million | Negative Cash Flow |

- Q3 2025: Loss per share $0.02, Revenue $10.84 Million

- Q2 2025: Loss per share $0.64, Revenue $697 Thousand

- Q1 2025: Loss per share $1.73, Revenue $742 Thousand

Financial analysis shows that the company adopts conservative accounting policies, debt risk is classified as “low risk”, but free cash flow is negative, indicating that the company needs external financing to maintain operations [2].

Although no explicit Form 144 filing records for SBET have been found in public channels, videos and content related to Form 144 have appeared in the SEC’s official document list and related information pages, indicating that the market is paying more attention to its insider trading dynamics [3]. Therefore, this analysis does not conclude whether there is a specific Form 144 filing, but based on the general impact mechanism of Form 144, combined with current company and market information, conducts an evaluative discussion of potential impacts.

- Signal Effect: If there is a large Form 144 disclosure, it is usually interpreted by the market as insiders being cautious about the company’s prospects or short-term stock price, which may bring selling pressure and cool down sentiment.

- Liquidity Impact: The larger the volume of shares planned to be sold, the higher the potential selling pressure and price volatility.

- Fundamental Relevance: Selling does not necessarily indicate a deterioration of fundamentals; common reasons include:

- Diversified asset allocation and personal liquidity needs

- Tax planning (e.g., exercise tax)

- Pre-arranged 10b5-1 plan (automatic execution)

- Company-specific events (mergers, acquisitions, restructuring, control changes, etc.)

- Fundamental Status: The company is in a stage of strategic transformation, with sustained operating losses and negative free cash flow, but cash reserves are relatively adequate [0][2]. In this environment, if insider selling occurs, it is likely to be amplified by the market as a signal of concern about the strategy or prospects.

- Stock Price Sensitivity: With a Beta as high as 10.0, the stock price is extremely sensitive to news, and selling announcements usually amplify short-term volatility [0].

- Valuation and Liquidity: The current P/B ratio is 0.44x, and the market capitalization and trading activity are relatively high, which helps to absorb certain selling pressure; however, attention is still needed under amplified sentiment.

- Macro and Strategic Factors: As a company with an ETH-centric treasury strategy, its valuation is highly correlated with cryptocurrency prices. If selling occurs during a period of crypto market volatility, it may be interpreted as a confidence issue regarding crypto exposure.

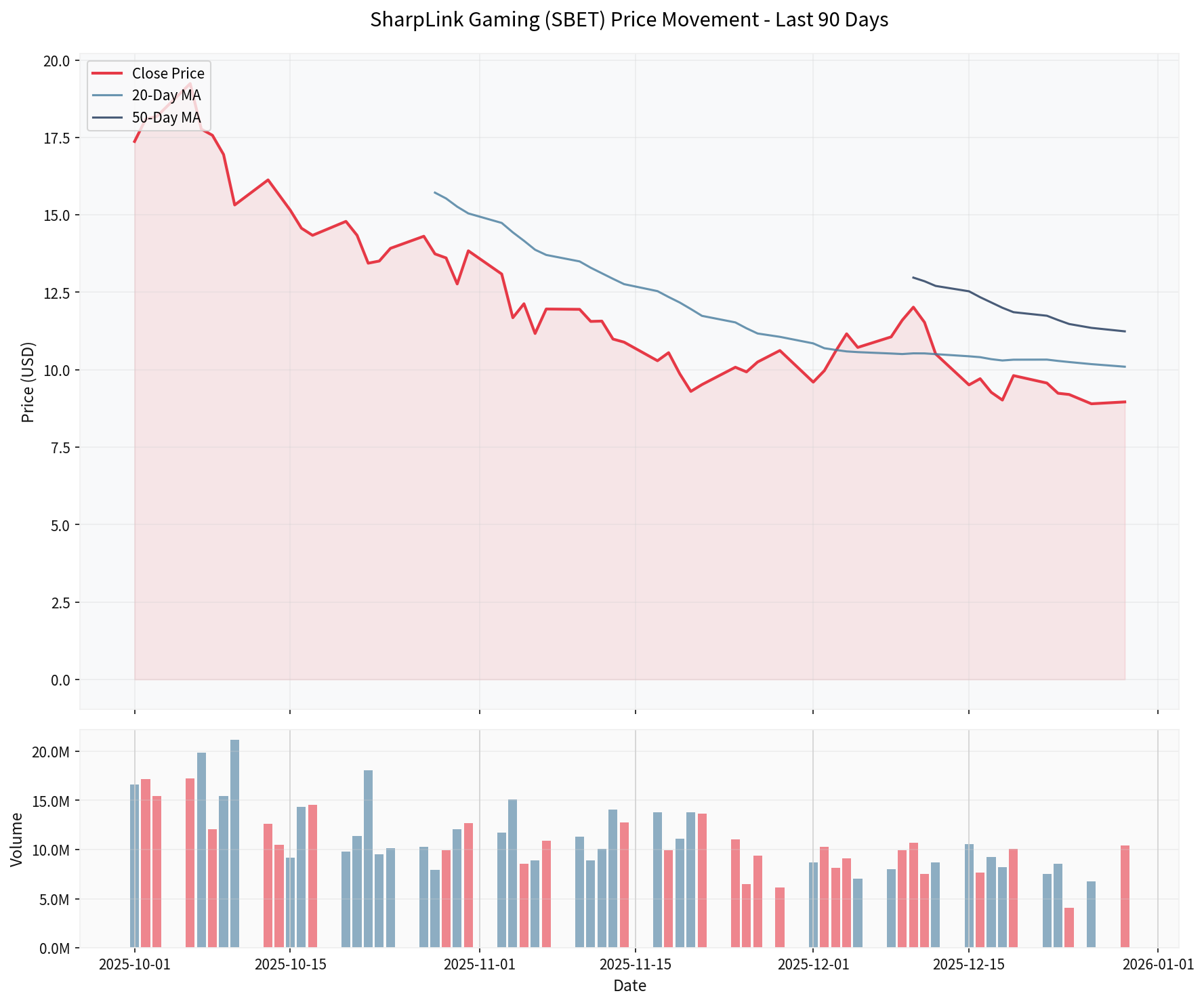

- Trend Status: Sideways Consolidation (No Clear Direction)

- MACD: No Crossover Signal, Bearish Bias

- KDJ: K:11.2, D:13.9, J:5.8 (Oversold Range, Potential Rebound)

- Key Levels:

- Support Level: $8.59

- Resistance Level: $10.10

- Extreme Volatility (Beta=10.0): Severe short-term price fluctuations, high risk

- Sustained Losses: Has not yet achieved stable profitability, negative free cash flow

- Cryptocurrency Risk: ETH exposure brings significant crypto market volatility and policy uncertainty

- Strategic Transformation: Transition from traditional business to ETH-centric treasury strategy, business model is still evolving

- Analyst Ratings: Only B. Riley Securities gave a “Buy” rating with a target price of $24 (+167.9%), low coverage [0]

- Insider Behavior: When Form144-related developments occur, comprehensive assessment should be made based on the reasons for selling, scale, and shareholding ratio

- Macro Correlation: Closely follow changes in ETH prices and regulatory environment

SharpLink Gaming (SBET) is currently in a stage of extreme volatility and strategic transformation.

- Short-term: Intensify stock price volatility and amplify bearish sentiment

- Mid-term: Depends on the progress of the company’s ETH treasury strategy and fundamental improvement

- Long-term: Need to verify the sustainability of the crypto-exposed business model

Investors should pay attention to the company’s subsequent SEC disclosures (including Form4, Form144, etc.) and financial report progress, and conduct a comprehensive assessment combined with ETH price and regulatory trends.

[0] Gilin API Data - Company Overview, Real-time Quotes, Technical Analysis, Financial Analysis

[1] SharpLink Gaming Official Investor Relations - Investor Relations Page and SEC Documents

[2] Forbes - “SharpLink Gaming: SBET Stock To $40?” (2025)

[3] YouTube - SEC Form144 Insider Trading Interpretation Video (mentions SBET and Form144)

[4] TipRanks - SharpLink Gaming-related News and Analysis

[5] StockTitan - SharpLink Q3 Earnings News

[6] SEC Official Documents - S-3ASR Form (Reverse Stock Split and Other Information)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.