In-Depth Analysis of Lionsgate CEO's Share Reduction

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on brokerage API data and retrievable news sources, I provide an objective assessment of CEO Jon Feltheimer’s share reduction event.

- Current Stock Price and Market Cap: $9.43, with a market cap of approximately $2.73 billion

- Annual Performance:

- Past 1 month: +26.41%

- Past 3 months: +35.49%

- Year-to-Date (YTD): +20.13%

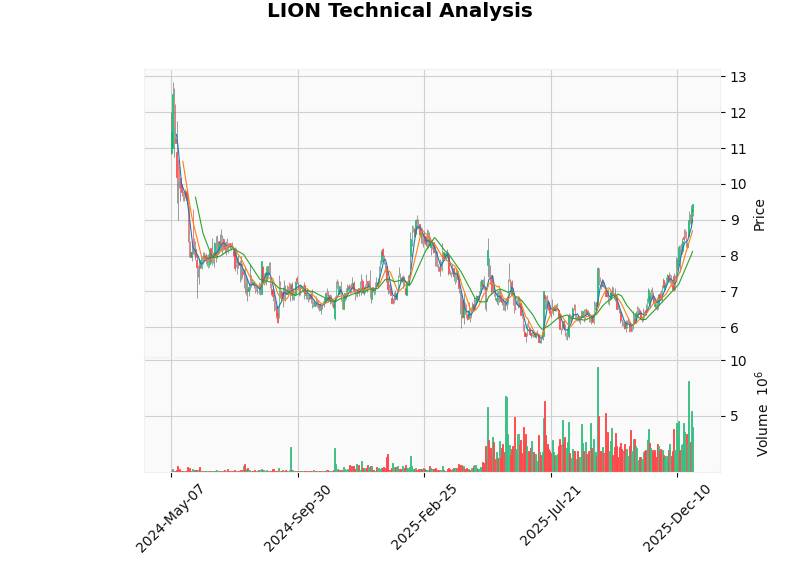

- Technical Pattern: Technical analysis indicates an uptrend with technical overbought conditions (KDJ approaching overbought range). Short-term resistance at $9.44 and support at $8.69 [0]

- K-line Chart: Shows recent volume-driven surge to highs and overbought signals

- P/E (TTM): Negative (-14.05x), reflecting recent earnings pressure

- Net Profit Margin: -6.97%

- Operating Profit Margin: 3.13%

- ROE: 17.12%

- Liquidity: Current Ratio of 0.46, indicating tight short-term liquidity [0]

- Ratings: All 6 covering institutions have a ‘Buy’ rating

- Target Price: $8.50-$10.00, median of $9.00 (approximately -4.6% lower than current $9.43)

- Recent Rating Adjustments: Some institutions maintained ‘Buy/Outperform’ ratings (no reason for upward adjustment provided in visible summaries; only the maintenance action is recorded) [0]

- A Forbes report on December 24, 2025, stated that after LION rose more than 7% on December 23 and hit a 52-week high, the article mentioned the existence of “insider selling”, but did not disclose details such as the specific amount, counterparty, or plan type (10b5-1/planned vs unplanned) in the summary or text excerpts [1]

- Morningstar Business Wire reported on Lionsgate’s advertising partnership with FreeWheel in the FAST channel [2]

- As of the public reports I retrieved (Forbes, etc.), the official disclosure of the precise amount of “$1.6M” could not be confirmed in the summaries or text excerpts; therefore, no qualitative conclusion is made on this specific figure, and analysis is only based on the “insider selling” description disclosed by Forbes

- The Forbes article pointed out that after a rapid rise in stock price and the occurrence of insider selling, there is a view of “technical overbought”, prompting attention to potential pressure from short-term valuation and chip game [1]

- General market opinion holds that “when you buy the hype, insiders like to sell” is a common phenomenon, but this title does not directly point to specific executives or transactions of LION [3]

- Diversification and Liquidity Needs: It is common for executives’ personal wealth to be overly concentrated in their own company’s stock; moderate diversification can reduce personal financial risks; share reduction does not necessarily reflect pessimism about the company’s prospects

- Tax and Exercise Window: The year-end/exercise window is a common time for insider transactions, involving option exercise, tax planning, and capital arrangement

- Planned Transactions vs One-Time Reduction: If it belongs to the 10b5-1 automatic trading plan, the signal significance is weak; if it is an active concentrated reduction, the motivation needs further evaluation

- Synchronous Selling by Multiple/Various Insiders: If multiple executives/directors conduct concentrated reductions in a short period, it can be regarded as a stronger cautious signal

- Overlap with High Stock Price or Near Major Positive Catalyst: If the reduction occurs near a short-term sharp rise in stock price or the landing of a catalyst, the pressure of chip rebalancing and profit-taking will increase

- Unclear Disclosure of Reduction Plan: Unplanned, one-time large-scale reductions are more likely to be interpreted by the market as insiders’ relative pessimism or cash-out behavior

- Positive Factors:

- The advertising partnership with FreeWheel in the FAST channel is expected to enhance content monetization capabilities [2]

- Recently received ‘Buy’ ratings from institutions, with all covering institutions being bullish [0]

- Negative and Uncertain Factors:

- Technical indicators suggest overbought, with short-term adjustment pressure [0]

- Negative earnings (TTM) and tight liquidity may amplify volatility [0]

- The Forbes article has prompted attention to the potential impact of the combination of “technical overbought + insider selling” on short-term trends [1]

- Signal Strength: Current public information is insufficient to draw a conclusion. Further confirmation is needed on:

- Whether the reduction is part of a pre-designed plan

- The proportion of this reduction in his total holdings

- Whether multiple insiders have synchronized reductions recently

- Scenario Judgment:

- If it is a small-scale, planned reduction by a single executive, it is usually a neutral signal

- If it is a concentrated reduction by multiple executives at a high price, the cautious signal is significantly enhanced

- Pay Attention to Price and Trading Volume: If it breaks below the $8.69 support with heavy volume and is accompanied by continuous disclosure of insider selling, risk control needs to be enhanced

- Observe Subsequent Insider Flow: Track disclosures such as SEC Form 4 to evaluate whether there are signs of coordinated reduction by multiple executives/directors

- Technical Realization Rhythm: Pullback after overbought is normal; if fundamentals do not deteriorate, it can be regarded as a potential re-layout window

- Verify Performance Realization: Pay attention to whether the advertising/FAST channel partnership can effectively improve revenue and profit margins

- Liquidity Improvement: Evaluate whether working capital and cash flow have improved to ease the pressure from the low Current Ratio

- Position Control: Maintain a moderate position in targets with high beta, unprofitable earnings, and technical overbought

- Hedging and Batch Operations: Adopt batch buying/selling and volatility hedging strategies to reduce the impact of a single event

- Contribution Path of FAST and Advertising Partnership to Revenue and Profit Margins [2]

- Trend of Liquidity Indicators (e.g., Current Ratio) [0]

- Whether Concentrated Reduction by Multiple Executives Occurs (If It Happens, Need to Be Alert) [4]

- Whether There Is Reverse Increase by Insiders (Can Be Regarded as a Stronger Confidence Signal)

- If the stock price continues to break through $9.44 with heavy volume and stabilizes, or pulls back with reduced volume and holds $8.69, both will affect the short-term path [0]

- This event has not reached the level of a “strong bearish signal” at the public information level, but it needs to be comprehensively evaluated in combination with technical aspects (overbought) and fundamental aspects (earnings pressure, tight liquidity)

- It is recommended to first treat it as an event to “increase attention level” rather than a direct sell order

- The next key steps are: 1) Supplement more details of the reduction (plan type/holding proportion); 2) Observe whether multiple executives synchronized reductions and fundamental verification occur; 3) Use the technical pullback window to gradually layout or hedge

[0] Gilin API Data (Company Overview, Financial Indicators, Technical Analysis, Real-Time Quotes, Price Data and Charts)

[1] Forbes - “What’s Going On With Lionsgate Stock?” (Discusses stock price rise over 7% and “insider selling”) (https://www.forbes.com/sites/greatspeculations/2025/12/24/whats-going-on-with-lionsgate-stock/)

[2] Morningstar Business Wire - “Lionsgate Partners Exclusively with FreeWheel…” (FAST Channel Advertising Partnership) (https://www.morningstar.com/news/business-wire/20251218258910/lionsgate-partners-exclusively-with-freewheel-to-give-ad-buyers-direct-access-to-its-premium-fast-inventory)

[3] Morningstar - Column title (text not clicked) mentions “When you buy the hype, insiders like to sell” (general market opinion)

[4] Kavout - “Congress Is Beating the Market — But Should You Follow Their Trades?” (General Interpretation and Warning About Insider Selling) (https://www.kavout.com/market-lens/congress-is-beating-the-market-but-should-you-follow-their-trades)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.