A Systematic Analysis of Meta's Acquisition of Manus: Impact on Its AI Competitive Position and Stock Valuation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Public reports indicate that Meta has announced the acquisition of AI startup Manus (or its parent company “Butterfly Effect”), with a transaction size of billions of US dollars, making it one of the larger acquisitions in the company’s history; some media call it the “third-largest acquisition”, second only to WhatsApp and Scale AI acquisitions [1].

- Some market descriptions mention “Chinese AI startup Manus”. According to the company’s public disclosures and media reports, Manus is headquartered in Singapore and is an AI Agent company targeting small and medium-sized enterprises (SMEs). This transaction is completed through the acquisition of its parent company [1].

- In December 2025, Meta announced on its official website and press release that Manus would join Meta to enhance enterprise-facing AI Agent capabilities, with transaction details not fully disclosed [2].

- In April 2025, Manus’s parent company completed a financing round of approximately $75 million, with a valuation close to $500 million [1].

- Manus has made rapid commercial progress: According to the company’s updates, its 2025 ARR (Annual Recurring Revenue) exceeded $125 million, with a commercialization cycle of about 9 months [3][4].

- Business positioning: An AI Agent (“intelligent agent”) company targeting SMEs, helping enterprises use Agents to complete automated tasks and processes, emphasizing the evolution from “can converse” to “can work” [5].

- Current status and challenges: Meta has faced debates in AI models (Llama series), infrastructure investment, and productization. In 2025, the company’s AI investment was approximately $60-72 billion, and the competitiveness of its models and productization pace have been discussed by the market. Some views say the strategy is “chaotic” and lacks market-influential iconic products [6].

- Competitive landscape: OpenAI (GPT series), Google (Gemini), Anthropic, etc., continue to advance in models and engineering (such as Skills and other scaffolding tools); cloud vendors compete fiercely in GenAI models, engineering, and ecosystems [6][7]. Against this background, Meta needs more solid application layer and engineering implementation to enhance its competitiveness.

- Potential benefits of acquiring Manus:

- Product layer capabilities: Manus’s Agent framework and SMB scenario experience can complement Meta’s enterprise AI application layer capabilities, forming a more complete AI application closed loop.

- Engineering and scaling experience: Manus’s engineering practices in Agent orchestration, tool calling, and long-chain task execution can enrich Meta’s know-how at the AI system level, improving the implementation efficiency from models to system engineering [5].

- Scenario expansion: Combining Meta’s data and reach in social, content, and advertising ecosystems, Manus’s Agent capabilities are expected to improve efficiency and coverage in commercial scenarios.

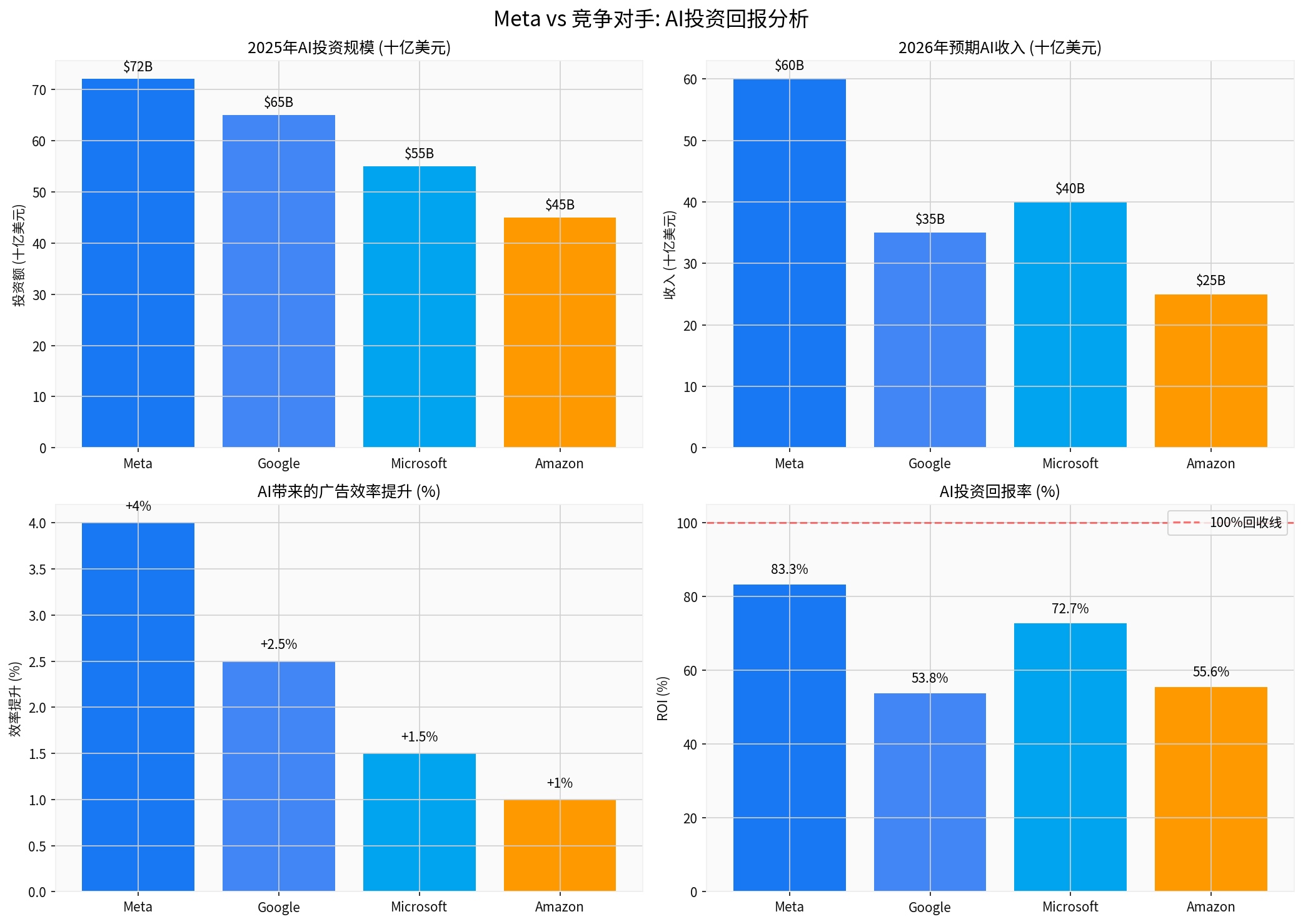

- Efficiency improvements brought by AI have been empirically verified: According to Meta’s Q2 2025 financial report, AI has increased advertising efficiency by approximately 3-5 percentage points; market and some research views believe Meta has shown the potential of “annualized AI revenue of about $60 billion” (to be understood as a quoted judgment, not an official company guideline) [6][8].

- Industry comparison (media and research views): Meta has certain advantages in AI return on investment—if compared by industry discussion standards, its performance in AI investment scale and efficiency improvement is relatively prominent (charts and quoted data come from Python visualization and industry discussions; not official company disclosures) [8].

- Through the acquisition, Meta will gain a team with experience in Agent engineering and productization, which helps accelerate the pace of AI engineering and product implementation, and enhance the attractiveness of AI talent and system building capabilities.

- Current stock price: $658.69 (real-time quote from brokerage API) [0].

- DCF scenarios (brokerage API):

- Conservative scenario: Fair value $548.41 (vs current -16.7%).

- Neutral scenario (Base Case): Fair value $629.29 (vs current -4.5%).

- Optimistic scenario: Fair value $856.20 (vs current +30.0%).

- Probability-weighted valuation: $677.97 (vs current +2.9%) [0].

- Key parameters and implications: The valuation of the neutral scenario is lower than the current price, indicating that under the baseline assumptions, the market has partially incorporated higher growth expectations; if the AI implementation speed and commercialization brought by Manus exceed expectations, there is significant room for valuation to migrate to the optimistic scenario (to be verified by subsequent financial reports and product implementation).

- Analyst consensus target price: $825.00, with upside potential of approximately +25.2% (brokerage API) [0].

- Rating distribution: Buy and above ratings account for about 84.3% (Strong Buy 3.9% + Buy 80.4%), showing that the market is generally positive about Meta’s medium and long-term prospects [0].

- Profitability: ROE is approximately 30.93%, net profit margin is approximately 30.89%, and operating profit margin is approximately 43.23% (brokerage API) [0].

- Cash flow and risk: Strong free cash flow; debt risk rating is “low risk”, and financial prudence is relatively conservative (brokerage API) [0].

- Capital expenditure and investment intensity: AI-related capital expenditure and infrastructure investment in 2025 reached $60-72 billion, and the market remains concerned about its investment scale and output pace [6].

- Cross-border acquisitions and AI technology integration may face regulatory reviews in multiple countries (including but not limited to CFIUS and antitrust approvals), and transaction structures and data compliance need to pass one by one (a risk generally recognized by the market).

- Changes in Sino-US technology and data governance environments may affect cross-border data use and talent flow, increasing integration complexity (public discussions and industry focus points).

- Technology stack and team integration: Meta’s original AI stack and Manus’s Agent architecture need to be integrated at the model calling, workflow orchestration, and tool chain levels, which may lead to short-term slowdown or efficiency loss.

- Cultural and organizational synergy: Rapid expansion and high-intensity investment test organizational management and talent retention. Internal research shows that employee sentiment has improved with strategic adjustments, but the sustainability of the high-intensity strategy still needs to be observed [6].

- Competitors (OpenAI, Google, Anthropic, etc.) continue to iterate in model and Agent ecosystems, and Meta needs to quickly form differentiated advantages in productization and engineering [6][7].

- Investment return timeline: The market is sensitive to the pace and scale of AI investment converting into considerable revenue, and subsequent financial reports need to continuously verify advertising efficiency improvements and new business progress [6][8].

- Acquiring Manus strengthens Meta’s AI Agent application layer and engineering capabilities, which is expected to accelerate the closed-loop construction of AI from models to applications, and enhance coverage and monetization capabilities in enterprise scenarios.

- Combined with the verification of AI’s role in advertising efficiency (3-5 percentage points improvement), this acquisition provides Meta with a grasp to further expand AI commercialization and helps alleviate the market’s concern about its “large investment but unclear output” [6][8].

- Short-term: The event-driven revaluation space depends on the market’s recognition of the “Agentization” and “enterprise AI” tracks; if integration is smooth and commercialization accelerates, valuation is expected to move closer to the DCF optimistic scenario or analyst consensus target price.

- Medium-term: Need to pay attention to AI revenue proportion, ARPU/advertising efficiency, and indicators related to enterprise scenarios (such as enterprise adoption rate, retention, and paid conversion).

- Long-term: If AI Agent becomes a new generation of interaction and automation paradigm, Meta’s position in this field will enhance its ecological moat and user stickiness.

- Regulatory progress and closing conditions.

- Technology and product integration progress (such as the landing path of Agent products in Meta’s ecosystem).

- AI-related disclosures in financial reports (AI revenue proportion, advertising efficiency improvement continuity, AI-related capital expenditure pace).

- Competitors’ movements in the Agent ecosystem and market share changes.

- Chart: Comparison of AI Investment and Return Between Meta and Major Tech Companies (visualization results). This chart shows comparisons in AI investment scale, expected AI revenue, advertising efficiency improvement, and return on investment dimensions, with data from public reports, market discussions, and Python visualization [8].

- Acquiring Manus provides Meta with complementarity in technology and product dimensions, especially in Agent engineering and SMB scenario implementation, helping to improve the visibility and efficiency of AI in commercialization.

- From a valuation perspective, the current stock price fluctuates between the DCF neutral and optimistic ranges; if integration is smooth and AI output is delivered, there is room for valuation to migrate to the optimistic scenario or consensus target price; conversely, if execution is hindered or regulation tightens, it may affect market sentiment and valuation repair pace.

- It is recommended to continue to pay attention to regulatory progress, integration execution, and AI-related indicators in financial reports to evaluate the substantive impact of this acquisition on Meta’s AI competition pattern.

[0] Jinling API Data (real-time quotes, company overview, DCF scenarios, financial analysis, technical analysis, etc.)

[1] Sina Finance - Meta Officially Announces Acquisition of Intelligent Agent Startup Manus (2025-12-30) https://finance.sina.com.cn/tech/roll/2025-12-30/doc-inhepntw9749993.shtml

[2] Bloomberg - Meta Acquires Startup Manus to Bolster AI Business (2025-12-29) https://www.bloomberg.com/news/articles/2025-12-29/meta-acquires-startup-manus-to-bolster-ai-business

[3] Manus Official Blog - ARR Exceeds $100 Million, Revenue Run Rate Reaches $125 Million https://manus.im/zh-cn/blog/manus-100m-arr

[4] Tencent News - Manus’s Annual Recurring Revenue Exceeds $100 Million (2025-12-22) https://news.qq.com/rain/a/20251222A03YBC00

[5] 36Kr - Agent Chaos: From “Can Converse” to “Can Work” (2025-07-21) https://m.36kr.com/p/3616277656847616

[6] 36Kr - Meta’s Great Escape: High-Intensity Betting on AI (2025-12-29) https://www.36kr.com/p/3616038591563012

[7] Titanium Media/AI Cloud 2025: Google Cloud and Alibaba Cloud Counterattack (2025-12-21) https://m.thepaper.cn/newsDetail_forward_32220226

[8] Geek Park/Overseas Unicorns - 2026 AI Best Ideas Discussion (2025-12-27) https://hub.baai.ac.cn/view/51480

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.