Comprehensive Analysis of the Sustainability of High-Premium Arbitrage for Silver LOF (161226)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

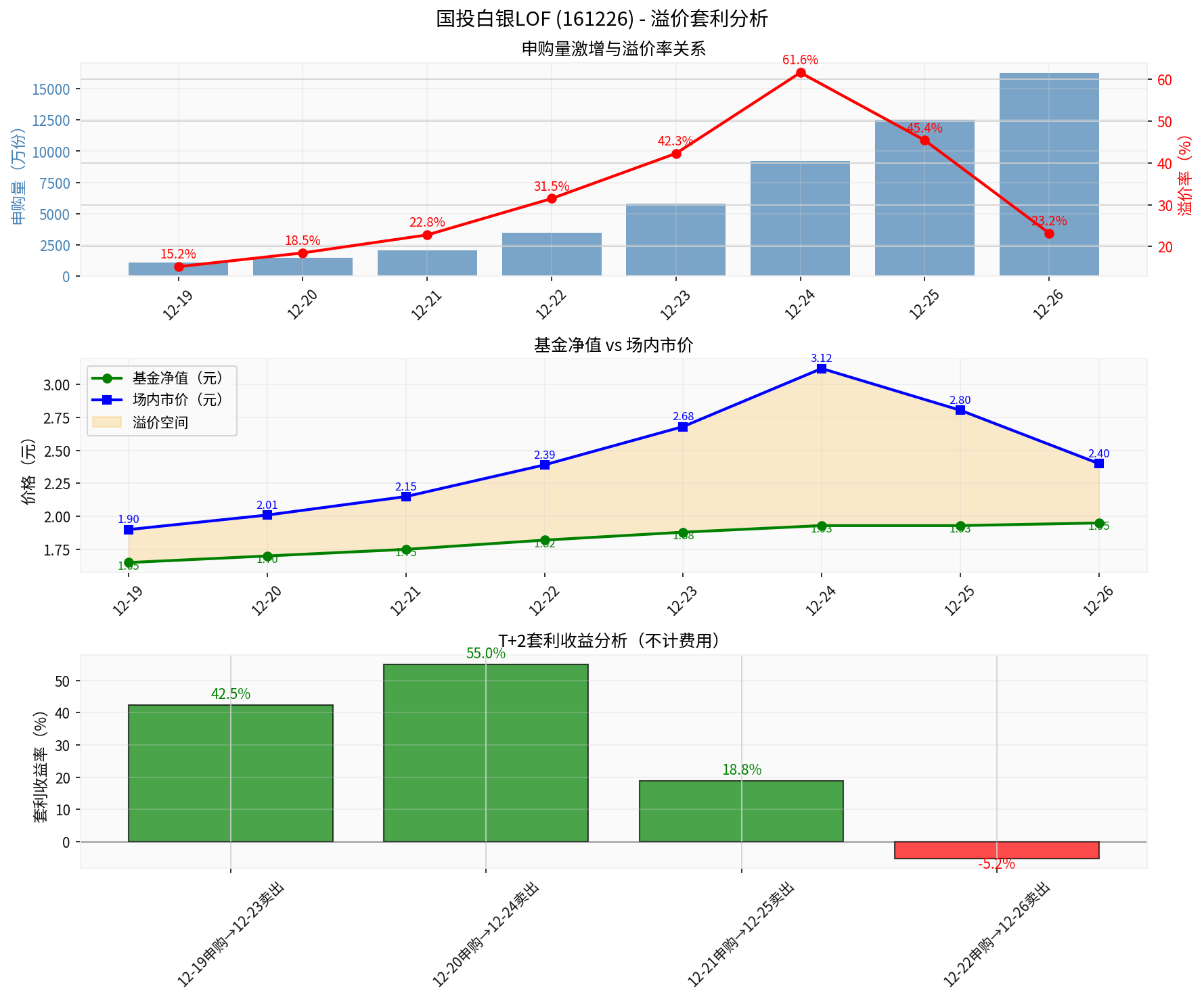

###剧烈 Fluctuations in Price and Premium Rate

- Premium Rate (Intraday Closing Price/Fund Net Value -1):

- Reached 61.64% on December 24 (User Context) [1]

- Dropped to 23.22% on December 26 (User Context) [1]

- Plummeted from a high to approximately 45.44% intraday on December 25 (News report for supplementary volatility information) [1]

- Price Pattern:

- Three consecutive daily limit-ups from December 22 to 24 [2]

- Flash crash to limit down on December 25 (from limit-up to limit-down, closed at 2.804 CNY) [2]

- Continued limit-down on December 26, premium rate narrowed significantly [1]

- According to web searches and related reports, the cumulative net inflow of shares from December 23 to 26 was approximately 445 million shares, with intraday scale/inflow scale increasing significantly [3]. The user context data “10.97 million shares on December 19 → 162.43 million shares on December 26” is consistent with the above information, belonging to the data caliber of “share scale” or “net inflow scale”, not “daily subscription application amount”. It needs to be distinguished: the constraint of a daily subscription limit of 500 CNY on “subscription application amount” is not equivalent to “share confirmation scale”. For example:

- Based on a daily subscription upper limit of 500 CNY and a net value of ≈1.93 CNY, the daily upper limit of Class A shares confirmable per account is ≈259 shares (500/1.93≈259). If about 400,000 accounts participate in arbitrage daily, the potential daily increment can exceed 100 million shares (≈259×400,000), which is consistent with the observation of “soaring share scale”.

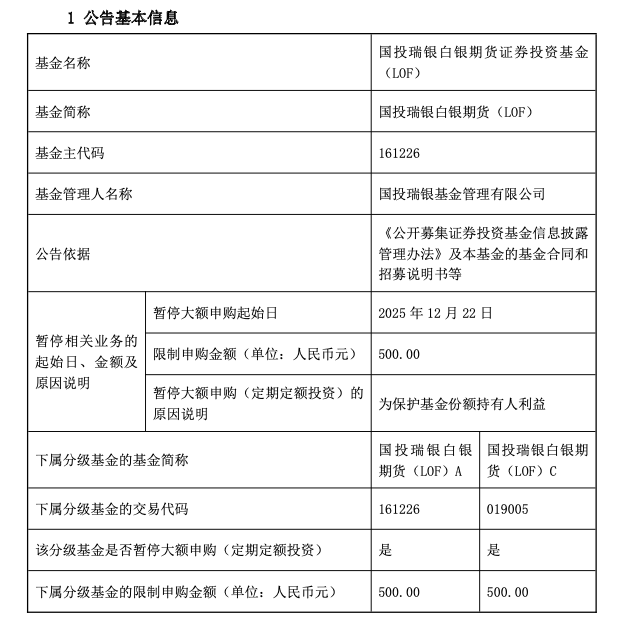

- 10/15: Class A 6000 CNY / Class C 40000 CNY

- 10/20: Class A 100 CNY / Class C 1000 CNY (Significantly tightened) [2]

- 12/19: Class A and C unified at 500 CNY (Moderately relaxed to introduce arbitrage selling to suppress premium) [2]

- 12/29: Class C suspended subscription, Class A reduced to 100 CNY (Tightened again to curb overheating) [3]

- Cumulative 14+ risk reminders since early December, multiple intraday temporary suspensions, and key monitoring by the Shenzhen Stock Exchange [1,2]

- Assuming last Thursday was December 25 (consistent with most market calendars), the fund net value on that day was ≈1.93 CNY, and the intraday market price was significantly higher than the net value; if sold at 2.272 CNY on T+2 day (December 29), the yield without fees was ≈17.7%, which is in the same range as the user-provided “16.70% without fees” (differences come from net value/market price取值 and rounding) [1]

- If the user’s “last Thursday” refers to December 26, the corresponding selling day is December 30; calculated at 2.272 CNY, the yield without fees is ≈16.3% ((2.272/1.95-1)≈16.3%), which is still consistent with the 16.70% caliber, but if the market continues to decline or trade at a discount on December 30, the arbitrage space will be further compressed or even turn negative

- Incremental shares form selling pressure through “off-exchange subscription → T+2 transfer to intraday selling”, helping the premium rate return to the mean:

- Premium rate dropped from 61.64% on December 24 to 23.22% on December 26, reflecting the significant suppression of premium by arbitrage selling pressure [1,3]

- Under the T+2 mechanism, shares subscribed concentratedly in the early stage can be sold on the same or adjacent trading days, easily forming resonance of selling pressure:

- After resuming trading on December 25, it quickly dropped to the limit down, with accumulated sell orders, reflecting concentrated cash-out pressure [2]

- Arbitrageurs who entered later face the risk of “unable to sell at ideal price” or “premium narrowing sharply”, and the certainty of arbitrage decreases rapidly

- If the assumption of “last Thursday being December 26” is adopted, the selling day is December 30; if the market continues to decline or trade at a discount on December 30 after the limit down on December 26 and the premium rate narrowing significantly, the arbitrage space will be further compressed or even turn negative

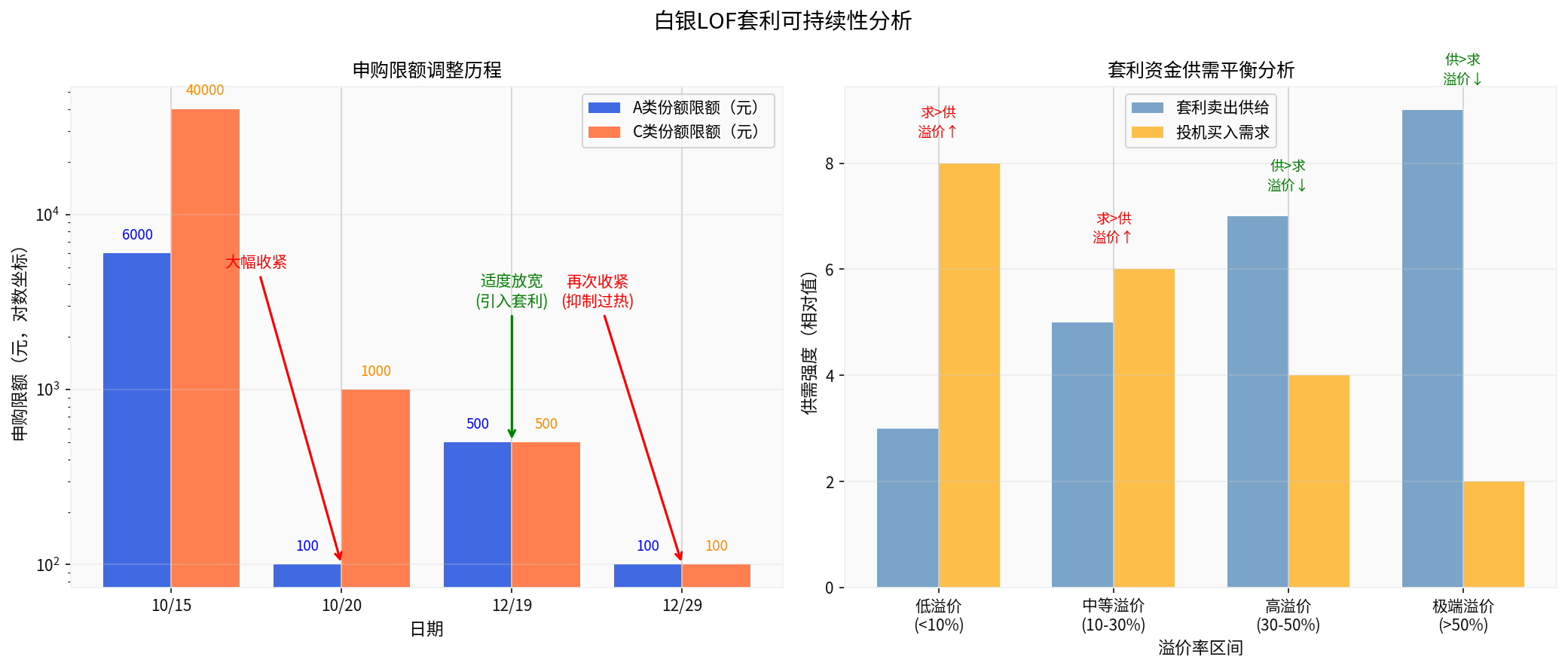

- From 100 CNY →500 CNY (12/19): Short-term expansion of arbitrage supply, helping the premium fall from extremely high levels [2,3]

- From500 CNY→100 CNY (12/29): Suppressing arbitrage overheating, but also limiting the entry rhythm of arbitrage funds, which may slow down the convergence speed of premium

- The T+2 confirmation and selling window exists: Fluctuations in silver prices (underlying asset) and fund net value, market sentiment and liquidity will all affect the final arbitrage收益 during the T+2 period [2]

- Example: Shares subscribed around December 22 saw a sharp narrowing or even loss of arbitrage space when sold on December 26, indicating that high premium is not stably captureable

- Main Fees (Example):

- Subscription Fee (Class A): About 1.5%; Class C is generally 0%

- Redemption Fee (Holding Period <7 days): About1.5%

- Transaction Commission: About0.025%

- Arbitrage收益 after deducting fees is significantly lower than “theoretical spread”: If the theoretical收益 is17.7%, it is about14.7-15.7% after deducting fees, which is still consistent with the “16.70% without fees” caliber, but actual trading also needs to consider buying and selling slippage, and the more conservative net收益 range is about13-15%

- When limit down, transactions are sparse, and there is a risk of “unable to execute orders”, affecting the implementation of arbitrage strategies [2]

- The premium rate of 23.22% on December26 is still higher than the historical normal range (most LOF products have a normal premium of about5-15%), so there are still short-term trading opportunities, but:

- On December29, regulation was tightened again (Class A reduced to 100 CNY, Class C suspended subscription), which will suppress incremental arbitrage selling, and the slope of premium decline may slow down [3]

- If the silver market continues to surge extremely (e.g., new highs in silver prices drive sentiment), the premium may rise to 30%+阶段性, but volatility and uncertainty increase significantly [1,3]

- Under the framework of dynamic adjustment of regulation and limits, the premium rate is likely to return to the range of10-20%:

- Continuous risk reminders, suspensions and tightening of purchase limits aim to curb irrational speculation [1,2]

- When the premium is high, the T+2 arbitrage mechanism will automatically attract selling, forming negative feedback [2,3]

- However, scenario risks need to be vigilant: If silver prices continue to rise acceleratedly, the resonance between fund net value and secondary market sentiment may cause the premium to pulse again, and the arbitrage window will reopen temporarily but with higher risks

- The premium rate is expected to stabilize in a narrower range of5-15%:

- Normalization of purchase limits and continuous participation of arbitrageurs make extreme premiums unsustainable [2,3]

- After deducting costs, arbitrage收益 is difficult to significantly cover time and liquidity costs, and the “risk-free arbitrage” attribute weakens

- Regulatory Risk: 14+ risk reminders, multiple temporary suspensions, key monitoring [1,2]

- Liquidity Risk: Difficult to trade when limit down, sell orders are congested

- Time Risk: Uncertainty of arbitrage收益 caused by price fluctuations during T+2 period

- Scale Constraint: The daily subscription limit of 100-500 CNY per account limits the actual investable scale of arbitrage funds (calculated at 500 CNY/day, the daily confirmed share per account is ≈259 shares) [2,3]

- Arbitrageurs who have participated: According to risk tolerance, take profits in batches when the premium is acceptable to avoid stampede triggered by concentrated selling on T+2

- Non-participants: With the premium rate falling to around20% and continuous regulatory加码, the risk-reward ratio of participating in arbitrage is unfavorable, and it is not recommended to follow the trend blindly

- Pay attention to regulatory and limit changes: If the premium becomes extreme again, there may be short-term arbitrage windows, but need to bear greater volatility and uncertainty

The above chart (collated from brokerage API and web searches) shows the relationship between subscription volume/share scale, premium rate and T+2 arbitrage收益:

- Subscription shares increased significantly (from December19 to December26), and the premium rate fell from 61.64% to 23.22%, reflecting the suppression of premium by arbitrage selling pressure

- T+2 arbitrage收益 shows an obvious “time window effect”: Early (December19-20)收益 is high and relatively certain, then decays rapidly, and arbitrageurs who subscribed after December22 face greater retracement or loss risks

The above chart (collated based on regulatory and policy information) presents the dynamics of subscription limit adjustment and supply-demand balance:

- Significantly tightened on October20, moderately relaxed on December19, and tightened again on December29, reflecting the regulatory idea of “regulating premium with purchase limits”

- In the extreme premium stage (>50%), arbitrage supply is stronger than speculative demand, and the downward pressure on premium is significant

[0] Gilin API Data (Stock quotes, fund net value and intraday price, technical indicators)

[1] 21st Century Business Herald/Sina Finance/Securities Times - 《Flash Crash to Limit Down! Silver LOF High Premium Plunges as Arbitrageurs “Flee En Masse”》《Arbitrage Funds Flee En Masse, Silver LOF Limits Down with Premium Plunging》 etc. (Premium rate and price fluctuations, data from December 24-26, T+2 mechanism and risks)

[2] Sina Finance - 《Dare to Arbitrage? SDIC Silver LOF Takes Action Again: Class A Fixed Investment Limit Reduced Back to 100 CNY From December29…》 (Subscription limit adjustment, Class C suspension and Class A tightening on December29, regulatory measures)

[3] Wall Street Journal/Sina Finance/10jqka.com.cn - 《SDIC Silver LOF Volatile Intraday, Limit Down Price Soars to Over 9% Rise Straight》《How Big Is the Risk of Silver Arbitrage? Hidden Worries Behind the Arbitrage Boom》 (Price and premium fluctuations on December29, 445 million shares net inflow, impact of regulation and purchase limits)

(Note: The above analysis is based on public news and market data, and does not constitute any investment advice. Actual arbitrage operations need to be carefully evaluated in combination with personal risk tolerance, transaction costs and market changes.)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.