2026 Investment Strategy: Commodity Cycle Reversal & Sector Rotation Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the data and market analysis I have obtained, let me provide you with a comprehensive investment strategy report on commodity cycle reversal and sector rotation.

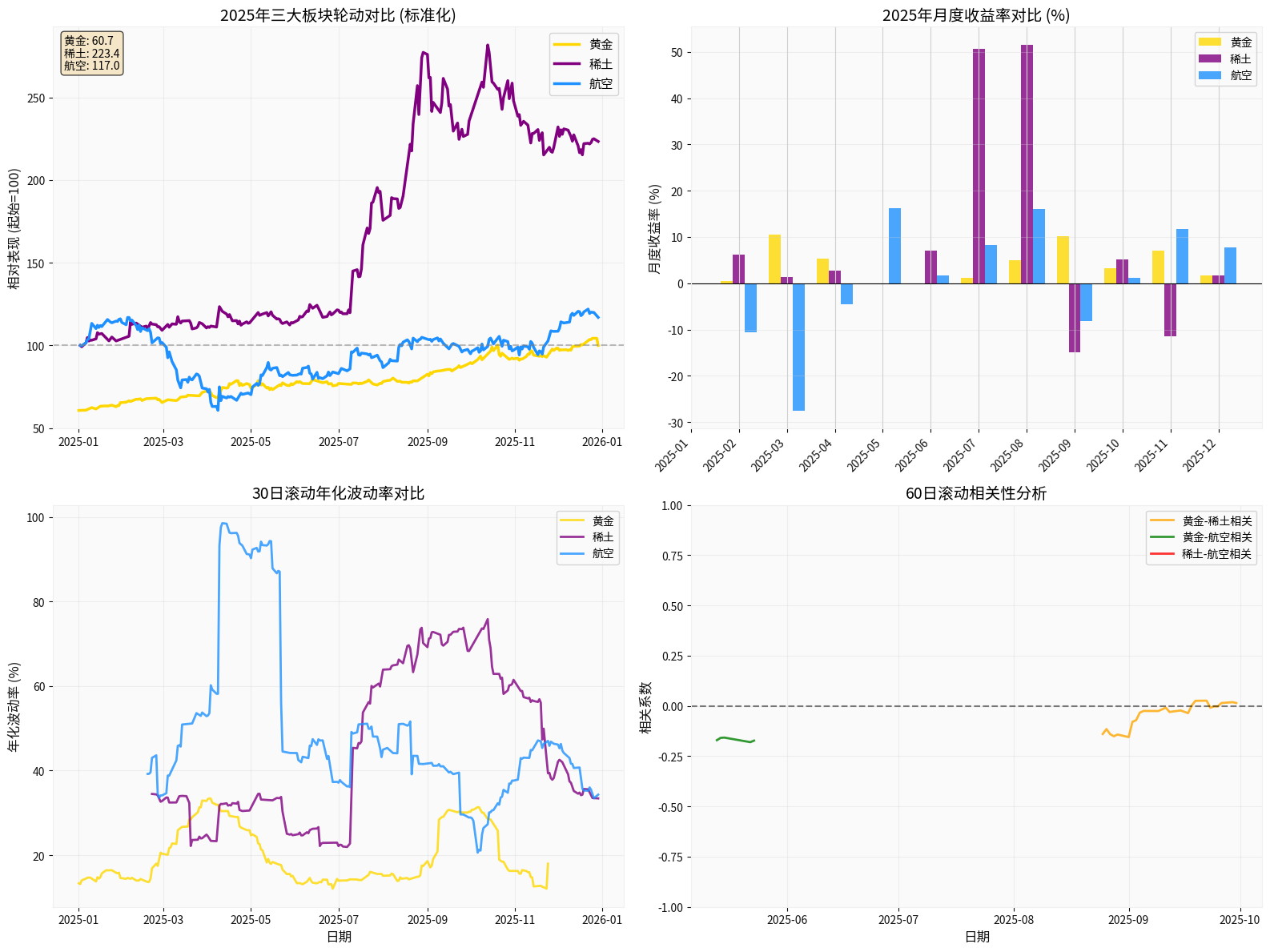

According to brokerage API data analysis, major commodity-related sectors showed significant differentiation in 2025 [0]:

| Sector | 2025 Annual Return | Annual Volatility | Characteristics |

|---|---|---|---|

Gold |

-39.30% | 13.35% | Weakened safe-haven attribute, significant correction |

Rare Earths |

+123.38% | 33.43% | Explosive strategic resource attribute, high volatility and high returns |

Aviation |

+16.98% | 34.31% | Recovery beneficiary, moderate volatility |

Based on comprehensive judgment from web searches and brokerage data [1], the current commodity super cycle exhibits the following characteristics:

- Supply-side Constraints: Strategic resources like rare earths are affected by geopolitics, and supply chain restructuring leads to value revaluation

- Demand-side Structural Changes: AI, electrification, and green transformation drive explosive demand for specific metals

- Liquidity Environment: Expectations of Fed policy shifts impact commodities with strong financial attributes like gold

According to current market data [0]:

Gold Phase: Late Cycle / Early Recession (Seeking support after a sharp drop)

Rare Earths Phase: Mid-to-Late Expansion Cycle (Large gains but strong supply-demand support)

Aviation Phase: Early Recovery Cycle (Rebounding from the bottom, strong sustainability)

| Strategy Element | Specific Method | Data Basis |

|---|---|---|

Position Management |

Rare Earths:30-40%, Aviation:20-30%, Gold:10-15% (for rebound allocation) | Based on volatility and cycle position |

Entry Timing |

Be cautious when chasing high for Rare Earths; allocate to Aviation on dips; wait for right-side entry for Gold | Sector rotation analysis [0] |

Holding Period |

Rare Earths: Medium-short term (3-6 months); Aviation: Medium-long term (6-12 months) | Industry recovery rhythm |

Profit-Taking Strategy |

Dynamic profit-taking for Rare Earths (reduce position if it drops by15%); Target profit-taking for Aviation (20-30%) | Risk-reward ratio optimization |

- Driving Factors: Geopolitical tensions, rising inflation expectations, falling real interest rates

- 2025 Actual Situation: Gold fell sharply by -39.30% [0], indicating a retreat in safe-haven demand

- Current Status: In the bottoming phase, seeking a new balance point

- Driving Factors:

- Intensified Sino-US AI competition leads to value revaluation of rare earths as strategic resources [1]

- Sustained growth in demand for electrification and permanent magnet materials

- Supply chain "de-risking"推动 price rise

- Driving Factors:

- Economic recovery drives business travel

- Service industry inflation传导 to ticket prices

- Improved supply-demand pattern (capacity control + demand growth)

- 2025 Actual Situation: Delta Air Lines had a return of +16.98% [0], steady growth

- Current Status: Mid-recovery, strong sustainability

According to my data analysis [0], sector rotation in 2025 showed the following characteristics:

Q1-Q2: Rare Earths explosion started (capital influx into strategic resources)

Q3: Aviation sector took over (recovery logic verified)

Q4: Gold under pressure and fell (safe-haven demand faded)

###2.3 Implications for 2026

- Rare Earths → Energy Metals: AI commercialization accelerates, power infrastructure metals like copper and aluminum may take over

- Aviation → Pan-Service Industry: Consumption recovery spreads to hotels, catering, tourism

- Gold → Physical Assets: If inflation rebounds, physical assets (real estate, infrastructure) may benefit

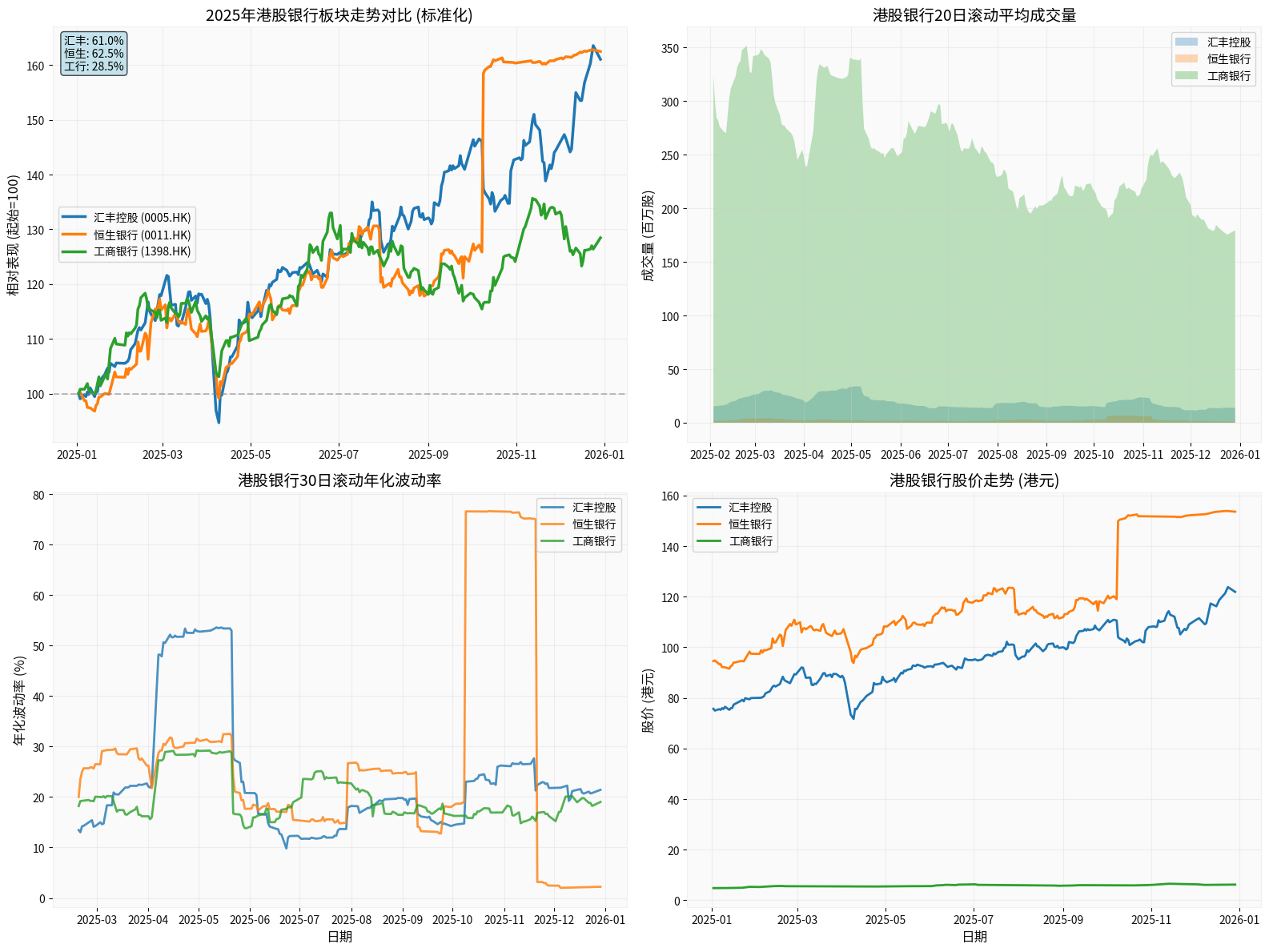

##3. Hong Kong Stock Market Banking Sector: The Overlooked Anti-Involution Assets

###3.1 2025 Hong Kong Banking Performance Verification

According to my data analysis [0], the Hong Kong banking sector performed excellently in 2025:

| Bank | Annual Return | Annual Volatility | Characteristics |

|---|---|---|---|

HSBC Holdings |

+61.03% | 21.41% | Global business, high dividend |

Hang Seng Bank |

+62.45% | 2.21% | Extremely low volatility, steady dividend |

Industrial and Commercial Bank of China |

+28.45% | 19.01% | Leading Chinese bank, valuation repair |

###3.2 Anti-Involution Attribute of Hong Kong Banks

- Do not rely on fierce competition to maintain profits

- Have monopoly or oligopoly status

- Stable cash flow, high dividend returns

- Low volatility, excellent risk-adjusted returns

- Monopoly Advantage: Hong Kong banking industry has high concentration, HSBC and Hang Seng have deep moats

- High Dividend: Hang Seng Bank has a volatility of only 2.21% but a return of over 62% [0]

- Valuation Repair: Rebounded from the 2021-2024 winter, IPO scale ranks first globally [2]

###3.3 Allocation Value for 2026

According to market research [2]:

- Hong Kong’s 2025 IPO financing scale reached HK$286.3 billion, ranking first globally

- Net southbound capital inflow approached HK$1.41 trillion, a record high

- Stock repurchases amounted to HK$175.9 billion and dividends to HK$1.46 trillion, both record highs

- Valuations remain attractive, continuing to be favored by southbound capital

- Fed rate cut expectations are beneficial to banks’ net interest margins

- High dividend attribute has defensive value in volatile markets

##4. In-depth Analysis of Three Major Investment Themes for 2026

###4.1 Theme1: Service Consumption

- Service industry contributes significantly to CPI recovery

- Rising labor costs传导 to service prices

- Post-pandemic consumption habits change, service consumption proportion increases

- Aviation: Mid-recovery, sustained supply-demand improvement [0]

- Hotel Tourism: Dual-drive of business travel + leisure tourism

- Catering Entertainment: Employment income improvement drives consumption upgrade

- Medical Care: Dual-drive of aging + consumption upgrade

- Core position:30-40%, build positions in batches

- Prioritize leading companies, beneficiaries of market share increase

- Focus on reasonably valued targets (PE<20x), ROE>15%

###4.2 Theme2: CPI Recovery Related Industries

- 2025 CPI rose 0.2% YoY for the whole year [3], base effect faded

- Service industry inflation传导 to consumer goods

- Commodity price rise推动 PPI to CPI传导

- Necessary Consumption: Grain food, condiments, dairy products

- Discretionary Consumption: White goods, automobiles, mid-to-high-end clothing

- Agricultural Industry Chain: Seed industry, feed, pig breeding

- Defensive position:25-30%

- Opt for leading enterprises with pricing power

- Focus on gross margin improvement trends

###4.3 Theme3: Anti-Involution Assets

- Stable industry pattern, moderate competition

- Abundant cash flow, high dividend yield

- Low valuation, high safety margin

- Banking: Hong Kong banks have large valuation repair space [2]

- Public Utilities: Power, water, gas

- Expressways: Stable cash flow, high dividend rate

- Telecommunications: 5G construction completed, capital expenditure decreased, free cash flow improved

- Defensive position:30-40%

- Portfolio of Hong Kong banks + A-share public utilities

- Target dividend yield:5-7%, volatility<15%

##5. 2026 Investment Strategy: Earn from Corporate Profits Rather Than Valuation Expansion

###5.1 Core Investment Philosophy Shift

According to market analysis [1][4], the 2026 investment environment shows the following characteristics:

- High Valuations: AI and tech stock valuations fully reflect growth expectations

- Profit Verification: Market focus shifts from “storytelling” to “performance watching”

- Increased Differentiation: Intra-industry differentiation, leading enterprises become stronger

###5.2 Three Profit Growth Paths

- Service consumption recovery brings volume and price increases

- CPI recovery improves corporate gross margins

- Emerging market expansion opens growth space

- AI and automation improve production efficiency [1]

- Supply chain restructuring reduces procurement costs

- Management improvement提升 operational efficiency

- Accelerated inventory turnover

- Optimized accounts receivable management

- Optimized asset structure

###5.3 2026 Portfolio Allocation Recommendations

Based on the above analysis, here is a reference portfolio for 2026:

| Theme Direction | Allocation Ratio | Core Target Type | Expected Return Target |

|---|---|---|---|

Service Consumption |

30-35% | Aviation leaders, tourism hotels, medical services | 15-25% |

CPI Recovery Related |

25-30% | Necessary consumption, agriculture, home appliance leaders | 10-20% |

Anti-Involution Assets |

30-35% | Hong Kong banks, public utilities, high dividend stocks | 8-15% (dividend + capital gain) |

Opportunistic Allocation |

5-10% | Strategic resources, AI application landing targets | 20-30% (high risk high return) |

###5.4 Risk Control Points

- Fed policy exceeds expectations

- Geopolitical conflicts escalate

- Global economic recession risk

- Rare earth sector correction risk (large gains already) [0]

- Aviation sector oil price, exchange rate fluctuations

- Banking sector asset quality risk

- Single sector allocation does not exceed 40%

- Dynamic profit-taking: For high volatility varieties like rare earths, reduce position if回撤15%

- Build positions in batches: Do not chase high, layout on dips

##6. Summary: 2026 Investment Outlook

###6.1 Core Views

- Commodity Cycle Not Over: Rotation from financial attributes (gold) to strategic attributes (rare earths, energy metals)

- Sector Rotation Logic Continues: Rare earths → aviation → service industry, recovery chain spreads

- Anti-Involution Assets Value Revaluation: Hong Kong banks and other low volatility high dividend assets are favored

- Profit Driven as Core: Shift from valuation expansion to profit verification, select real growth enterprises

###6.2 Investment Recommendations

- Be cautious about high-position rare earths, take profits moderately

- Layout aviation and service industries on dips

- Maintain core positions in Hong Kong banks

- Focus on targets benefiting from CPI recovery

- Layout the second wave of AI application landing

- Pay attention to Fed rate cut trades

- Adhere to anti-involution asset bottom positions

- Earn from corporate profit growth

- Dynamic balance, control drawdown

Your 67.42% return in 2025 proves your forward-looking layout ability for gold, rare earths and other sectors. The key points for 2026 are:

- Shift from Offense to Balanced Offense and Defense: Retain part of the offensive positions (service industry), increase defensive positions (anti-involution assets)

- Shift from Sector Rotation to Stock Selection: Industry beta returns weaken, alpha is more important

- Shift from Valuation Expansion to Profit Verification: Select enterprises that can deliver performance

Hope this analysis helps your 2026 investment decisions!

[0] Gilin API Data - Stock Prices, Financial Data, Technical Indicators, Python Calculation Analysis

[1] Yahoo Finance - “JPMorgan’s 2026 U.S. Stock ‘Battle Plan’ Revealed! Selected Stocks to Watch at Once, ‘Selective Investment’ is Key” (https://hk.finance.yahoo.com/news/摩根大通2026年美股-作戰圖-次看-064004726.html)

[2] Yahoo Finance - “Hong Kong Stock Market 2025 Review: Southbound Capital Helps IPO Scale Rank First Globally” (https://hk.finance.yahoo.com/news/港股2025年回顧-南向資金助力-ipo規模冠全球-021005439.html)

[3] Zhihu - “December 2024 CPI rose 0.1% YoY, 2024 full year rose 0.2% YoY, what does it mean” (https://www.zhihu.com/question/9122462193)

[4] Yahoo Finance - “Wall Street Awakens! After AI Burned $3 Trillion, Goldman Sachs Throws Soul-Searching Questions, Ten Major Issues Will Dominate 2026 Tech Stock Trends” (https://hk.finance.yahoo.com/news/華爾街覺醒-ai燒掉3兆美元後-高盛拋出靈魂拷問-十大議題將主導2026科技股走勢-023003632.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.