Luzhou Laojiao's 'Gate of Hell' Judgment and In-depth Analysis of Consumption Transformation in the Baijiu Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

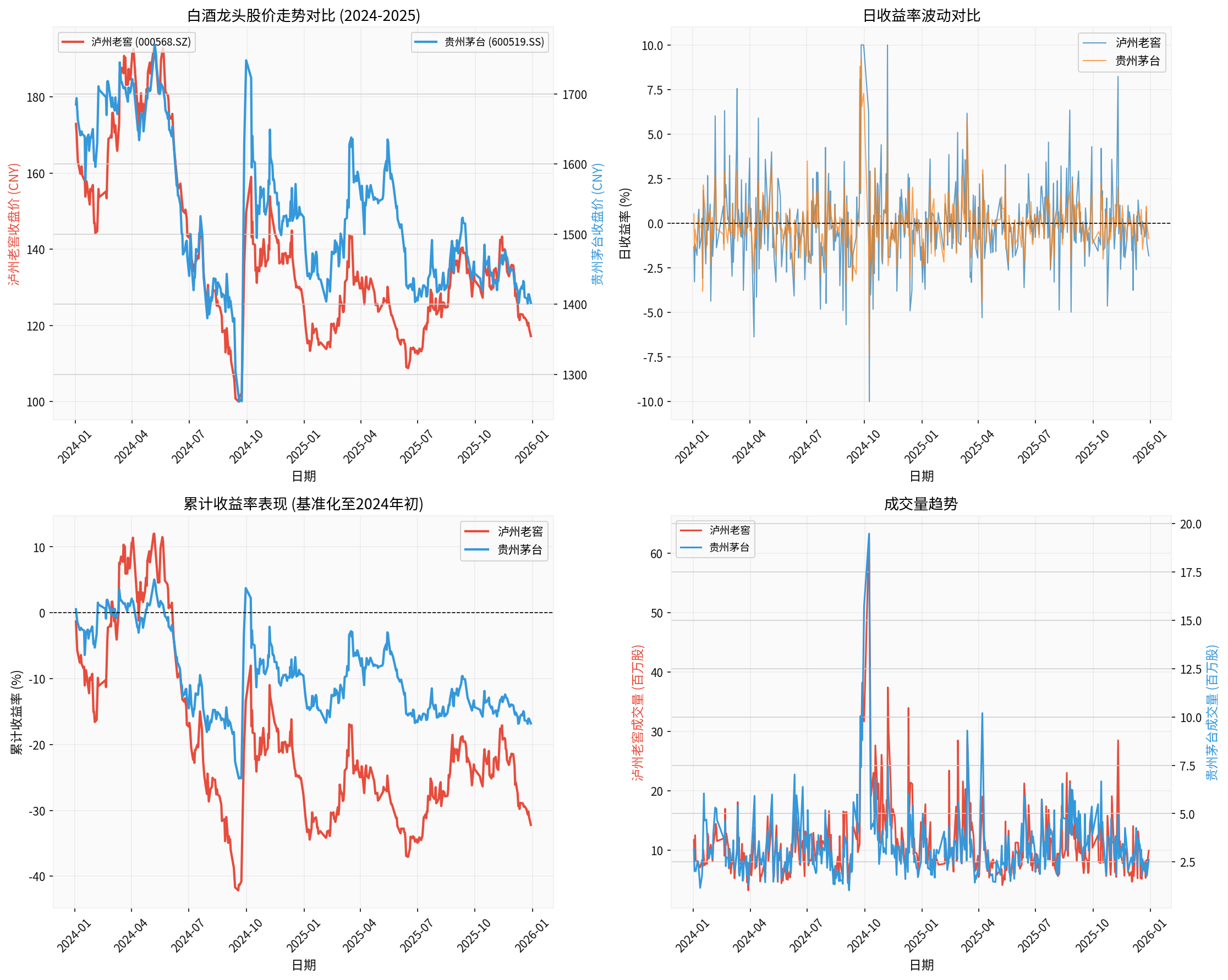

According to market data, the baijiu industry is indeed facing significant pressure. Since 2024, the stock prices of leading baijiu enterprises have generally fallen, reflecting market concerns about the industry’s prospects [0].

- Luzhou Laojiao(000568.SZ):From 172.87 yuan to 117.21 yuan, a drop of32.20%

- Kweichow Moutai(600519.SS):From 1685.01 yuan to 1402.00 yuan, a drop of16.80%

The following chart visually shows the stock price trends and cumulative return performance of the two leading enterprises:

Luzhou Laojiao’s judgment that “2026 Q1 is the Gate of Hell”

-

Spring Festival consumption weakness expectation: Management expects the Spring Festival consumption volume to be only 4 times the usual level (traditionally 6-8 times), and the mid-to-high-end market faces a 30%-40% demand contraction. This aligns with current consumption trends.

-

Global spirits industry downturn: International spirits giants have issued performance warnings. Diageo(Diageo) explicitly stated in its 2025 fiscal year Q1 report thatthe weakness of the Chinese baijiu market reduced its group net sales by approximately 2.5 percentage points[1]. The company expects organic sales growth to be “flat to slightly down” in fiscal year 2026[1].

-

U.S. spirits industry困境: In 2025, U.S. spirits manufacturers faced severe challenges;well-known brands like Jim Beam announced production suspensions[2], reflecting widespread pressure on global spirits consumption.

However, from multiple factors, Luzhou Laojiao’s judgment may

-

Chinese luxury consumption is expected to rebound: According to UBS(UBS) analysis,Chinese consumers’ luxury consumption is expected to grow by approximately 6% in 2026, a significant rebound from the 5% decline in 2025[3]. JPMorgan also predicts that the luxury industry will stabilize in 2026;the improvement of Chinese consumer confidence will be a key driving factor[4].

-

Valuations have reflected pessimistic expectations:

- Luzhou Laojiao’s current P/E is only 13.63x, at a historical low

- Kweichow Moutai’s P/E is 19.51x, also at a low level

- The market has already priced in a large number of pessimistic expectations

- Luzhou Laojiao’s current P/E is only

-

Industry differentiation intensifies: Although mid-to-high-end segments face pressure, the“affordable luxury”(affordable luxury) segment has performed relatively well, and the ultra-wealthy class’s consumption of high-end alcoholic beverages remains stable[5].

According to market trend analysis, baijiu consumption is undergoing profound transformation:

Dimension |

Face Consumption Era |

Personal Baijiu Era |

|---|---|---|

Consumption Motivation |

Social entertainment, business banquets | Personal enjoyment, quality pursuit |

Purchase Decision |

Low price sensitivity, pursuit of high prices | Cost-performance oriented, pursuit of real quality |

Consumption Scenario |

Public occasions, collective consumption | Private occasions, personal drinking |

Brand Preference |

Pursuit of popularity, scarcity | Pursuit of flavor, taste, personality |

According to luxury industry data[5][6]:

- Active luxury consumersaccount for about60%of the target customer group last year, dropping to40%-45%

- Total number of luxury consumersdecreased from 400 million in 2022 to approximately340 millionin 2025

- New customer acquisitiondecreased by5%between 2024 and 2025

This change in consumer structure also exists in the baijiu industry;

Luzhou Laojiao’s digital transformation strategy is the right direction for the industry:

- Expected to be put into production in September 2026; through technological upgrading to improve production efficiency and quality stability

- Many enterprises in the industry have begun to explore digital and intelligent brewing[8], including automated fermentation, quality control systems, etc.

- Learn from international spirits industry experience, such as Bacardi(Bacardi) testing robotic technology for whisky warehouse management[9]

- Molson Coors implemented a data-driven plan for green manufacturing; new equipment is expected to reduce energy use by 30%[10]

- Develop mid-priced product lines: Capture opportunities in the “affordable luxury” market

- Small-capacity packaging: Adapt to personal consumption scenarios

- Flavor innovation: Innovate based on young consumers’ tastes

- Traceability system: Establish a full traceability system from raw materials to finished products

- Quality certification: Enhance consumer trust through third-party certification

- Process transparency: Show brewing processes and quality control procedures to consumers

- Establish online e-commerce platforms and private domain traffic

- Reduce reliance on traditional dealer channels

- Improve channel profit distribution efficiency

- Enhance consumer awareness through baijiu culture education

- Build emotional connections between brands and consumers

- Use digital tools to accurately reach target audiences

- Develop drinking scenarios suitable for personal consumption

- Promote matching of baijiu with food

- Advocate rational and healthy drinking concepts

- Spring Festival consumption may be lower than expected

- Mid-to-high-end market demand continues to face pressure

- Channel inventory digestion takes time

- Consumption upgrade trend remains unchanged: The long-term growth potential of the middle class is still there

- Industry concentration increases: Leading enterprises’ market share is expected to grow

- Digital transformation reduces costs and increases efficiency: Improve profitability and risk resistance capabilities

For investors and industry observers, it is recommended to focus on:

- 2026 Spring Festival actual consumption data: Verify the accuracy of Luzhou Laojiao’s prediction

- Enterprise digital transformation progress: Whether technical transformation projects are put into production on schedule and generate benefits

- Effect of product structure optimization: Market acceptance of new products

- Effect of channel reform: Increase in DTC channel share

- Policy environment changes: Impact of consumption stimulus policies on the baijiu industry

Luzhou Laojiao’s ‘Gate of Hell’ judgment

For traditional baijiu enterprises to应对 the transformation challenges of the ‘personal baijiu era’, the core lies in:

- Accelerate digital transformationto improve operational efficiency and product quality

- Reconstruct product systemsfrom ‘face consumption’ to ‘quality consumption’

- Innovate marketing modelsto establish direct connections with consumers

- Balance short-term pressure and long-term strategyto avoid overreaction

For Luzhou Laojiao, its management’s crisis awareness and forward-looking layout are worthy of recognition, but execution and strategic determination will be the key to whether it can pass the ‘Gate of Hell’ and successfully transform.

[0] Jinling API Data - Luzhou Laojiao(000568.SZ) and Kweichow Moutai(600519.SS) stock prices, financial indicators and market data

[1] ts2.tech - “Diageo plc Stock Outlook December 2025: Profit Warning, New CEO and What Comes Next for DGE & DEO” (https://ts2.tech/en/diageo-plc-stock-outlook-december-2025-profit-warning-new-ceo-and-what-comes-next-for-dge-deo-2/)

[2] USA Today - “Bankruptcies hit US spirit makers as Americans drink and spend less” (https://www.usatoday.com/story/money/food/2025/12/25/liquor-spirits-industry-bankruptcies/87914241007/)

[3] Business of Fashion - “Luxury Stocks Look Ready for a Stronger Year After Their ‘Detox’” (https://www.businessoffashion.com/news/luxury/luxury-stocks-look-ready-for-a-stronger-year-after-their-detox/)

[4] CNBC - “Why aspirational luxury shopping is losing steam — and what’s ahead in 2026” (https://www.cnbc.com/2025/12/03/luxury-could-diverge-further-in-2026-analysts-say-heres-how.html)

[5] MediaPost - “Luxury Isn’t Collapsing – It’s Recalibrating Downward” (https://www.mediapost.com/publications/article/411062/luxury-isnt-collapsing-its-recalibrating-down.html?edition=140753)

[6] TradingView/Reuters - “2026 a ‘make or break’ year for luxury, DB says” (https://www.tradingview.com/news/reuters.com,2025:newsml_L8N3X70DH:0-2026-a-make-or-break-year-for-luxury-db-says/)

[7] Various financial media charts and reports - Predictions on 2026 Spring Festival baijiu consumption and analysis of mid-to-high-end markets

[8] Relevant reports on digital transformation of China’s baijiu industry - Industry news on intelligent brewing and digital transformation

[9] The Manufacturer - “Robot dog sniffs out the future of whisky warehousing innovation” (https://www.themanufacturer.com/articles/robot-dog-sniffs-out-the-future-of-whisky-warehousing-innovation/)

[10] Manufacturing Digital Magazine - “Molson Coors’ Data-Driven Plan for Greener Manufacturing” (https://manufacturingdigital.com/news/molson-coors-data-driven-plan-for-greener-manufacturing)

[11] Cannabis Industry Journal - “From Craft to Scale: What Cannabis Can Learn from the Craft Beer Revolution” (https://cannabisindustryjournal.com/feature_article/from-craft-to-scale-what-cannabis-can-learn-from-the-craft-beer-revolution/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.