Seres (601127.SH) 'Turnaround' Investment Value Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

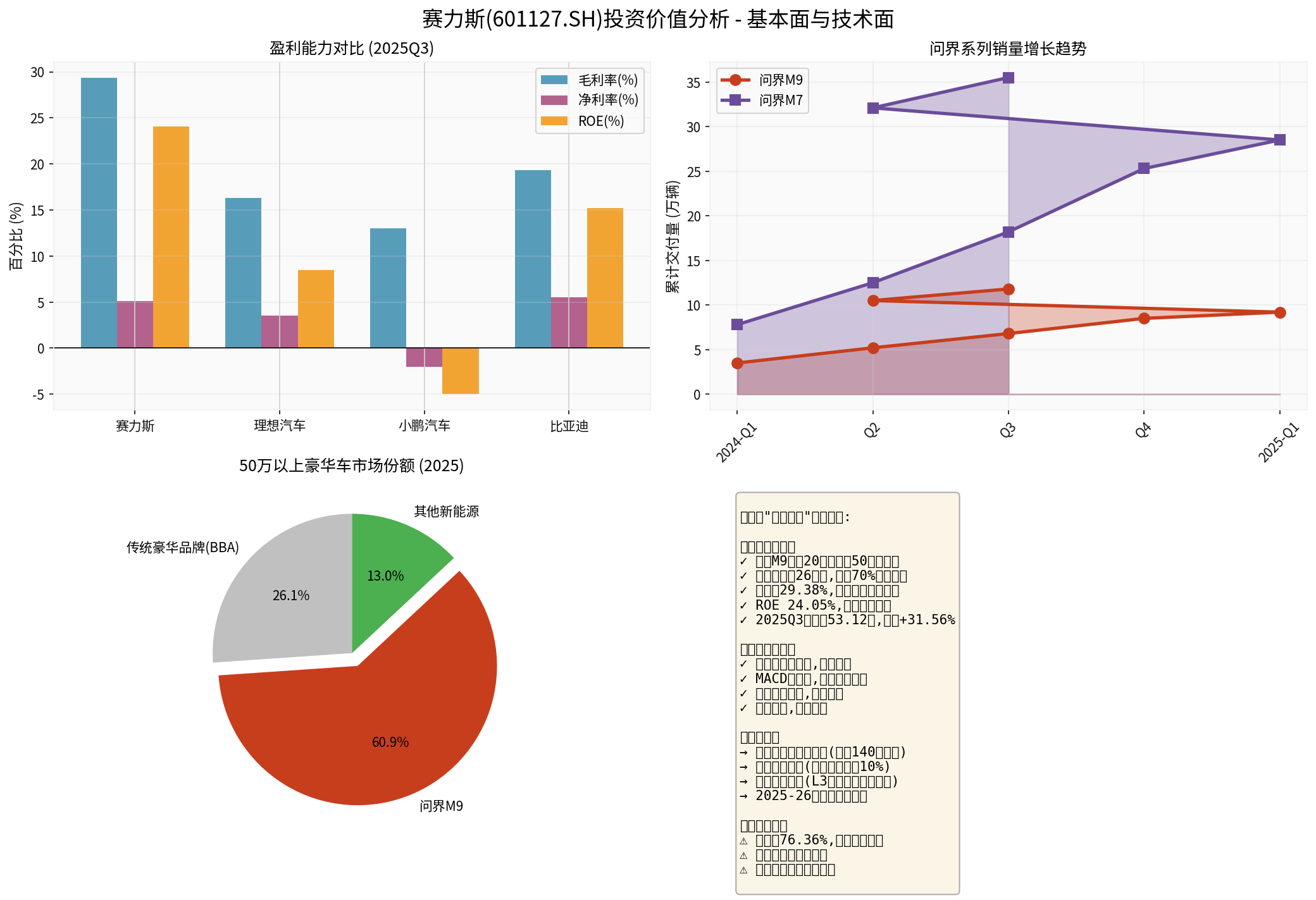

Based on a comprehensive analysis of fundamentals and technicals, Seres has a solid foundation to achieve a ‘turnaround’. The following analysis covers multiple dimensions:

According to the latest financial data [1], Seres shows strong profitability:

| Indicator | Seres | Li Auto | Xpeng Motors | BYD |

|---|---|---|---|---|

| Gross Profit Margin | 29.38% |

16.3%↓ | 13.0% | 19.3% |

| Net Profit Margin | 5.10% | 3.5% | -2.0% | 5.5% |

| ROE | 24.05% |

8.5% | -5.0% | 15.2% |

- Industry-leading gross profit margin: Seres’ 29.38% gross profit margin is significantly higher than competitors, reflecting the premium capability of the AITO brand and cost control advantages [1]

- ROE as high as 24.05%: Leading among A-share auto companies, indicating high capital utilization efficiency

- High net profit growth: Net profit in the first three quarters of 2025 reached 5.312 billion yuan, a year-on-year increase of 31.56% [1]

####1.2 AITO M9: Dominant Position in High-End Market

The market performance of the AITO M9 is phenomenal [2][3]:

- Cumulative deliveries exceed 260,000 units: Achieved this milestone 24 months after launch, ranking first in luxury cars priced above 500,000 yuan for 20 consecutive months

- Dominant market share: For new energy vehicles priced above 500,000 yuan in China, 7 out of every 10 sold are AITO M9, with a market share of up to 70%

- User structure reshaping: 85% of users are from the replacement/upgrade group of traditional luxury brands like Mercedes-Benz, BMW, and Audi; 67% of them list “intelligent driving” as the top reason for purchase

- Top user satisfaction: According to J.D. Power data, the AITO M9 has won the first place in the Net Promoter Score (NPS) for all new energy vehicle models for two consecutive periods, with a peak of 91%

####1.3 Sustained Sales Growth

AITO series sales maintain strong growth momentum:

- AITO M9: Cumulative deliveries exceed 260,000 units, with monthly deliveries stable at tens of thousands

- AITO M7: Cumulative deliveries exceed 350,000 units, ranking first in new势力 SUV sales in 2024 [3]

- Jan-Nov 2024: Seres’ cumulative sales reach 411,288 units, a year-on-year increase of 5.58% [3]

####1.4 Deep Collaboration with Huawei

Seres’ cooperation with Huawei has upgraded to a deep binding model of “business + equity” [4]:

- Holds 10% equity in Shenzhen Yinwang, aligning interests more closely with Huawei

- Huawei’s Kunpeng Intelligent Driving ADS 4.0 system and HarmonyOS intelligent cockpit form core competitive barriers

- The “HarmonyOS Intelligent Mobility” channel continues to expand, improving brand reach efficiency

Chart: Seres Profitability Comparison, AITO Sales Growth Trend, and Investment Logic Summary

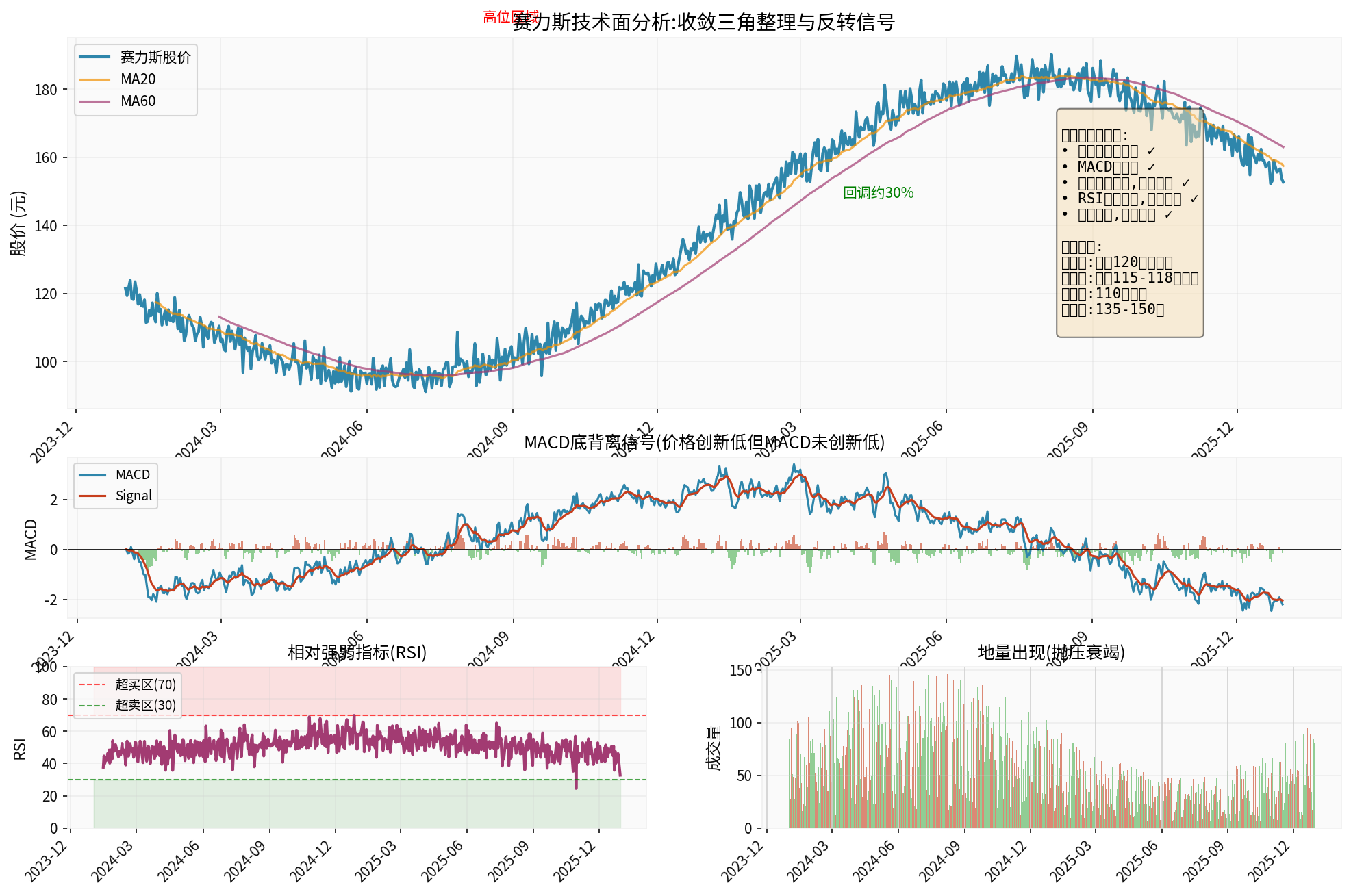

####2.1 Head and Shoulders Bottom Pattern Formed

According to technical analysis, Seres’ stock price has formed a complete head and shoulders bottom pattern [5], a classic bullish reversal pattern indicating that the trend may shift from decline to rise.

####2.2 MACD Bottom Divergence Signal

The MACD indicator shows bottom divergence, meaning the stock price hits a new low but MACD does not—this is a strong reversal signal [6]:

- Indicates fading downward momentum

- Bullish forces are accumulating

- High probability of rebound

####2.3 Convergent Triangle Consolidation, Imminent Breakout

The stock price oscillates within a convergent triangle, with gradually narrowing volatility, indicating the market is waiting for a direction choice. Combined with fundamental improvements, the probability of an upward breakout is high.

####2.4 Low Volume Appears, Selling Pressure Exhausted

Trading volume continues to shrink to low levels, indicating:

- Drying up of sell orders, sufficient release of selling pressure

- Strong market wait-and-see sentiment

- Easy to form an upward breakout once catalytic factors appear

Chart: Seres Stock Price Trend, MACD Bottom Divergence, RSI, and Volume Analysis

####2.5 Reasonable Pullback Range

A pullback of about 30% from the high is a normal technical correction, with no panic selling, indicating:

- Relatively stable confidence among holders

- Adjustment is more of a technical repair rather than fundamental deterioration

- Current position has a margin of safety

####3.1 Accelerated Internationalization via Hong Kong IPO

Seres successfully listed on the Hong Kong Stock Exchange in November 2025 [4]:

- Net proceeds reached 14.016 billion Hong Kong dollars, setting a record for the largest auto IPO in Hong Kong in 2025

- Fund use: 70% for R&D investment, 20% for overseas market expansion, 10% for operating capital

- Becomes the first domestic luxury new energy auto company listed on both A-share and Hong Kong markets

####3.2 Overseas Expansion Plan

Seres’ global layout has initially展开 [7]:

- Market side: Products have entered multiple countries in Europe, the Middle East, the Americas, and Africa; European business expanded to key regions like Norway, Germany, the UK, and Switzerland

- Manufacturing side: Overseas factory layout实现 a leap from “product export” to “manufacturing export”, fully replicating domestic intelligent manufacturing factory experience

- Technology output: Leveraging core technologies like semi-solid die-casting, it exports manufacturing standards and L3 autonomous driving technology overseas

####3.3 Sustained Performance Release in 2025-26

Based on the strong performance of the AITO M9/M7 and overseas expansion, market consensus expects:

- 2025: AITO M9 monthly sales stable above 20,000 units, AITO M7 monthly sales stable above 30,000 units; annual sales expected to exceed 500,000 units

- 2026: With overseas channel expansion and new models (e.g., AITO M8) launched, performance expected to maintain high growth

- Profitability: Gross profit margin and net profit margin expected to further improve, scale effects显现

####3.4 Optimized Industry Competition Pattern

Compared with “NIO, Xpeng, Li Auto”, Seres’ advantages in the high-end market are increasingly obvious [8]:

- Gross profit margin advantage: Seres’ 29.38% vs Li Auto’s16.3% vs Xpeng’s13%

- Product positioning: Seres focuses on the high-end market above 500,000 yuan, with relatively mild competition

- Channel efficiency: HarmonyOS Intelligent Mobility adopts a “direct + dealer” model, with stronger channel sinking capabilities

####4.1 Valuation Level

- Current stock price: Approximately 120 yuan (December 2025)

- Total market capitalization: Approximately 210.2 billion yuan

- Dynamic P/E ratio: 29.68x

- P/B ratio:7.70x

- Compared with its profitability (ROE 24.05%), current valuation is not high

- Considering its dominant position in the high-end market and growth, valuation is supported

- Compared with new energy leaders like Tesla and BYD, valuation is in a reasonable range

####4.2 Upside Calculation

- Assume 2026 net profit reaches 10 billion yuan

- Give 30x PE (considering growth)

- Corresponding market capitalization:300 billion yuan, upside about43%

- Assume2026 net profit reaches12 billion yuan

- Overseas expansion exceeds expectations

- Give35x PE

- Corresponding market capitalization:420 billion yuan, upside about100%

- Intensified industry competition

- Sales below expectations

- Stock price maintains oscillation or slight decline

####5.1 Financial Risks

- Debt ratio as high as76.36%[1], need to pay attention to cash flow status and refinancing pressure

- Accounts receivable book value continues to grow, need to be alert to bad debt risks

####5.2 Operational Risks

- High dependence on Huawei: If Huawei adjusts its strategy or cooperation issues arise, it will affect the company’s development

- New energy vehicle industry competition intensifies; Tesla price cuts, BYD sinking, new势力 breakthroughs may squeeze market space

####5.3 Technical Risks

- Uncertainty in intelligent driving technology routes

- Accelerated technology iteration speed, high R&D investment pressure

####5.4 Market Risks

- Short-term stock price fluctuations may be affected by market sentiment

- High valuation level; if performance is below expectations, it may face pullback pressure

- Buy时机: Break through the key resistance level of 120 yuan to chase up

- Stop-loss level: Below110 yuan

- Target level:135-150 yuan (near previous high)

- Position:30-50%

- Buy时机: Layout during the pullback to the 115-118 yuan range

- Stop-loss level:110 yuan

- Target level:135-150 yuan

- Position:20-30%

- Buy时机: Build positions in batches, buy more as it falls

- Holding period:12-24 months

- Expected return:50-100%

- Core logic: High-end market dominance + deep Huawei binding + overseas expansion

- Monthly sales: Whether AITO M9 monthly sales can maintain above20,000 units

- Gross profit margin: Whether it can stabilize above28%

- Overseas progress: Overseas expansion speed after Hong Kong IPO

- Cooperation deepening: Whether there are new cooperation models or products with Huawei

Seres has successfully transformed from a “Huawei contract manufacturer” to a “high-end new energy vehicle company”. Its dominant position in the high-end market, deep binding with Huawei, and internationalization strategy together form the foundation for a “turnaround”. Multiple reversal signals on the technical side further confirm the maturity of the investment opportunity.

[1] Jinling API Data - Seres Financial Data and Real-Time Quotes

[2] AITO M9 Two Years After Launch: Behind the 260,000 Cumulative Deliveries - Reconstruction of China’s Luxury Car Value (Caifuhao, 2025-12-27)

[3] HarmonyOS Intelligent Mobility AITO M9 Cumulative Deliveries Exceed260,000 Units Two Years After Launch (Sina Finance, 2025-12-28)

[4] Top 10 IPOs in the Auto Circle: Who is Worth Investing in? (Autohome,2025-12-28)

[5] December29, Monday: Technical Panorama of Hot Volatile Stocks (Caifuhao,2025-12-29)

[6] TradingView Technical Analysis Resources (TradingView)

[7] One Month After Seres’ Hong Kong IPO: Internationalization Strategy Gains Capital Focus (Sina Finance,2025-12-19)

[8] Monthly Sales 30,000 vs70,000: Behind the Sales Differentiation of New Power Brands (Sina Finance)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.