In-depth Analysis of Moutai's Moat: Symbiotic Relationship Between Quality and Brand

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

As a personal investor with heavy holdings in Moutai, your question hits the core of value investing. Based on the latest market data analysis and professional research [1,3,5,7], I will systematically dissect Moutai’s quality and brand moats from an investment perspective, and evaluate the competitive landscape and sustainability.

As of the close on December 29, 2025, Guizhou Moutai (600519.SS) closed at 1402.00 yuan (-0.86% from the previous trading day), with a total market capitalization of approximately 1.76 trillion yuan [0]. Over the past year, the stock price has fallen by about 8.07% [0].

Key financial indicators (TTM) [0]:

- Net Profit Margin: 51.51%

- Operating Profit Margin:71.37%

- ROE (Return on Equity):36.48%

- Current Ratio:6.62

- P/E Ratio: ~19.55x

These figures confirm your observation of “Moutai’s high gross profit margin”—its profitability ranks top in A-shares and even the global consumer goods sector.

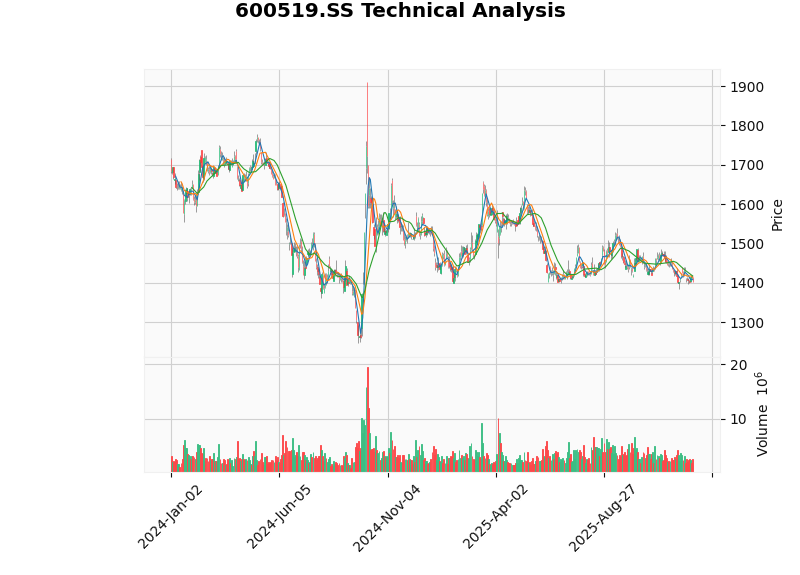

Based on technical analysis from January 1,2024 to December30,2025 (600519.SS, benchmark SPY) [2]:

- Latest closing price:1402.00 (Dec29,2025)

- β:0.72

- MACD: death_cross (bearish)

- KDJ: bearish

- RSI(14): normal range

- Trend judgment: sideways/no clear trend; reference trading range ~1394.25—1417.16

- Support: ~1394.25; Resistance: ~1417.16[2]

K-line Chart:

The technical outlook shows a recent sideways pattern with cautious short-term indicators; combining fundamental and moat analysis provides a more comprehensive risk-return assessment.

###1. Geographic Monopoly:15.03 sq km “Microecosystem Kingdom”

The core production area of Moutai Town is ~15.03 sq km, located in the “Golden Triangle” along the Chishui River. Its unique microclimate, water quality, soil, and microbial community form an immovable microecosystem [3,5,7].

- Chishui River water is pure with beneficial minerals;

- Humid climate and rich microbial air form a unique microecosystem—replicating the process elsewhere fails to reproduce the flavor;

- National origin protection limits “Moutai Liquor” production to specific Moutai Town areas [3].

This geographic monopoly raises entry barriers significantly.

###2. Process Barrier: Time Code of the12987 Traditional Brewing Process

Moutai follows the 12987 process:1 production cycle/year,2 feedings,9 cookings,8 fermentations,7 distillations, then ≥5 years of cellar storage before launch [3,5,7].

- Highly dependent on manual experience and natural rhythms (e.g., Dragon Boat Festival starter making, Double Ninth Festival grain feeding);

- From local Hongyingzi sorghum to fermentation/blending, all controlled manually by experienced distillers.

This makes replication extremely hard and the process an intangible cultural heritage barrier [3,5].

###3. Microbial Black Box: Science vs Metaphysics

Research shows Moutai Town’s microbial community evolved over decades, forming an unreplicable system—process migration elsewhere cannot reproduce the flavor [3,5,7].

- Despite advances in microbiology, restoring the full “flavor fingerprint” remains challenging;

- This black box further strengthens the quality moat.

###4. Quality Stability: Scale vs Consistency

Quality consistency is harder than single-bottle quality. Moutai maintains stability via strict standards and large-scale production—scarce among competitors.

- Long-term high margins and supply shortages allow continuous investment in quality systems;

- Industry research shows famous liquors have stronger resilience in price/index and inventory adjustment [5].

###1. Symbolic Value: Cultural Totem Beyond Commodity

- Core premium: Brand sits at the center of “scarce resources + high-end identity + cultural recognition” [3,5];

- From the First State Banquet to national gifts, Moutai has become a national symbol [3].

###2. Social Currency: Hard Currency Attribute

- Strong collection/investment value; high recognition in weddings/business dinners;

- Ultra-high-end shipments perform strongly during festivals [5], enhancing social currency value.

###3. Digitalization & Service Ecosystem

- iMoutai online channel share increases, enabling precise marketing and channel control;

- Building an iMoutai ecosystem (cultural complexes, tasting experiences, liquor-tourism integration) to transform transactions into emotional connections and drive second growth curves [1].

Conclusion:

| Dimension | Quality Moat | Brand Moat |

|---|---|---|

| Formation Time | Decades-centuries (geography/process/cellars) | Decades (marketing/culture/events) |

| Replicability | Extremely low | Medium (requires time/huge investment) |

| Sustainability | Extremely strong | Strong (needs continuous investment) |

| Vulnerability | Quality decline erodes brand foundation | Consumer preference shifts/negative events weaken symbolic value |

Industry data:

- Mainstream sauce-flavored liquors (Honghua Lang, Guotai Guobiao, etc.) trade at ~300 yuan [5];

- 2024 sauce-flavored liquor production was ~650k kiloliters (first decline in6 years)—small enterprises closed, head concentration increased [5].

- Geographic immovability;

- Process/microbial black box;

- Scale consistency is hard to match;

- Consumer symbolic recognition of Moutai is irreplaceable short-term.

- Valuation-Growth Match: P/E ~19.5x, ROE>36%—strong profitability with rational growth [0,1];

- Channels/Inventory: Industry de-stocking ongoing—top brands have stronger resilience [5];

- Long-term Drivers: High-endization/head concentration, digitalization/internationalization, product+brand+service barriers [1,3];

- Risks: Policy (tax/price regulation), demographic changes, substitutes (low-alcohol/whiskey), short-term weak technicals (MACD/KDJ bearish) [2,5].

- Quality and brand are symbiotic—both form an insurmountable barrier;

- Quality moat has stronger long-term sustainability;

- No short-term quality replicators exist;

- Long-term: Moutai remains a high-quality asset. Short-term: Monitor inventory/technical trends. Recommendations:

- Track channel inventory and price stability;

- Evaluate brand/service innovation;

- Watch policy and substitute trends.

Finally, the “brand over quality” view does not negate quality—it emphasizes brand as the value amplifier. Your experience (quality as moat anchor) aligns with the product+brand+service moat logic.

[0] Gilin API Data (600519.SS)

[1] Behind Counter-trend Growth: Moutai Sauce-flavored Liquor’s Strategic Resilience - Xinhuanet (2025) [Online Search]

[2] Technical Analysis:600519.SS (2024-01-01 to 2025-12-30) [Brokerage API Tool technical_analyze] [Chart] https://gilin-data.oss-cn-beijing.aliyuncs.com/financial_charts/930377e6_600519_SS_kline.png

[3] Moutai’s Quality & Brand - Huxiu (2025-12-28) [Online Search]

[4] Moutai’s Quality & Brand - Xueqiu (Discussion) [Online Search]

[5] Liquor Festival Consumption Differentiation - Securities Times (Industry Observation) [Online Search]

[6] Moutai’s Moat: Geography/Process/Scarcity/Brand - CSDN (2025)

[7] Why Is Moutai So Expensive? - CSDN (2025-11-27)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.