Analysis of Seres' Outperformance in the Low-Growth Auto Market in 2026

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

The following analysis is based on publicly available data and brokerage forecasts, and summarizes how Seres can achieve market outperformance in the low-growth environment of 2026.

- Market Environment and Core Data (Source: Brokerage Forecasts and Online Searches)

- Overall auto market growth expectation: Nomura Securities predicts China’s auto sales will reach approximately 28.75 million units in 2026, a year-on-year increase of about 2%, which is a stock/micro-growth phase characterized by ‘high sales volume, low growth rate’ [10].

- Industry trend: The penetration rate of new energy vehicles is expected to further increase, the market is shifting from incremental to stock competition, and competition will become more intense [9].

- Seres’ Growth Targets and Implementation Path

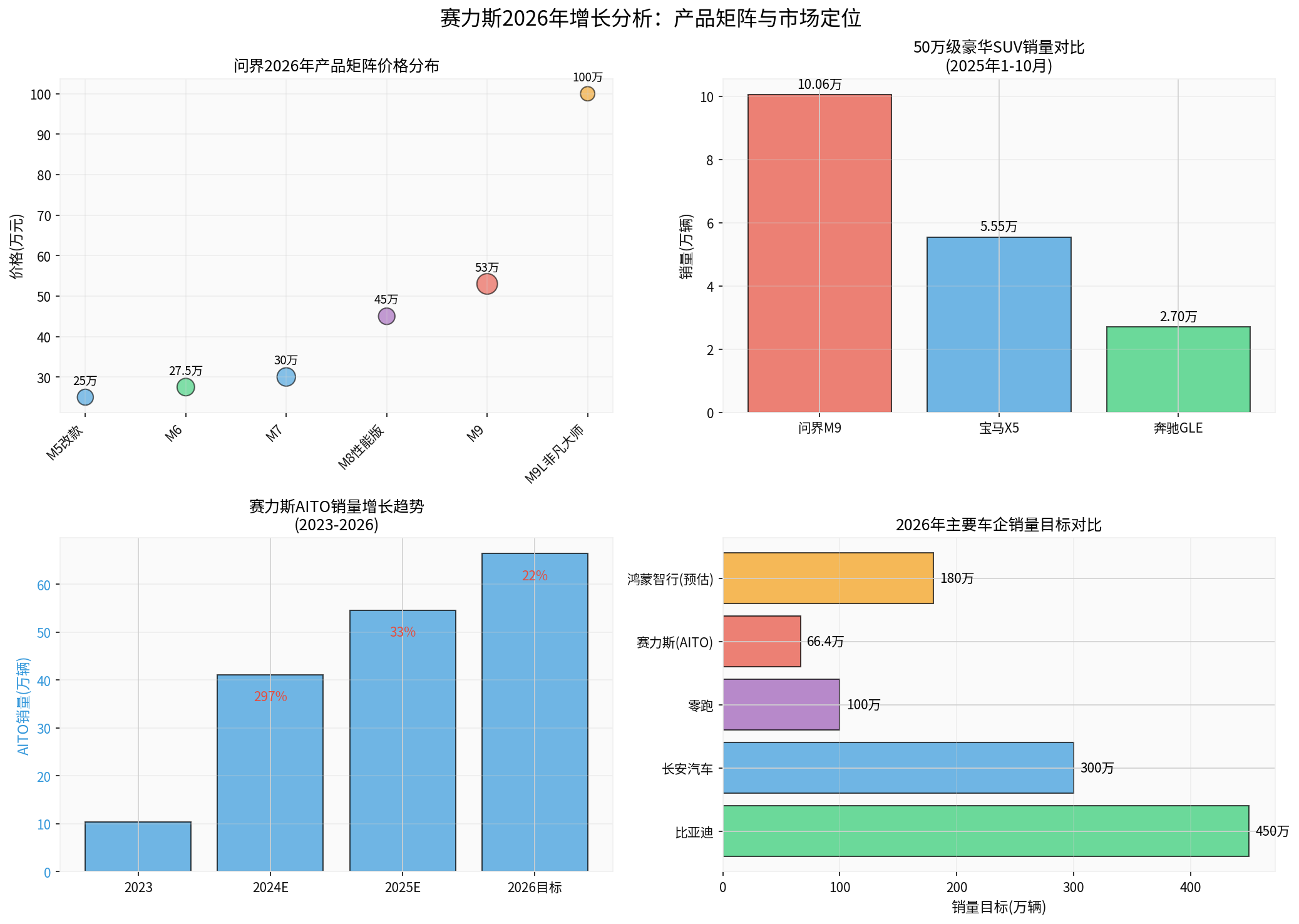

- Sales targets and growth rate: Soochow Securities predicts AITO’s sales will be 546,000 units/664,000 units in 2025/2026, with year-on-year growth rates of approximately 33%/22% [1]. Following this path, a growth rate of over 20% can be achieved in 2026, significantly outperforming the market’s approximately 2% growth rate [1][10].

- Increment sources (based on product planning and existing model performance):

- AITO M9: Flagship model’s stock replacement effect

- From January to October 2025, AITO M9 sales reached approximately 100,600 units, ranking first among luxury SUVs in the 500,000 RMB class, higher than BMW X5 (55,500 units) and Mercedes-Benz GLE (27,000 units) [11].

- As of December 2025, cumulative deliveries of AITO M9 exceeded 260,000 units; it accounted for approximately 70% of China’s new energy market above 500,000 RMB, and 85% of users came from trade-ins or upgrades from traditional luxury brands such as Mercedes-Benz, BMW, and Audi [11][12].

- In November 2025, AITO M9 topped China’s passenger car sales list for models above 500,000 RMB, and its 1-year residual value rate reached approximately 78%, ranking first in plug-in hybrid/extended-range residual value rates for several consecutive months [11][12].

- New product matrix (2026): Fill gaps and strengthen competitiveness

- AITO M6: Mid-to-large SUV, expected price range 250,000-300,000 RMB, filling the price gap between M5 and M7 [5].

- M9L: Long-wheelbase version, targeting higher-positioned markets (e.g., million-level luxury) [5].

- M5 facelift: Iterative upgrade to consolidate the mid-to-high-end household market [5].

- M8 performance version: Enhance performance and product strength to cover mid-to-high-end segmented needs [4].

- Channels and ecosystem (HarmonyOS Intelligent Mobility)

- In 2026, HarmonyOS Intelligent Mobility (AITO, Zhijie, Xiangjie, Shangjie, Zunjie) will launch more than ten new models, covering the full price range from 150,000 to 1 million RMB, and all categories from sedans, SUVs to MPVs and hard-core off-road vehicles [2][5].

- HarmonyOS Intelligent Mobility is advancing toward the target of approximately 1.3-2.2 million annual sales in 2026, and ecosystem synergy is expected to further amplify AITO’s channel and brand momentum [9].

- AITO M9: Flagship model’s stock replacement effect

- Financial and Cost Perspective Considerations (Based on Obtained Information)

- Scale effect: If AITO’s sales reach the predicted 664,000 units in 2026 [1], the scale effect is expected to dilute per-unit fixed costs and R&D expenses, supporting profitability.

- Policy and cost factors: Public information indicates policy changes such as purchase tax subsidies in 2026 and fluctuations in raw material/battery costs [7][9]. Industry-level cost pressures will test each company’s supply chain management and pricing capabilities; Seres’ actual bearing capacity shall be subject to its subsequent announcements and financial reports.

- Competitors and Relative Positioning (Based on Public Targets)

- 2026 targets of major auto companies (public reports from online searches): BYD approximately 4.5 million units, Changan Automobile approximately 3 million units, Leapmotor approximately 1 million units, and HarmonyOS Intelligent Mobility’s overall target approximately 1.3-2.2 million units [7][8][9].

- Compared with Leapmotor, BYD, etc., Seres has formed certain differentiated advantages in the high-end path (represented by AITO M9) and residual value rate [11][12].

- Key Observations (Based on Public Information)

- Execution delivery: The achievement of the above target of 550,000 units (with 664,000 units as the upper limit) depends on the timely launch of new products and supply chain stability [1][5].

- Market penetration: Whether the high-end market above 500,000 RMB can maintain its current high share, and whether new models can open up incremental space, will be key variables [11][12].

- Technology and ecosystem: The iteration rhythm of Huawei’s intelligent driving, cockpit, and HarmonyOS ecosystem capabilities will directly affect product competitiveness and user reputation [2][5].

- Risks and Uncertainties (From Public Reports and Market Forecasts)

- Macroeconomic demand: If the actual growth rate of the auto market is lower than expected (e.g., Nomura’s prediction of approximately 2%), industry competition will further intensify [10].

- Policy and cost: Subsidy withdrawal, fluctuations in raw material and battery costs may compress profit margins [7][9].

- Execution risk: The parallel development of multiple models, capacity ramp-up, and channel expansion are difficult to execute; attention should be paid to delivery rhythm and quality control stability.

(Chart description: The above chart shows the price distribution of AITO’s 2026 product matrix, sales comparison of 500,000 RMB-class luxury SUVs, AITO’s sales growth trend, and sales target comparison of major auto companies in 2026. Data sources are as marked in the text.)

References

- Jinling API Data (Brokerage Forecasts and Industry Data): [0]

- Soochow Securities’ “2025 Investment Strategy for Automotive Intelligence” on Seres’ Performance Forecasts (Including AITO Sales and YoY Growth): [1] https://pdf.dfcfw.com/pdf/H3_AP202412081641219266_1.pdf?1733653259000.pdf

- Sohu Auto: 2026 New Model Plans of Major Auto Companies (Including AITO M6, Zhijie V9, etc.): [5] https://db.m.auto.sohu.com/model_6803/a/968206637_122597549

- Autohome: 2026 AITO New Car Preview (M6, M9L, etc.): [4] https://chejiahao.autohome.com.cn/info/24604550

- Phoenix Auto: 2026 New Car Plan of HarmonyOS Intelligent Mobility (Five Brands Layout, Over Ten New Models): [2] https://auto.ifeng.com/c/8pTpsXM3Raa

- Nomura Securities Global Automotive Industry Report (China’s 2026 Auto Sales Forecast of Approximately 28.75 Million Units, YoY +2%): [10] https://m.sohu.com/a/970411750_122594?scm=10001.325_13-325_13.0.0-0-0-0-0.5_1334

- Caifuhao: 2026 New Energy Vehicle Forecasts (Leapmotor’s 1 Million Units, BYD’s 4-4.5 Million Units, HarmonyOS Intelligent Mobility’s 1.3-2.2 Million Units Target and Industry Penetration): [9] https://caifuhao.eastmoney.com/news/20251221165849441149020

- Sohu: 2026 Sales Targets of Independent Auto Companies (BYD, Changan, Leapmotor, etc.): [8] https://www.sohu.com/a/969627115_389163

- Jiemian News: Leapmotor’s 2026 1 Million Units Target and Internal Letter Disclosure: [7] https://www.jiemian.com/article/13824009.html

- Huxiu: AITO M9’s “Triple Crown” Performance in 500,000 RMB-class Luxury Market (Sales, NPS, Residual Value Rate) (Including Sales Comparison): [11] https://www.huxiu.com/article/4820241.html

- Caifuhao: AITO M9’s 260,000 Units Delivery in Two Years and Residual Value Rate Data: [12] https://caifuhao.eastmoney.com/news/20251227230926755879680

- Zhong’an Online: HarmonyOS Intelligent Mobility’s 2026 New Energy Market Attack (Five Brands Layout and Million Units Target): [9] http://auto.anhuinews.com/rdzx/202512/t20251225_8996477.html

- New Energy Vehicle Industry Analysis (BEV New Car Launch and Market Trend): [9] http://www.cadcc.com.cn/article/3010.html

- Sohu: Nomura Securities’ Growth Forecasts for 2026 China and US Auto Markets: [10] https://m.sohu.com/a/970411750_122594?scm=10001.325_13-325_13.0.0-0-0-0-0.5_1334

- Autohome: AITO M9’s Sales and Share in 500,000 RMB-class Luxury Vehicles (Approximately 7 out of 10 are AITO M9): [11] https://www.huxiu.com/article/4820241.html

- China Automobile Dealers Association Residual Value Rate Report (AITO M9 Ranked First in Plug-in Hybrid/Extended-range Residual Value Rate for Several Consecutive Months): [11][12] https://www.huxiu.com/article/4820241.html, https://caifuhao.eastmoney.com/news/20251227230926755879680

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.