Analysis of the Impact of 2026 Electricity Market Reform on New Energy Projects and Power Operators

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the background information you provided, I will systematically analyze the far-reaching impact of the 2026 electricity market reform on new energy projects and power operators from the perspective of investment value analysis. This is a historic turning point from ‘policy-driven’ to ‘market-driven’.

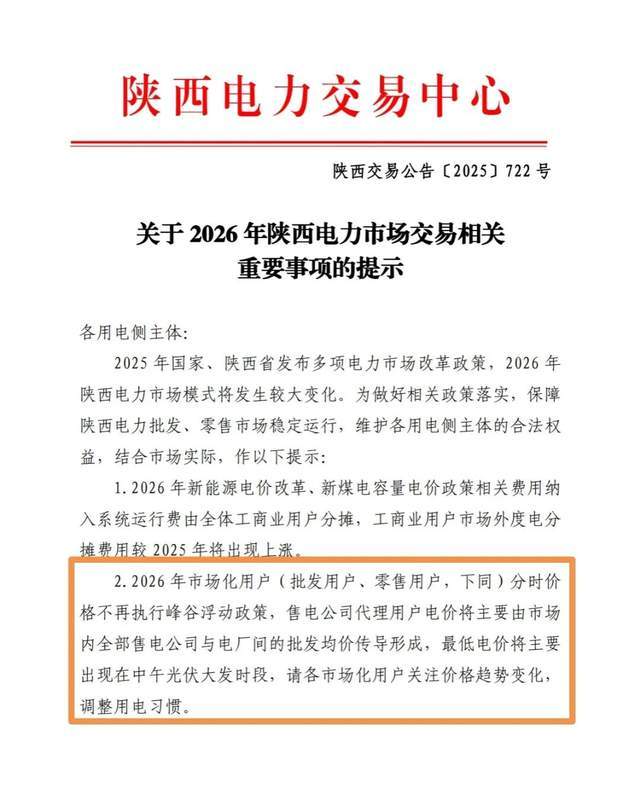

On January 27, 2025, the National Development and Reform Commission (NDRC) and the National Energy Administration jointly issued the Notice on Deepening the Market-oriented Reform of New Energy Grid-connected Electricity Prices and Promoting the High-quality Development of New Energy (NDRC Price [2025] No.136), marking the official transition of China’s new energy industry from ‘policy-driven’ to ‘market-driven’. The core of the document is to divide existing and incremental projects with

- Guarantee Mechanism: Enjoy mechanism electricity price protection through the price difference settlement mechanism; the part where the average market transaction price is lower than the mechanism electricity price will be settled by the power grid company through price difference.

- Electricity Price Level: The mechanism electricity price is not higher than the coal-fired benchmark electricity price (about 0.4 yuan/kWh).

- Electricity Volume Scale: The mechanism electricity volume is consistent with the guaranteed electricity volume, but it will be gradually diluted as new energy projects increase.

- Provincial Differences: There are significant differences in mechanism electricity prices across provinces:

- Zhejiang Province: 0.4153 yuan/kWh

- Henan Province: 0.3779 yuan/kWh

- Guizhou Province: 0.3515 yuan/kWh

- Gansu Province: 0.3078 yuan/kWh

- Provinces with good absorption capacity: Up to 90% or more

- Provinces with high absorption pressure: As low as 10-30%

- Pricing Mechanism: Mechanism electricity prices are determined annually through fully market-oriented bidding.

- Market Participation: Must participate in centralized bidding or real-time bidding for grid connection.

- Price Risk: In the spot market, prices may drop to 0.1 yuan/kWh or even negative electricity prices.

- Bidding Results: There are significant differences in mechanism electricity prices for incremental projects across provinces:

- Heilongjiang: 0.2281 yuan/kWh

- Tianjin: 0.3196 yuan/kWh

- Shanghai: 0.4155 yuan/kWh (the highest so far)

- Guizhou: 0.19~0.3515 yuan/kWh

According to data from the National Energy Administration, negative electricity prices showed a trend of ‘from occasional to normalized’ from 2024 to 2025 [2]:

| Province | Negative Electricity Price Situation | Duration |

|---|---|---|

| Shandong | Approached 1000 hours for two consecutive years from 2023 to 2024 | May exceed 1000 hours in 2025 |

| Zhejiang | Reported -0.2 yuan/kWh for two consecutive days in January 2025 | Individual time periods |

| Mengxi | Dropped to a minimum of -0.004 yuan/kWh in April 2025 | Short-term occurrence |

| Sichuan | Full-day negative electricity prices appeared in September 2025 | First full-day negative electricity price |

| Gansu | Frequently ‘hit the bottom’ at the positive floor price of 40 yuan/MWh (0.04 yuan/kWh) | High-frequency occurrence |

- Surge in new energy installed capacity: By the end of 2024, China’s new energy installed capacity reached 1.41 billion kW, accounting for more than 40% of the country’s total power installed capacity [1].

- Mismatch between power generation and load: New energy generation peaks (e.g., midday photovoltaic generation) do not match electricity load peaks.

- Insufficient regulation capacity: The power system’s absorption and regulation capacity for new energy cannot grow in a short period.

- Price mechanism liberalization: Document No.136 clearly states ‘appropriately relax spot market price limits’, and many provinces have adjusted the quotation lower limit to negative values [2].

Zhang Yanqin, Deputy Director of the Market Supervision Department of the National Energy Administration, clearly stated: ‘

In 2024, the proportion of negative electricity price clearing periods in Germany’s electricity spot market was 5% (468 hours), and in the first half of 2025, the proportion of negative electricity price periods in Germany, the Netherlands, and Spain reached 8%-9% [2]. In contrast, the frequency of negative electricity prices in Shandong Province has far exceeded that in Germany.

- Protected Period Revenue: Electricity volume during the mechanism electricity price protection period enjoys stable electricity prices (e.g., 0.4153 yuan/kWh in Zhejiang).

- Market-oriented Electricity Volume: The part exceeding the mechanism electricity volume needs to participate in market-oriented transactions, facing price fluctuation risks.

- Gradual Dilution: As new energy projects increase, the mechanism electricity volume is diluted, and the proportion of market-oriented electricity volume rises.

- Provincial Absorption Capacity: Provinces with good absorption capacity (e.g., Zhejiang, Jiangsu) have a mechanism electricity volume proportion of up to 90%+, while provinces with high absorption pressure (e.g., Gansu, Ningxia) may only have 10-30%.

- Resource Endowment: Provinces with good wind and solar resources have large power generation, but high absorption pressure, so market-oriented electricity prices may be lower.

- System Flexibility: The richer the regulation resources such as energy storage, pumped storage, and gas-fired units in the province, the lower the frequency of negative electricity prices.

- Short-term (1-3 years): Revenues are relatively stable, with mechanism electricity prices providing protection.

- Medium-term (3-5 years): Mechanism electricity volume is gradually diluted, the proportion of market-oriented electricity volume rises, and revenue volatility increases.

- Long-term (more than 5 years): After full marketization, revenue uncertainty is high, and it is necessary to hedge risks through diversified revenue channels such as energy storage and green power transactions.

- Large Electricity Price Fluctuations: In the spot market, electricity prices may fluctuate sharply between -0.2 yuan/kWh and 1 yuan/kWh.

- Differentiation of Time Period Value: Negative electricity prices may occur during midday photovoltaic generation peaks, and high electricity prices may occur during evening peak load periods.

- Assessment Fees: Deviation assessment fees must be paid if output forecasts are inaccurate.

- Technological Cost Reduction: Must reduce component costs and operation and maintenance costs to maintain competitiveness.

- Efficiency Improvement: Adopt high-efficiency photovoltaic components and intelligent operation and maintenance systems to improve power generation efficiency.

- Energy Storage Configuration: Although mandatory energy storage allocation has been canceled [1], configuring energy storage is still economical to avoid negative electricity prices and obtain peak-valley price differences.

- Return Expectation: Compared with existing projects, incremental projects require a higher IRR (Internal Rate of Return), generally between 8-12%.

- Risk Premium: Additional risk premium is needed to compensate for electricity price fluctuation risks.

- Differentiated Competition: Project site selection will shift from resource-oriented to a three-dimensional evaluation system of ‘resource + absorption + electricity price’.

- High Electricity Price Provinces: Existing projects in Zhejiang (0.4153 yuan) and Shanghai (0.4155 yuan) have higher value.

- Low Electricity Price Provinces: Bidding for incremental projects in Gansu (0.3078 yuan) and Heilongjiang (0.2281 yuan) is fierce.

- Provinces with high absorption pressure (Shandong, Gansu) have high frequency of negative electricity prices, and the demand for energy storage and flexibility resources is stronger.

- Provinces with strong absorption capacity (Zhejiang, Jiangsu) have relatively low frequency of negative electricity prices, but they will still appear normalized.

Traditional Role:

With the large-scale development of new energy, thermal power is transforming from a traditional main power source to a combination of basic guaranteed and system regulating power source [3].

| Revenue Type | Mechanism Description | Policy Basis |

|---|---|---|

| Electric Energy Revenue | Power generation volume × market electricity price | Electricity Spot Market |

| Capacity Electricity Price | Fixed ‘minimum wage’ to ensure fixed cost recovery | NDRC Price [2023] No.1501 |

| Peak Shaving Revenue | Auxiliary service compensation for peak shaving for new energy | Auxiliary Service Market |

| Frequency Modulation Revenue | Revenue from providing frequency regulation services such as AGC | Frequency Modulation Auxiliary Service Market |

| Reserve Revenue | Compensation for rotating reserve and non-rotating reserve capacity | Reserve Auxiliary Service Market |

- The coal-fired power capacity electricity price mechanism established in 2023 provides fixed revenue guarantee for thermal power.

- The national average capacity electricity price is about 165 yuan/(kW·year) (including tax).

- Some provinces such as Sichuan are higher than the national average [2].

According to data from the National Energy Administration, China’s electricity auxiliary service market is expanding rapidly [3]:

- Provincial Peak Shaving Markets: 16

- Provincial Frequency Modulation Markets:15

- Regional Power Grids: 6 regional power grids have established auxiliary service markets such as peak shaving, reserve, and frequency modulation respectively.

- Increased Revenue Certainty: Capacity electricity prices provide stable cash flow, reducing sensitivity to coal prices and electricity prices.

- Highlighted Regulation Value: The higher the penetration rate of new energy, the stronger the demand for peak shaving and frequency modulation of thermal power.

- Asset Disposal Value: Some thermal power units are transformed from ‘burdens’ to ‘regulation resources’ through flexibility transformation.

- Change in Investment Logic: From ‘electricity volume competition’ to a comprehensive service provider of ‘capacity + regulation services’.

Document No.136 clearly states: ‘

- Sustainability of Capacity Leasing Revenue is Doubtful: Energy storage capacity leasing fees for new energy projects have always been the main revenue source of independent energy storage, and this revenue source is under pressure after the cancellation of mandatory allocation.

- Limited Arbitrage Space in Spot Market: Under the background of normalized negative electricity prices, the arbitrage space of peak-valley price differences is squeezed.

- Capacity Electricity Price Mechanism Not Yet Established: Except for a few regions such as Inner Mongolia, most provinces have not established an energy storage capacity compensation mechanism.

- Compensation Standard: 0.35 yuan/kWh (2025 fiscal year)

- Implementation Period: 10 years

- Enlightenment: The capacity electricity price mechanism is the key policy direction to support the economy of independent energy storage [1].

Despite short-term pains, long-term energy storage demand will still grow rapidly:

- Rigid Demand for New Energy Absorption: The higher the penetration rate of new energy, the stronger the demand for energy storage.

- Flexibility Gap in Power System: Pumped storage and electrochemical energy storage are still the main flexibility resources.

- Cost Reduction Trend: With technological progress and scale effects, energy storage costs continue to decline.

InfoLink predicts that China’s new energy storage market installed capacity will reach 112 GWh in 2025, with a year-on-year growth rate of about 9% [1]. However, if the supporting progress of local policies is lower than expected, there may be an industrial transition pain period from 2026 to 2027.

- Priority is given to areas with the best wind and solar resources.

- Focus on resource endowment (hours, irradiation, wind speed).

- Pursue scale expansion and installed capacity growth.

- Three-dimensional Evaluation System: Resource endowment + absorption capacity + electricity price level.

- Province Selection Strategy:

- High electricity price + good absorption: Zhejiang, Jiangsu, Shanghai (preferred for existing projects)

- High resource + good absorption: Guangdong, Shandong (opportunities for incremental projects)

- High resource + poor absorption: Gansu, Ningxia (cautious investment)

- Refined Layout: From ‘land grabbing’ to ‘refined layout’.

- Electric Energy Revenue: Medium and long-term contracts + spot market.

- Green Power/Green Certificate Revenue: Monetization of green power environmental value.

- Auxiliary Service Revenue: Providing peak shaving, frequency modulation and other services.

- Capacity Revenue: Future possible new energy capacity electricity price mechanism.

- Energy Storage Arbitrage: Configuring energy storage to obtain peak-valley price differences.

- Flexibility Transformation: Improving regulation capacity through technological upgrading.

- New energy installed capacity has shifted from supplementary energy to main power source (accounting for more than 40%).

- Absorption bottlenecks are increasingly prominent, and the era of ‘blind expansion’ is over.

- Technical Transformation and Upgrade: Old projects improve power generation efficiency through technical transformation.

- Energy Storage Matching: Existing projects configure energy storage to improve output curves.

- Power Prediction: Improve prediction accuracy to reduce assessment fees.

- Market Transaction Capability: Establish a professional electricity transaction team.

- Pre-investigation: Fully evaluate the absorption capacity and electricity price level of the province where the project is located.

- Flexible Configuration: Configure flexibility resources such as energy storage and gas-fired units according to market conditions.

- Multi-energy Complementation: Wind-solar-storage, wind-solar-water, wind-solar-thermal and other multi-energy complementary projects improve stability.

- Long-term Agreements: Sign long-term power purchase agreements (PPA) with users to lock in revenue.

- High electricity price + high absorption: Zhejiang (0.4153 yuan), Shanghai (0.4155 yuan), Jiangsu

- Medium electricity price + medium absorption: Henan (0.3779 yuan), Guangdong

- Low electricity price + high absorption pressure: Gansu (0.3078 yuan), Heilongjiang (0.2281 yuan)

- High frequency of negative electricity prices: Shandong, Mengxi

- Evaluate the mechanism electricity volume protection ratio and duration of the province where the project is located.

- Pay attention to the construction progress of the provincial electricity spot market and the frequency of negative electricity prices.

- Consider configuring energy storage or participating in the auxiliary service market to hedge risks.

- IRR Requirement: It is recommended to be 8-12% (including risk premium).

- Own Capital Ratio: It is recommended to be no less than 30% to avoid excessive leverage.

- Energy Storage Configuration: Even if mandatory allocation is canceled, it is still recommended to configure 10-20% energy storage.

- Province Selection: Provinces with strong absorption capacity and reasonable electricity price levels such as Guangdong, Zhejiang, and Jiangsu.

- Resource + Market Balance: Do not simply pursue the best resources, but balance ‘resource-market-absorption’.

- Flexibility Resource Matching: Match energy storage, gas-fired units or flexibly transformed thermal power.

- Long-term Agreements: Sign long-term PAs with industrial users to lock in base load revenue.

- From ‘fuel cost game’ to ‘capacity value investment’.

- Pay attention to the progress of flexibility transformation and revenue from the auxiliary service market.

- Priority is given to provinces with high capacity electricity prices and mature auxiliary service markets.

- Capacity electricity prices provide stable cash flow, reducing performance volatility.

- Revenue from peak shaving and frequency modulation services grows with the increase in new energy penetration rate.

- Some thermal power units improve their value through ‘Three Reforms Linkage’ (energy-saving and carbon reduction reform, flexibility reform, heating reform).

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.