Guide to Building a Barbell Strategy Position Allocation System

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on your shared investment evolution journey, the following systematically explains how to build an effective barbell strategy between “deterministic investments” and “high-odds investments”.

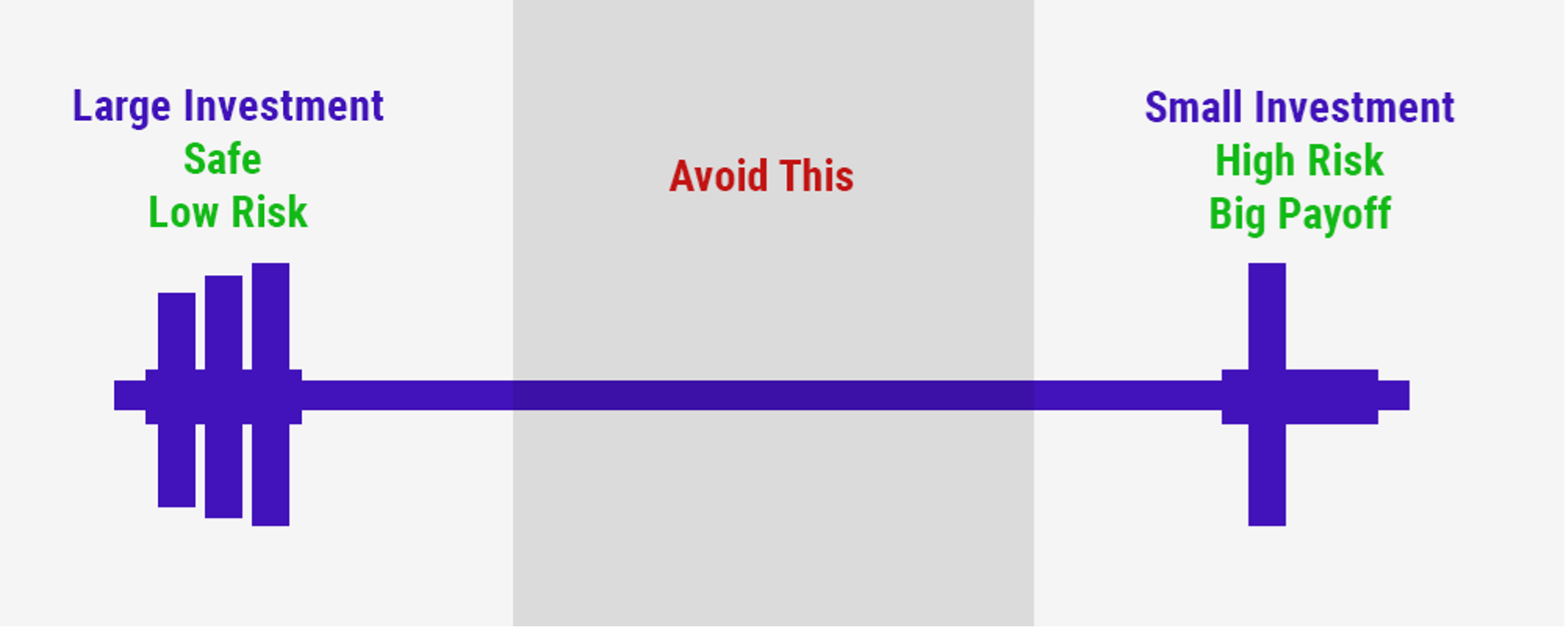

The barbell strategy is an

- One end: Deterministic assets(high win rate, medium-low returns)

- The other end: High-odds assets(low win rate, high returns)

- Middle: Abandon mediocre assets

Expected return = Win rate × Return magnitude - (1-Win rate) × Loss magnitude

- Strong cash flow and moat

- Stable industry position (leader/oligopoly)

- Reasonable or undervalued valuation

- Dividend yield >3%

| Allocation Principle | Specific Requirements |

|---|---|

| Single stock upper limit | 8-12% |

| Number of positions | 8-15 |

| Industry concentration | Single industry <40% |

| Turnover rate | <50% per year |

- Cognitive depth: >90 points (fully understand the business model)

- Margin of safety: >20% discount to intrinsic value

- Downside risk: <15%

- Disruptive technology or business model

- Large market space (10x potential)

- Early stage/high controversy

- Valuation difficulty or large market divergence

| Allocation Principle | Specific Requirements |

|---|---|

| Single stock upper limit | 2-5% |

| Number of positions | 10-20 |

| Industry diversification | Cover 3-5 emerging tracks |

| Dynamic adjustment | Quarterly evaluation |

- Layered buying: Initial 1%,加仓 to 3-5% after verification

- Stop-loss discipline: Mandatory review triggered at -30%

- Time stop-loss: Exit process initiated if no progress in 18 months

├── Deterministic positions: 45%

│ ├── Core positions (5-8% ×5 stocks) =25-40%

│ └── Satellite positions (2-3% ×5 stocks)=10-15%

│

├── High-odds positions:25%

│ ├── Headline opportunities (3-5% ×3-4 stocks)=10-15%

│ └── Exploratory opportunities (1-2% ×8-10 stocks)=10-15%

│

├── Cash/flexible positions:20%

│ ├── Strategic cash (10%):应对 systemic risks

│ └── Flexible funds (10%): Capture sudden opportunities

│

└── Risk hedging:10%

├── Volatility hedging (5%)

└── Industry neutrality (5%)

- Adjust when deterministic position deviation exceeds 5%

- Adjust when high-odds position deviation exceeds3%

- Reduce/increase position when a single stock rises/falls more than 50% of initial position

- Increase deterministic positions to55% when market VIX index >25

- Increase high-odds positions to35% when market VIX index <12

- Reduce high-odds positions by50% when personal win rate <50% for 3 consecutive months

###1. Stock Selection Weight (10%)

- Deterministic end:5-10 targets based on in-depth research

- High-odds end:20-30 targets based on theme screening

- Investment list: Continuously maintained, no more than50 tracked in depth

###2. Betting Strategy (40%)

f* = (bp - q) / b

Where:

b = Profit-loss ratio (expected return/expected loss)

p = Win rate

q =1-p

- Deterministic investment: f*=(0.7×1.5-0.3)/1.5=50% (actually reduced to30-40% considering portfolio risk)

- High-odds investment:f*=(0.3×5-0.7)/5=8% (actually controlled at2-5%)

- Deterministic targets:3 rounds of position building (30%→40%→30%)

- High-odds targets:2 rounds of position building (50%→50%, after verification)

###3. Psychological Management (50%)

- Deterministic positions: Provide psychological security, allowing calmness in high-odds end

- High-odds positions: Meet return expectations, prevent over-conservatism in deterministic end

- Cash positions: “Safety valve” for anxiety

- Assuming 50% loss in all high-odds positions, maximum portfolio drawdown <20%

- Assuming annualized return of only8% for deterministic positions, portfolio still has chance to outperform market

- Monitor position deviation

- Record emotion diary (psychological state of buy/sell decisions)

- Update research notes

- Evaluate 10/40/50 implementation

- Check win rate and profit-loss ratio

- Adjust single position upper limit

- Comprehensive rebalancing

- Evaluate cognitive depth score

- Update investment assumptions

- Stress test portfolio

- Avoid Middle Trap:果断 abandon targets that are neither deterministic enough nor high-odds enough

- Beware of Correlation: Correlation between deterministic assets and high-odds assets should <0.3

- Cognitive Honesty: Overestimating certainty is the biggest risk

- Survival First: No strategy should threaten principal safety

The essence of the barbell strategy is to

In the AI era, the threshold for information acquisition is lowered, but

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.