In-depth Analysis of Investment Value in the Container Shipping Industry for 2026

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

According to the latest industry data analysis, the container shipping industry in 2026 is in a

According to brokerage API data and online search information, the handheld order volume of the container shipping industry has exceeded the

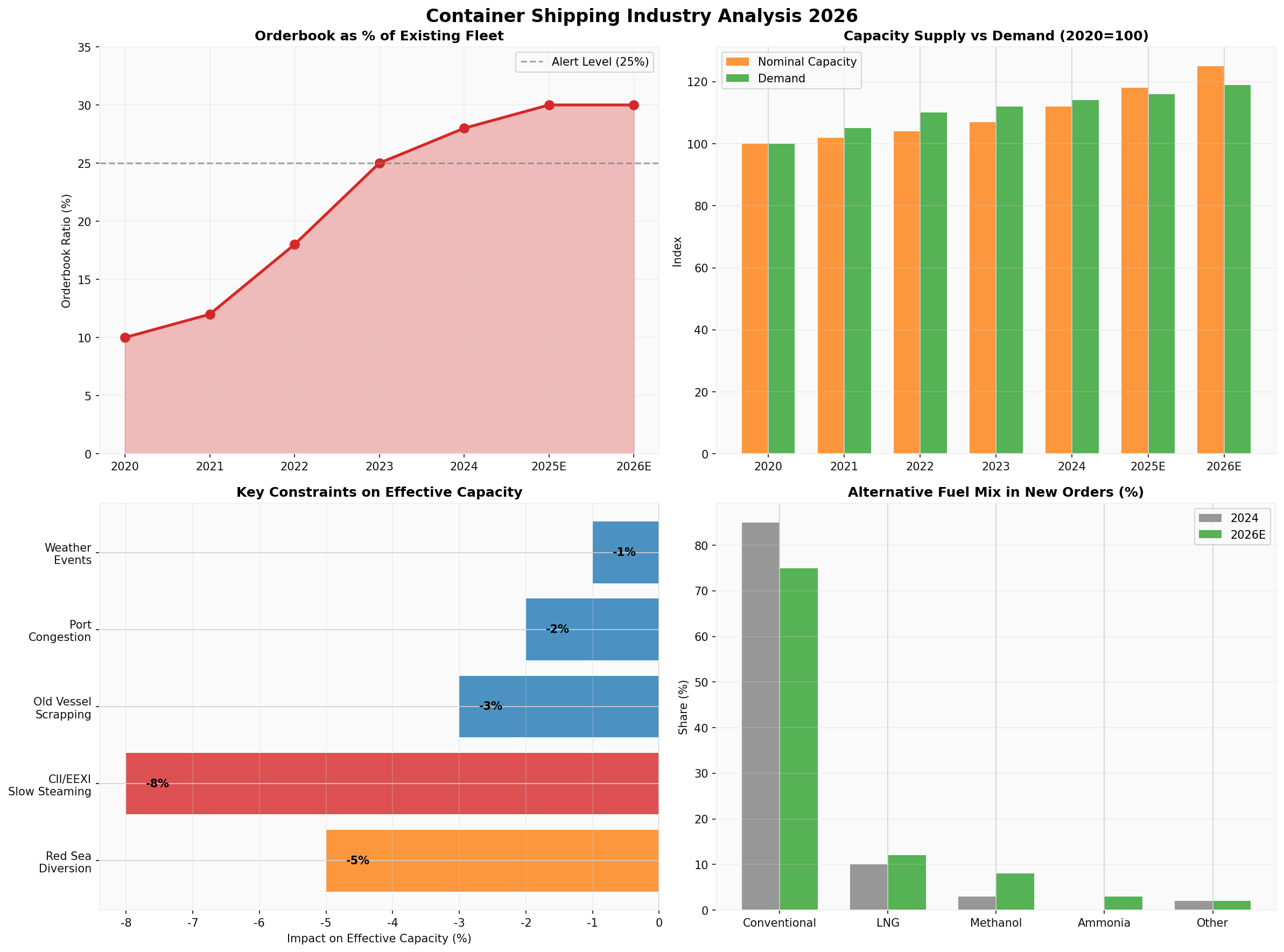

- 2025-2026 New Vessel Delivery Peak: A large number of new vessels will be delivered concentratedly in the next two years, and nominal capacity will expand rapidly

- Fleet Youthification Trend: More than 70% of new orders have alternative fuel capabilities (LNG, methanol, ammonia fuel, etc.), promoting green transformation [0]

- Asset Price Pressure: The expectation of overcapacity suppresses the prices of second-hand vessels and new shipbuilding prices

- Red Sea Diversion Continues: Attacks on merchant ships by Houthi rebels in Yemen have forced a large number of container ships to divert around the Cape of Good Hope, increasing the voyage of Asia-Europe routes by about30-40%, resulting in significant loss of single-vessel capacity [1]

- Suez Canal Traffic Plummets: As a throat for about 15% of global trade goods (higher proportion of container shipping volume), the effective passage capacity of the Suez Canal has dropped sharply [1]

- 2026 Variables: Bloomberg reports that the Suez Canal is expected to reopen in 2026, which may ease capacity tension, but geopolitical uncertainty remains high [1]

- CII (Carbon Intensity Indicator): Effective since 2023, emission limits are tightened annually, forcing ships to slow down or undergo technical transformations. DWNV data shows that non-compliant ships face operational restrictions or even market elimination risks [2]

- EEXI (Existing Ship Energy Efficiency Index): Requires all ships to calculate and meet specific energy efficiency standards, limiting the maximum speed and operational efficiency of ships [2]

- Slow Sailing Becomes Normal: To meet CII ratings, a large number of ships actively slow down by 10-20%, resulting in an effective capacity loss of about5-8%[0][2]

- EU Emissions Trading System (EU ETS): After the shipping industry is included in the EU ETS, carbon emission costs have risen sharply, further suppressing the willingness to operate old ships [2]

- Economic Scrapping: New ships have obvious energy efficiency advantages and lower operating costs, and old ships (especially those over 20 years old) face pressure to be scrapped in advance

- Environmental Compliance Costs: Ships with CII ratings D/E need to invest a lot of funds for transformation or exit the market, promoting natural elimination [0]

- Scrapping Price Support: Steel prices remain at a reasonable level, providing economic incentives for shipowners to scrap old ships

Container shipping connects the four links of global raw materials, energy, production, and consumption, and is the infrastructure of global division of labor. Even in the context of rising anti-globalization思潮:

- Regionalization Replaces Globalization: The supply chain shifts from “offshore outsourcing” to “nearshore outsourcing” or “friendshore outsourcing”, but cross-ocean transportation demand does not disappear, only the route structure changes

- Trade Growth in Emerging Markets: Trade growth in emerging economies such as ASEAN, India, and Africa partially offsets the impact of slowdown in demand from developed economies

According to multiple forecasts, the global container shipping demand growth rate in 2026 is expected to be in the

| Factor | Impact on Effective Capacity | Sustainability |

|---|---|---|

| Red Sea Diversion | -5% |

Highly dependent on geopolitical situation; may ease in 2026 [1] |

| CII/EEXI Slowdown | -8% |

Long-term existence, tightening annually [2] |

| Scrapping of Old Vessels | -3% |

Ongoing, accelerating in 2026-2027 |

| Operational Factors like Port Congestion | -2% |

Cyclical fluctuations |

| Accidental Factors like Weather | -1% |

Unpredictable |

- Suez Canal resumes operation (+5% effective capacity)

- Strict implementation of CII/EEXI, accelerated exit of old ships (-3% effective capacity)

- New ships delivered as scheduled, nominal capacity growth of 6%

- Conclusion: Effective capacity growth of about 3-4%, matching demand growth, stable freight rates

- Red Sea diversion continues

- Environmental regulations are gradually tightened

- New ships are delivered as planned

- Conclusion: Effective capacity growth of about 2-3%, supply and demand are tight, freight rates rise moderately

- Expansion of Middle East conflicts, more routes affected

- Economic slowdown leads to lower-than-expected demand

- New ship deliveries exceed expectations

- Conclusion: Effective capacity surplus of more than 5%, freight rates under pressure

The container shipping industry has significant

- 2020-2022: Super boom period (supply chain chaos + port congestion caused by the pandemic)

- 2023-2024: Adjustment period (freight rates return to rationality)

- 2025-2026: Rebalancing period (new ship delivery vs. effective capacity constraints)

- 2025 Stock Performance: +22.68%(from 11,905 Danish Krone at the start of the year to 14,605 Danish Krone) [0]

- Current Valuation: P/E ratio of approximately 7.35x, in the historical low range [0]

- 52-Week Range: 8,734 - 14,935 Danish Krone, currently close to the upper limit of the range [0]

- Market Capitalization: Approximately $225.7 billion[0]

- Low Valuation Reflects Market Pessimism: Current P/E has fully or even excessively reflected concerns about overcapacity in 2026

- Attractive Dividend Yield: Leading companies in the industry generally maintain a high dividend ratio, providing a safety margin

- Asset Value Reassessment: Owns a large number of self-owned ships and terminal assets, and book value provides a bottom support

| Evaluation Dimension | Current Status | Investment Implication |

|---|---|---|

| Supply-Demand Balance | Nominal surplus, effective balance | Neutral to Positive |

| Industry Prosperity | Fell from high, but still in profit range | Neutral |

| Valuation Level | Historical low (P/E 7-8x) | Bullish |

| Geopolitics | High uncertainty, Red Sea crisis continues | Bearish |

| Environmental Transformation | Accelerated progress, leading companies take the lead | Bullish |

| Dividend Yield | 5-8%, high attractiveness | Bullish |

- Industry Leaders: Companies with scale advantages and high proportion of green fleets (e.g., Maersk, Mediterranean Shipping Company, CMA CGM)

- Differentiated Competitors: Companies with advantages in specific routes or segmented markets

- Left-Side Positioning Opportunities: If the market is overly pessimistic leading to further valuation declines, consider phased positioning

- Geopolitical Risks: Black swan events such as the Red Sea crisis, Middle East situation, and Sino-US relations may lead to sharp fluctuations in freight rates [1]

- Global Economic Recession: A sharp decline in demand from major economies will directly impact container shipping demand

- New Ship Deliveries Exceed Expectations: If the delivery speed of handheld orders accelerates, short-term capacity pressure will surge

- Implementation Intensity of Environmental Regulations: If CII/EEXI is not strictly implemented, the slowdown effect will weaken, and the loss of effective capacity will be lower than expected

- Relief of Red Sea Crisis: The resumption of the Suez Canal will significantly improve effective capacity [1]

- Accelerated Scrapping of Old Vessels: If scrapping exceeds expectations, the supply-demand pattern will improve rapidly

- Tightening of Environmental Regulations: Stricter CII rating standards will suppress effective capacity

- Accelerated Industry Integration: Mergers and acquisitions of leading companies increase industry concentration and pricing power

- As the infrastructure of global trade, the container shipping industry has long-term allocation value

- Current valuation is at a historical low, and left-side positioning opportunities are emerging

- Focus on leading enterprises with green fleets, strong cash flow, and dividend capabilities

- Closely track high-frequency data such as the Red Sea situation and CII implementation

- Pay attention to seasonal factors (traditional peak season in Q2-Q3)

- Freight rate futures/forward contracts can be used as forward-looking indicators

- Safety First: Choose companies with healthy balance sheets and sufficient cash flow

- Leading in Green Transformation: Companies with a high proportion of LNG/methanol dual-fuel ships have stronger long-term competitiveness

- Vertical Integration: Companies with supporting assets such as terminals and logistics have stronger anti-cyclical capabilities

- Dividend Yield: Focus on companies with a dividend yield of more than 5% to provide a safety margin

The investment value judgment of the container shipping industry in 2026 must

- Nominal Capacity ≠ Effective Capacity: The 30% order capacity ratio needs to deduct 15-20% of structural losses

- Offset Effect Between Geopolitics and Environmental Regulations is the Core Variable: The Red Sea crisis, CII/EEXI, etc., will continue to compress effective capacity

- Valuation Repair Space Exists: Current P/E of 7-8x has fully or even excessively reflected pessimistic expectations

- Focus on Structural Opportunities: Leading enterprises with advanced green transformation and vertical integration will survive the cycle

[0] Gilin API Data - Real-time quotes and historical price data of Maersk stocks, industry handheld orders and capacity analysis

[1] Bloomberg - “The Suez Canal Reopening Is a 2026 Gift for Commodities” (https://www.bloomberg.com/opinion/articles/2025-12-16/the-suez-canal-reopening-is-a-2026-gift-for-commodities)

[2] DNV - “EEXI and CII requirements taking effect from 1 January 2023” (https://www.dnv.com/news/2023/eexi-and-cii-requirements-taking-effect-from-1-january-2023-237817/)

[3] Yahoo Finance - “CMA CGM Flags Tough 2026 for Shipping Amid Rising Overcapacity” (https://finance.yahoo.com/news/cma-cgm-flags-tough-2026-190000508.html)

[4] Bloomberg - “Trump Port Fees Bring Added Headache for Chinese Ship Operators” (https://www.bloomberg.com/news/articles/2025-10-14/trump-port-fees-bring-added-headache-for-chinese-ship-operators)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.