Tencent Holdings (0700.HK) Valuation and Investment Logic Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

As of December 29, 2025, Tencent Holdings closed at

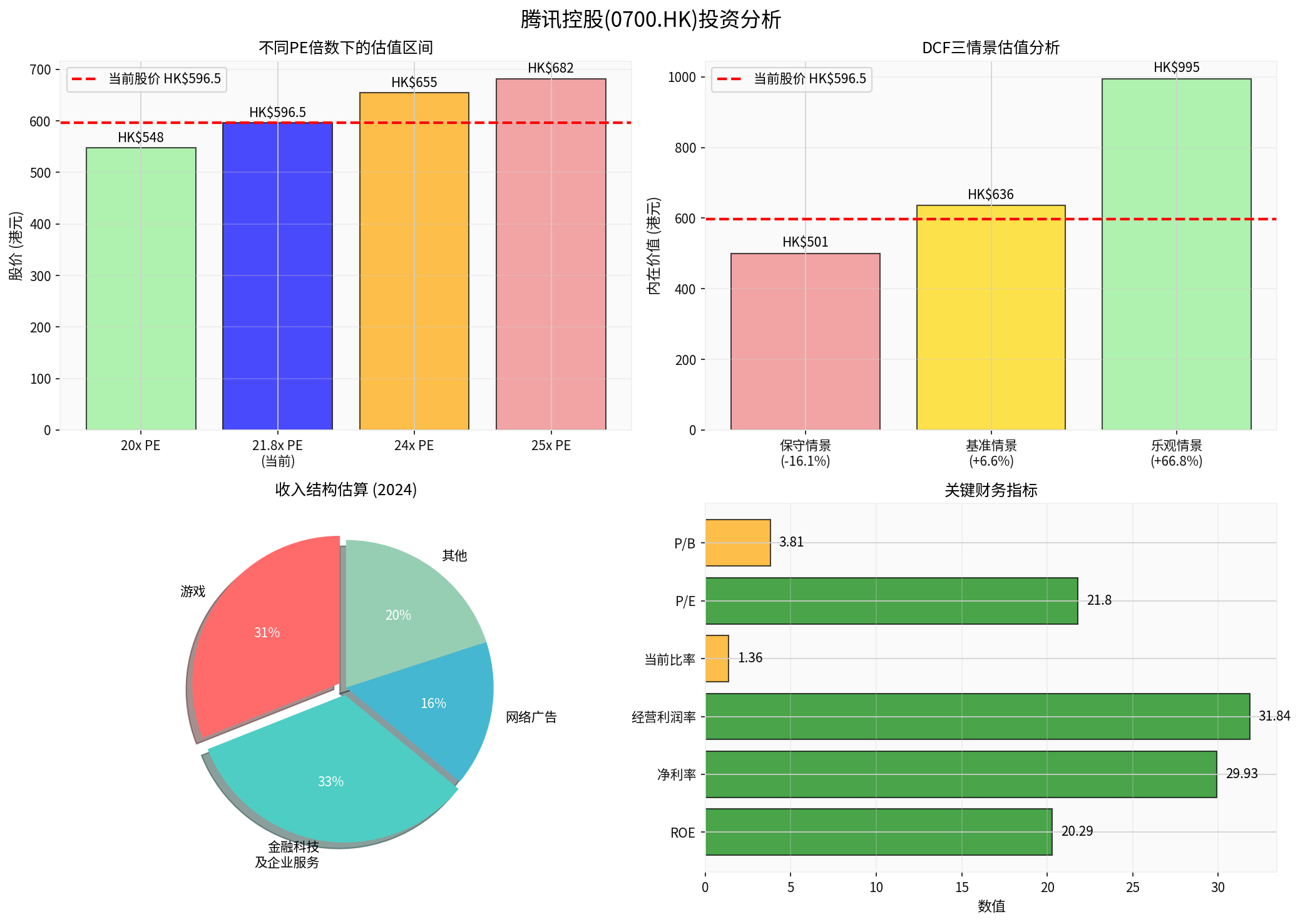

| PE Multiple | Corresponding Share Price | vs Current Share Price |

|---|---|---|

| 20x | HK$548 | -8.1% |

| 21.8x (Current) | HK$596.5 | Benchmark |

| 24x | HK$655 | +9.8% |

| 25x | HK$682 | +14.3% |

Calculated based on the estimated 2025 earnings per share (EPS) of approximately

- 20-25x PE corresponds to share price range: HK$548-HK$682

- Current share price of HK$596.50 is at 21.8x PE level, which is in the lower-middle part of the reasonable valuation range

- HK$400 is equivalent to only about 14.6x PE, significantly lower than current market pricing

Three-scenario valuation based on Discounted Free Cash Flow (DCF) model[0]:

| Scenario | Intrinsic Value | vs Current Share Price | Key Assumptions |

|---|---|---|---|

Conservative Scenario |

HK$500.57 | -16.1% | Zero growth, high discount rate |

Base Scenario |

HK$635.97 | +6.6% | 8.2% revenue growth, 41.4% EBITDA margin |

Optimistic Scenario |

HK$994.98 | +66.8% | 11.2% revenue growth,43.4% EBITDA margin |

Probability-Weighted Value |

HK$710.51 | +19.1% | - |

- Base intrinsic value is HK$636, with 6.6% upside potential vs current share price

- HK$400 is far below the conservative scenario’s intrinsic value of HK$500, belonging to deep value range

- Probability-weighted fair value is HK$711, meaning current share price still has 19% upside potential

###3. Technical Analysis Perspective

Current technicals show

- Support Level: HK$590.52

- Resistance Level: HK$607.42

- 200-day Moving Average: HK$562.75 (long-term uptrend line)

- Beta Coefficient:0.85 (lower volatility relative to market)

###1. Sustained High Industry Prosperity

According to data from the “2025 China Game Industry Report”[1]:

- 2025 China game market revenue is expected to reach RMB 350.789 billion, up 7.68% YoY, hitting a new historical high

- Game user base increases to 683 million, up1.35% YoY, also a new historical high

- Overseas sales revenue of self-developed games reaches US$20.455 billion, up10.23% YoY, exceeding RMB100 billion for 6 consecutive years

- Console Games: Actual sales revenue of RMB8.362 billion, surging 86.33% YoY, 3 consecutive years of explosive growth

- Mini Program Games: Revenue reaches RMB53.535 billion, up34.39% YoY, becoming the biggest highlight

###2. Global Expansion of Tencent Games

Tencent’s game business set a record of

- Management believes international game market growth rate is higher than external forecasts

- AI drives game operation efficiency improvement

- Potential of emerging markets and new business models is underestimated by the market

###3. Growth Logic of Game Business

- Internationalization Strategy: Tencent has built a global game版图 through mergers & acquisitions and independent development

- IP Operation Capability: Owns super IPs like “Honor of Kings” and “Peacekeeper Elite”

- Technology Empowerment: AI improves game development efficiency and user experience

- Cross-terminal Interoperability: Continuous incremental contribution from client and multi-terminal interoperability

###1. Talent Reserve and Technical Strength

In December 2025, Tencent appointed

###2. Commercialization Progress of Hunyuan Large Model

According to market research data, Tencent’s Hunyuan Large Model is expected to

- Game Development: AI-assisted game design, testing, and operation

- Advertising System: AI optimizes ad delivery efficiency and conversion rate

- Content Recommendation: Improves user experience and platform stickiness

- Enterprise Services: Enhances Tencent Cloud’s AI service capabilities

###3. Practical Contribution of AI to Business

Goldman Sachs maintains a “Buy” rating on Tencent, optimistic about

- Cost Reduction & Efficiency Improvement: Lower game development and operation costs

- Revenue Growth: AI-driven personalized advertising and content recommendation

- New Business Opportunities: AI SaaS services, enterprise-level AI solutions

###1. Valuation Judgment

- Relative Valuation: HK$400 corresponds to only ~14.6x PE, significantly lower than industry average and Tencent’s historical valuation level

- Absolute Valuation: HK$400 is far below the conservative scenario’s intrinsic value of HK$500

- Margin of Safety: Provides 33% downside protection (from HK$596.50 to HK$400)

- Corresponding to 21.8x PE, at the median of historical valuation

- 6.4% lower than DCF base value

- Valuation is attractive considering growth prospects

###2. Business Growth Logic

- High industry prosperity, sustained domestic market growth

- Successful overseas expansion, effective internationalization strategy

- AI empowerment improves efficiency and profitability

- Sufficient talent reserve and enhanced technical strength

- Hunyuan Large Model expected to be profitable in 2025

- AI empowers all business lines, enhancing long-term competitiveness

- WeChat Ecosystem: Strong growth in Video Accounts advertising revenue

- FinTech: Steady growth in payment business and wealth management

- Enterprise Services: Improved AI capabilities of Tencent Cloud

###3. Risk Tips

- Regulatory Risk: Game version number approval, anti-monopoly regulation

- Competitive Risk: Intensified competition in domestic game market

- Macroeconomic Risk: Slowdown in China’s economic growth affecting consumption

- Exchange Rate Risk: Hong Kong stock market and exchange rate fluctuations

- Short-term consolidation, lack of clear direction

- Currently close to support level of HK$590.52, need to watch if it can hold

###4. Investment Strategy Recommendations

- Strongly Recommend Buy

- Provides rich margin of safety

- Extremely attractive valuation

- Recommend Buy

- Corresponding to18-20x PE

- Lower limit of reasonable valuation range

- Recommend Hold or Buy on Dips

- Reasonable valuation, clear growth logic

- Short-term consolidation provides加仓 opportunities

- Cautiously Hold

- Corresponding to above24x PE

- Watch for fundamental fulfillment

Based on

- Game Business: Steady domestic growth + breakthrough in overseas expansion

- AI Empowerment: Improves efficiency and competitiveness of all business lines

- WeChat Ecosystem: Continuous advancement of Video Accounts and advertising monetization

- Valuation Repair: Regression from current reasonable valuation to intrinsic value

[0] Jinling API Data - Tencent Holdings (0700.HK) Real-time Quotes, Company Overview, Financial Analysis, Technical Analysis, DCF Valuation

[1] Yahoo Finance Hong Kong - “China Game Revenue Expected to Reach RMB350.7 Billion This Year, Users Up1.35% YoY, Both Hit Historical Highs” (https://hk.finance.yahoo.com/news/今年中國遊戲收入料達3-507億人幣-用戶年增1-35-均創歷史新高-035730002.html)

[2] Bloomberg - “Tencent Goes Hands-On to Reshape $10 Billion Global Games Empire” (https://www.bloomberg.com/news/articles/2025-12-09/tencent-goes-hands-on-to-reshape-10-billion-global-games-empire)

[3] Yahoo Finance Hong Kong - “Nomura Gives Tencent Target Price of HK$775, Management Says Market Forecasts Underestimate Emerging Market Game Potential” (https://hk.finance.yahoo.com/news/野村予騰訊-00700-目標775元-管理層指市場預測低估新興市場遊戲潛力-020101641.html)

[4] Bloomberg - “Tencent Appoints Former OpenAI Researcher Its Chief AI Scientist” (https://www.bloomberg.com/news/articles/2025-12-17/tencent-appoints-former-openai-researcher-its-chief-ai-scientist)

[5] Yahoo Finance Image - 2020-2025 Forecast of China’s AI Software Market Share, Showing Tencent’s Hunyuan Large Model Expected to Achieve Commercial Profitability in2025 (https://s.yimg.net/ny/api/res/1.2/z6bwGJxM4XNf3QuRTFVW.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MDtoPTM2MA--/https://media.zenfs.com/zh-cn/bloomberg_chinese_simplified_41/9d2df8d7c05081ab57ef09124ed8dd6e)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.