Impact of Clinical Trial Failure on Biopharmaceutical Company Valuation and Analysis of Ultragenyx's Competitiveness

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the latest data, Ultragenyx Pharmaceutical (RARE) plummeted

The direct cause of this plunge was the failure of

- Primary Endpoint Failure: Neither study met the primary endpoint—no significant reduction in annualized clinical fracture rate compared to placebo or bisphosphonates[1]

- Secondary Endpoint Success: Although fracture rates did not improve, both studies achieved statistically significant secondary endpoints in bone mineral density (BMD) improvement[1]

- Good Safety Profile: No changes in safety were observed[1]

Based on industry cases and statistical data,

| Case | Stock Price Decline | Clinical Trial Phase | Source |

|---|---|---|---|

| Vertex Pharmaceuticals (VRTX) | -20% | Lead Candidate Failure | [7] |

| Neumora Therapeutics (NMRA) | Significant Plummet | Study Failure | [7] |

| Alector (ALEC) | Significant Valuation Downgrade | Phase3 Failure | [4] |

Ultragenyx (RARE) |

-44.50% |

Dual Phase3 Trial Failure |

[0] |

Ultragenyx’s decline is close to the

- High Market Expectations: Investors had high hopes for setrusumab

- Pipeline Concentration Risk: The drug was a key component of the company’s mid-term pipeline

- Dual Failure Impact: The simultaneous failure of two Phase3 studies significantly reduced the drug’s success probability

Despite the setrusumab failure, Ultragenyx has successfully commercialized

| Product | Indication | Quarterly Revenue Performance | Growth Trend |

|---|---|---|---|

Crysvita |

X-linked Hypophosphatemia | $103-120M | 25% YoY Growth[5] |

Dojolvi |

Long-chain Fatty Acid Oxidation Disorder | Not Disclosed | In Promotion |

Mepsevii |

Mucopolysaccharidosis Type VII | $7-8M | 27% YoY Decline[5] |

Miplyffa |

Saffico Syndrome | Not Disclosed | Newly Launched |

Ultragenyx has built differentiated competitiveness in the gene therapy field:

-

DTX401 (Glycogen Storage Disease Type I)

- Rolling Biologics License Application (BLA) submitted to the FDA (August 2024)[6]

- Expected to be the first approved gene therapy for this disease

-

DTX201 (Hemophilia A)

- Co-developed with Sangamo Therapeutics

- In clinical development phase, expected to enter the market[4][6]

-

Angelman Syndrome Gene Therapy

- Phase3 pivotal trial data readout is imminent, called a key catalyst for the company’s “transformative year”[1]

- Phase3 pivotal trial

| Financial Indicator | Value | Assessment |

|---|---|---|

| Current Ratio | 1.89 | Healthy Level |

| Quick Ratio | 1.74 | Good Short-term Solvency |

| P/S Ratio | 2.90 | Reasonable Relative Revenue Multiple |

| Price-to-Book Ratio | 206.82 | Reflects Intangible Assets and Pipeline Value |

| Net Profit Margin | -91.95% | Still in Investment Loss Phase[0] |

Based on DCF analysis (using 5-year financial data and analyst consensus):

| Scenario | Fair Value | Gap vs Current Stock Price |

|---|---|---|

| Conservative | -$121.21 | -738.8% |

| Base | -$175.05 | -1022.5% |

| Optimistic | -$326.63 | -1821.4%[0] |

- Sustained High Losses: EBITDA margin of -109.5%[0]

- High Debt Cost: Debt cost up to156.3%[0]

- Negative Free Cash Flow: -$422 million[0]

This valuation model reflects that the company needs to significantly improve profitability under its current financial structure.

###3.2 Analyst Ratings: Still Optimistic About Long-term Prospects

Despite recent setbacks, analysts remain

- Consensus Target Price: $50.00 (+163.5% upside potentialfrom current stock price)[0]

- Rating Distribution:

- Buy:27 analysts (81.8%)

- Hold:5 analysts (15.2%)

- Sell:1 analyst (3.0%)[0]

- Baird Target Price Downgrade: Lowered from a higher level to$47(still reflects +148% upside potential)[Context]

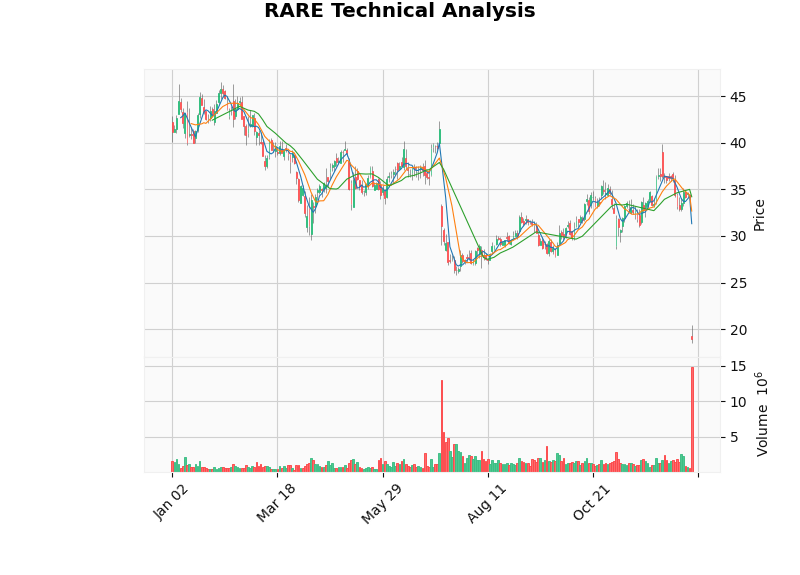

###3.3 Technical Analysis: Short-term Oversold

Technical indicators show:

- Trend: Sideways consolidation, trading range [$17.74, $34.20][0]

- RSI: Oversold zone, potential rebound opportunity[0]

- Support Level:$17.74 (close to current price)[0]

- Resistance Level:$34.20 (previous support now turned resistance)[0]

###4.1 Core Competitiveness Matrix

| Dimension | Strengths | Risks |

|---|---|---|

Product Portfolio |

4 products on market, Crysvita growing rapidly | Mepsevii declining, overall scale small |

Pipeline Depth |

Multiple late-stage gene therapy assets | Lost key candidate due to setrusumab failure |

Rare Disease Expertise |

Focus on rare/ultra-rare diseases, clear regulatory path | Limited market size, pricing pressure |

Financial Flexibility |

Healthy current ratio, management committed to cost cuts | High cash burn rate, sustained losses |

Catalyst Timing |

2 potential gene therapy launches + Angelman data | Uncertainty in clinical success |

###4.2 Company Response Measures

Management has announced

- Protect cash flow

- Reallocate resources to better projects

- Stabilize investor sentiment

###4.3 Long-term Development Prospect Assessment

- Gene Therapy Success: DTX401 or DTX201 approved for market

- Positive Angelman Data: Phase3 trial meets endpoints

- Commercial Expansion: Crysvita continues to grow, new products gain traction

- Operational Improvement: Cost control enhances profit path clarity

- Gene Therapy Regulatory Delay or Failure: Pipeline risk materializes again

- Cash Flow Pressure: Sustained losses require further financing, diluting shareholders

- Increased Market Competition: More competitors in the rare disease field

###5.1 Summary of Valuation Impact from Clinical Trial Failure

- Direct Impact: -44.5% (single day)

- Impact Duration: May last several months until new catalysts emerge

- vs Historical Cases: At the upper limit of impact range, reflecting high market expectations for setrusumab

###5.2 Is Ultragenyx’s Core Competitiveness Sufficient?

- ✅ Proven Commercial Capability:4 products on market, 15-20% YoY revenue growth

- ✅ Differentiated Gene Therapy Pipeline: DTX401 BLA submitted, leading competitors

- ✅ Unshaken Analyst Confidence:82% Buy rating, target price $47-50

- ✅ Adequate Liquidity: Capable of weathering R&D cycles

- ⚠️ Significant Loss from Setrusumab: Reduced pipeline diversity and mid-term catalysts

- ⚠️ Financial Structure Pressure: Negative DCF valuation requires profit path improvement

- ⚠️ Execution Risk: Two gene therapies must succeed to support valuation

[0] Gilin API Data - RARE Stock Real-time Quotes, Company Overview, Financial Analysis, DCF Valuation and Technical Analysis

[1] Benzinga - “Ultragenyx Announces Phase 3 Orbit and Cosmic Results for Setrusumab” (https://www.benzinga.com/pressreleases/25/12/g49607518/ultragenyx-announces-phase-3-orbit-and-cosmic-results-for-setrusumab-ux143-in-osteogenesis-imperfe)

[2] Bloomberg - “Ultragenyx Tumbles After Setrusumab Fails Two Clinical Trials” (https://www.bloomberg.com/news/articles/2025-12-29/ultragenyx-tumbles-after-setrusumab-fails-two-clinical-trials)

[3] Endpoints News - “Ultragenyx, Mereo crash on late-stage bone disease failure” (https://endpoints.news/ultragenyx-mereo-crash-on-late-stage-bone-disease-failure/)

[4] Yahoo Finance - “Hemophilia A Market to Exhibit Growth” (mentions Ultragenyx DTX201 development) (https://finance.yahoo.com/news/hemophilia-market-exhibit-growth-cagr-223100077.html)

[5] Yahoo Finance - Ultragenyx Earnings Analysis, Crysvita and Mepsevii Revenue Data (https://finance.yahoo.com/news/ultragenyx-rare-14-4-since-163026845.html)

[6] Yahoo Finance - “Ultragenyx Pharmaceutical (RARE) Valuation Spotlight” DTX401 BLA Submission (https://finance.yahoo.com/news/ultragenyx-pharmaceutical-rare-valuation-spotlight-101416834.html)

[7] Investopedia/Yahoo Finance - Vertex (VRTX) and Neumora (NMRA) Clinical Trial Failure Cases (https://www.investopedia.com/vertex-vrtx-drops-20-after-failed-drug-trial-5082627)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.