Reddit Investor Sells NVDA, AVGO, GOOGL, JNJ Amid AI Bubble Concerns - Market Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on a Reddit post [0] published on November 7, 2025, where an investor disclosed selling all holdings in NVDA, AVGO, GOOGL, and JNJ after approximately 12% gains, expressing concerns about an AI bubble, overvaluation, inflation, tariffs, unemployment, and influence from Michael Burry’s market views.

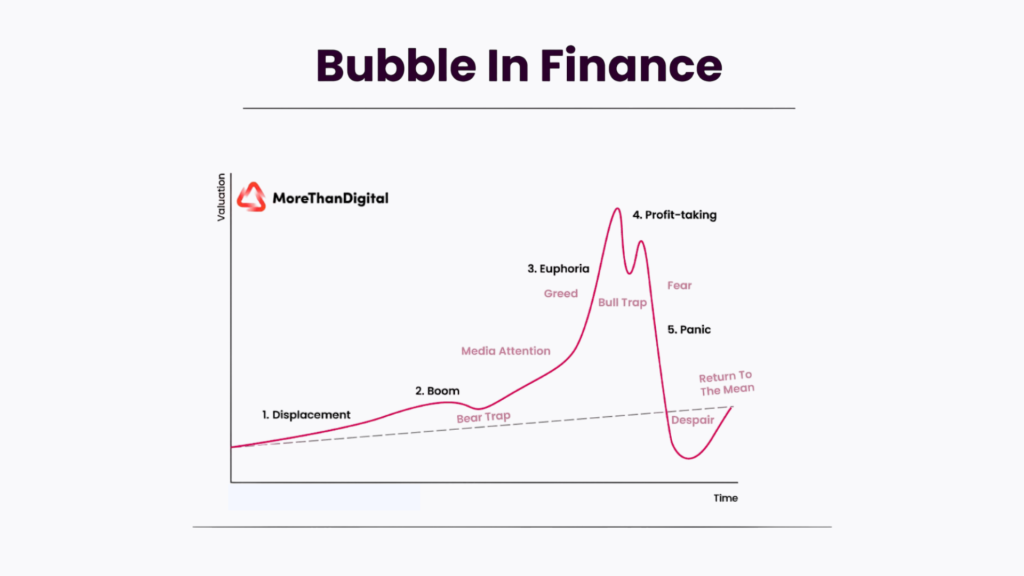

The investor’s decision comes during a period of significant market turbulence in November 2025, where over $1 trillion was wiped from tech valuations as AI euphoria faded and investors sought reality checks [1]. The market sentiment shift reflects growing concerns about sustainability of AI-driven valuations and energy infrastructure constraints [2].

The Reddit investor’s concerns about AI bubble valuation align with legitimate market concerns emerging in November 2025. The technology sector experienced significant corrections as investors questioned sustainability of AI-driven growth, particularly given energy infrastructure constraints and the massive capital requirements for AI data centers [2].

However, the fundamental performance of the sold stocks suggests the decision may have been premature. All three tech companies (NVDA, AVGO, GOOGL) reported strong quarterly results with actual revenue growth supporting their valuations, rather than speculative gains alone [0]. The companies are generating real cash flows from AI infrastructure demand, not merely benefiting from hype.

The timing of the sale is particularly noteworthy given that the investor purchased these stocks at April 2025 lows and sold after 12% gains. This represents a relatively conservative return given the strong YTD performance of these stocks (NVDA +40.14%, AVGO +55.94%) [0], suggesting the investor may have missed significant upside potential by exiting early.

- AI valuation sustainability concerns remain valid, with $1 trillion wiped from tech valuations in November 2025 [1]

- Energy infrastructure constraints could limit AI expansion and impact growth projections [2]

- Macroeconomic factors including inflation, tariffs, and unemployment cited by the investor could pressure broader market performance [0]

- Market sentiment shifts could lead to continued volatility in AI-related stocks

- Strong fundamental performance suggests the sold stocks may represent buying opportunities at current levels

- AI infrastructure demand remains robust with actual revenue growth supporting valuations [0]

- JNJ’s defensive healthcare characteristics and dividend yield could provide portfolio stability [0]

- Market corrections often create entry points for fundamentally strong companies

The Reddit investor’s decision to sell all holdings reflects broader market anxiety about AI valuations that emerged in November 2025. While concerns about overvaluation are legitimate given the $1 trillion market cap reduction in tech stocks [1], the fundamental analysis reveals that the sold companies maintain strong growth trajectories with actual revenue supporting their valuations [0].

The three tech stocks (NVDA, AVGO, GOOGL) all reported exceptional quarterly results with significant year-over-year growth, suggesting their gains are supported by business performance rather than pure speculation [0]. JNJ provides defensive characteristics with consistent earnings growth and recent regulatory approvals [0].

The investor’s strategy of moving to cash or bonds while awaiting a market crash back to April lows represents a conservative approach that may miss potential upside if the current correction proves temporary. Historical market patterns suggest that strong fundamental companies often recover from valuation corrections, particularly when supported by actual earnings growth [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.