Analysis of Kinco Shares (688160)'s Strong Performance and Trend Assessment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

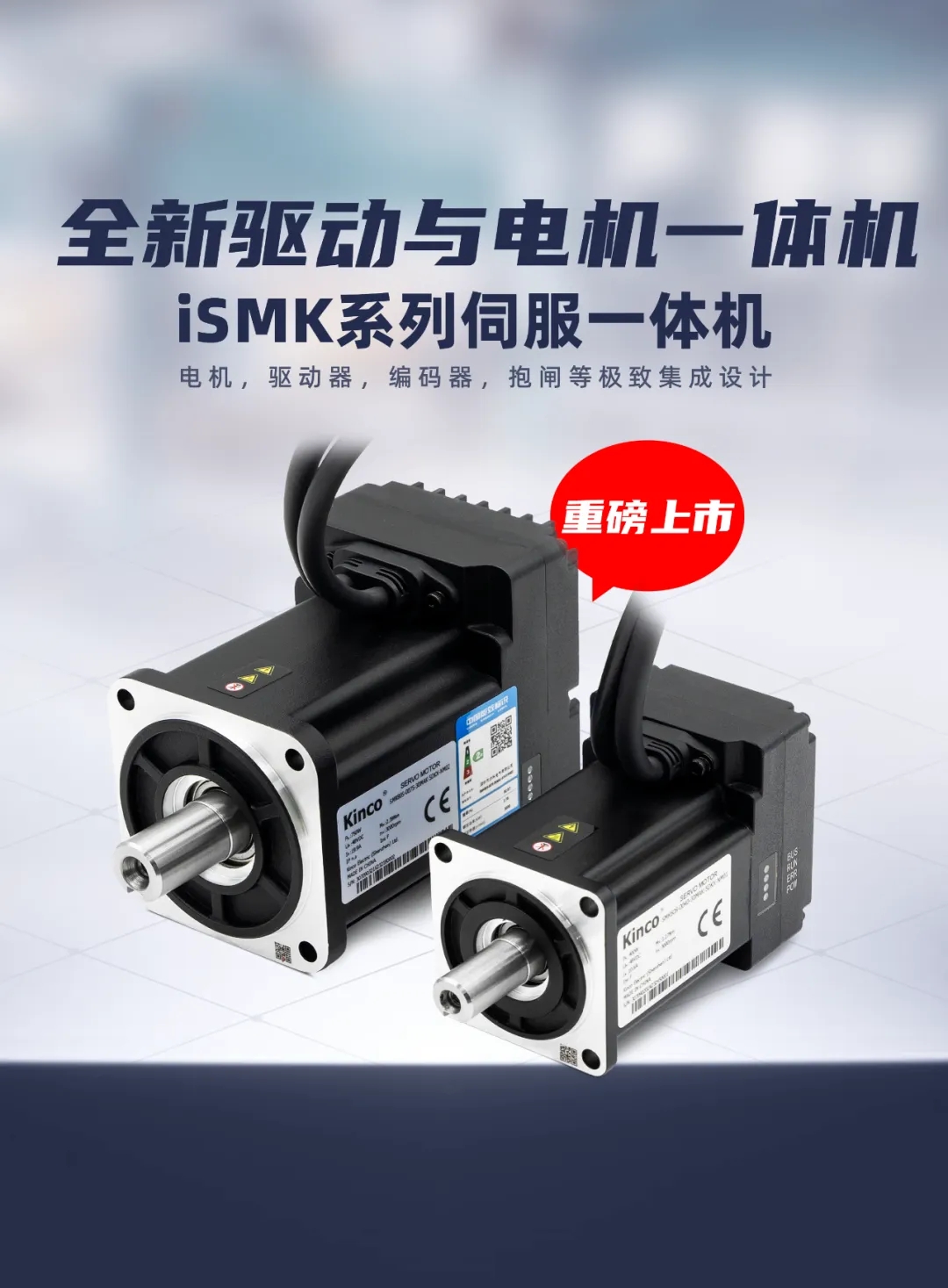

Kinco Shares (688160), as a STAR Market industrial automation enterprise, has entered the strong stock pool. However, due to limited coverage of China’s STAR Market stock data by the tool, real-time prices, trading volumes, and company news cannot be obtained [0]. From the industry perspective, China’s “Made in China 2025” and “Industry 4.0” strategies are driving the growth of the industrial automation market. The industry is expected to have a compound annual growth rate (CAGR) of 11.22% from 2025 to 2033 [0], and the overall sentiment of the sector is positive. The company’s fundamentals may have improved (such as better-than-expected financial reports or business progress), but further verification is needed.

- Industry Policy and Growth Drivers: The industrial automation industry is supported by national strategies, with clear long-term growth potential. The overall increase in sector popularity may drive individual stock performance [0].

- STAR Market Attributes: As a high-tech enterprise on the STAR Market, Kinco Shares benefits from increased sector attention, and its liquidity and valuation flexibility may be higher than traditional sectors.

- Impact of Data Limitations: Lack of specific financial, price, and news data for the individual stock means the analysis relies on industry trends, requiring supplementary verification from local platform information.

- Opportunities: Under the industry growth dividend, if the company has technological advantages or business breakthroughs, its future performance may have potential; STAR Market policy support provides space for long-term development.

- Risks: Data gaps lead to incomplete analysis, making it impossible to confirm the authenticity of short-term driving factors; the industry is highly competitive, requiring response to competition from domestic and foreign enterprises [0]; if the increase is too large, there is a risk of overvaluation.

Kinco Shares’ strong performance may be driven by industry trends and sector popularity, but verification of the company’s fundamental improvement through local financial platform data is needed. Investors should pay attention to changes in industry policies, company business progress, and the rationality of valuation, while noting the impact of data limitations on analysis conclusions.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.