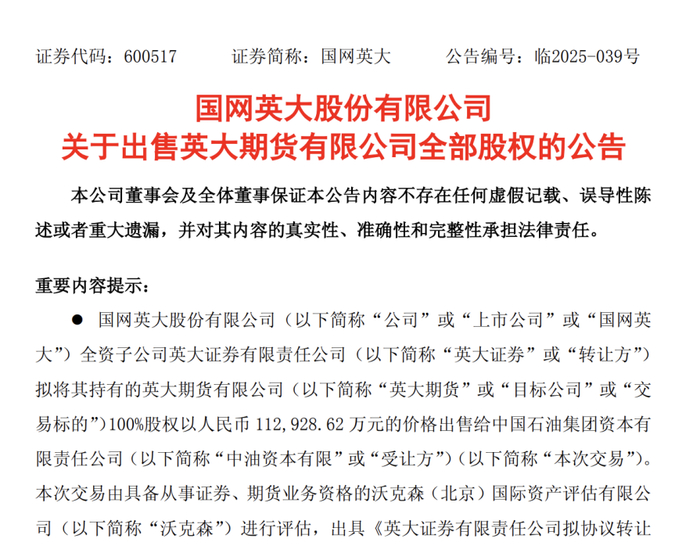

Path Analysis of ROE Improvement for CNPC Capital After Acquiring Yingda Futures

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the latest financial data [0], CNPC Capital (000617.SZ) currently has an ROE of

| Financial Indicator | 2024 Value | Industry Reference |

|---|---|---|

| ROE | 4.18% | Financial Industry Average:8-12% |

| Net Profit Margin | 11.94% | Medium Level |

| Total Asset Turnover | 0.15 | Low |

| Equity Multiplier | 2.10 | Moderate |

Calculated via DuPont Analysis: ROE = Net Profit Margin × Total Asset Turnover × Equity Multiplier =11.94% ×0.15 ×2.10 =

As a futures company, Yingda Futures’ business characteristics are highly aligned with CNPC Capital’s energy finance layout:

- Industry Chain Extension: Expand from traditional credit/investment to futures and derivatives

- Risk Management Capability: Provide energy futures, hedging tools for customers

- Customer Resource Sharing: Connect full-chain financial services for industrial clients

###1. Improve Net Profit Margin (Sales Net Margin)

Futures business has

| Business Type | Gross Margin | Contribution to ROE |

|---|---|---|

| Futures Brokerage | 50-70% | High commission margin |

| Asset Management | 60-80% | Management fees + performance fees |

| Risk Management | 40-60% | Stable high gross margin |

- No large capital input, low marginal cost

- High gross margin from fees/interest

- Superposition effect lifts overall net margin

###2. Improve Asset Turnover

Futures use

- Low Capital Occupation: Margin =5-10% of contract value

- High Efficiency: 10-20x transaction scale per fund

- Revenue-Intensive: Light asset model boosts turnover

###3. Optimize Equity Multiplier

Support high-margin business via

- Moderate liability increase for scale expansion

- Low-risk profile allows reasonable financial leverage

- Optimize capital structure and efficiency

Based on DuPont three-factor model:

| Factor | Contribution | Explanation |

|---|---|---|

| Net Margin Lift | +2.5% | Futures’ high margin |

| Asset Turnover Lift | +1.2% | Light asset efficiency |

| Equity Multiplier Optimization | +0.8% | Reasonable leverage |

Total |

+4.5% |

Expected ROE:8.68% |

- Integration efficiency (futures team + existing business)

- Customer conversion (industrial clients to futures)

- Risk management (futures control system)

- Market volatility (price swings affect earnings)

- Regulatory compliance (strict adherence)

- Integration friction (short-term costs)

CNPC Capital can improve ROE via three DuPont dimensions:

- Net margin via futures’ high margin

- Asset turnover via margin leverage

- Equity multiplier via reasonable leverage

Expected ROE to reach

[0] Jinling API - CNPC Capital (000617.SZ) Profile & Financial Data

[1] Sina Finance - CNPC Capital & Yingda Futures Equity Change Report (https://finance.sina.com.cn)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.