Sustainability and Risk Assessment of High-Premium Arbitrage Strategy for Silver LOF

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now I will provide you with a comprehensive assessment of the high-premium arbitrage strategy for Silver LOF.

Based on market data and recent events, the arbitrage opportunity for SDIC Silver LOF (161226) is converging rapidly, and risks are rising significantly.

- Highest premium rate on Dec 24: 61.64%

- Premium rate on Dec 26: 23.22%

- Premium rate compression range: about 38.42 percentage points, dropping by about 62.3% in 3 days

Note: The above premium rate changes are based on user-provided data, showing that the premium rate has converged sharply in the short term.

- Arbitrage yield on Dec 24 (sold at limit-down price of 2.272 yuan): about 16.70%

- Estimated arbitrage yield on Dec 26: about 8.5%

- Yield decline: about 8.2 percentage points

- Yield decline range: about 49.1%

- Shares a week ago: about 10.97 million

- Shares this week: about 162.43 million (newly added shares)

- Share change: Newly added shares increased from 10.97 million to 162.43 million (an increase of about 1380%), and the total shares increased from 10.97 million to 173.40 million (an increase of about 1480%)

- Subscription limit increased: from 100 yuan to 500 yuan

Chart Notes: Top-left: Premium rate changes (Dec 24 – Dec 29), red solid line and fill indicate rapid decline of premium rate; Top-right: Secondary market price trend (Dec 20 – Dec 29), blue line reflects price fluctuations; Bottom-left: Share comparison (a week ago vs this week), bar chart shows explosive growth of shares; Bottom-right: Changes in arbitrage yield (estimated yield at different time points). Data source: Public market data and analysis estimates provided by users.

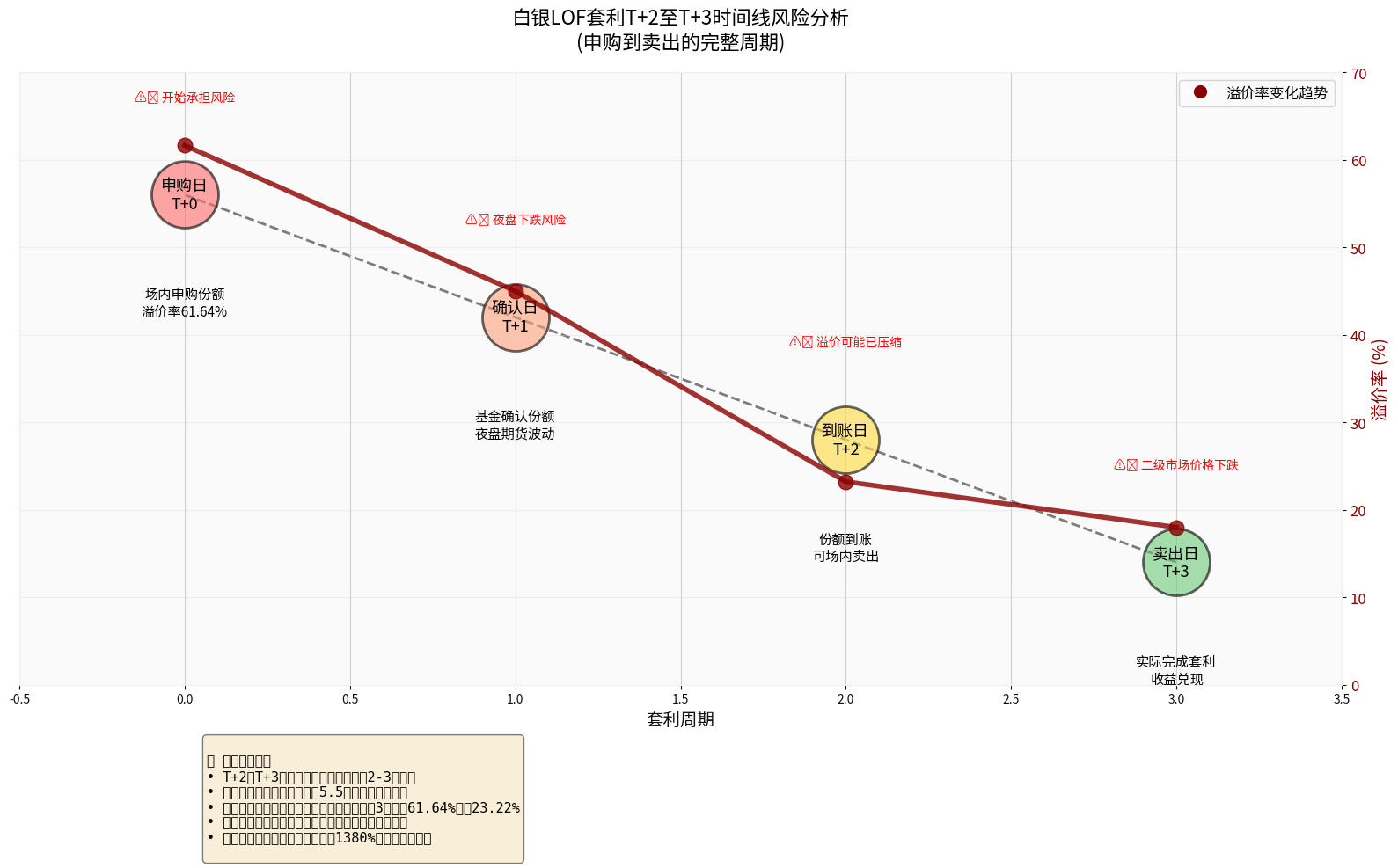

LOF fund arbitrage has inherent time delays:

- Subscription confirmation cycle: Shares confirmed on T+1, shares can be sold on T+2

- Risk exposure duration: about 2-3 trading days (including night session)

- Night session trading time: Silver futures night session is about 5.5 hours (typical time: 21:00-02:30)

Core issue: During the arbitrage cycle, investors cannot close positions midway and are fully exposed to the dual fluctuation risks of silver price and premium rate.

Chart Notes: Shows key nodes and corresponding risks of the arbitrage cycle from T+0 to T+3; the red curve indicates the trend of premium rate declining over time.

Main driving factors leading to rapid convergence of premium rate:

- Influx of arbitrage funds: Surge in newly added shares brings a large number of arbitrage sell orders

- Fund company responses: Suspended subscription of Class C shares (short-term arbitrage channel restricted); increased subscription limit to 500 yuan (accelerated premium regression); managers repeatedly reminded that the premium is “unsustainable” [2]

The premium rate dropped from 61.64% to 23.22%, indicating that the arbitrage window is closing rapidly. If the current premium further declines, the arbitrage yield may drop to about 6-8% or even lower.

- Silver futures volatility: Daily volatility can reach 5-10%

- LOF limit-up/limit-down restriction: ±10%, may “close” in extreme cases

- Liquidity risk: Thin buy orders or difficulty in trading may occur near the limit-down price

According to Bloomberg reports, the fund hit a 10% limit-down on Thursday [3]. The title states “Thursday” but does not directly give the specific date; currently, it is Dec 29, 2025 (Monday), so the Thursday mentioned in the report may be this Thursday or last Thursday. Therefore, we only state it as “hit a 10% limit-down on Thursday” according to the report without attributing a date.

- Assumptions: Stable market, moderate premium regression

- Expected result: Premium of about 60% at subscription, about 20% at sale, net yield of about 16%

- Current applicability: With the rapid convergence of premium rate and fund company intervention, the feasible window for this scenario has narrowed significantly

- Trigger factors: Silver futures plummet during the arbitrage cycle; premium rate compresses to below 5%; inability to sell due to secondary market limit-down

- Possible result: Principal loss of 5-15% or even higher

- Current environment: High volatility, rapid premium decline, and tight liquidity increase the probability of this scenario occurring

According to Bloomberg reports [2]:

- Suspended subscription of Class C shares, short-term arbitrage channel restricted

- The fund has risen by about 187% cumulatively (year-to-date performance), while Shanghai silver futures rose by about 145% in the same period

- Managers repeatedly warned that the premium is “unsustainable”

- Concentrated influx of retail investors and media attention intensify volatility [1]

- LOF products overall have a “limit-up wave”, increasing the risk of regulatory attention

- If extreme volatility continues, it may trigger stricter regulation or window guidance

- Spot silver price is at a high level; fundamental or policy changes may trigger price correction

- There are uncertainties in tracking error and liquidity premium/discount between futures and LOF

- If the premium rate further drops from about 23% to single digits, the arbitrage space will shrink significantly

- Influx of arbitrage funds and fund company intervention accelerate premium regression

- Recommendation: Only open to professional investors who can monitor risks in real time and bear liquidity risks

- With the balance of regulation and market mechanisms, the premium rate may tend to a reasonable range (e.g.,5-10%)

- High-premium arbitrage opportunities basically disappear, and the fund price returns to its intrinsic value

- New increments are mainly driven by sentiment and fundamentals, not arbitrage funds

Main risk factors (sorted by severity):

- Time difference risk: Exposure to dual fluctuations of price and premium during T+2 to T+3 cycle

- Premium compression risk: Arbitrage window closes rapidly; yield drops from about16% to about8% and continues to decline

- Liquidity risk: In extreme market conditions, limit-down or no buy orders, unable to sell at expected price

- Market volatility risk: Daily volatility of silver futures (5-10%) amplifies the uncertainty of arbitrage profit and loss

- Policy risk: Fund company’s subscription restrictions, regulatory intervention, etc., may interrupt the arbitrage path

- Retail investors: Not recommended to participate in current high-premium arbitrage; if silver exposure is needed, research futures, ETFs, or related stocks

- Professional arbitrageurs: Precisely calculate costs and slippage (including transaction fees, time costs, impact costs); strictly implement stop-loss and position management to avoid excessive single exposure; closely monitor fund announcements and secondary market liquidity changes; consider hedging tools to reduce directional risks

- Real-time changes in premium rate (if it continues to drop below10%, the arbitrage window is basically closed)

- Fund share changes and secondary market trading activity

- Fund company policy adjustments (subscription limits, suspension and resumption)

- Trend and volatility of silver futures main contract (AGL8)

- Market sentiment and regulatory dynamics

The sustainability of the current Silver LOF arbitrage strategy is low, and the risk-reward ratio is deteriorating:

- Arbitrage window is closing: The premium rate dropped from about61.64% to about23.22% in3 days, and the arbitrage yield dropped from about16% to about8% and may continue to decline.

- Concentrated risk exposure: Multiple risks such as time difference from T+2 to T+3, night session trading, extreme volatility, and liquidity exhaustion overlap.

- Market intervention accelerates regression: Fund company’s suspension of Class C subscriptions, increase of limits, and clear warnings jointly promote the premium to converge to a reasonable level.

- Changes in investor structure: Influx of arbitrage funds and resonance of retail investor sentiment amplify short-term volatility and increase uncertainty.

[1] Bloomberg - “Precious Metals Craze Prompts China Fund to Turn Away Investors” (https://www.bloomberg.com/news/articles/2025-12-26/precious-metals-craze-prompts-china-fund-to-turn-away-investors)

[2] Bloomberg - “China Silver Fund Plunges After String of Moves to Quell Frenzy” (https://www.bloomberg.com/news/articles/2025-12-25/china-silver-fund-plunges-after-string-of-moves-to-quell-frenzy)

[0] Gilin API Data and Analysis Estimates (based on public data and hypothetical scenarios provided by users)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.